Graham Index English is Graham Number, a value indicator for measuring the stock price.Benjamin Graham published his masterpiece in 1949 “Smart Investor”, Introduce their investment philosophy to the world.In this book, Benjamin Graham proposed a stock price measurement indicator, namely the Graham Index, providing a stock selection standard for defensive investors to reduce the scope of stock selection for investors.

The index is to measure whether the company’s stock price is overestimated or underestimated by the company’s earnings per share and the book value of each share.When the company’s stock price is lower than its Graham index, it is usually considered to be underestimated, which may become a good investment.When the company’s stock price is higher than the Graham index, it means that the company’s stock price is high in high.It is estimated that blind investment may cause losses.

In actual use, the Graham index has certain restrictions, the company’s P / E ratio(P/E Ratio) should be less than 15, Net rate(P/B Ratio) should be less than 1.5, otherwise it will not apply to the Graham index.At the same time, the Graham Index is not suitable for companies that cannot be profitable.Because the earnings per share may be negative, it is impossible to provide a guiding role.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the Graham index?

- How to calculate Apple’s Graham index?

- What is the significance of investment guidance in the Graham index?

- What are the limitations of the Graham index?

- More company valuation

How to calculate the Graham index?

The calculation method of the Graham index is the company’s Earnings per share and Book value per share The values are multiplied, and then multiplied by 22.5 for an open operation, that is,:

Graham Index = (22.5 x Backage per share x Bedry value per share)1/2

Graham Number = (22.5 * EPS * BVPS)1/2

It can also be used at the same time:

Graham Index = (15 x per share X 1.5 X book value per share)1/2

Graham NUMBER = (15 x EPS x 1.5 x BVPS)1/2

The second formula better illustrates the restrictions of using the Graham index.The income per share must be less than 15, and the book value of each share must be less than 1.5.Or underestimage.

in:

The income per share is the net income divided by the number of circulation shares, that is,:

Earnings per share = net income / number of circulation shares

Earnings Per Share (EPS) = Net Income / Shares Outstanding

The book value per share is except for the number of shareholders’ equity, which represents the minimum value of the company’s equity, that is,:

Book value per share = shareholders’ equity / circulation stocks

BOOK VALUE PER ShaRE (BVPS) = Shareholder ’s Equity / Shares Outstanding

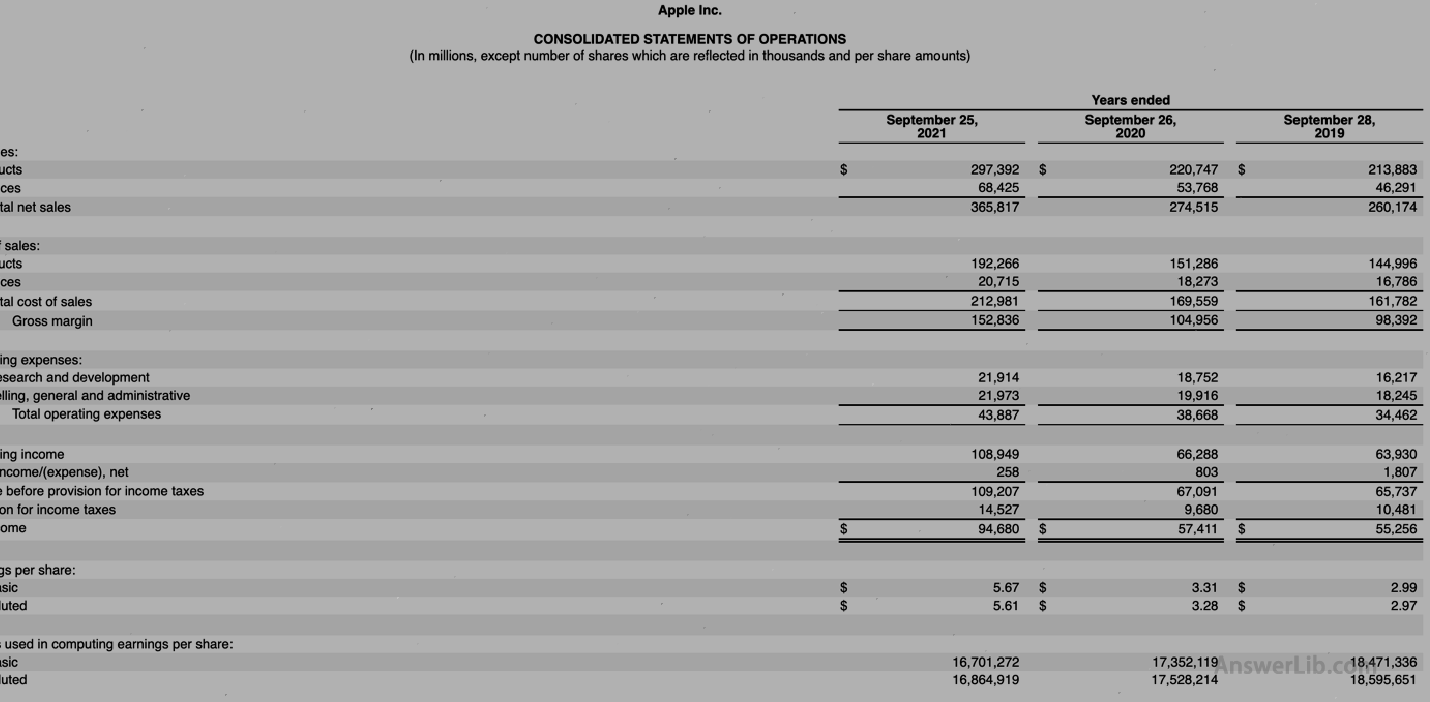

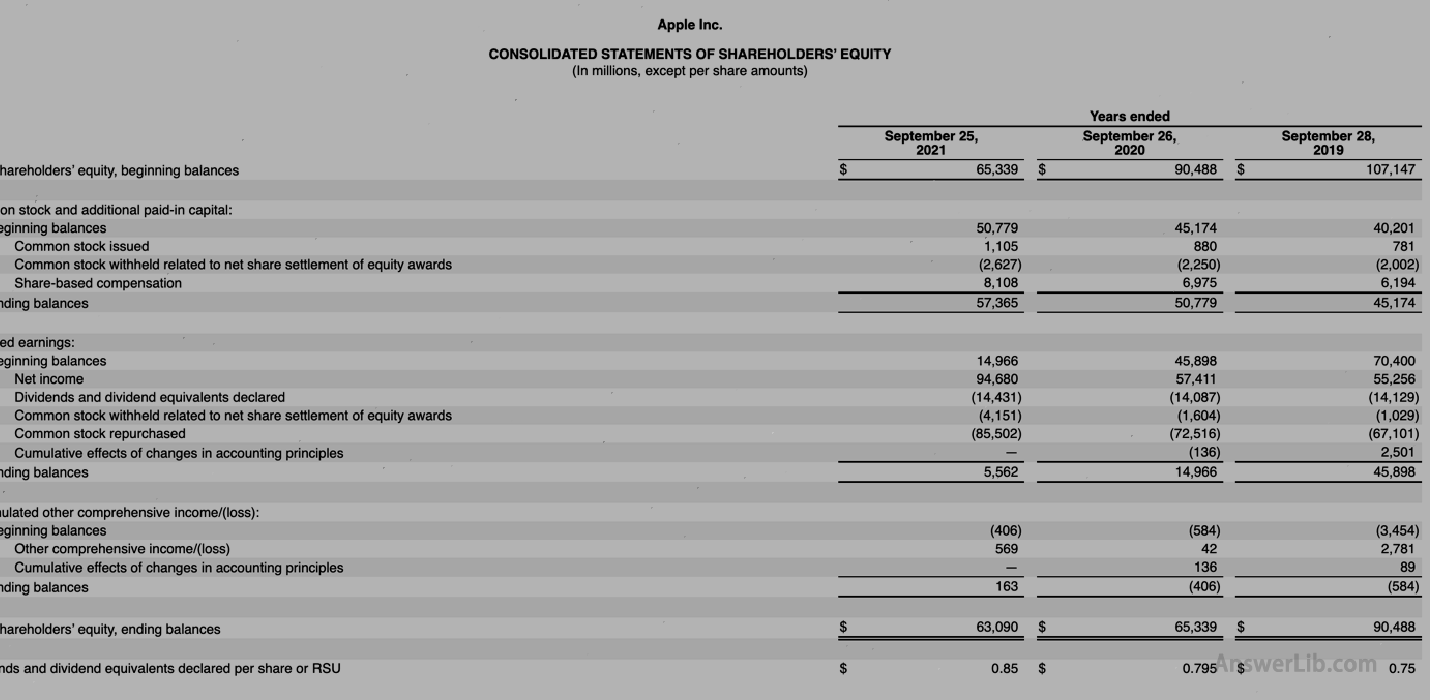

The net income and the number of circulation shares can be found in the company’s comprehensive business report (Statements of Operations), and shareholders’ equity can be found in the company’s Statements of Shareholders ’Equity.

how Calculate Apple’s Graham index?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance:

AAPL Financial Report The comprehensive business report and shareholder equity report are shown below:

You can see from the data table:

During the 2021 Financial Year, Apple’s net income was $ 94,680 m, the number of circulating shares was 16,701,272 K, and the shareholders’ equity was $ 63,090 m.

so:

Earnings per share = net income / number of circulation shares

Earnings Per Share (EPS) = Net Income / Shares Outstanding

= $ 94,680 m / 16,701,272 k

= $ 5.67

Book value per share = shareholders’ equity / circulation stocks

BOOK VALUE PER ShaRE (BVPS) = Shareholder ’s Equity / Shares Outstanding

= $ 63,090 m / 16,701,272 k

= $ 3.78

Graham Index = (22.5 x Backage per share x Bedry value per share)1/2

Graham Number = (22.5 x EPS x BVPS)1/2

= (22.5 x 5.67 x 3.78)1/2

= 21.96

Therefore, Apple’s current Graham index is 21.96.

However, because of the calculation process, Apple’s book value per share is 3.78, which is greater than 1.5, so according to the concept of the Graham Index, it is not suitable to use the Graham index to evaluate whether Apple’s stock price is overestimated or underestimated.

What is the significance of investment guidance in the Graham index?

Benjamin Graham believes that the more investors pay for stocks, the lower the income they can get.It can be understood that the Graham Index provides an upper limit for the purchase price of a specific stock.

Similarly, you can also use the Graham index to determine whether the company’s current stock price is overestimated or underestimated:

- The company’s stock price is higher than that of the Graham index, but it is believed that the company’s stock price is overvalued, and it is not very investment value;

- The company’s stock price is lower than the Graham index, and it is believed that the company’s stock price is underestimated and has better investment value.

What are the limitations of the Graham index?

The Graham Index is suitable for profitable companies, because when the company does not have profitability, its income may be negative, which loses the calculation significance.

The Graham Index is not suitable for companies with greater returns per share and a book value of each share than 1.5.

Because the Graham Index uses only two simple values, it will have a certain deviation when the value evaluation of the company is evaluated.If investors need to accurately measure the high and low and low of the company’s stock price and their true value, it needs to be used more.Multi-measurement indicators are used for comprehensive assessment.

More company valuation

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage