Extraction of interest and tax pre-amortization benefits, English is E Arnings Before Interest, TAXES, depreciation and amortization, Abbreviation Ebitda It is one of the financial analysis indicators to measure the company’s overall operating performance.EBITDA proposed by John C.Malone, former president and CEO of the US television media giant Tele-Communications Inc..

EBITDA’s basic calculation method is to add the company’s net income to interest expenses, tax expenditures, depreciation loss and amortization loss, and the expenditure that will not belong to the company’s core business will be added to the company’s income to give a relatively more comprehensive comprehensive comprehensive comprehensiveCompany assets.EBITDA is very useful when measuring different types of companies, the proportion of different debt, and different tax discount companies, because EBITDA includes factors such as interest, taxation, depreciation, and amortization.From this to make more suitable comparisons for different companies.

However, EBITDA is not the financial indicator of conventional accounting standards (GAAP), so different financial analysts can adjust the number of parameters according to their own analysis needs or corporate requirements in actual use.EBITDA accounting calculates different values.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate EBITDA?

- Calculate Apple’s EBITDA?

- What is the significance of investment guidance in EBITDA?

- What are the limitations of EBITDA?

- Ebitda vs ebitit

- What indicators are mainly used for EBITDA?

- More company value analysis

How to calculate EBITDA?

The main calculation method of EBITDA is to add the company’s net income and tax costs, interest costs, depreciation and amortization costs, that is,:

EBITDA = net income + tax + interest cost + depreciation and amortization

EBitda = network + taxes + interest expense + depreciation & amortization

in:

- Net Income: Refers to the company’s income value after removing the cost of all sales, production costs, depreciation and amortization costs, interest costs and tax costs.

- Interest Expense: Refers to the money that needs to be paid to the lenders except the loan principal.

- Taxes (TAXES): Refers to the amount of taxes and fees that the company must pay to government departments in accordance with local regulations.

- Depreciation: Reflected the reduction in the value of existing office supplies, inventory or other capital expenditure.

- Amortization: In addition to fixed assets, other assets used for operations occur with value loss over time, such as the reduction of intangible assets.

Another EBITDA calculation method is to add the company’s operating income with depreciation and amortization amount, that is,:

EBITDA = operating income + depreciation and amortization

EBitda = Operating Income + depreciation & amortization

in:

Operating income Operateing Income: Refers to the company’s income that has been obtained through business activities without interest and tax adjustment.

Calculating EBITDA’s data values can be found in the profit statement, other income/expenditure tables and cash flow tables in the company’s financial report.

Calculate Apple’s EBITDA?

This chapter will be released by 10-k released by Apple in September 2021 Financial report Calculate the instance:

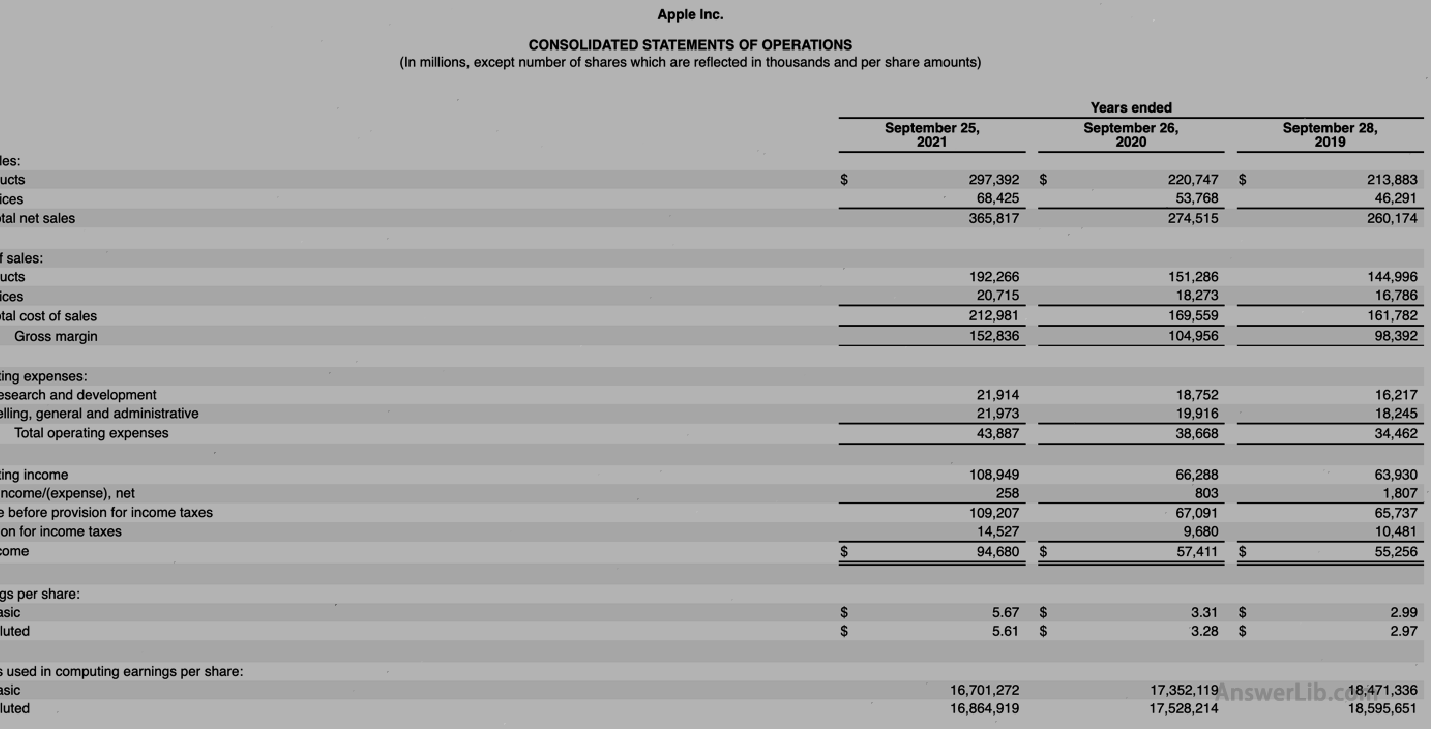

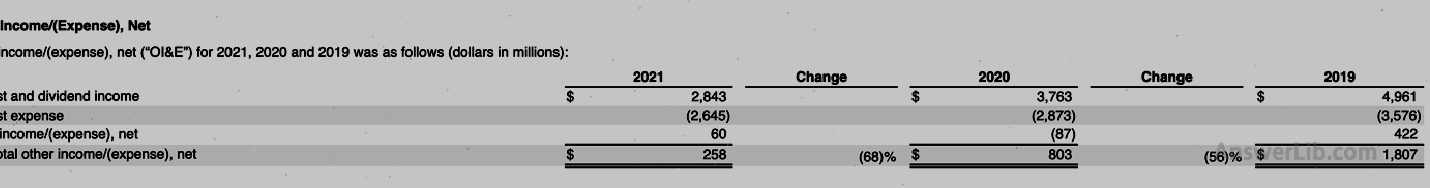

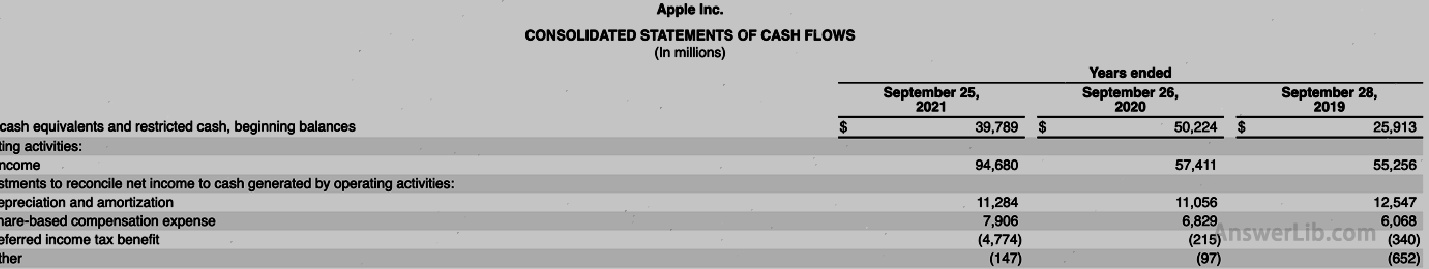

AAPL Financial Report The profit statement, other income/expenditure forms, and cash flow statement are shown below:

Profit table:

Other income/expenditure table

Cash flow table:

You can see from the financial statements:

Net income | $ 94,680 m |

Interest Expense | $ 2,645 m |

Income taxes | $ 14,527 m |

Depreciation & amortization | $ 11,284 m |

Operating infome | $ 108,949 m |

Use the first formula:

EBITDA = net income + tax + interest cost + depreciation and amortization

EBitda = network + taxes + interest expense + depreciation & amortization

= $ 94,680 m + $ 14,527 m + $ 2,645 m + $ 11,284 m

= $ 123,136 m

Use the second formula:

EBITDA = operating income + depreciation and amortization

EBitda = Operating Income + depreciation & amortization

= $ 108,949 m + $ 11,284 m

= $ 120,233 m

The EBITDA calculated by the above two formulas is different.Because Apple, in addition to operating income, has a small part of other income, can be obtained from the “other income” table of the 10-K financial report.

Therefore, it is more accurate to use the first company with income.

What is the significance of investment guidance in EBITDA?

For a company alone, EBITDA can measure the company’s total cash flow, because EBITDA adds all the assets related to business, so if the EBITDA value is low or even negative, it means that the company will indicate the companyThe current cash flow is poor.However, if the value of EBITDA is very high, it can only show that the company’s overall cash flow is good, but it cannot be judged that the company’s profitability is good.When evaluating the company’s profitability, more financial data is needed to make comprehensive analysis.

Because EBITDA considers the depreciation and amortization of the company, and the amortization fee is greatly affected by the intangible assets of technology companies.For technology and technology companies holding a large number of intangible assets, they are more willing to use EBITDA to measureThe overall operation of the company.At the same time, for asset-intensive companies, EBITDA can add the depreciation costs caused by a large amount of assets to the income.Although these costs do not constitute the company’s core operating income, it plays an important role in the company’s business.ThereforeWhen calculating the overall assets of the company, it is necessary to consider it.

When comparing different companies, using EBITDA can well avoid the deviation of evaluation bias caused by differences in different debt distribution, tax benefits, and asset ratio.Because EBITDA calculates all these parameters, it can be more balanced from a specific perspective.Compare different companies.

What are the limitations of EBITDA?

When measuring the company’s assets, because the depreciation and amortization costs are calculated, it will keep the company’s assets always maintain the best value without value loss.However, in the actual situation, this is notPossible, so investment masters such as Warren Buffett have doubts about EBITDA’s evaluation value.

When using EBITDA to measure the company’s development, it is impossible to reflect the company’s lending level and cost level increase, which may provide investors with guiding opinions of deviation or even wrong.

Ebitda vs ebitit

Ebitit is EBIT And EBITDA is the profit before the interest and tax depreciation.

EBITDA and EBIT both returned interest expenses and tax expenditures into profits.The difference is that EBITDA has returned the company’s depreciation and amortization costs to the profit.

In actual use, if it meets the following situations, EBITDA has a better calculation value than EBIT:

- When assessing companies that have large fixed assets and are mainly based on debt;

- Evaluate companies with relatively low capital expenditure required for operations;

If it meets the following situations, EBIT has a better calculation value than EBITDA:

- Evaluate when oil, natural gas, mining and other industries;

- High leverage companies with good business profits;

What indicators are mainly used for EBITDA?

EV/EBITDA multiple

That is, the ratio of corporate value/EBITDA, English is Enterprise Value/EBITDA Ratio.

The calculation method is to remove the company’s corporate value with the company’s EBITDA value.

The significance of this value is to help investors understand or underestimate the value of the company.When the EV/EBITDA multiple is high, it means that the company’s value is overestimated.When the EV/EBITDA multiple is low, it means that the company’s value is underestimated.

This ratio is suitable for companies with similar industries or nature, otherwise there will be a large assessment deviation.

EBITDA profit margin

The calculation method is to remove the company’s EBITDA value with the company’s total revenue.

The significance of this value is to measure the impact of operating expenses on the company’s gross profit.The higher the value, the smaller the company’s financial risk.

Interest coverage ratio

The English is & nbsp; Interest Coverage Ratio.The calculation method is to eliminate EBITDA with total interest expenditure.

The significance of this ratio is to evaluate whether the company’s income can cope with its interest expenses.The higher the ratio, the better the repayment capacity.The lower the ratio, the worse the repayment capacity of the interest.

More company value analysis

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage