The Relative Stream Index (RSI) is a Momentum Indicator that Measures the Velocity and Magnitude:

DEVELOPED by Jone Welles Wilder Jr., The RSI users the values of stock price gains or losses over, CIFIC FORMULA.

General, An RSI Over 70 Indicates that a stock is overBought (ITS Price Is Considered Too High), While An RSIWEROW 30 SUGGESTS The Stock Isold (ITS Price Is D D D D D EEMED TOO LOW).

The 30/70 Threshold Can Sometimes Be Adjusted Based on Stock Price Trends, Such As Changing It to 20/80.

In Most Cases, The RSI Trend Aligns with the Stock Price Movement.However, DIVERGENCES Can Occur, Requiring Investors to Have Sufferine Inters ESE TRENDS and their Implications for Price Flutuations.

It ’s Important to Note that the rsi callration is based Solely on Stock Price Gains and Losses Over A Specific Period.The when asksSessing a Stock for Buying or Selling, it ’s cracial to consider a broader range of finish indicators for a comprehensive every.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

This Article USES Apple Inc.Stock (AAPL) As an Example.This stock is used solely for demonstration purposes and is not intended as a public.Remndation.Rem.Ember: Investing in the stock Market Involves Risks, and Investments Should Be Made with Caution.

Table of Contents

- How to call the relative stream index?

- How to call the relative stream index for Apple inc.

- What is the significance of using the relative stream index?

- What are the limitations of use the relative stream index?

- How TO Use Relative Stringth IBRK?

- More invessting guides

How to call the relative stream index?

The Calculation for the Relative Streangth Index (RSI) is as Follows:

RSI = 100 – 100 / (1 + Average of Upward Price Change / Average of Download Price Change)

in white,

- The Typical Period for Calculating The Average is 14 Days.

- The Average of Downward Price Changes is Taken as a POSITIVE NUMBER.For Example, if the Average Price Drop is $ 1.5, it is considered 1.5, not -1.5.

- To call the average upward price Changes, the values on days when the stock price falls are taro.This Means admit up all the increases in stock p Rice and Dividing by 14.Similaly, When Calculating the Average Download Price Changes, The Values OnDays When the Stock Price Rises Are Considered Zero.This Involves Adding up all the decreases in stock price and dividing by 14.

How to call the relative stream index for Apple inc.

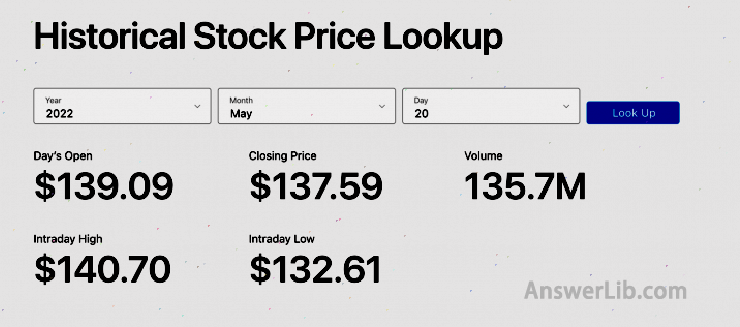

This section demonstrates how to call the current RSI value userical stock prices object Apple Inc.’s Investment Website Then, then

To call the day changes in stock price, we subtract the previous day ’s closing price from the current day’ s closing price.

| Day | Closing price ($) | Gain ($) | Lose ($) |

|---|---|---|---|

5/2/2022 | 157.96 | ||

5/3/2022 | 159.48 | 1.52 | |

5/4/2022 | 166.03 | 6.55 | |

5/5/2022 | 156.77 | 9.26 | |

5/6/2022 | 157.28 | 0.51 | |

5/9/2022 | 152.06 | 5.22 | |

5/10/2022 | 154.51 | 2.45 | |

5/11/2022 | 146.50 | 8.01 | |

5/12/2022 | 142.56 | 3.94 | |

5/13/2022 | 147.11 | 4.55 | |

5/16/2022 | 145.54 | 1.57 | |

5/17/2022 | 149.24 | 3.7 | |

5/18/2022 | 140.82 | 8.42 | |

5/19/2022 | 137.35 | 3.47 | |

5/20/2022 | 137.59 | 0.24 | |

total | 19.52 | 39.89 |

From the table,

- The Average of Stock Price Increases is: $ 19.52 / 14 = $ 1.394

- The Average of Stock Price Decreases is: $ 39.89 / 14 = $ 2.849

Thereay,

RSI = 100 – 100 / (1 + Average of Upward Price Change / Average of Download Price Change)

= 100 – 100 / (1 + $ 1.394 / $ 9.973) = 12.26

This callration indicates that thecurnt stock price of Apple is in an oversold state (<30).

What is the significance of using the relative stream index?

The Relative Stringth INDEX (RSI) is a Popular Technology Analysis TOOL Used to Assess Overbought Conitions in Stocks or Other Financial Assets.

Here some Common SCENARIOS for USI TO Gauge Market Trends:

1.overBought or oversold

When the rsi is about 70, the stock is considerted overBought.This meeting.

When the rsi is below 30, the stock is considered oversold.This subgssts that there are more sellers that, and the price is near the bottom and might rebound.IT ‘ s also seen as underrvalued, presenting a portal oppointunity for investorsSell high.

The 30/70 Threshold Can be Adjusted Based on the Actual Stock Price Movement.For Instance, if a stock’s RSI FREQUENTLY HOVERS AROUND 70, The Threshold Might Be A Djusted to 80 for a Better Assessment of the Trend.Similaly, The Lower Threshold Can beAdjusted to 20.

2.DIVERGENCE

RSI DIVERGENCENCE OCCURS When there is an inconsisisister BetWeen The Stock Price Trend and the RSI TREND.This Divergeence is often Viewed As a Potential Signal FOR A TREND REND Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rend Rendees Versal.

DIVERGENCE is of Two Types: Bearish Divergeence and Bullish Divergence.

Bearish DiverGence Happy Hits a New Hits a New High While the RSI DOES NOT.Although the price is rising, the weakening momentum mighten indecent a portenti Al download trend in the stock price.

Bullish DiverGence Occurs when the stock price reaches a new low, but the rsi does not a new low.Wnward momentum is weakening, potentially signaling an upcoming uptrend in the stock price.

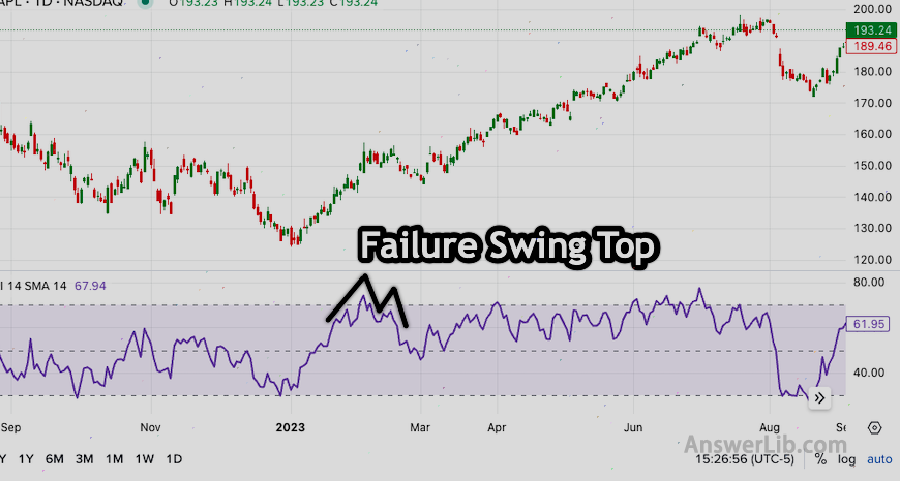

3.Failure Swing

Failure Swings in the Relative Streangth Index (RSI) Are A Specific Pattern within the RSI Indicator, Used to Predict Potentials in Market Trends.This Patter.n is independent of Price Action and is base Solely on Changes in RSI Values.

Failure Swings Are Categorized Into Two Types: Failure Swing Top and Failure Swing Bottom.

Failure Swing Top: This Occurs when the RSI FIRST Exceeds 70 (Entering the OverBought Zone), then Falls Back, Rises Again But Fails to Previous High, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, A, a A, A, a A.nd Subsently Falls Below The Low Point Between These Two Highs.This formation is seen as asA Sell Signal, Indicating a Potential Download Trend.Visually On the RSI Chart, this Pattern resembLS the Letter “M”.

Failure Swing Bottom: This OCCURS When the RSI FIRST FALLS BELOW 30 (Entering the Oversold Zone), then Rebounds, Drops Again But Does Not Fall Below the Previous Low , And Subsently Rises Above the High Point Between the Two Lows.a Buy Signal, Suggesting a Potential Upward Trend.The Pattern of the RSI on the Chart Resembles the Letter “W”.

These two-types of failure swings provides provided potential trading signals, but they should be approached with caution.It ’s best to use the conjunch with o THER Technology Analysis Tools to Enhance the Accuracy of Trading Decisions.

What are the limitations of use the relative stream index?

The RSI is a widly used technical analysis tools, but it has been carTain Limitations.

The RSI is typically more Suited for short-term inves.Long-term Investors, Who Focus on Fundamental Analysis, Need to Consider more comprehensiects of a com.Pany ’s functionals like propitability and overall business capabilities.

The Limitations of RSI Are Summarized As Follows:

- MISLEADING OVERBUGHT/Oversold Zones: The OverBought (USUALLY ABOVE 70) and Oversold (USUALLY BELOW 30) Zones of the RSI Are Not Alway IndustrialTors.For Buying or Selling.In a Strong Trend Market, The RSI Can Remain in the ZONES for An ExtendedPeriod Without Necessarily Indicating An Immity Reversal.

- InEffectiveness in Trend Markets: In Sustaind Bull or Bear Markets, The RSI Can Produce Misleading Signals.For Example, in A Strong UPWARD TREND, The RSI MAY Continu OUSLY Indicate An Overbought Condition, MISLEADING Investors into Thinking that a Market Correction is Immity.

- Delay in Price DiverGence Signals: While RSI DIVERGENCEREN BEE A POWERFUL SIGNAL SIGNAL SIGNAL SIGNAL SIGNAL SIGNAL Reversals, It often Comes with A Delay.The Market May have alream reverseed for some time.

- Necessity to use with Other Tools: The RSI Works Best When Combined with Other Technical Analysis Tools and Indicators to Enhance The Validity of Signals.Usin G RSI Alone May Not Provideo Sufficient Trading Signals.

- Subjectivity in Parameter Selection: The Calculation of the RSI DEPENDS on the Chosen Period (SUCH As 14 Days, 10 DAys, ETC.).d to viming results, adding subjectivity to the analysis.

How TO Use Relative Stringth IBRK?

Realive Brokers is an intermingal brokeRage Firm Offering A Wide Range of Trading and Investment Services, Suitable for Individual, Professional Investors, and Institutional Clien TS.

For a detailed introduction to interest “Interactive brokers deposit and investment guide.” Essence

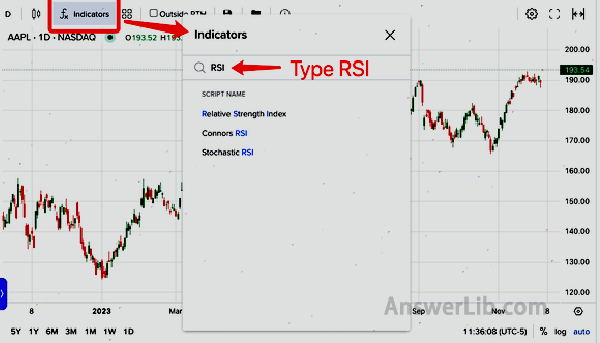

Next, let ’s see how to use the related stream index in the IBKR web platform

Go to the interactive brokers homepage and log in to your account.

Find the stock you are intersected in, user inc.

In the stock ’s candlestick chart, Locate the Menu item” Indicators.“

In the “Indicators” pop-up menu, type in “RSI”.From the Search Results, Select “Relative Streangth Index.”

Then the relative stream index will be displayed below thecandlestick chart.