Speed ratio, English is Quick ratio Sometimes also call it “Acid test ratio”, English is Acid-test ratio It is an indicator of a listed company using its mobile assets (except for inventory) to pay its short-term mobile debt capabilities.

Speed ratio and Cash ratio(Cash Ratio) and Flow ratio(Current Ratio) is very similar:

- The mobile ratio is to measure the company’s ability to repay short-term debt to repay short-term debt by using all mobile assets.

- Speed ratio is a more conservative indicator that measures the company’s short-term debt capacity.It excludes inventory in mobile assets and other assets that cannot be rapidly realized.

- The cash ratio is more conservative than the speed rate ratio, and it is used to measure the company’s ability to repay short-term debt to repay short-term debt.

Generally speaking, the greater the speed ratio, the stronger the ability to repay the short-term debt of the listed company.Generally, the speed ratio is greater than 1, which is a good value.

When calculating the speed ratio, you need to use the “fast” assets that can be used to quickly transform into cash within 90 days, including cash and cash equivalent, price securities, and accounts receivable.For short-term liabilities including short-term debt, account payable, and debt payable, the company’s ability to quickly cope with liabilities is evaluated by calculating the ratio of calculation.

Under normal circumstances, when the speed ratio is less than 1, it means that the current company’s current asset-liquidity is limited and there is no ability to repay its existing liabilities.

On the contrary, when the speed ratio is greater than 1, it means that the current mobile asset holdings of the listed company are sufficient, which can fully cope with the current liabilities.

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the speed ratio?

- How to calculate Apple’s speed ratio?

- What is the investment guidance significance of the speed ratio?

- The use of speed ratio is limited

- Speed-freezing ratio and flow ratio

- More investment strategies

How to calculate the speed ratio?

When calculating the speed ratio, two data are mainly obtained: “fast” flow assets and liabilities, and then “fast” flow assets can be removed by mobile liabilities to get the speed ratio of listed companies during the financial period, that is,:

Speed ratio rate = flow asset / liabilities

Quick ratio = liquid assets / quick liabilities

There are two calculation methods when calculating the flow assets:

1: Add the company’s cash and cash equivalents, Marketable Securities, and the accounts receivable, that is,:

Moral assets = cash and cash equivalent + securities + accounts receivable;

Liquid Assets = Cash and Cash Equivalents + Marketable Securities + Accounts Receivable;

2: Skill the current inventory and prepaid expenses from the company’s total current assets (Inventory) and Prepaid Expenses, that is,:

Migrant assets = total flow assets-inventory -prepaid fee;

Liquid assets = Total Current Assets – Inventory -Prepaid Expenses;

When calculating liabilities, you can add the company’s short-term debt (SHORT-TERM DEBT), accounts payable, and the liabilities and Other DebTs (account).

Liabilities = short-term debt + account payable + liabilities and other debt

Quick Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

All these data can be found in the Balance Sheets in the company’s financial report.

It should be noted that the company’s inventory and prepaid fees are not considered in the calculation of the speed ratio.

Inventory may usually take more than 90 days to monetize.If you need to quickly sell inventory inventory, you may need to depreciate, so the value will be greatly reduced;

The prepaid fee usually refers to the subscription costs of some insurance or projects.These costs cannot be used to pay liabilities, so they are not included in the calculation of the speed ratio.

How to calculate Apple’s speed ratio?

This chapter will be released by Apple in September 2021 10-K financial report Calculate the instance.

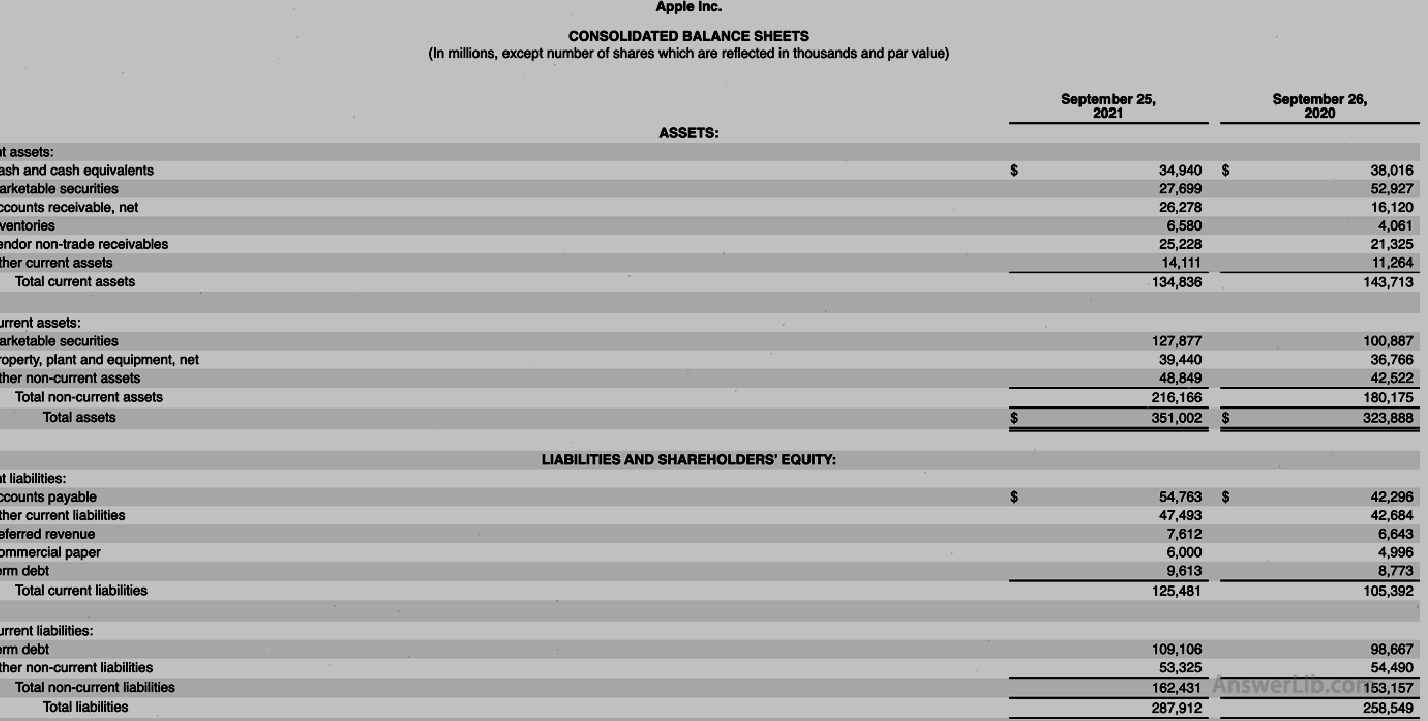

AAPL Financial Report middle Balance sheet As follows:

You can find it from the data table:

Cash and Cash Equivalents | $ 34,940 m |

Marketable Securities | $ 27,699 m |

Accounts Receivable | $ 26,278 m |

Total Current Assets | $ 134,836 m |

Current inventory (Inventory) | $ 6,580 m |

Suppliers non-trade receivables | $ 25,228 m |

Other current assets | $ 14,111 m |

Short-Term DEBT | $ 9,613 m |

Accounts Payable | $ 54,763 m |

Liability and other debts | $ 47,493 m |

Use calculation formula 1:

Migrant assets = cash and cash equivalents + securities + accounts receivable

Liquid Assets = Cash and Cash Equivalents + Marketable Securities + Accounts ReceIvable

= $ 34,940 m + $ 27,699 m + $ 26,278 m

= $ 88,917 m

Liabilities = short-term debt + account payable + liabilities and other debt

Quick Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

= $ 9,613 m + $ 54,763 m + $ 47,493 m

= $ 111,869 m

Speed ratio rate = flow asset / liabilities

Quick ratio = liquid assets / quick liabilities

= $ 88,917 m / $ 111,869 m

= 0.79

Use calculation formula 2:

In Apple’s financial report, its assets that cannot be quickly equal to the price within 90 days will be labeled as the supplier’s non-trade receivables (VENDOR NON-TRADE Receivables) and other mobile assets, so::

Migrant assets = total current assets-current inventory inventory-supplier non-trade receivables-other mobile assets

Liquid Assets = Total Current Assets-Inventory-Vendor Non-Trade ReceIVles-Other Current Assets

= $ 134,836 m -$ 6,580 m — $ 25,228 m – $ 14,111m

= $ 88,917 m

Liabilities = short-term debt + account payable + liabilities and other debt

Quick Liabilities = Short-Term DEBT + Accounts Payable + Accrumd Liabilities and Other DEBTS

= $ 9,613 m + $ 54,763 m + $ 47,493 m

= $ 111,869 m

Speed ratio rate = flow asset / liabilities

Quick ratio = liquid assets / quick liabilities

= $ 88,917 m / $ 111,869 m

= 0.79

What is the investment guidance significance of the speed ratio?

It is generally believed that when the speed ratio is less than 1, it means that the company’s current mobile assets cannot pay their mobile liabilities.The smaller the speed ratio, the more vigilant investors need to be vigilant.

When the speed ratio is equal to 1 or larger, it means that the company has sufficient mobile funds to repay the liabilities, and the higher the speed ratio, the greater the company’s mobile assetInvestors are a good signal.

However, the higher the speed ratio, the better, because when the speed ratio is too high, it may mean that the company has accumulated a lot of funds without reasonable use to accelerate the development or expansion.Therefore, this also shows that the company’s operating strategy has emerged.When the speed ratio is usually higher than 7, investors will question the company’s operating model or even criticize.

Like other financial data, the speed ratio will also have different instructions in different industries.For example, for industries with stable cash flow and predictable, such as in the retail industry, a lower speed ratio does not mean that the company may be possibleThere are risks because they can rely on expected income to provide the required cash.On the other hand, in fluctuations or seasonal industries, a higher speed ratio will cover up the company’s insufficient income.

The use of speed ratio is limited

The calculation significance of the speed ratio is more to show the company’s survivability, that is, whether it can repay the debt that needs to be fulfilled in the short term, but for the health of the company, the explanation effect of the speed ratio is usually limited.

For example, if a company has a large number of long-term receivables, that is, the receivables with a cycle of more than 120 days, etc., when using the speed ratio to evaluate the enterprise, a more serious deviation will occur.

The speed ratio is different for companies with different development periods.For companies that grow in a period of growth, a higher speed ratio is required to help them quickly expand the scale of operation.For stable companies, lower companies are lower.The speed ratio is acceptable because it has reached a relatively stable cooperative relationship with partners.

Speed-freezing ratio and flow ratio

The mobile ratio, English is the Current Ratio, a financial indicator similar to the speed ratio of the speed ratio.It is different from the speed ratio.The flow ratio is expanded to the original 90 -day-to -90 days.The flowing assets that can be discounted, that is, calculate the prepaid fees and inventory inventory, and the value is equal to Total Current Assets.

In use, for industries that need a large amount of inventory, there will be large differences in the speed ratio and flow ratio.For example, the retail industry will expand the inventory before the holiday.Fluctuations, but the flow ratio will suddenly rise.After the holidays are over, the company’s speed ratio will not fluctuate due to the decrease in inventory, but for the flow ratioThere will be periodic fluctuations, and the speed ratio will be relatively conservative.