13F The table is a form that manages an institutional investment manager (Instituital Investment Manager) that needs to be submitted to the US Certificate offered every quarter, which disclose the positions of these large investment institutions.For example, if you want to know the positions of everyone in Buffett and Ray Dalio, then checking its 13F form is a very good way.

Therefore, for investors who want to “copy homework”, they can roughly understand some of the investment directions of large investment institutions through the positioning information disclosed in Tables 13F as a reference for stock selection.

According to the requirements of the US Securities Association, 13F form does not require investment institutions to disclose all its positions, but only need to disclose holdings that meet certain conditions.For example, short stocks do not need to be disclosed in Table 13F.U.S.stocks will not disclose the trading of investment institutions in other countries.Therefore, the use of 13F instructing investment still has certain limitations.In actual use, investors still need to refer to a large number of other tables and financial data for comprehensive analysis.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is 13F form?

- How to check the position of the agency?

- How to understand the position of the organization?

- Which institutions are worthy of attention?

- What are the advantages and disadvantages of using the 13F query mechanism?

What is 13F form?

The 13F form is the Securities and Exchange Commission (Securities and Exchange Commission ( SEC) Since 1975, institutional investment managers who are required to manage assets of over 100 million US dollars need to be published in each quarterly position structure.

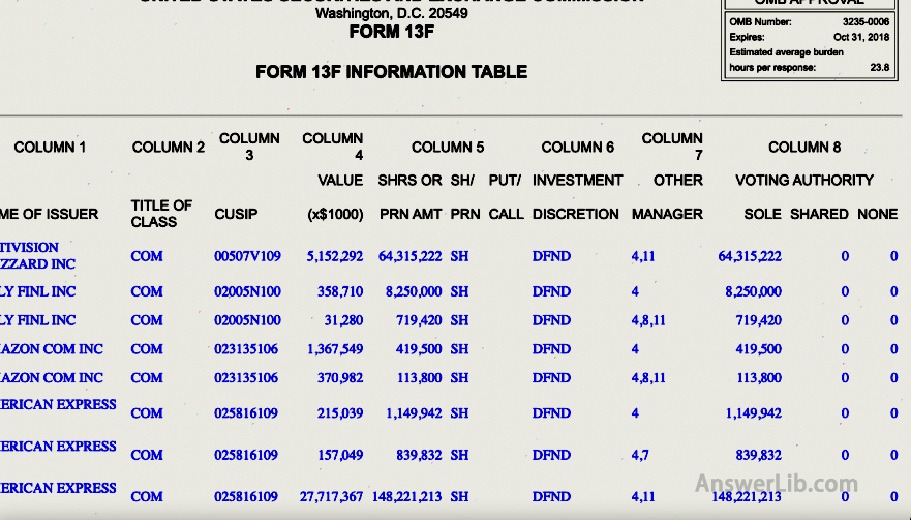

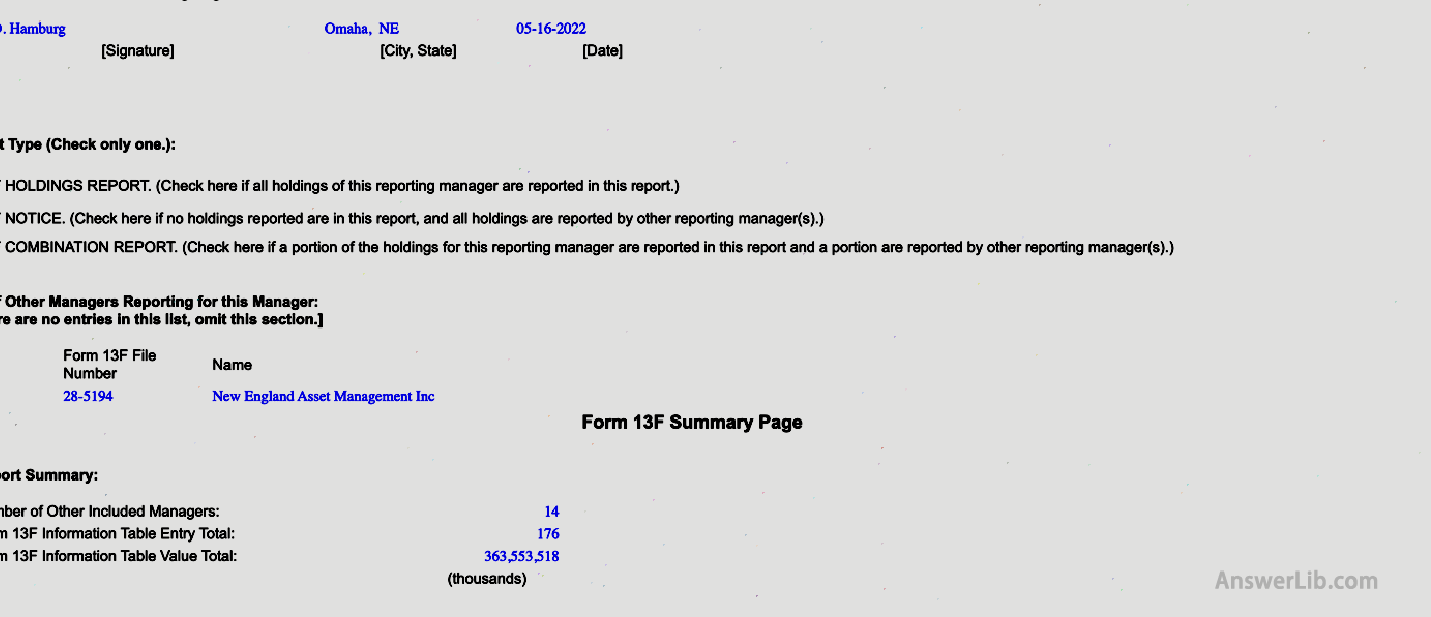

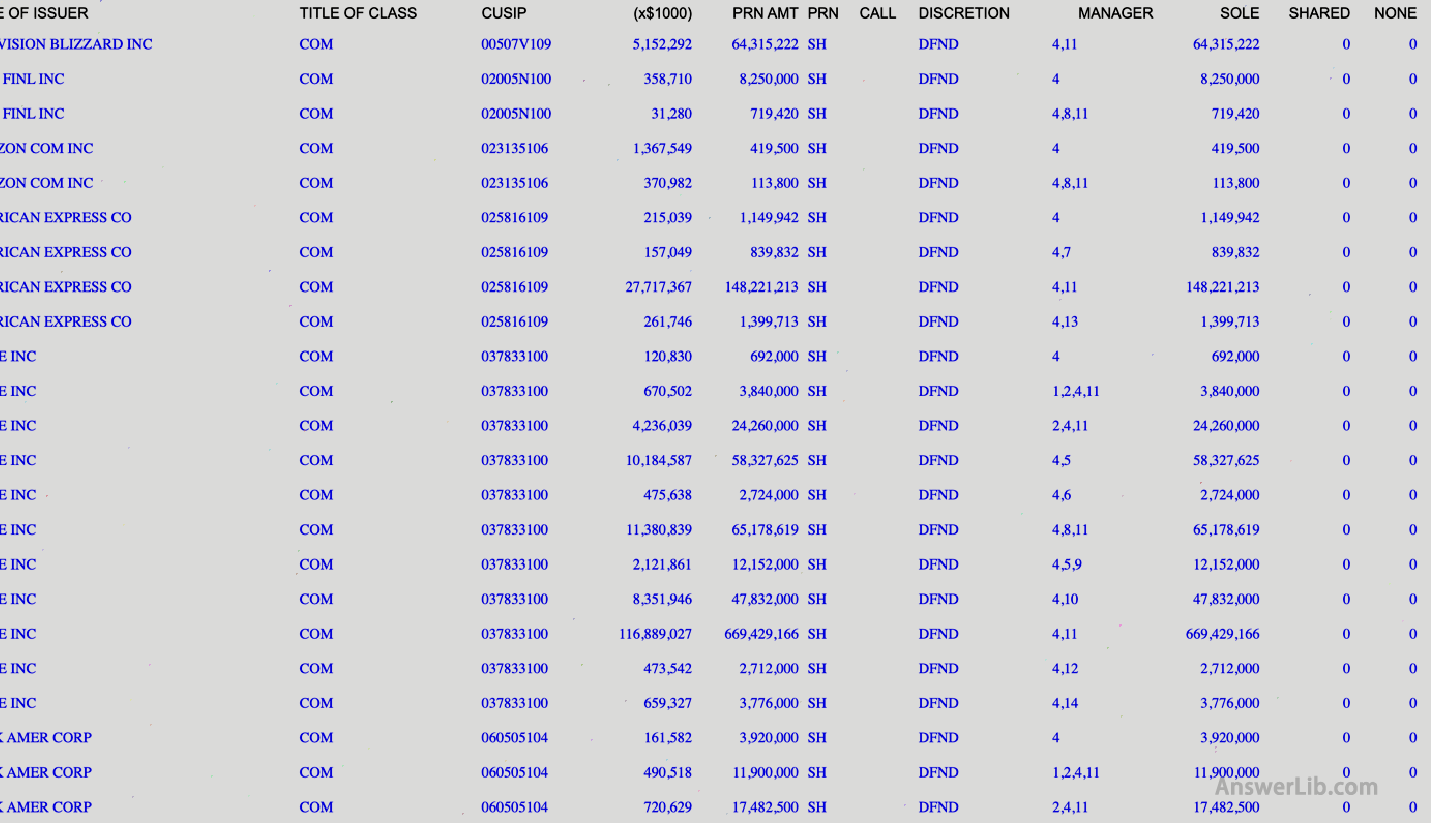

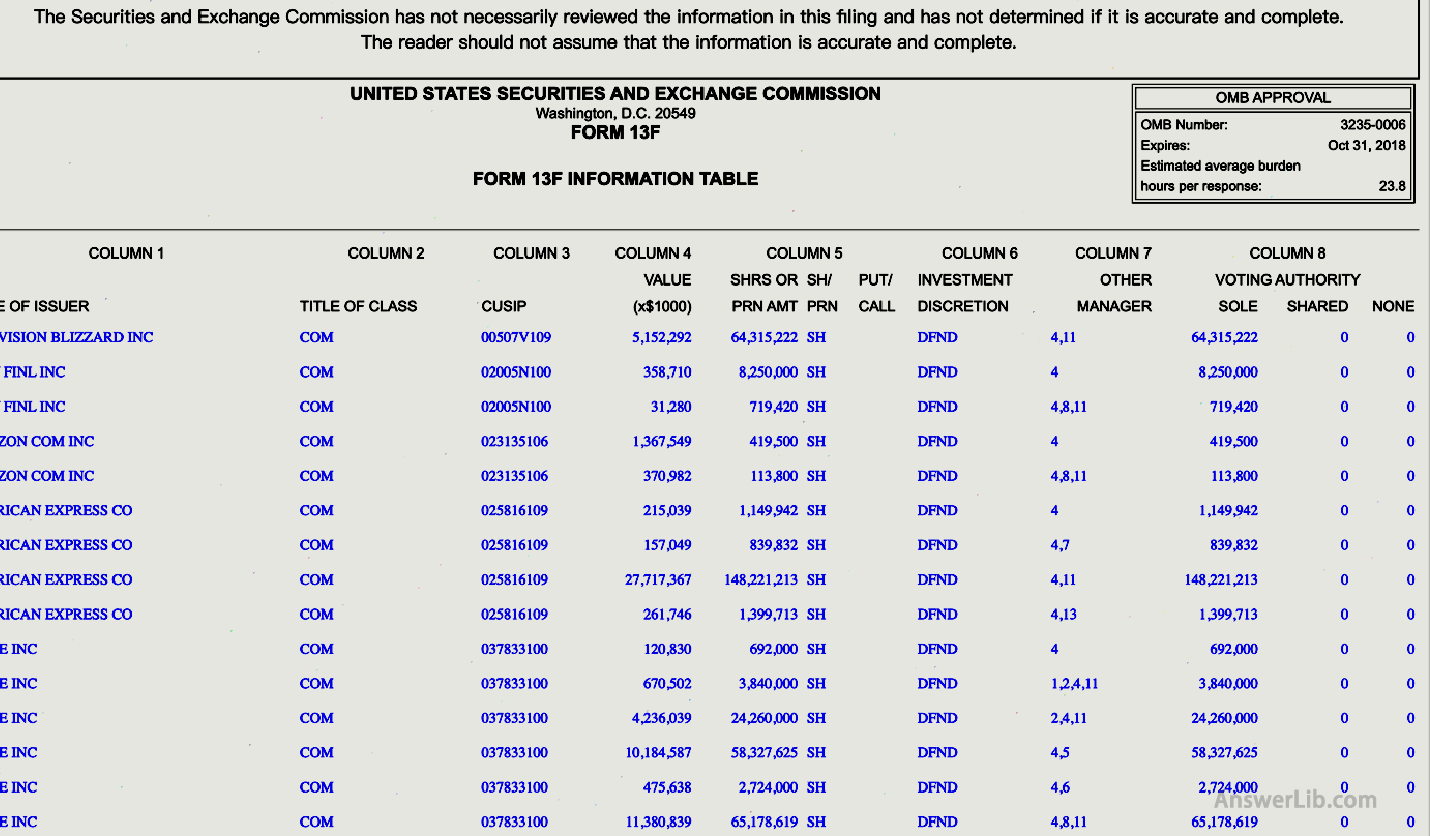

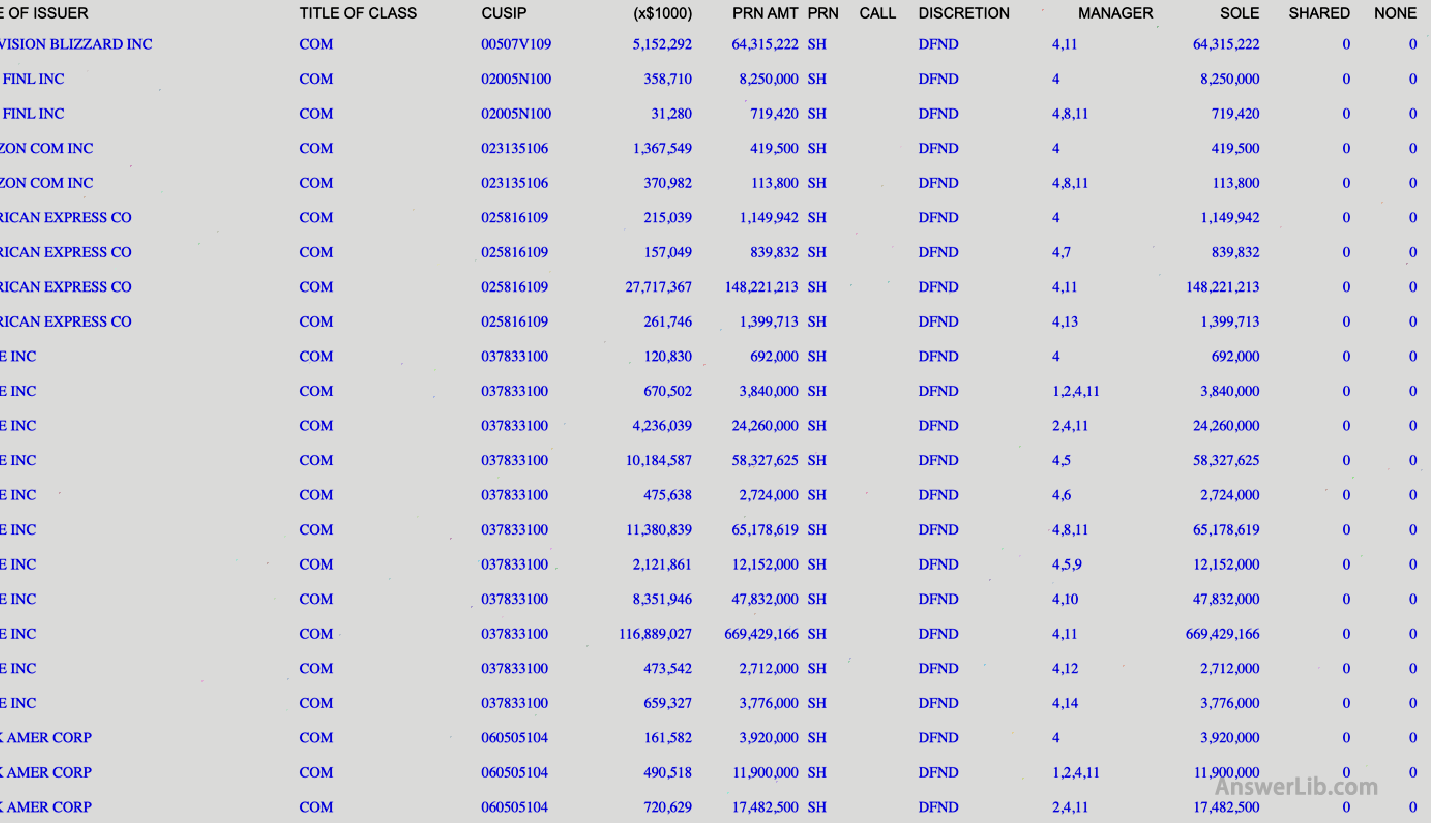

Below is part of the 13F table of Berkshire Hathaway:

The so-called “institutional investment manager” here must use the US address to carry out business, and at the same time, the assets manage more than 100 million US dollars.These institutional investment managers include both investment institutions or individuals who manages their own investment accounts, such as banks, insurance companies, companies, and pension funds, and also include institutions or individuals that manage other individuals or physical investment.

The 13F form needs to be submitted once a quarter, and Institutional Investment Managers must submit to the US Securities and Exchange Commission within 45 days after the end of the calendar.

The position information that must be disclosed in the 13F form often includes:

- The name of the investment institution has a certificate;

- The category of the certificates (convertible bonds, stocks, bullishness, and options);

- The number of certificates owned by investment institutions and its market value at the end of the quarter;

Investment institutions do not need to disclose all its types of positions.They only need to disclose the certificate that the US Securities Regulatory Commission requires disclosure.The US Securities Regulatory Commission will list all the certificates that need to be disclosed on their official website every quarter.List list“, Released in the first quarter of 2022 List of Certificate A total of 23,694 certificates information that needs to be disclosed.For example, for Apple, the required disclosure of the proof includes the following three items:

These SECs require the following categories: the following categories:

- Common Stock: Stocks including NYSE, AMEX, NASDAQ transactions, ETFs, ETF

- Watch / rise Options(Put / call option)

- WARRANTs: The equity permit refers to a financial investment derivative tool that can be traded and sells securities at a specific price before its expiration or due, which gives the holder right without obligation.

- American Depositary Receipts (ADRS): ADRS is a transferable certificate issued by US deposit bank U.S.DEPOSITARY Bank, which indicates a specific number of foreign companies.ADRS, like domestic stocks, trades in the US stock market.

- Convertible Debenture: It is a long-term debt issued by the company and can be converted into stocks after regularly.

Note that the Mutual Funds does not belong to the type of syndrome that requires disclosure of 13F.Therefore, if the investment institution holds these stocks, there is no need to disclose relevant information in Table 13F.

How to check the position of the agency?

step one: Investors can log in Official Website of the US Securities and Exchange Commission, Enter its homepage.

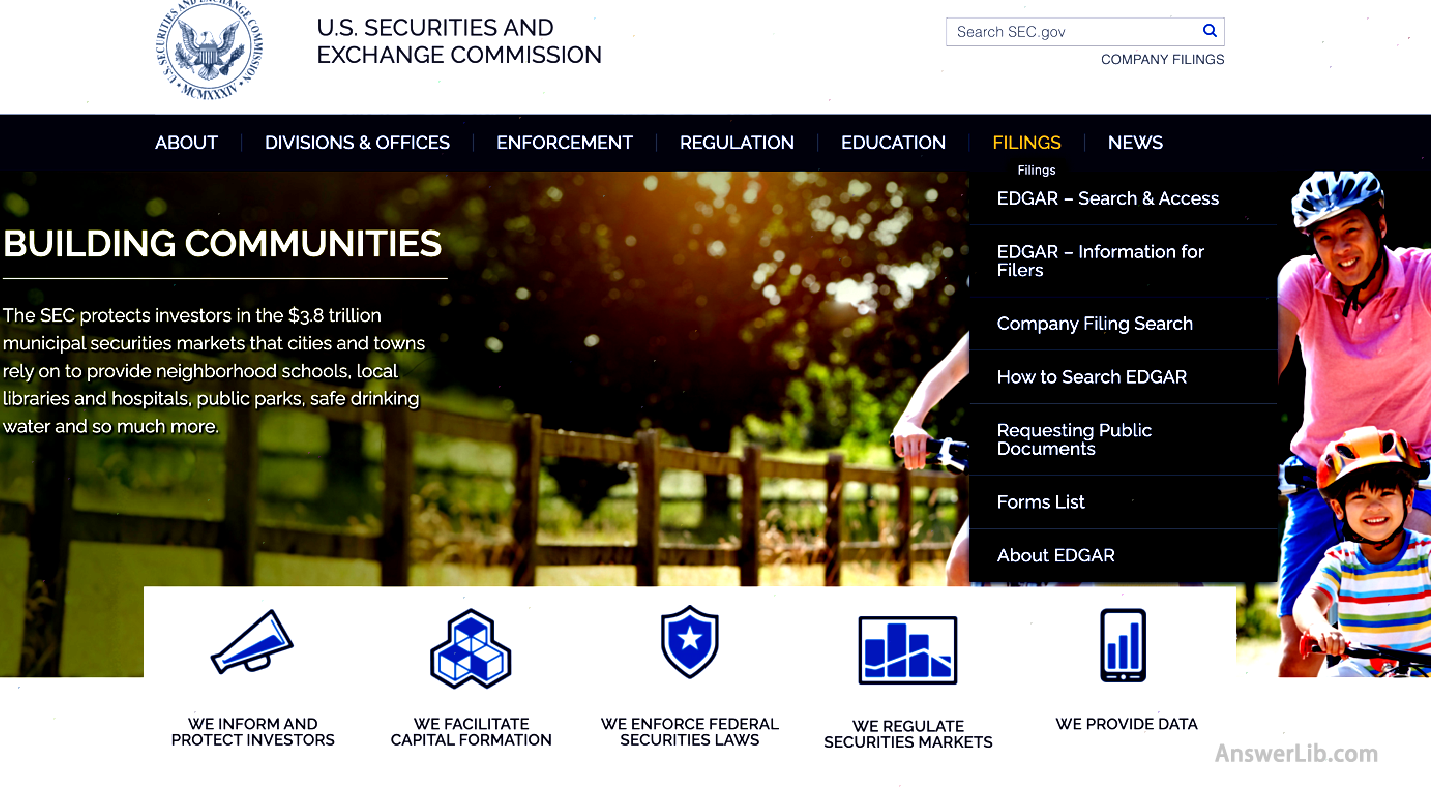

Step 2: In the “Filings” in the home menu bar, find “Edgar – Search & Access”, click to enter.

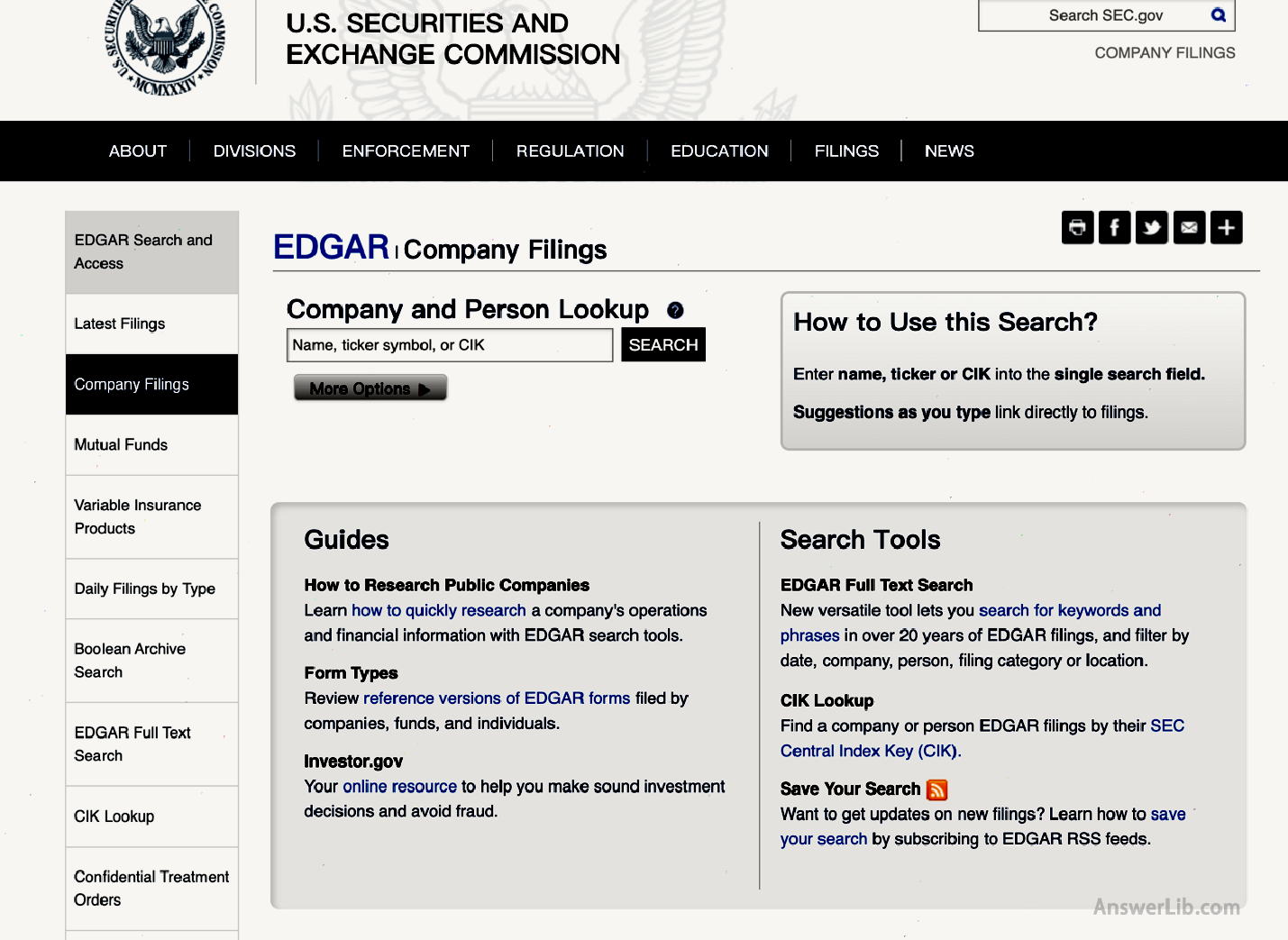

Step 3: In the “EDGAR-Search & Access” page, click “Company Filings” in the menu bar on the left, and you can enter the search page.You can enter the name of the target company, stock code or CIK code in the search box.Here is Berkshire Hathaway as an example.

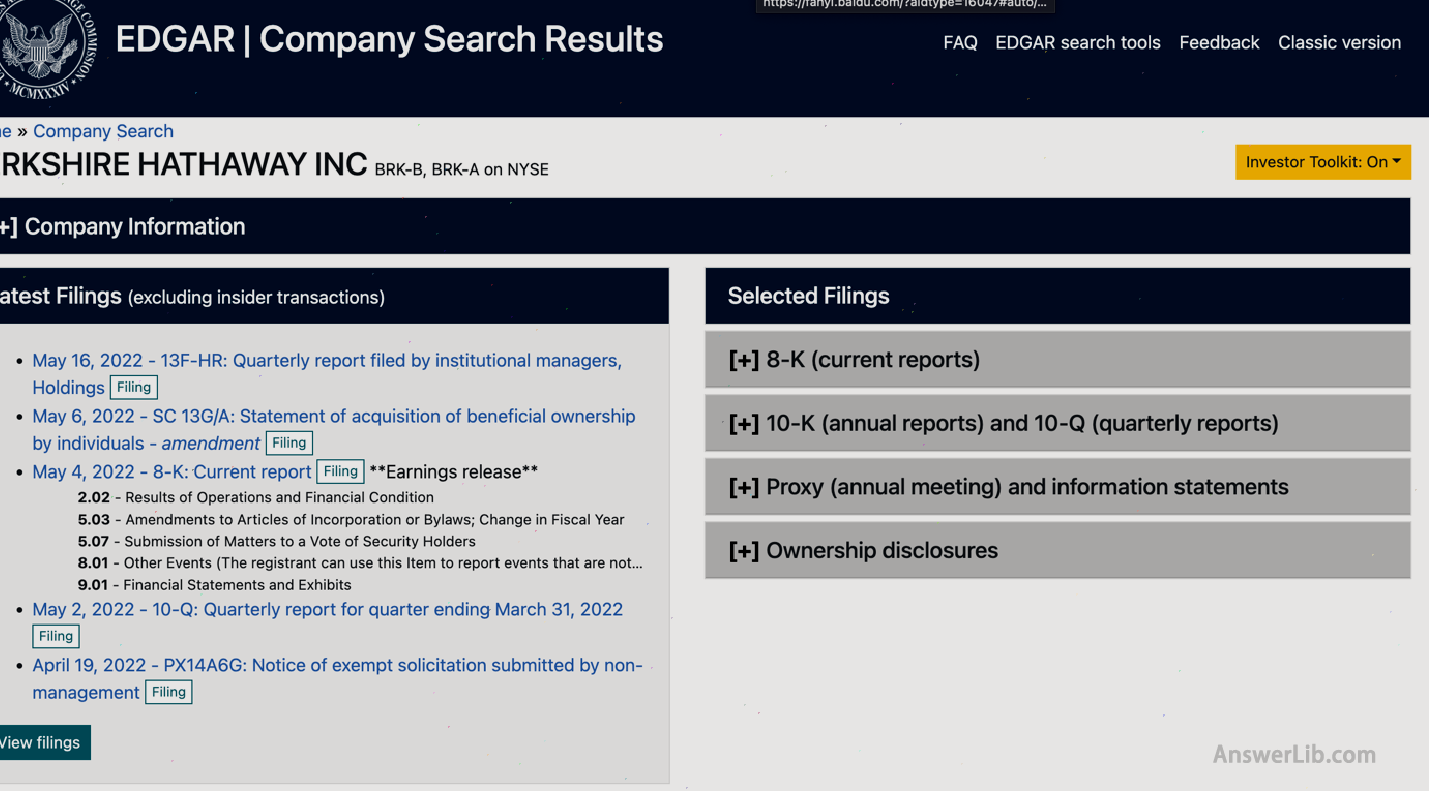

Step 4: After entering the information page of Berkshire Hathaway, you can see all the data tables recently released by Berkshire Hathaway on the left.Click “View Filings” below to enter all table pages, or directly click the 13F form connection in the information bar to enter thisThe company released the latest 13F form.It should be noted that clicking the form connection, which enters the review information, which provides investment institution information, manager information, and the company information included.Click the “Filings” link to see the relevant forms such as the company’s stock holding.

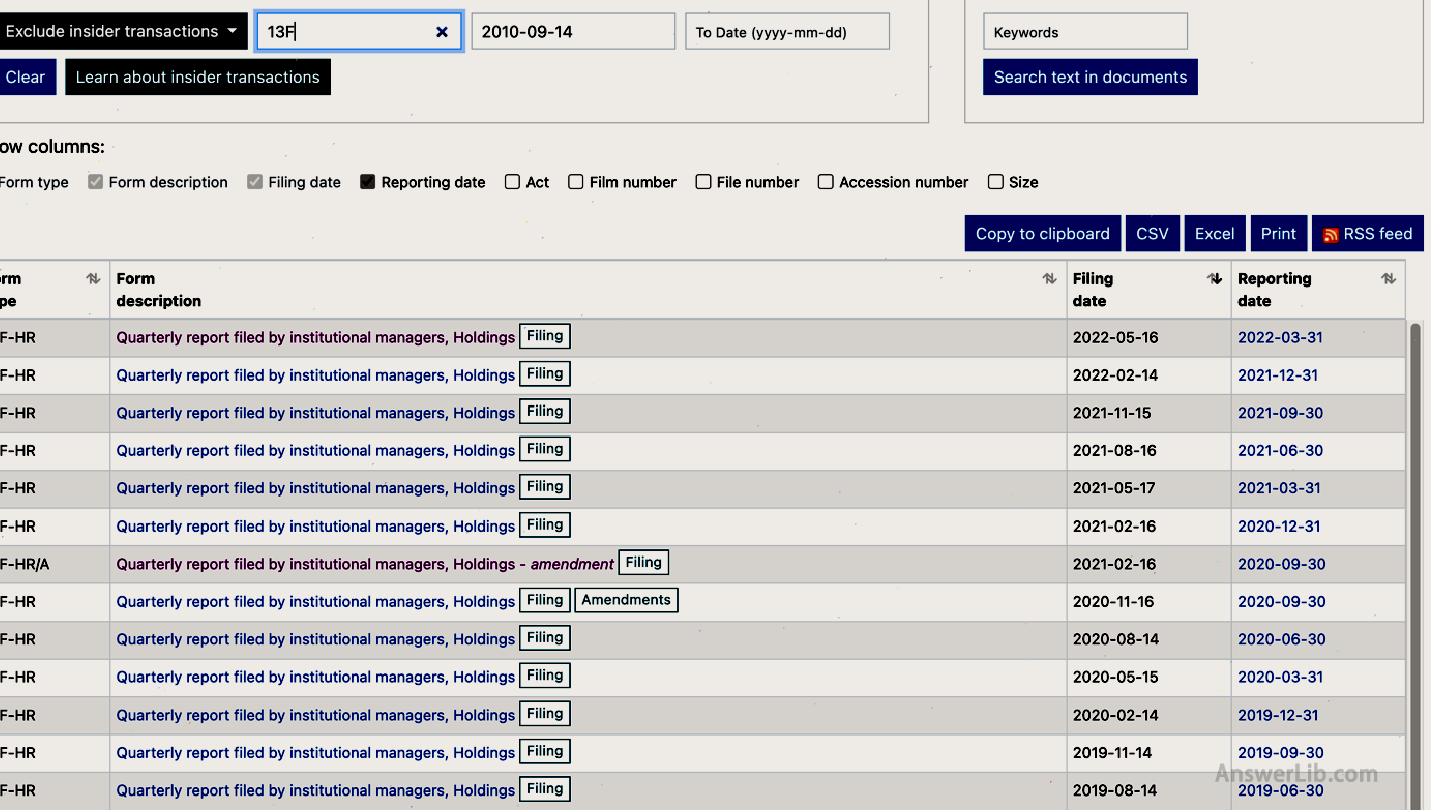

Step 5: After entering the “View Filings” page, you can enter “13F” in the screening box above to view all 13F forms of the company.Similarly, click the form connection, enter the review information page, click “Filings” linkRelated forms such as holdings.

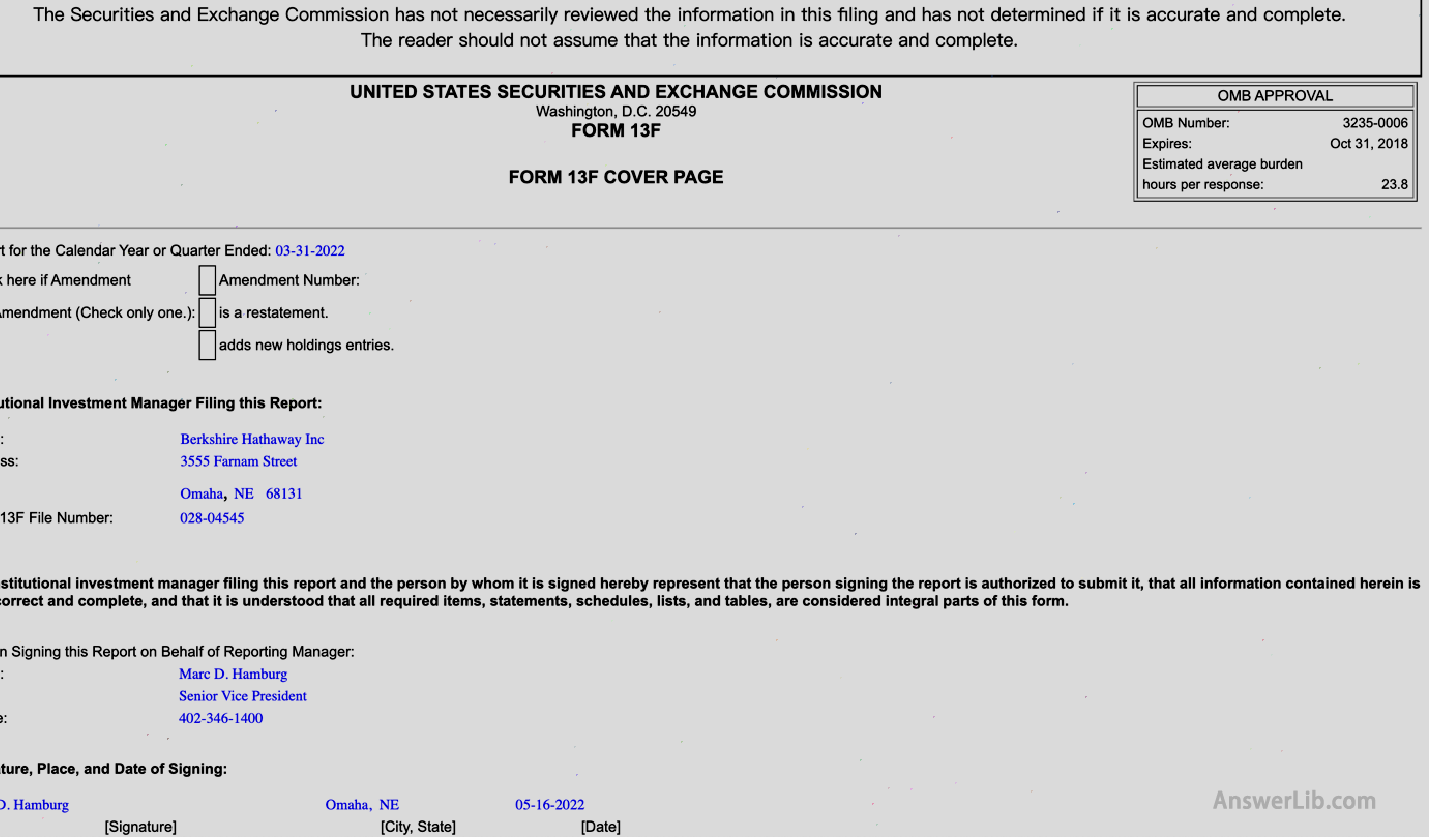

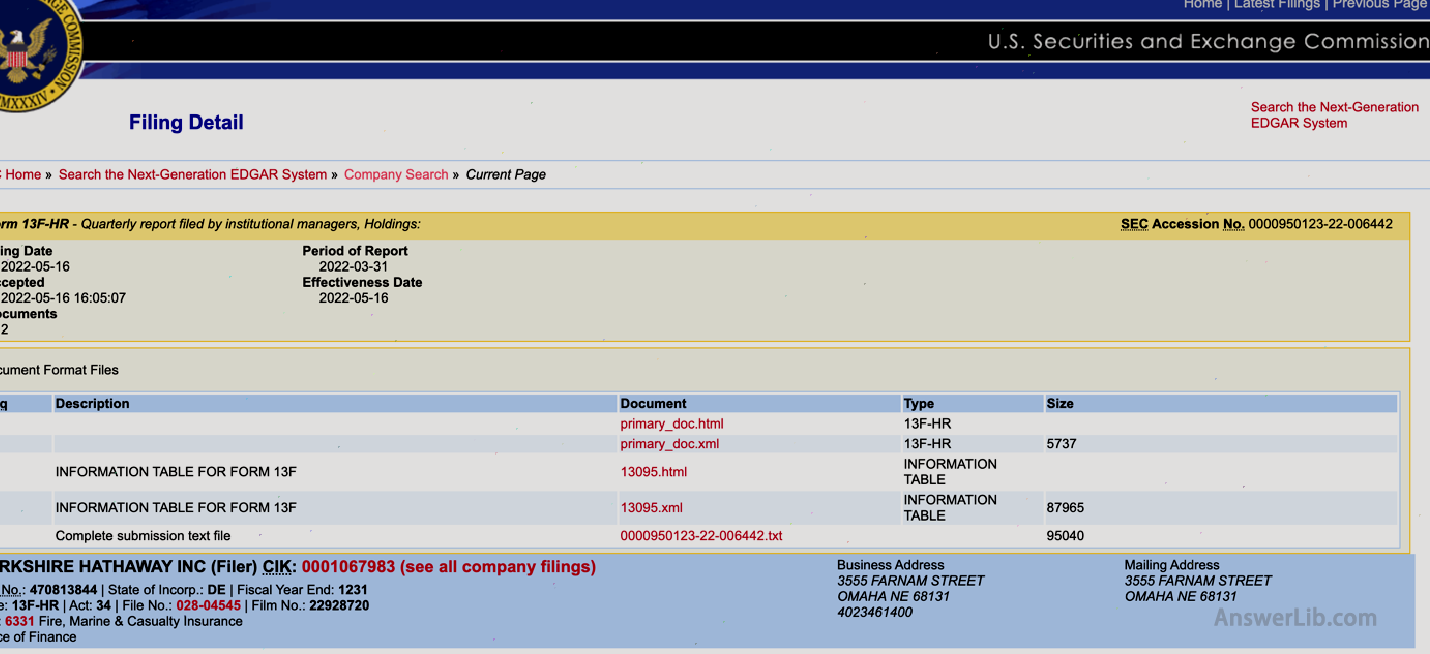

The following is the information review page entered after clicking the 13F form link:

The following is the table information page entered after clicking the “Filings” link.Click the file type of the table to view.Here is “13095.html”.

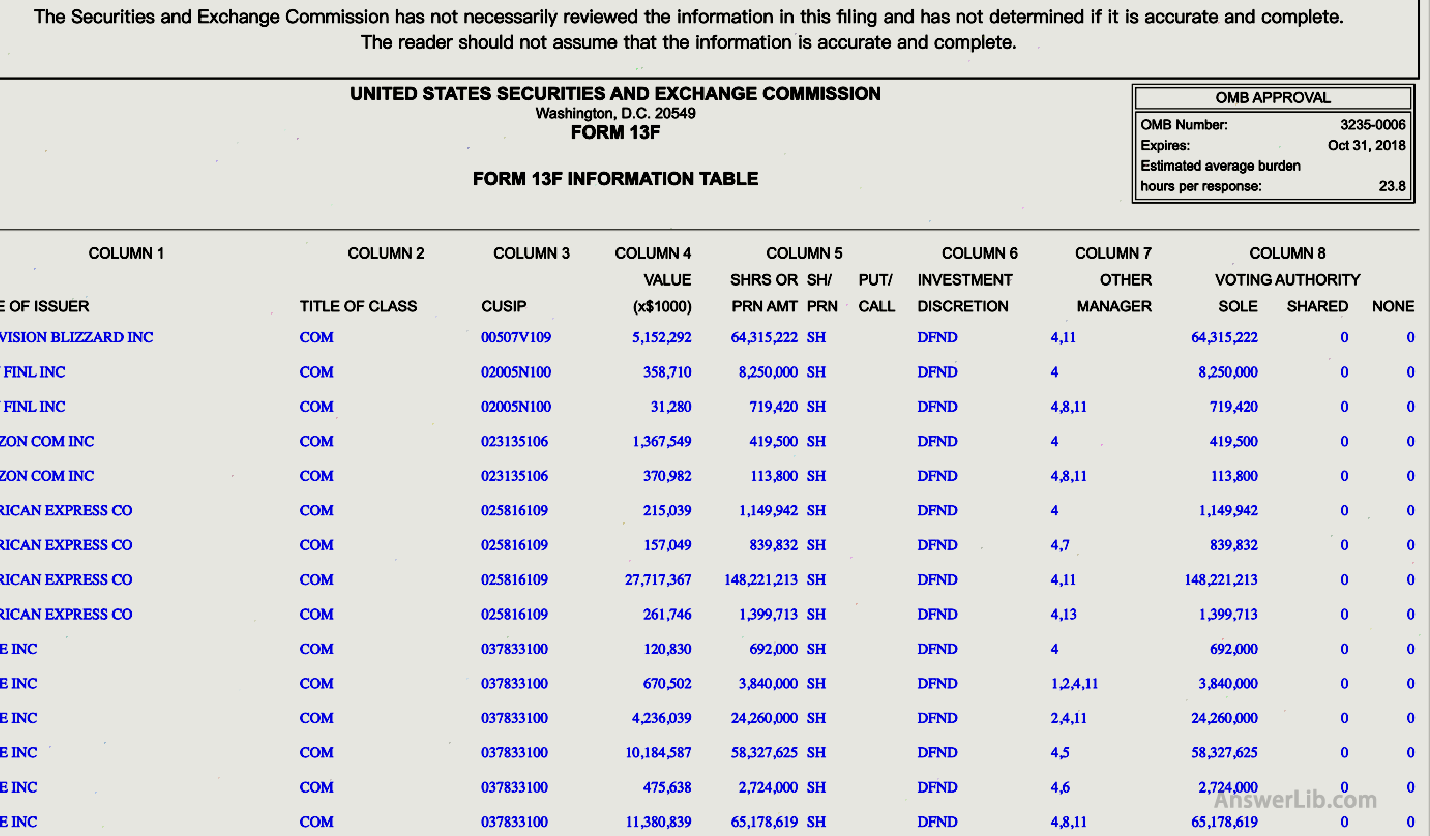

The following is the detailed stock investment information form in the latest 13F form released by Berkshire Hathaway:

How to understand the position of the organization?

The following is a detailed stock investment information form in the latest 13F form released by Berkshire Hathaway as an example to introduce the position information of the institution:

In the information table, there are eight columns from left to right:

Column 1: name of issue

The name of issue, that is, the name of the stock issuance company that is in line with the “13th (F) Securities” invested by the institution, will appear many times due to different investor portfolios.

Column 2: Title of class

Title of Class refers to the types of positioning cards, usually common shares (Common Stock “SH”), Principal Amount “PRN”) to see / call option, and the US deposit videos (American Depositary Receipts, referred to as ADRS), convertible bonds and other types.The “COM” in this table is ordinary stocks.

Column 3: cusip

Refers to the CUSIP code of the stock issuance company, which is consistent with the list code of all the cards issued by the US Securities Regulatory Commission.

Column 4: Value

It refers to the total market value of the agency at the end of the quarter of the 13F form at the end of the quarter.

Column 5: SHRS or SH

Refers to the number of certificates held by the institution at the end of the quarter of the 13F form at the end of the quarter.

Column 6: Investment discreting

Investment Discretion refers to the decision of the institution to conduct a testimony.In this column, there are usually three categories:

- Sole: Refers to the right to determine the single decision, that is, the institution that submits 13F has a complete decision right for the current transliteration of this certificate;

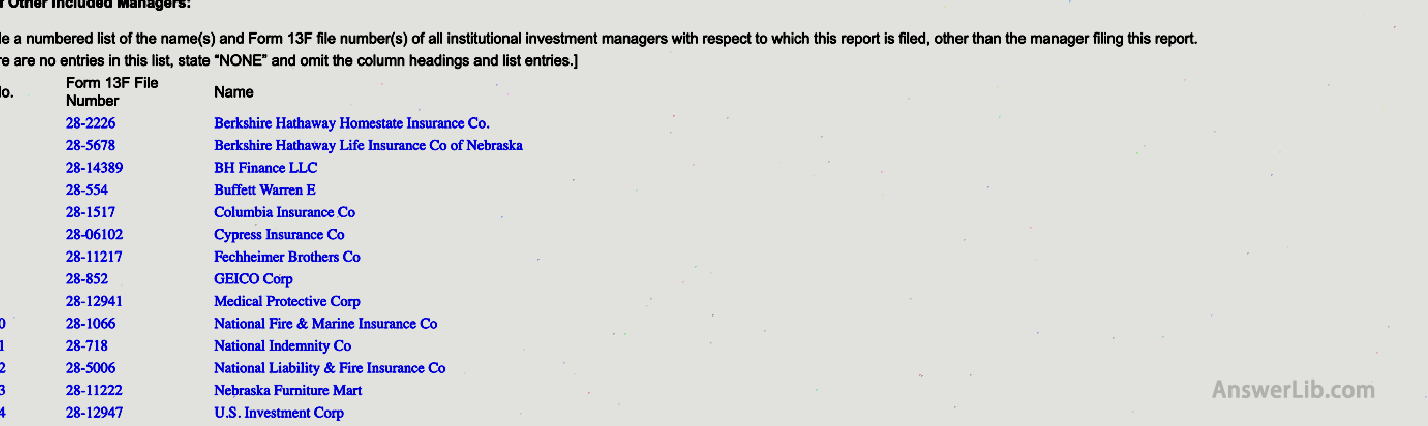

- DFND: It is the abbreviation of Shared DEFINED, which refers to the investigation institution that submits 13F and other institutional investment managers to jointly determine the trading of the certificate.These other institutions must be listed in the 13F form.In the subsequent Column 7, the corresponding corresponding to the corresponding.The name of other agencies;

- OTR: It is the abbreviation of Shared Other, which refers to the situation that is different from Shared Defined.

Column 7: Other Manager

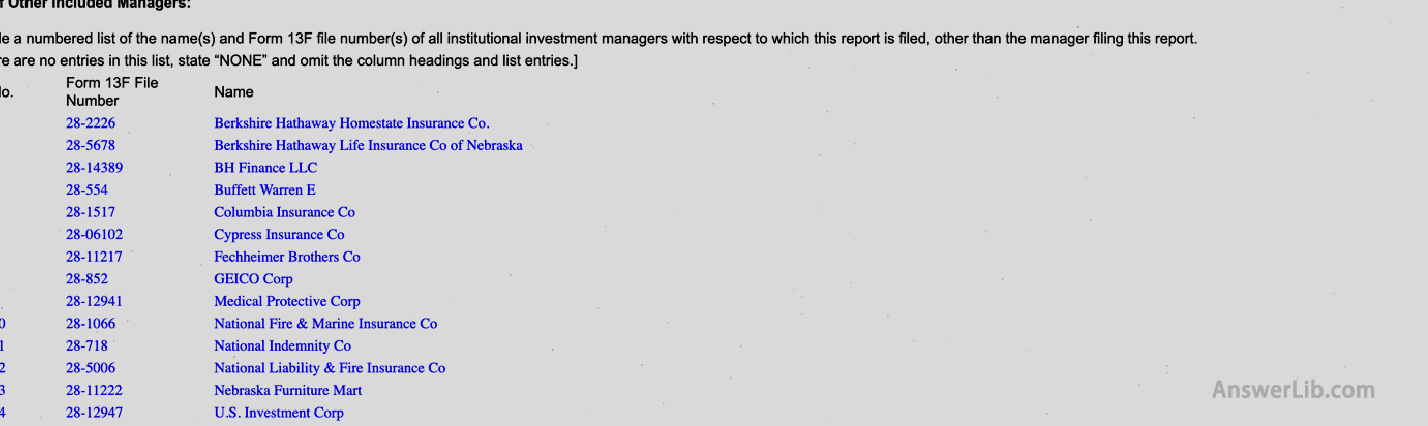

In Column 6, if the decision of securities trading is determined by the investment institution submitted to 13F and other institutional investment managers, then in the 7th column, the name of other institutional investment managers needs to be indicated.

The numbers in this column correspond to the “List of Other Included Managers” on the BERKSHIRE HATHAWAY Corporation 13F Form Salculation Page.

Column 8: Voting Authority

Voting Authority refers to institutional investment managers on the type of proven by institutional investment manuscripts and the corresponding voting rights.In the column of Voting Authority, there are three main categories:

- Sole: Voting the company’s important decision-making, such as controversial directors elections, mergers, selling major assets, changes in corporate articles of association that affects shareholders, and changes in basic investment policies.If you choose “DFND” in the INVESTMENT DICRETION in Column 6, then in Colant 8, you should fill in “Sole”;

- Shared: The right to vote for important decisions of the company, share with other institutional investors;

- None: There is no important decision-making voting right, or only voting rights for daily affairs.The daily affairs here include the selection of accountants, the non-disputed election of the directors, and the approval of the annual report.

From the 13F form released by Berkshire Hathaway, it can be seen that almost all the stocks they hold are almost all “Sole”, that is, these certificates that have the right to participate in non-daily affairs voting.

Which institutions are worthy of attention?

| Investment agency | Total amount of positions | Total number of positions | Top three positions | ||

|---|---|---|---|---|---|

| Ako Capital | $ 9.26 b | 25 | Bkng | ACN | TMO |

| Alex ROEPERS – Atlantic Investment Management | $ 310 m | 11 | WRK | Hun | Emn |

| Altarock partners | $ 3.92 b | 9 | Googl | TDG | MSFT |

| Bill & Melinda Gates Foundation Trust | $ 19.8 b | 18 | Brk.b | WM | CNI |

| Bill ACKMAN-PERSHING SQUARE CAPITAL Management | $ 10.4 B | 8 | LOW | CMG | HLT |

| Bill Miller-Miller Value Partners | $ 2.63 b | 88 | Amzn | OVV | Nclh |

| Bill Nygren – Oakmark Select Fund | $ 5.41 B | 25 | Googl | CBR | Ally |

| Bruce Berkowitz – Fairholme Capital | $ 1.72 B | 14 | Joe | CMC | EPD |

| Bryan Lawrence – Oakcliff Capital | $ 193 m | 10 | TDG | Goog | Chtr |

| Carl iCahn – iCahn Capital Management | $ 21.9 B | 16 | IEP | CVI | LNG |

| Charles bobrinskoy-Ariel Focus Fund | $ 71 m | 29 | APA | MOS | BWA |

| Charlie Munger – Daily Journal Corp. | $ 213 m | 5 | Bac | WFC | Baba |

| Chase Coleman-Tiger Global Management | $ 26.6 b | 88 | JD | MSFT | CRWD |

| Chris Hohn – TCI Fund Management | $ 36.8 B | 11 | Goog | MSFT | CNI |

| Christopher Bloomstran – Semper Augustus | $ 393 m | 32 | Brk.b | Brk.a | Oln |

| Christopher Davis-Clipper Fund | $ 1.11 B | 29 | Brk.a | WFC | Googl |

| Chuck akre – Akre Capital Management | $ 14.4 B | twenty one | Ma | MCO | AMT |

| Clearbridge value trust | $ 2.09 B | 63 | AIG | PXD | WFC |

| Daniel Loeb – Third Point | $ 7.68 B | 75 | S | PCG | DHR |

| David Abrams – Abrams Capital Management | $ 4.28 B | 18 | LAD | Googl | ChNG |

| David Einhorn-Greenlight Capital | $ 1.57 B | 52 | Grbk | BHF | TECK |

| David Katz – Matrix Advisors Value | $ 66 m | 30 | MSFT | Goog | AAPL |

| David Rolfe – Wedgewood Partners | $ 709 m | 42 | AAPL | FB | TSCO |

| David TEPPER-APPALOSA Management | $ 2.5 B | 34 | Goog | Amzn | FB |

| Dennis Hong – ShawSpring Partners | $ 727 m | 4 | IAC | SE | CPNG |

| DODGE & CoX | $ 96.3 b | 73 | SCHW | WFC | Goog |

| First Eagle Investment Management | $ 40.8 B | 378 | Orcl | Xom | CMCSA |

| FPA Queens Road Small Cap Value Fund | $ 446 m | 52 | SFBS | AEL | Syna |

| Francis Chou – Chou Associates | $ 135 m | 14 | Brk.a | RFP | BHC |

| Glenn Greenberg – Brave Warrior Advisors | $ 3.39 B | twenty four | Antm | FNF | APO |

| Glenn Welling – Engaged Capital | $ 988 m | 8 | BRCC | EVH | NCR |

| Greenhaven associates | $ 3.77 B | twenty two | GS | GM | Len |

| Greg Alexander – Confer Management | $ 873 m | 11 | EQH | Stla | BLDR |

| Guy Spier-Aquamarine Capital | $ 221 m | 13 | Brk.b | AXP | Bac |

| Harry Burn – Sound Shore | $ 1.15 B | 34 | Flex | Prgo | Orcl |

| Hillman Value Fund | $ 219 m | 34 | Googl | SPG | CVS |

| Howard Marks – Oaktree Capital Management | $ 7.76 b | 234 | CH | SBLK | VST |

| Jefferies Financial Group | $ 208 m | 6 | HLMN | LGF.A | FRGI |

| Jensen infestment management | $ 13.4 B | 80 | MSFT | Googl | PEP |

| John Armitage – Egerton Capital | $ 19 b | 29 | CP | Goog | MSFT |

| John Rogers – Arie Appreciation Fund | $ 1.25 B | 42 | Msge | Bokf | NTRS |

| Josh Tarasoff – Greenlea Lane Capital | $ 359 m | 11 | Amzn | CRM | Bam |

| Kahn Brothers Group | $ 788 m | 46 | PTEN | AGO | MBI |

| Lee Ainslie – Maverick Capital | $ 5.58 B | 225 | CPNG | Amzn | MSFT |

| Leon cooperman | $ 1.99 b | 56 | Coop | Googl | Inh |

| Li Lu – Himalaya Capital Management | $ 2.38 B | 6 | MU | Bac | Brk.b |

| Lindsell track | $ 6.35 B | 29 | MDLZ | PEP | Intu |

| Maires & Power Growth Fund | $ 5.4 B | 51 | MSFT | Goog | Amzn |

| Mason Hawkins – Longleaf partners | $ 1.68 B | twenty one | Lumn | CNX | FDX |

| Meridian Contran Fund | $ 687 m | 67 | SGH | CNHI | DBRG |

| MFP Investors | $ 846 m | 128 | Intc | BG | Sanw |

| Michael Burry – SCion Asset Management | $ 165 m | 11 | BMY | Bkng | WBD |

| Mohnish Pabrai – Pabrai Investments | $ 142 m | 2 | MU | SRG | |

| Nelson Peltz – Trian Fund Management | $ 5.97 B | 8 | Ferg | IVZ | Jhg |

| Norbert Lou – Punch Card Management | $ 390 m | 3 | Brk.a | Ally | WGO |

| Pat Dorsey – DormYASET Management | $ 1.04 B | 11 | FB | SMAR | Wix |

| Polen capital management | $ 51.2 B | 90 | Amzn | Goog | Adbe |

| Prem Watsa – Fairfax Financial Holdings | $ 3.01 B | 65 | ATCO | RFP | BB |

| Richard Pzena – Hancock Classic Value | $ 2.91 B | 40 | GE | AIG | WFC |

| Robert Olstein-Olstein Capital Management | $ 798 m | 106 | IVZ | WBD | WCC |

| Robert Vinall – RV Capital GmbH | $ 323 m | 6 | CACC | CRM | CVNA |

| Ruane, Cunniff & Goldfarb – Sequoia Fund | $ 4.04 B | twenty three | UNH | Antm | Googl |

| SETH KLARMAN – Baupost Group | $ 9.06 b | 53 | Lbtyk | QRVO | Intc |

| Stephen Mandel-Lone Pine Capital | $ 16.8 B | 29 | MSFT | Amzn | WDay |

| Steven Romick-FPA CRESCENT FUND | $ 6.68 B | 52 | Googl | CMCSA | AIG |

| Terry Smith – Fundsmith | $ 29.1 B | 44 | MSFT | IDXX | EL |

| Third Avenue Management | $ 733 m | 56 | FPH | HCC | TDW |

| Thomas Gayner-Markel Asset Management | $ 8.4 B | 124 | Brk.a | Brk.b | Bam |

| Thomas Russo – Gardner Russo & Quinn | $ 10.4 B | 82 | Brk.a | NSRGY | Ma |

| Torray fund | $ 349 m | 29 | Brk.b | GD | MMC |

| Tweedy Browne Co.-Tweedy Brown Value Fund | $ 418 m | 82 | Brk.a | Googl | NSRGY |

| Valley Forge Capital Management | $ 2.63 b | 10 | Ma | SPGI | FICO |

| Jeffrey ubben – ValueAct Capital | $ 7.27 B | 13 | FISV | KKR | STX |

| Viking Global Investors | $ 24.6 b | 90 | TMUS | Amzn | GE |

| Wallace weitz – weitz value fund | $ 930 m | 27 | Goog | Brk.b | CSGP |

| Warren buffett-Berkshire Hathaway | $ 363.6 b | 49 | AAPL | Bac | AXP |

| William Von Mueffling – Cantillon Capital Management | $ 14 B | 37 | SPGI | Googl | AVGO |

| Yacktman Asset Management | $ 11.2 b | 64 | CNQ | PEP | MSFT |

What are the advantages and disadvantages of using the 13F query mechanism?

The 13F form, as the publicized shareholding information statement issued by the investment institution, intuitively presents the viewing institution’s point of view on the current stocks.It can judge which stocks consider which stocks are good investment in stock holdings and which stocks are considered to reduce their holdings.

- To understand the holdings of the top investment institutions of Wall Street through Form 13F, including which stocks they have increased, the amount of stocks of which stocks have been reduced, and then you can consider following the operation;

- Observing which stocks are held from the historical form 13F form for a long time, it will usually indicate that these stocks are stocks with investment value;

Precautions

- Because the 13F form was published within 45 days at the end of the quarter, and the stock price continued to fluctuate during the trading day, relatively speaking, the information provided by the 13F form that investors sawWhen the institution makes a form, a stock is a good investment, but when investors check the 13F form, it has become a stock without investment value;

- In the 13F form, only the holding of the institution is reflected, and it does not provide any other information related to stock issuance companies, so the incomplete information may bring problems to investors’ decisions.

- In the 13F form, an open investment that does not include institutional investment including the common fund, so if investors want to make such investment, they cannot find related guidance information in Table 13F.

- The stocks contained in Tables 13F are all domestic stocks, excluding stocks, common funds that do not include international transactions, so investors cannot learn the guidance information of international investment through Form 13F.