Options, English is Options, Is a way of financial trading, used for transactions Derive futures trade Financial investment categories.To buy or sell for buyers at a certain price at a certain price at a certain price in the future Target asset Power profit, Not obligation.

here Target asset May stock As well as commodity As well as currency or index wait.Those who buy options need to pay a certain fee, which is called Option fee EssenceThe size of the option fee depends on multiple factors, including Optional bank prices As well as Options expiration time As well as The volatility of the target asset wait.

Futu Moomoo Provided 11 options and customized strategies, including watching bullish/falling, covering up, littering/falling, collars, crossing, triangle, etc.If you plan to conduct options Futu Moomoo account You can get a number of US stocks that are free of charge.

Options Two-way transaction The characteristics are more flexible than stock transactions, and they also have the characteristics of inconsistent profit and loss.At the same time, Sasitive than futures transactions At the same time, there are also a variety of strategies that can be used in combination, which makes investment financial management no longer a single linear profit and loss, but full of more variables and interests.

Want to start trying option transactions?First understand what options transactions are.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is an option transaction?

- What is the options?

- What is the options?

- What are the characteristics of options?

- How does option contract valuation?

- How to play options?What are the strategies of options transactions?

- Recommended by the trading options

- Is the transaction option risk at a high risk?

- What are the differences between options transactions and stock transactions?

- common problem

What is an option transaction?

Options yes Futures transaction Financial derivatives.

“Expect” It shows that the transaction process is based on futures contracts, “right” It refers to the right to buy or sell for futures contracts.

Therefore, the option transaction is simply a process of investors’ buying or selling rights for futures contracts.

Compared with futures transactions, the risk of options transactions has been adjusted, and it is also a unilateral rights model, which is different from most financial transactions.

Options transactions are widely used in speculation and risk management.Speculators can profit by buying or selling options, and risk managers can protect their investment portfolio through options transactions to avoid unexpected price fluctuations.Objective transactions are also highly flexible, and investors can carry out a variety of different types of option trading strategies according to market conditions.

The following uses a simple example to explain: “Bill WANTS to Buy A Car FROM Zoe”

Zoe has a car, and Bill proposes to Zoe that in the future period, you can get the right to buy this car at $ 15,000.

Zoe agreed with this transaction and asked Bill to pay 2%first, that is, $ 300 (option fee), and it will perform it.In the next month, it will not sell cars.The car was sold to him in the previous agreement.

This process is the basic process of option contract, wherein::

- The promise reached between Zoe and Bill is the “option contract” (option “;

- Zoe is a seller, that is, “Originator”, “Option Writer”, or “Option Seller”;

- Bill is a buyer, that is, “Option Holder”, or “Option Buyer”;

- Bill has obtained the right to buy ZOE cars, that is, “recipient the right” (recipient the right).For option contracts that obtain the right to purchase rights, it is called “Call Option”;

- One month is the option period, that is, A Known Pre-Defined Time Frame, or Option ’s Term, Option’ s Duration;

- Car is the “target” of this option contract, that is, “A Known Asset”;

- $ 15,000 is the “fixed price” of this contract.English is Strike, which is “A KNOWN Price”;

- $ 300 is the fee paid by the two parties when the two parties reached this contract, which is the cost of this option contract for each other, which is called “option fee”, and English is the price of the option;

From this example, it can be seen that options are a contract that gives buyers’ rights but does not make any obligations.It allows buyers to exercise power within a certain period of time and sell or buy clear target objects at the proposed price.Essence

The subject matter of the current rights contract is a stock, that is, the agreed between the two parties.Before a certain time, the buyer has the right to buy the shares held by the seller at a price to the seller at a certain price.Options contract “.

Similarly, the subject is ETF At the same time, the transaction is “ETF option transaction”.

Regarding the option period, the US market stipulates that at any time before the expiration, the buyer can exercise power; the EU market stipulates that only the buyer can exercise power only on the maturity date.

Objective contract is a very practical financial tool, which also meets the needs of a variety of transaction models.The most important ones are the options and the options.

What is the right to look up Intersection

Watch the options, English is Call options.

The bullish period refers to the right of buyers to buy the target objects based on the validity contract of the option contract and based on the proposed price and the quantity.Usually, the buyer believes that the value of the subject matter will rise, and the actual value of the actual value and the formulation value of the formulation value will be earned on the date of exercise date.The difference between the between.

When you buy the options, you get the right to purchase a certain asset at a specific price or before.

In the stock field, the bullish options are also called “Subsulation Perception” or “Buy options” Essence

The contract means that the buyer believes that the price of the stock will rise in the future, so he signs the option contract with the seller.

- During the validity period of the contract, when the stock does rose and the price exceeds the fixed price of the contract, the buyer can exercise the right to purchase to buy the stock in order to buy the stock.If the stock sells the stock after buyingThe difference between the price and the fixed price;

- When the stock price has not risen, or the increase is not more than the total amount of the proposed pricing plus the option fee, if the buyer exercises the option contract, there may be a certain loss.At this time, the buyer can choose not to exercise the right to purchase, and at this timeThe biggest loss of buyers is the option fee paid before.

The following is an example of the bullish options:

Assuming that the current market price of ABC’s stock is $ 100 per share.You believe that the stock price of ABC will rise in the future, so you purchase an expiration date of the expiration date, and the exercise price will be $ 110.You pay $ 5 options.

If ABC’s stock price will rise to $ 120 or more in the next 3 months, you can exercise your options and purchase ABC’s stock at $ 110.This means that you will get a profit of $ 10 per share (in fact, you need to deduct the options you paid).

On the contrary, if ABC’s stock price will not rise to $ 110 or more in the next 3 months, you will not exercise your options, and you will only lose the cost of USD 5 to US dollars.

What is the options?

Look at the options, English is Put options.

The declining options refer to the option buyers who have the right to sell a certain number of subject objects based on the decided price during the validity of the option contract.In the process of formulating the price, buyers will often think that the value of the subject matter will fall and exercise the rights and exercise rights.Earn the difference between the daily price and actual price.

When you buy Put Option, you have the right to sell a certain asset at a specific price or before a specific price.It generally means that you predict that a stock will fall in the future, so you hold the stock and sign an option with the seller.

In the stock field, the options are also called “Put option” or “Selling options” Essence

During the validity period of the contract, if the stock price has fallen and falling to the following price, the buyer can exercise the right to sell, and the seller must buy the stock at the proposed price.At this timeThe difference between the actual price.

Of course, if the stock has not fallen or the decline price is not lower than the fixed price, then this degradation option does not have the meaning of performance.Therefore, when buying a house, you will choose to give up the exercise of option contracts, so that only the loss of the output rights.

The following is an example of the options:

Assuming the current market price of XYZ’s stock is $ 50 per share.You believe that the stock price of XYZ will fall in the future, so you purchase a period of time to see the period in the next three months, and the exercise price will be $ 40.You pay $ 3 options.

If XYZ’s stock price has fallen to $ 30 or less in the next 3 months, you can exercise your options and sell XYZ stocks at a price of $ 40.This means that you will get a profit of $ 10 per share (in fact, you need to deduct the options you paid).

On the contrary, if the stock price of XYZ will not fall to $ 40 or below in the next 3 months, you will not exercise your options, and you will only lose the $ 3 US $ 3 option fee.

What are the characteristics of options?

1.Two-way transaction

In traditional transactions, investors are only for buyers, and they can only look forward to making up the interests of the difference.Once they fall, they can only consider their own losses.

In options transactions, investors can invest as a buyer or seller based on the value of the subject matter, and earn profits.Therefore, when the stock price falls, it can also make profits through options transactions.

For example, if you predict that a stock is about to fall, traditional investors will either sell to stop loss or continue to hold a one-day recovery.And option transactions allow investors to adopt Buy the decline period Power or Selling the bullish period To deal with transactions, that is, you can also earn profits in the process of stock decline.The two-way transaction model gives investors more strategic choices.

2.Unilateral power

Options transactions give buyers to exercise power.

During options transactions, buyers can choose to do or have no rights according to the market of futures contracts.

When the buyer proposes to exercise power within the contract period, the seller has the obligation to fulfill the contract.

3.Promotion and loss is not equivalent

Because the exercise of the option transaction is in the hands of the buyer, only when it is beneficial to themselves, the buyer will exercise the buying or selling behavior of futures contracts.

- If it is beneficial to the buyer, its profit is usually unlimited;

- If the price is unfavorable, the loss will not exceed the option fee.Compared with futures transactions, the degree of losses of buyers in options transactions greatly decrease, which is generally the loss of options.

Options Seller In the case of, the income is up to the option fee of the option contract, but the loss will be determined according to the content of the futures contract.In most cases, the loss may also be unlimited.

The characteristics of incorrect profit and loss have made options transactions unique in risk management.

How does option contract valuation?

The valuation of options contracts is essentially considered to be the probability prediction of the future price change of the subject matter.

1.Probability

When the probability of the estimated situation is large, the valuation of the option contract will naturally increase.For example, the value of viewing options will rise with the rise of the subject matter stock, so that the value of the option contract can also be to a certain extent, which can also become to a certain extent.A reference item for the judgment of the stock market.

2.The length of time

The option contract near the date of date will gradually decrease, because the change of the value of the subject matter is limited, and the room for change will gradually decrease.The value of the maturity option contract will be higher than the option contract expired after a month.

3..Volatility

Significant fluctuations are the situation that investors are willing to see and are afraid of seeing.The significant fluctuations in the favorable direction mean the rise in interests, otherwise it is the expansion of losses.

For buyers with option contracts, due to the existence of a two-way trading model, significant fluctuation means the expansion of profit margins.Therefore, the greater the option contract value of the option contract, the greater the volatility.

How to play options?What are the strategies of options transactions?

Here are some common Option trading strategy The most of which is used by investors is Bullish options and Dependence Essence

- Buy the bullish options (Long Call): It is believed that stock prices will rise, and purchase options will gain benefits when the price rises.

- Buy to see the options (Long Put): It is believed that the stock price will fall, and the purchase of options will gain benefits when the price falls.

- Selling options (SHORT CALL): Holding stocks and expected that the price will remain stable or rising slightly.

- Selling options (Short Put): I hope to buy stocks and expect the price to remain stable or rising slightly.Selling sees options to earn option costs and purchase shares at the exercise price when the options expire.

- Insurance strategy (Protective Put): Holding stocks and worrying about falling prices, buying options to protect your investment.

- Iron Butterfly: In the case of expected stock prices to remain stable, buy options and demeanor power at the same time, as well as selling two copies with slightly lower or slightly high or slightly high levels of sees of options.

- Long Straddle: It is estimated that the stock price fluctuates a lot.At the same time, it will buy the options and see the options to obtain benefits when the price rises or falls.

Due to the two-way trading model, options have a variety of transaction strategies, more flexible, and also testing investors’ strategic formulation capabilities.You can start with the basic four strategies.

1.Buy the bullish options (Long Call)

Buying options is the most popular trading strategy.It gives option holders the right to purchase assets that purchase bids at specific prices at specific prices, rather than obligations.Object holders will buy options by buying the options, and believe that the price of the underlying assets (such as stocks, goods, and currencies) will rise, so as to gain benefits at the future price rising.

For example, suppose the current transaction price of the company’s stock stock is $ 100.You believe that the company’s prospects are good, and the stock price may rise, so you buy the expiration date of the futures date, the right to watch the options, the exercise price is 110 US dollars, and the option cost is $ 3.

If the stock price of XYZ rose to $ 120 before the option expires, you can exercise your bullish options, purchase XYZ stocks at a price of $ 110, and sell at the current market price of $ 120, so as to get per share per share$ 10 income (minus your options paid).

If the stock price of XYZ has not risen to $ 110 or more before the options expire, you will not exercise your options, and you will only lose the cost of US $ 3 to the US $ 3 option fee.Therefore, buying the bullish period has a fixed loss and unlimited income potential.

Judgments based: The market is bullish and can earn benefits from the rise in the price of the target securities.

Basis and loss:

- Maximum profit: Unlimited limit, coming from the stock price difference

- Maximum loss: option fee

- Balancing point of profit and loss: execution price + option fee

Volatility: The amplitude of the fluctuations rises to the front, and the decline is negative

Time reduction: Negative impact

2.Buy to see the options (long pu T)

Buying options is an ideal strategy for investors to make a profit from the decline of the target stock price.

Investors can buy such options contracts to sell the target assets at certain prices at a certain time.This option contract allows investors to earn benefits when the target asset price falls.

For example, suppose an investor thinks that the stock price will fall and want to protect his investment portfolio from losing money.The investor can buy stocks to see the option contract, which stipulates that the stock sells stocks at a specific price at a specific price at a specific price in the future.

Suppose the investor purchased a stock to see the options, the exercise price was $ 100, the expiration time was three months, and the right to pay $ 2 was paid.If the stock price falls to $ 90 within three months, the investor can exercise the options, sell the stock at a price of $ 100, and get a $ 10 of a profit.Because the investor has paid $ 2 rights, his net income is $ 8.

However, if the stock price is still higher than $ 100 after three months, the investor can choose not to exercise options, and the loss is limited to the $ 2 rights he paid.This strategy enables investors to gain benefits when the stock price falls, and when the stock price rises or keeps unchanged, it will only lose the right to pay.

Judgments based: If the market falls, it can make benefits from the decline in the price of the target securities.

Basis and loss:

- The maximum profit: very large, but the upper limit, that is, the stock price fell to zero yuan

- Maximum loss: option fee

- Balancing point of profit and loss: execution price-option fee

Volatility: The amplitude of the fluctuations rises to the front, and the decline is negative

Time reduction: Negative impact

3..Selling the options (Short Cal L)

Selling optional rights strategy refers to the shares that investors sell a bullish option contract and hold the same amount of shares at the same time.It is suitable for the shares of the target, but it is believed that the market may enter a slight shock before the option expires.

It is the right to sell options contracts to option buyers, and purchase the target assets at certain prices at specific prices.Holders who sell bullish options believe that the price of the underlying assets may fall or maintain stability, so that they want to obtain option costs and face possible losses in the future.

For example, suppose the current transaction price of the company’s stock stock is $ 100.You believe that the company’s prospects are stable or falling, and the stock price will not rise more than a specific price.Therefore, your selling date is the bullish options in the next three months.

If the stock price of XYZ has not risen to $ 110 or more before the options expire, the option buyers will not exercise options, you will receive an option cost of $ 3, while maintaining the holding of XYZ stocks.If the stock price of XYZ rose to $ 120 before the options expire, the option buyers will exercise options.You need to purchase XYZ stocks at a price of $ 110, and then sell it at the price of $ 120 at the current market price.$ 10 per share (minus the cost of US $ 3 for $ 3).

Selling the bullish options has limited benefits and unlimited losses, because before the options expire, the price of the underlying assets may increase exceeded the bank’s prices, resulting in the holder to purchase the target asset at a higher price.Or face higher losses.Therefore, selling options for sale is a high-risk, high-return option trading strategy, which needs to understand the relevant knowledge and risks of options transactions.

Judgments based: Hold the target stocks in neutral or bullish attitude.

Basis and loss:

- Maximum profit: Limited, the difference between the obtained rights and fees + the difference between the execution price and the purchase price of the stock

- Maximum loss: The degree of loss and the decline in the stock price correspond

- Balancing point of profit and loss: stock purchase price-obtained option fees

Volatility: The volatility rises to negative, and the decline is positive

Time reduction: positive influence

4.4..Selling options (Short Put)

Selling SHORT PUT refers to a contract that investors sell their rights and seller’s obligations to buy the underlying assets at a certain price at a certain price at a certain price.The seller collects the rights and bear the obligation of the assets purchased at a certain time at a specific time in the future at a certain time.

Let’s take an example to explain the principle of selling options.Assuming that the current market price of a company’s stock is $ 100, an investor expects the stock price to remain stable or up.You can choose to sell a decline in options, that is, selling options.

The investor sold a declining options with a license price of $ 90 and charged $ 2 rights.If the stock price is higher than $ 90 when the options expire, the buyer will not exercise the option, and the seller can retain the $ 2 rights received.However, if the options expire, the stock price is lower than $ 90, and the buyer will exercise options.The seller needs to purchase the stock at a price of $ 90, even if the market price was lower than $ 90 at that time.

In this case, the seller will face losses.For example, if the stock price drops to $ 80 when the options expire, the seller will need to purchase the stock at a price of $ 90, and then sell it at a price of $ 80 in the market, losing $ 10.

In short, selling options for sale is an investment strategy that allows investors to obtain benefits from stable or rising stock prices, but may bear restrictions on risks., Thus suffered losses.

Recommended by the trading options

As an investor, choosing a reliable and appropriate trading platform is the most convenient and suitable choice for security transactions.In addition, mature trading platforms often provide more effective and accurate market analysis.It will help.

Current online American merchant There are: Ying Diandai 劵(recommend), Futu Moomoo,, Robinhood As well as Micro-cow(Webull), Tastyworks, E*Trade, Eoption, TD American, Ally, etc.

Futu Moomoo option transaction

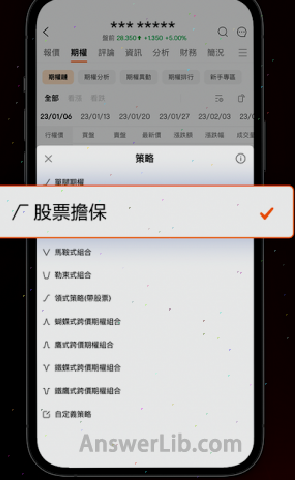

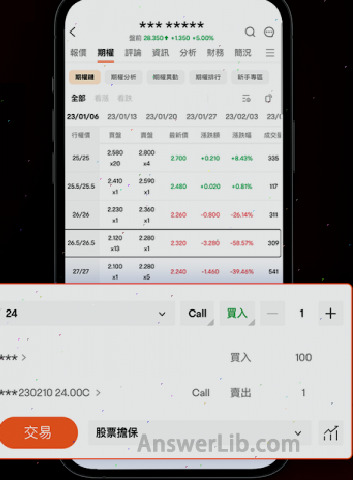

Futu Moomoo provides 11 option strategies and allows you to customize your strategy.Here, you can enter a complex multi-leg option strategy in a order, and the next two orders are the same.

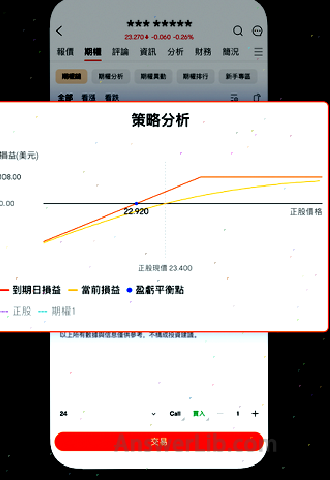

At the same time, Futu Moomoo supports tracking stop loss.You can set up a “tracking amount” or † “tracking ratio”, so that the system will continuously calculate the stop loss price with the fluctuation of the market.In addition, its profit and loss analysis is very insight and easy to use.Just click on, I can check the profit and loss balance point and the possibility of profitability before issuing an order.

You can choose different option strategies in the steps below, and select different option strategies in the Futu Moomoo APP.

The characteristics of Futu Moomoo option trading are as follows:

- 11 options and customized strategies: MOOMOO provides 11 optional strategies orders, including bullish/bruises, covered, littering/collars, collars, spans, triangles, butterflies, vertical, arbitrage, iron butterflies and iron sets.

- You can lower two orders at the same time (within the same strategy).

- Moomoo provides a custom strategy that allows you to combine option orders with basic securities according to your wishes.

- Tracking stop loss limit order: MOOMOO supports tracking stop loss for options transactions.You can set up a “tracking amount” or † “tracking ratio”, so that the systemAs the market fluctuates continuously, the stop loss price will be continuously calculated.

- Analysis of profit and loss analysis of insight: You can view the analysis of profit and loss, including profit and loss balance point, profit possibility, etc., and analyze the potential profit scope of one-click before the order.

Micro -Bull Op

Weiu is a large financial transaction online broker.It provides desktop programs and mobile clients.A series of practical tools allow investors to experience the convenience and smoothness of online transactions.

For options transactions, Weiu provides 0 commissions, 0 contract fees, 0 transfer or exercise fees, and two free stocks can be rewarded.

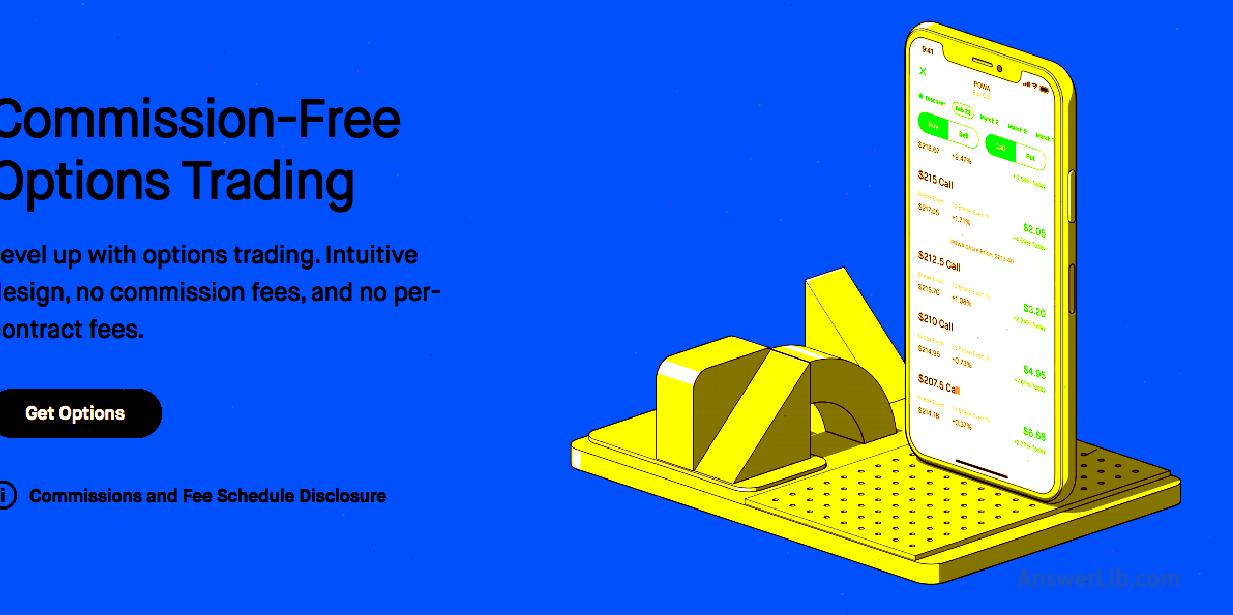

Robinhood option transaction

As the founder of Zero Gold Stock Transaction, Robinhood also provides advantageous charging policies in options transactions, 0 commissions, 0 contract fees, 0 transfer or exercise fees.

It is easy to learn and use desktop programs and mobile client interfaces.Even novices can quickly master the necessary basic knowledge and start their personal investment experience smoothly.

Is the transaction option risk at a high risk?

Any investment has certain risks, the difference is different risks and severity of risks.As far as option transactions are concerned, the risks that may exist during the transaction are:

1.Price fluctuation risk

Optional transactions are like a leveraged financial derivatives, and there are many factors that will affect option prices.For example, the price and time of the options bid will fluctuate in large price.This is an important risk that investors need to pay attention toone.

2.Forcibly liquidation risk

Forcibly liquidation is that an anumable transaction uses the same day-to -day debt settlement system with similar futures transactions.After the daily closing, it will collect a deposit to the option party according to the contract settlement price.

If the voluntary deposit account is insufficient, the deposit will be required to make up the deposit.If the margin is not replenished within the specified time and the position is not closed, it will be forcibly closed.

3.contract risk

There are valid time for contract transactions, and different option contracts have different expiration date.On the day of the expiration, if the right party has no exercise, the contract will automatically abolish, no more value, and the investor’s optional contract account will no longer show the expired contract positioning.

4.Risk of failure of exercise

The risk of failure in exercise refers to that if investors do not have sufficient option fees in their accounts, if investors have not had enough option fees in their accounts, they will be judged as failed to exercise rights and cannot exercise the rights given by the option contract.

What are the differences between options transactions and stock transactions?

A.The same point of options and stocks

- Both are financial investment products;

- After a certain judgment of the future stock price trend of the target stocks starts to start transactions;

B.The difference between options and stocks

Trading partners different

- Options are the right to buy or sell for a certain period of time in the future or or more stocks;

- Stocks are the actual ownership of a certain company’s shares;

Transaction direction different

- Options are two-way transactions.You can buy it first, or you can buy it first.Investors can be both buyers or sellers;

- In stock transactions, investors are only for buyers to buy stocks from the stock issuance company;

means of transaction different

- In the process of options transactions, two parts of expenses are involved in the process of options: the contract for the contract paid when the option fees and the later exercise of the rights;

- Stock transactions are one-time full transactions, that is, the total cost of buying stocks in actual purchase;

Transaction settlement Different ways

- The settlement method of options transactions is to exercise power on the buyer before the contract expires.If the buyer does not exercise power, the contract will be terminated automatically at the expiration date, and the option fee is owned by the seller;

- In stock trading, investors did not need to settle before the transaction was reached;

Trading expiration date different

- The date of the option transaction is on the date of date is the transaction expiration date

- Stock transactions unless the company delists, there is no transaction expiration date

Rights and obligations in transactions different

- In options transactions, the buyer has the right to exercise rights, without any obligations.The seller only has the obligation to perform the contract and has no rights;

- In stock transactions, the seller, that is, the obligation of stock issuers has the right to issue stocks and disclose operating information on time.The buyer, that is, the rights of shareholders to enjoy the right to know and check the account, must also fulfill the obligation to bear business risks;

common problem

Question 1: How to say English in English?Option English is Options, which has the characteristics of two-way transactions.It is more flexible than stock transactions and has the characteristics of inconsistent profit and loss.At the same time, it is safer than futures transactions.At the same time, there are many strategies to use.Linear profit and loss, but full of more variables and fun

Question 2: How to play options?Objective transactions mainly include: valuation of option contracts and strategies for options transactions.

The valuation of options contracts is essentially considered to be the probability prediction of the future price change of the subject matter.

Also due to the two-way transaction model, options have a variety of transaction strategies, more flexible, and also testing investors’ strategic formulation capabilities, mainly including buying options, buying options, selling options, selling and selling losses.Four strategies of options.

See More

Watching option English is Put Options.Declined option means that option buyers have the right to sell a certain number of target objects based on the decided price during the validity contract of the option contract.In the process of formulating the price, buyers often think that the value of the subject matter will fall, and on the day of exercise days, on the day of exercise daysEarn the difference between the fixed price and the actual price.

See More

The bullish option English is Call Options.The bullish options refer to the right to buy the subject matter of the target in the validity of the option contract and the amount of the target within the validity contract of the option contract.Usually the buyer believes that the value of the target will rise, and earn the actual value and the formulation on the day of the exercise date.Value differences.

See More