Short, English is Short Selling It is an investment strategy opposite to conventional stock investment strategies.Under normal circumstances, the vast majority of investors will obtain benefits through the rise in stock prices, so they will carry out the operation of buying low and selling high.And short, just Revenue from the decline in the stock price, Perform the operation of high sale before buying.

You are in stock trading software Futu Moomoo It can be easily short-term transactions.You only need to click the [SHORT] button of individual stocks to complete.

[Futu Moomoo provides an activity to open accounts and draws accounts, please check: Futu Moomoo Introduction.

Short-short is usually used to hedge investment risks, so that when the stock price falls, it can still maintain benefits.Some investors also use counterfeit to make speculation, and may use immoral means to suppress the stock price to obtain high returns.

Because the stock price is often faster than the rate of rising, some speculators can earn high returns from short-term transactions.However, the risks needed to be bearish are much higher than that of multiple transactions, because the minimum value of the stock price is limited, but the price of rising prices has no upper limit.Therefore, short-term transactions have very high transaction experience and investment vision of investors.The most famous short-to-short transaction is Michael Burry, a value investor in the 2008 economic crisis.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is going on when it is short?

- How to use Futu Moomoo shorts for short transactions?

- Three important indicators that need attention to short

- How to use the above three indicators to judge the trend of stocks?

- Michael Burry-the king of time?

- Why should investors short?

- What are the advantages of short transactions?

- What are the disadvantages of short transactions?

- More investment basic knowledge

What is going on when it is short?

Short Basic concept For: Investors borrowed stocks from the securities firms when the stock price was at a high level, and sold these stocks at the same time.After the stock price fell, buy back the same amount of stocks.At the same time, the stock was returned to Quotient, Earn the stock price difference.The operation of buying back stocks from the market is called “Buy to Cover” in English.

For example, investor towards Quotient Borrowing 10 stocks with a price of $ 100 and selling it to the market at a price of $ 100.When the price of the stock A fell to $ 50, then bought back 10 shares A from the market and returned the stock to the cricket.At this time, the investor earned $ 50 per share, totaling $ 500.

Corresponding to the short phase is to make more friends, that is, the most conventional type of stock investment transactions.Investors buy stocks to build bulls when they think they are low prices, and then wait for the stock price to rise.Out, earn the stock price difference.

In actual, investors need to perform the following operations:

- Apply for a margin account (Margin Account), open a short position, and intervene in the institution.

- At the same time, deposit in Maintenance Margin, the proportion of the maintenance deposit amount is formulated by the Financial Industry Regulatory Authority (FINRA), the New York Stock Exchange (NYSE) and the Federal Reserve, usually at least 50%of the value of the short position.During the transaction, investors must always maintain the balance in the account than maintaining the deposit amount, otherwise they will be forcibly closed.

- During the stock intervention, investors need to pay interest to the borrowing of the shares borrowed from the debit.

- When the stock price falls to the ideal price, investors can buy stocks and give it to debit to obtain returns after deducting all interests and commissions.

How to use Futu Moomoo shorts for short transactions?

Futu Moomoo It is one of the most mature financial trading software in the market.For stock short, Futu Moomoo not only provides detailed transaction introduction, but also helps entry-level novices can quickly understand the principles and operation methods of short transactions.Knowledge testing and practical links.

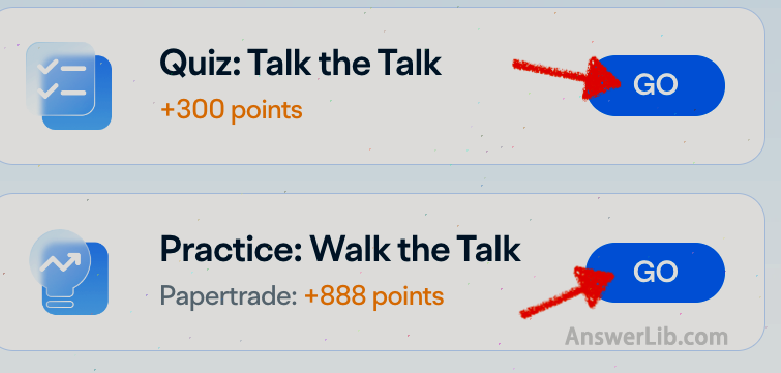

Futu MOOMOO investors have completed the study of relevant content, and after testing and practice, they can get the accumulation point (Points) provided by Futu Moomoo.At present, the test can be completed, you can get 300 accumulation points, complete practice, and you can get 888 accumulation points.

- If you are already a Futu Moomoo users, please log in to start testing and practice.

- If you are not a Futu Moomoo users, you can consider Account, Get a lot of free US stocks for free.

After entering the formal transaction, Futu Moomoo also provides real-time market indicators for short transactions, including daily short trading volume (Daily Short Volumn) and Short Interest.Market information, accurately judge the timing of investment.

The process of carrying out short transactions through Futu Moomoo is shown in the video below:

The specific steps are shown below:

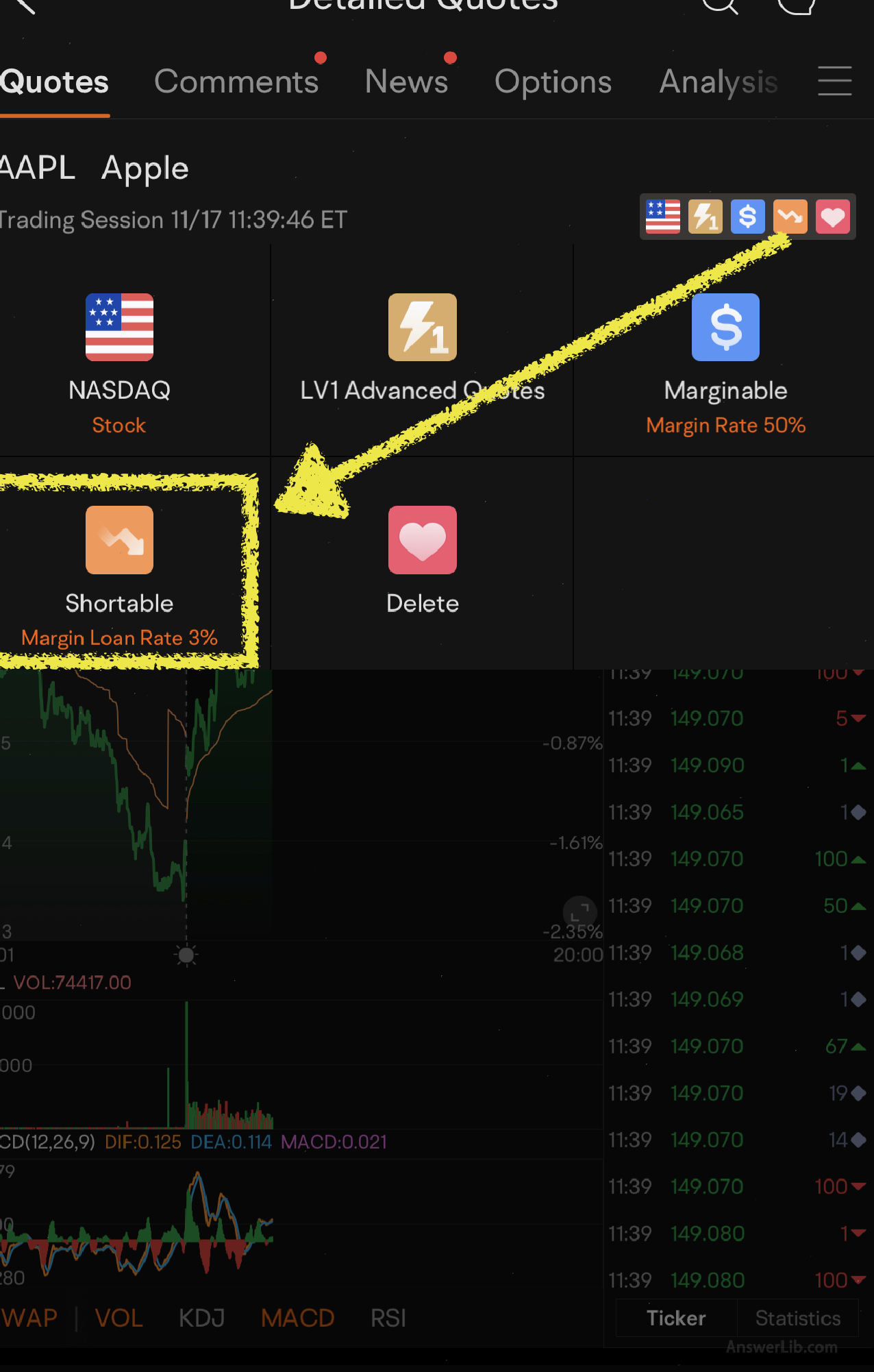

step one: Choose the target stock, not all stocks support short sell “Short Margin” The stock of the icon only supports short-selling transactions.The figure below takes Netflix (NFLX) as an example.

Step 2: Click “SHORT Margin” to get the detailed short selling information of the stock.

Step 3: After confirming the intention of the transaction, return to the transaction page, click “Trade” at the bottom of the stock to enter the trading page;

Step 4: Enter the number of stocks that need to be traded in the data bar, click the “Sell” option below;

Step 5: After reading the transaction reminder, click “Continue Anyway” to complete the establishment of a short position;

Step 6: After completing short transactions, you need to check the risk level of the account from time to time.If the account level is at “high risk”, your account may be closed.

Step 7: After tracking stocks, after the stock price fell to the target price, click the “Trade” option on the stock page, enter the number of stocks bought, click “Buy”, and then “Continue Anyway” to complete the “Buy to Cover” order.After buying the entire number of “selling” stocks, the short position was closed and completed the short transactions.

Three important indicators that need attention to short

It should be noted that it is impossible to use one or several indicators to judge the changes in the stock price.Please summarize in the process of learning and find out your own judgment method.

When doing short transactions, you need to pay attention to three important short indicators:

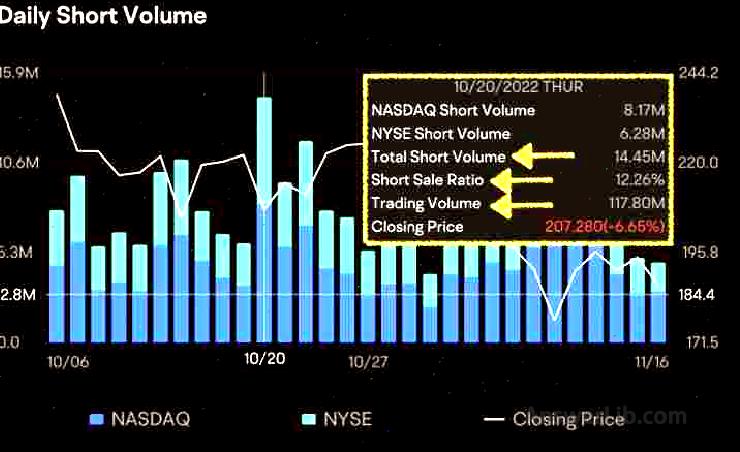

- Daily short trading volume ( Daily Short Volume): It refers to the short transaction volume of the daily public transactions.For U.S.stocks, this data is provided by the New York Certificate Exchange;

- Blind net (net Short Internet or Short Float): Refers to the total amount of stocks that has been short.It is also often expressed by percentage (%), which is to divide the total number of all shares currently shorted in the total number of shares issued.

- Putting proportion ( Short Ratio): The ratio of the net to the daily short-term transaction volume, that is, the ratio of the two indicators mentioned above, indicates that the short-term stocks are the average number of days of BUY-TO-Cover, so English is also called Days to Cover Short.The calculation formula is, short ratio = Short Interest / Daily Short Volume.

In general, The higher the values of these three indicators, the heavier the emotions of shortness Essence

These indicators can be observed in Futu MOOMOO, directly click on the individual stocks that follow, and then find it from the top options at the top 【Analysis】 You can find it Daily Short Volume and Short Internet Important indicators.

in, Daily Short Volume and Short Internet The two parts are displayed in the upper and lower parts.

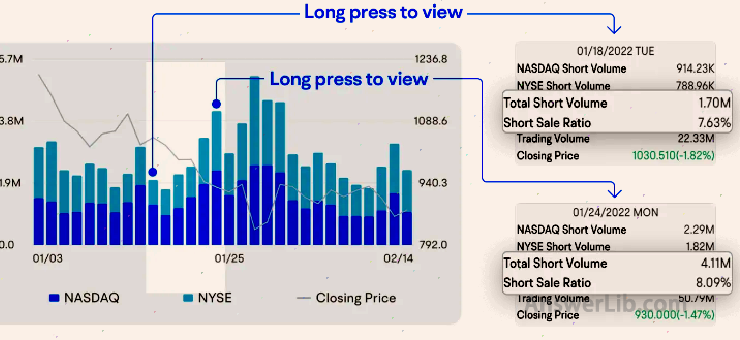

For Daily Short Volume on the upper side, you can press each column on the column-shaped diagram, and you can get data such as “Total Short Volume”, “Trading Volume”, and “Short Sale Ratio”.

- Total Short Volume: Refers to the total short quantity of the day, that is, Daily Short Volume;

- Trading volume: Refers to the total transaction volume of the day;

- Short Sale Ratio: Note that this is different from the previously introduced “SHORT RATIO”.This refers to the ratio of Total Short Volume to Trading Volume, which is the ratio of the ratio of all transactions that day that day.

For Short Interest on the lower side, you can get “Short Interest (%)” by long pressing, “Short Interest (Volume)”, “Day to Cover” and other data:

- Short Interest (Volume): It is the total amount of short short calculation calculated according to the “quantity”

- Short Internet (%): The total amount of short-term calculation calculated according to the “percentage” is the ratio of the total amount of short short and the total amount of the stock;

- Days to cover: It is the third short indicator “SHORT RATIO”, indicating that investors buy the stock back to the average number of days after short shares.

How to use the above three indicators to judge the trend of stocks?

Here, we use the “Total Short Volume”, “Short Sale Ratio”, “Short Interest” in the Futu Moomoo App.

- If only Total Short Volume rises, it cannot judge the trend of the stock price.

- If Total Short Volume rises with Short Sale Ratio, the stock price may fall in the short term.

For example, from January 8th to January 24, 2022, Daily Short Volume and Short Ratio of Tsla (TSLA) are increasing.

Therefore, during this time, TSLA’s stock price showed a decline.

- If SHORT Intert is significantly up, it means that most investors may have a decline in stock prices for the sorrow of stocks.

- However, if SHORT Interest declines sharply, then you must be careful.This may be that a large number of short investors are buying back short stocks, then the stock price may rise.

Michael Burry-the king of time?

Michael Burry can be said to be the most successful short-to-short trading profit.

Michael Burry suffers from mild autism, but this disease helps him to learn and study some content when he learn and study some ordinary people.When he found that he was interested in financial investment during his studies, he dropped out of school to start researching financial investment and established SCION CAPITAL Fund Company in 2000.

After the establishment of SCION Capital, he analyzed the market trend through his unique financial perspective.In the first year of operation, he received a 55%return rate.In 2004, he managed assets of up to $ 600 million.

In 2005, Michael Burry predicted the upcoming crisis in the real estate industry and told his investors to short the real estate market together.In the end of the 2007 loan crisis, the financial crisis broke out in 2008.Many banks and hedge funds closed down due to these crises, but Michael Burry led his investors to earn billions of dollars in profits.

After that, Michael Burry closed SCION CAPITAL in 2008.During the 8 years, SCION CAPITAL’s total return rate was as high as 489.3%.

Michael Burry became famous in the 2008 financial crisis, and his experience was written into the New York best-selling book “The Big Short” At the same time, his experience in the 2008 sub-loan crisis was remake into the Hollywood movie “The Last Short”.The Chinese translation is “big short”, which is well known to the world.

Why should investors short?

There are usually two purposes: hedge or speculation.

1.Risk hedge

This is the most common purpose of short-term transactions.Investors can build a long position when buying stocks, hoping to earn a short position while earning income by rising stock prices.In this way, the stock price rises, and investors can get benefits from the bulls.If the stock price falls, investors can still get a certain amount of benefits from the short position to hedge the risk brought by the price fluctuations.

2.speculation

Because the felling speed of the stock price is usually faster than the rise, some investors choose short transactions for speculative benefits.When they predict that the stock price of a stock will fall sharply in the near future, they borrow a large number of stocks and sell them at a certain price at a certain price.When the stock price fell rapidly, buy a large number of stocks to give borrowers, so as to quickly earn high returns.Essence

What are the advantages of short transactions?

1.Hedry investment risk

The biggest advantage of short-term transactions is that it can play a role of hedging risk.When investors invest in one or one set of stocks, they may face the investment risk brought about by the decline in the stock price.The role of falling risk, whether the stock price rises or falls, can ensure that there is benefits in investment.

2.Low initial cost

The initial cost of short-term transactions is almost only the deposit.After paying the deposit, you can borrow the required shares, and then start short transactions.

3.Create leverage investment

The short-term transaction can achieve the beneficiary effect of leverage transactions.The initial cost of investors is the deposit amount, and the margin is a certain percentage of the value of the stock in the stock, such as 50%.Nearly $ 0.For example, when investors borrow a stock worth $ 10,000 and the margin ratio is 50%, investors need to pay $ 5,000, and when the stock finally falls nearly $ 0, the investor can benefit $ 10,000 after buying the stock to give the borrower to reduce the initial stageThe cost of $ 5,000 is to benefit $ 5,000.

What are the disadvantages of short transactions?

1.There is no upper limit

The biggest loss of short transactions and multiple transactions, the biggest loss of making multiple transactions is your net investment.For example, if you invest at 10,000 US dollars, make more Apple stocks.If Apple’s stock is completely delisted, you will lose up to 10,000US dollars.The loss of short transactions may be unlimited.

The loss of short-term transactions comes from the rise in the stock price of target stocks, because short transactions are to earn benefits through the decline of the stock price.If the stock price rises, investors have to buy back the stock at a high price and give it to borrowers.The main loss of investors.

Because the stock price rises without the upper limit, the loss faced by investors is also indispensable.At the same time, investors must always ensure that there is sufficient deposit in the account, otherwise they will be forcibly closed and suffer.In addition to the stock price and margin, short investors also face interests that need to be paid by borrowing stocks.As the transaction time is prolonged, the amount of interest to be paid will continue to accumulate.Therefore, overall, the risk of losses facing short investors is much higher than that of multiple investors.

2.Forced to close the position

Because short transactions are borrowing stocks, you need to pay a certain deposit, but if the stock does not fall, you need to add a deposit.

If you cannot add a deposit in time, then your stock will be strong, and English is called “Margin Call”.

Especially when the stock with a very high proportion of empty warehouse rises, a large number of shorts will be closed, which will lead to further increase in the stock price, causing more liquidation.

3.Facing short squeeze (short squeeze)

When a stock is short, as the shortcomings begin to repurchase the stock, the stock price will rise rapidly.At this time, a short squeeze may occur, that is, the short-term investor has reduced the benefits due to the centralized transactions of other short investors.There are even losses.

More investment basic knowledge

- What is a necessary return?Required Rate of Return

- What is the American Commodity Futures Trading Commission?CFTC

- What is a credit default? Credit Default Swaps

- What is “oil dollar”?Petrodollar

- What is technical analysis?Technical Analysis

- What is fundamental analysis?Fundamental Analysis

- What is short transaction?Short Selling

- Year-on-year VS?MOM, QOQ, YOOY

- How to query financial institutions to hold positions? FORM 13F

- What is mortgage support bond?Mortgage-back security