IRA accounts are generally divided into: traditional IRA account and Roth IRA account.This article focuses on you to recommend the most suitable traditional IRA account.If you want to know the recommendation of the Roth IRA account, please check what we write “Roth IRA Account Recommendation”

After reading this article, you will understand in detail:

- Recommendation of traditional IRA account

- What is an IRA account?

- What is the difference between traditional iRA and Roth Ira?

IRA account recommendation

- The best overall performance IRA account: TD Ameritrade

- IRA account for best customer service: Charles SCHWAB

- The best retirement service IRA account: Fidelity

- The best intelligent investment adviser IRA account: Betterment

- IRA account of the best common funds: Vanguard

- Best Investment Ira account: Merrill Edge

- The best balanced income IRA account: E*trade

- Best IRA account for the best transaction fee: Firstrade

- The IRA account that is most suitable for beginners: SOFI

- IRA account of minimum transaction commission: Ally Invest

We will above Ten IRA accounts A detailed comparison:

|

IRA account |

Minimum deposit |

Online transaction commission |

Account opening promotion |

Stock commission |

ETF commission |

Optional commission |

RA annual fee |

Full account transfer fee |

|---|---|---|---|---|---|---|---|---|

| TD Ameritrade | $ 0 | $ 0 | none | $ 0 | $ 0 | $ 0.65 | $ 0 | $ 75 |

| Charles SCHWAB | $ 0 | $ 0 | none | $ 0 | $ 0 | $ 0.65 | $ 0 | $ 50 |

| Fidelity | $ 0 | $ 0 | 500 free transactions | $ 0 | $ 0 | $ 0.65 | $ 0 | $ 0 |

| Betterment | $ 0 | 0.25% | One year free management | $ 0 | 0.07 ~ 0.17% | $ 0 | indefinite | $ 0 |

| Vanguard | $ 1,000 | $ 20 | none | $ 0 | $ 0 | $ 0 | $ 20 | $ 0 |

| Merrill Edge | $ 0 | $ 0 | Maximum $ 600 | $ 0 | $ 0 | $ 0.65 | $ 0 | $ 49.95 |

| E*trade | $ 0 | $ 0 | none | $ 0 | $ 0 | $ 0.65 | $ 0 | $ 75 |

| Firstrade | $ 0 | $ 0 | none | $ 0 | $ 0 | $ 0 | $ 0 | $ 75 |

| SOFI | $ 0 | $ 0 | none | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Ally Invest | $ 0 | $ 0 | Maximum $ 3,500 | $ 0 | $ 0 | $ 0.5 | $ 0 | $ 50 |

The term explanations in the table above are as follows:

- Minimum deposit: When opening the account, the minimum deposit amount required;

- Online transaction commission: Investors online stock, bonds, ETF and other handling fees needed for transactions;

- Account opening promotion: When you open the IRA account, you can enjoy the account opening discount, such as providing the first year’s account-free annual fee, account opening bonus, and so on;

- Stock commission/every pen: The expenses required for investors to trade each stock;

- ETF commission: The full name of ETF is Exchange-Traded Fund, that is, the transaction-type open index securities investment fund.ETF is an open fund listed on the stock exchange.It has the characteristics of an indexed investment strategy and low cost; the ETF commission is the fee required to pay when trading EFF;

- Optional commission/each pen: Options refer to the power of buying or selling a certain number of specific commodities at a certain price at a certain price in the future.Objective commissions/each is the fee required to pay for each option transaction for each investor;

- IRA annual fee: The fee required to manage the IRA account of the securities trading company;

- Full account transfer fee: When investors transfer funds from an IRA account of another securities trading company of a securities trading company, they need to pay the handling fee.

1.TD Ameritrade IRA account

Reasons

- The best overall performance IRA account

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: none

- Account annual fee: $ 0

- Transaction fee: no online transaction commission, stock-free, ETF transaction commission , Optional transaction each contract 0.65 US dollars commissions

- Full account transfer fee: $ 75

IRA account introduction

TD Ameritrade is rated as one of the most suitable online brokers for transactions and long-term investment.As a customer, you can get any resources you need, from banking services to advanced trading tools, and hundreds of bank business halls to provide face-to-face customer services.TD Ameritrade can provide and very user-friendly customer support.For any investors with different backgrounds, the TD American account is a good choice.

The TD American IRA account is characterized by the minimum investment amount and a diversified investment portfolio, including more than 300 free ETFS, stocks and bonds and regular deposits.TD Ameritrade provides funds with low cost and low requirements.It has more than 11,000 common funds on its platform with a cost ratio of 0.5%or lower.Investors invest.

advantage

- Stocks, ETF transactions free commissions

- Freedom combination of intelligent investment and professional investment

- Automatic balance account funds and tax saving strategies

- After upgrading, you can access the human financial adviser unlimited times

- There are Chinese web pages and Chinese customer service

shortcoming

- Completed at the end of 2020 by the acquisition by Charles Schwab, the subsequent accounts may change

- Intelligent investment consultants (smart investment) need to charge 0.3%annual fee, minimum charging $ 500 per year

- The transfer fee of $ 75 for full account transfer

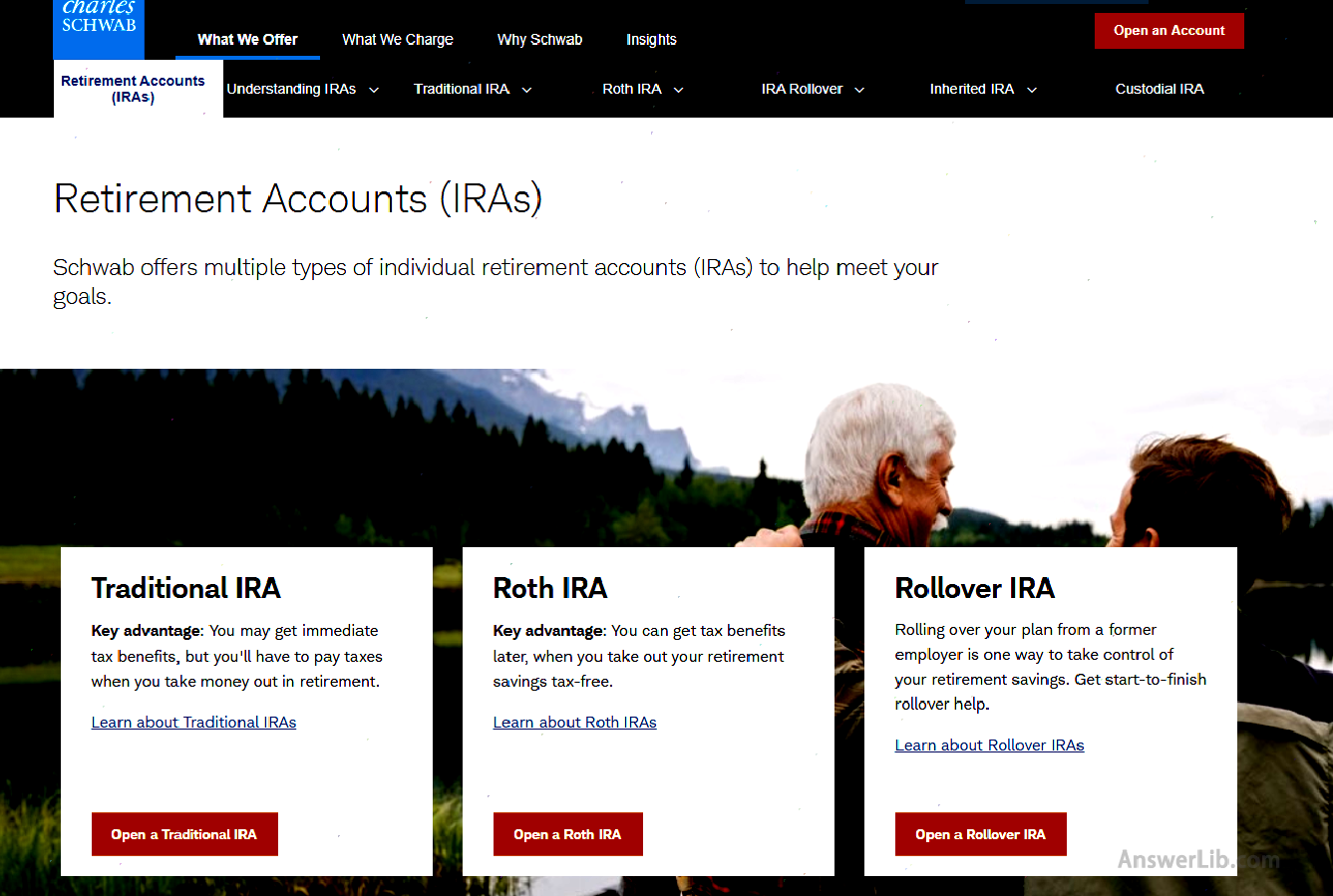

2.Charles Schwab IRA account

Reasons

- IRA account for best customer service

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: none

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction each contract 0.65 US dollars commissions

- Full account transfer fee: $ 50

IRA account introduction

Charles Schwab is known for its customer support and services.It has rich educational resources and is very conducive to the assets of initial investors planning.Initial investors with less savings can make good use of the requirements of CHARLES SCHWAB without the minimum deposit amount.Active investors favors investment products such as stocks, ETFs, and bonds that are popular with face transaction commissions.In addition to low costs, Charles Schwab also comprehensive investment research tools to help investors make the best transaction decisions.

Stocks, ETFs, and options trading fees of Charles Schwab IRA account are the most competitive in the industry.And you will also find that when investing in a common fund, you can decide that when you manage your account, you choose to take the initiative to manage or give it to the agent.At the same time, you do n’t need to be careful to meet the required transaction volume.

advantage

- No minimum deposit requirements and monthly account fees

- Free intelligent investment consultant

- Many commission-free common funds

shortcoming

- Mate $ 50 or $ 25 partial transfer fee

3.Fidelity IRA account

Reasons

- The best retirement service IRA account

Ira account characteristics

- Minimum deposit: $ 0

- Accounting Reward: 500 commission transactions

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction each contract 0.65 US dollars commissions

- Full account transfer fee: $ 0

IRA account introduction

Fidelity provides extensive investment services.From the industry’s leading stocks, funds and bond research, to excellent investment education resources and retirement planning tools, these tools can calculate your retirement preparation and track your retirement progress.Fidelity provides a large number of research products and easy-to-use investment platforms, and can also customize trading platforms for senior investors.

FIDELITY exempted transaction commissions during stocks and ETF transactions, and almost canceled all account fees for IRA accounts, including transfer and account closure fees that agents usually charged.The IRA account provides more than 3,500 common funds without transaction fees, as well as more than 700 other common funds and index funds, and its cost ratio is 0.5%or lower.It can be seen that the service value of Fidelity is reflected in the process of the entire investment from the beginning to retirement

advantage

- Low transaction cost

- Rich online consultation

- Support wide range of asset transactions

- All ETFs are free of commissions

shortcoming

- The platform is unstable during a large number of trading

- The initial account sets the dividend and re-investing, and the dividend income will be used to buy stocks

- When changing account security, you need to call customer service

- The use of service websites is not highly convenient

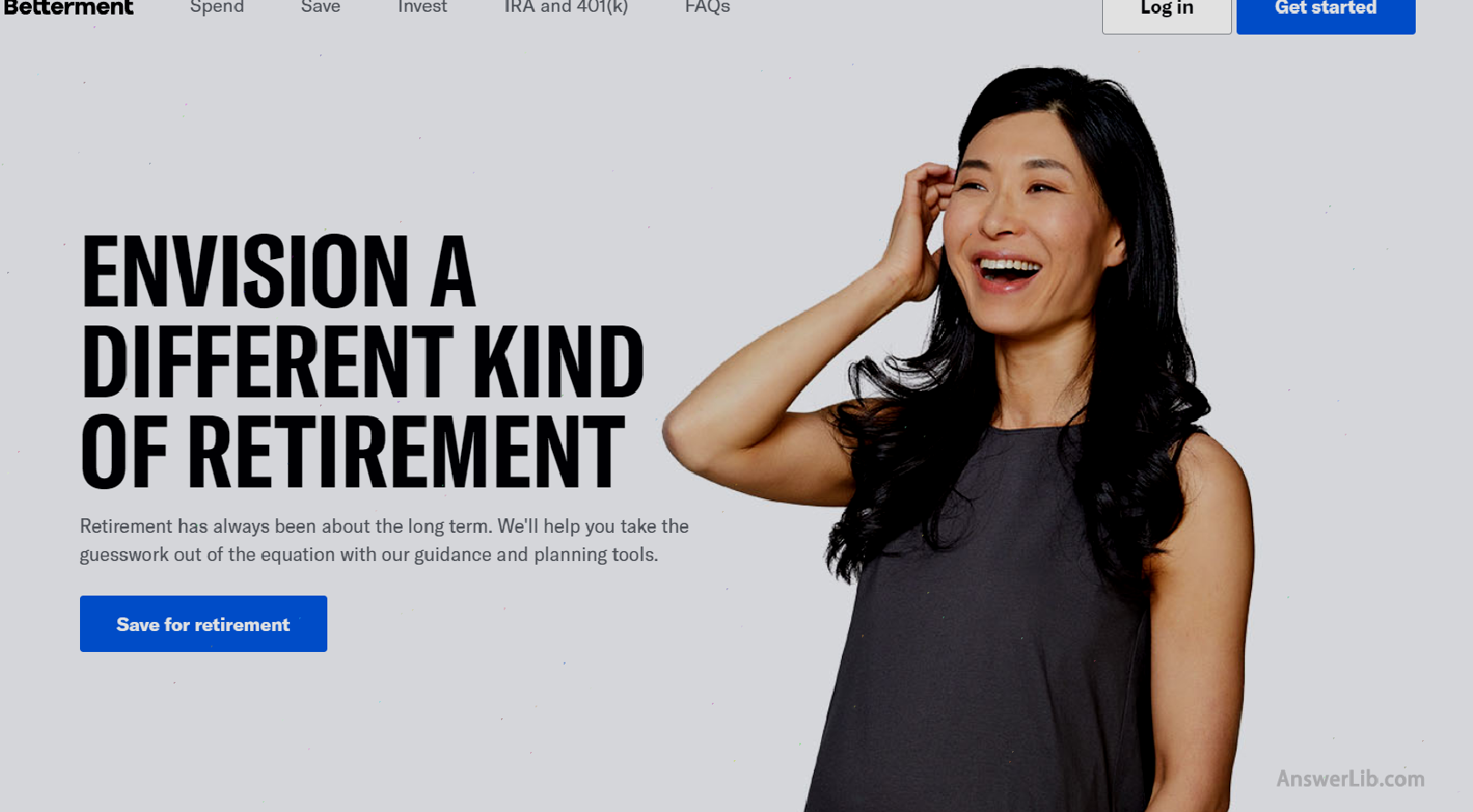

4.Betterment IRA account

Reasons

- The IRA account of the best intelligent investment advisor

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: free management for one year

- Account annual fee: open digital account for free, 0.25%annual fee; 100,000 US dollars open high-end accounts, 0.40%annual fee

- Transaction fee: Collection of 0.25%online transaction commission, free stock transaction commission, ETF transaction commission ratio is between 0.07%and 0.17%

- Full account transfer fee: $ 0

IRA account introduction

Betterment is one of the most popular agents in intelligent investment advisors (intelligent investment consultants) and the first choice for automated investment.From the first moment you use Betterment, you will enjoy the convenience brought by smart investment consultants.When you register an account on Betterment, you will fill in a financial goal about your retirement and risk tolerance.After that, Betterment will design a professional investment portfolio for you to manage your Ira, Roth IRA, SEP (SIMPLIFIED EMPLOYEE PENSIONS, simple employer pension, which is a pension plan paid by employers for employees) and conversion accounts (in various retirement plansTransfer assets between accounts).

The IRA account of Betterment is fast and simple.Before investing, you can know that all investment portfolios can easily change the risk of investment portfolios or switch to other types of investment portfolios.As the best intelligent investment advisor, the IRA account evaluates the investment benefits once a month.If it deviates from the target distribution, it will re-balance.As the dates of the pre-set investment target are approaching, your investment portfolio will become more conservative, with the goal of locking income and avoiding major losses.While enjoying convenient services, you need to pay a management fee accordingly.The digital account of Betterment IRA needs to pay 0.25 % of the management fee each year, while the advanced account increases to 0.40 % per year.

advantage

- Choose a variety of investment portfolios for automatic investment

- Advanced automatic re-balance and tax-saving strategy

- After upgrading, you can access the human financial adviser unlimited times

shortcoming

- Low transaction cost

- Rich online consultation

- Support wide range of asset transactions

- All ETFs are free of commissions

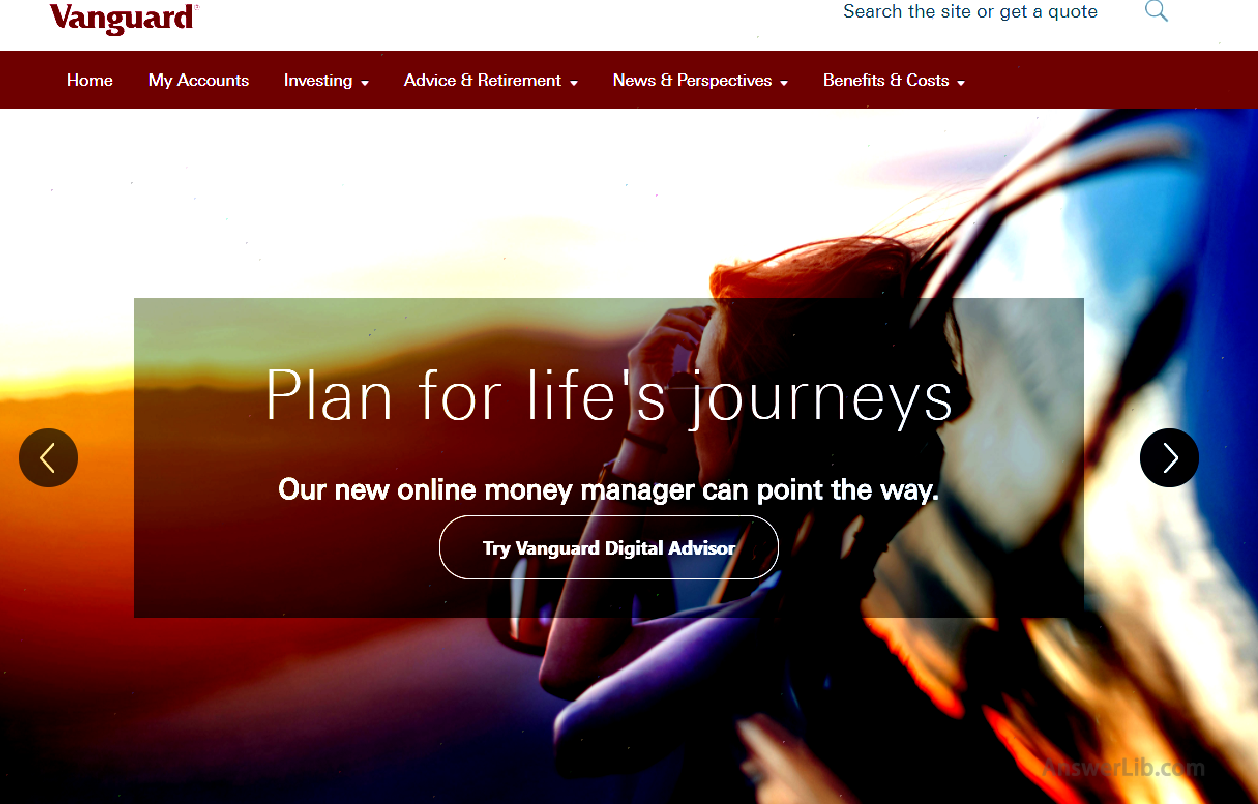

5.Vanguard IRA account

Reasons

- IRA account of the best common funds

Ira account characteristics

- Minimum deposit: $ 1000

- Account opening reward: none

- Account annual fee: $ 20, when the minimum deposit is 10,000 US dollars, the annual fee can be exempted

- Trading fee: online transaction commission 20 US dollars, stock-free, ETF transaction commission, option trading each contract without commission

- Full account transfer fee: $ 0

IRA account introduction

Vanguard is a good choice for users who mainly want to invest in common funds and ETF series of investment.It is known for its low-cost fund service.Vanguard provides more than 125 common funds and more than 70 ETFs, and all stocks and ETF transactions are free of charge.

The Vanguard IRA account charges an annual fee of 20 US dollars per year, and if you register an electronic bill or account to reach the minimum balance standard, Vanguard will be exempted from the annual fee.However, in the case of charging annual fees, you will enjoy the overall minimum cost investment experience.For example, Vanguard’s ETF fee is 82%lower than the average level of other securities trading companies.Because Vanguard has a relatively high $ 1,000 minimum deposit requirements, this Vanguard may not be a good choice for investors who have a small savings or urgent need of money.

advantage

- Common funds, stocks and ETFs are all commissions transactions

- The cost ratio of the common fund is lower than the industry average level

shortcoming

- Potential 20 US $ 20 account annual fee

- The strength of the investment platform is weak

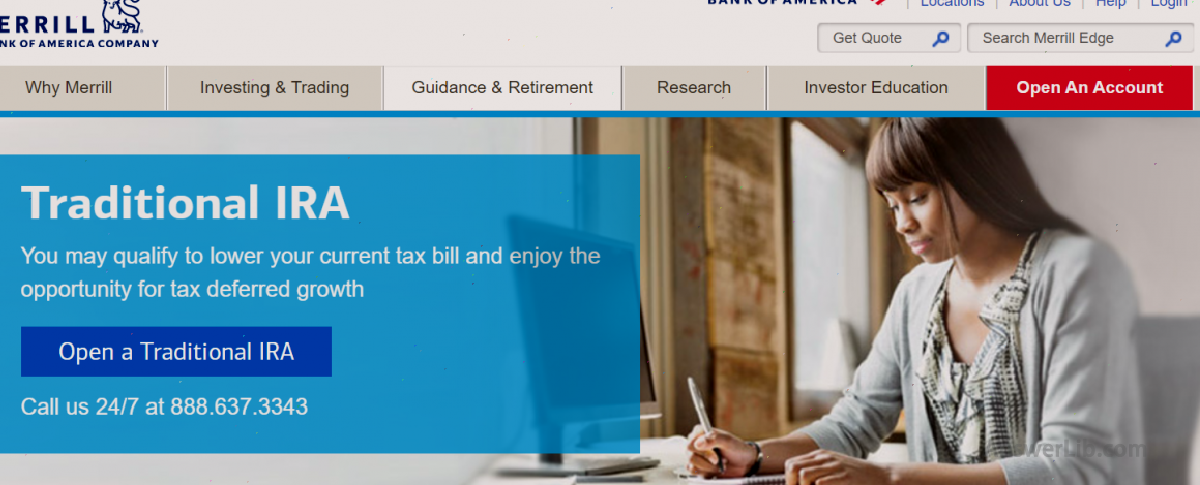

6.Merrill Edge IRA account

Reasons

- The best investment Ira account

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: maximum $ 600

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction each contract 0.65 US dollars commissions

- Full account transfer fee: $ 49.95

IRA account introduction

Merrill Edge’s investment services will fully consider investors’ investment experience, life stage, personal experience and retirement planning, and guide you to invest in articles, videos, online seminars, and online courses.Merrill Edge almost all of the investment tools have long focused on investors’ retirement plans.After fully understanding your needs, you provide you with your required suggestions, guidance and investment tools to help you use every current currently use every current strokeInvestment to obtain long-term best income.

In addition, the parent company Bank of America gives Merrill Edge’s rich investment products, so that the Merrill Edge IRA account provides commission-free stocks and ETF transactions, and provides excellent investment research and customer service.Investment settings can show your asset allocation and achieve the progress of your goals with a clear investment layout.Merrill Edge customers who have the BOA account can obtain the “Preferring Reward” plan to join Merrill Edge.The plan can use various discounts and promotion activities, including higher interest rates of savings accounts, reduced interest rates for car loans, and discount expenses for mortgage loans.Essence

advantage

- Personalized investment portfolio

- First-class investment tools for retirement and life planning

- Enjoy investment news of specific suppliers

shortcoming

- The option transaction process is complicated

- Frequently persuaded to hire financial consultants

7.E*Trade IRA account

Reasons

- Ira account with the best balanced income

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: none

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction each contract 0.65 US dollars commissions

- Full account transfer fee: $ 75

IRA account introduction

E*Trade is a famous online investment broker.It can provide investors with access to the access of every kind of investment product and resources required., Options, futures and ETFs.Although E*Trade’s stock transaction commission is higher than the industry average, it has more than 9,000 common funds, of which 4,400 common funds are commission-free transactions.

E*Trade is very suitable for investors, low-frequency traders, and investors in long-term investment common funds who want to make a variety of investment in IRA accounts.The E*Trade transaction commission of online stocks, options and ETF transactions has been reduced from $ 6.95 to $ 0.Options still have contract fees, but reduced to $ 0.65, and the discount for active traders is $ 0.50.

advantage

- Many common fund investment tools

- A large amount of commission-free common fund

- Balanced investment income

shortcoming

- Higher transaction commission

- Tools used to invest in research and investment education are poorly performed well

- The convenience of web platform is low

8.Firstrade IRA account

Reasons

- The best transaction-free IRA account

Ira account characteristics

- Minimum deposit: $ 0

- Account opening reward: none

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction without commission per contract

- All household transfer costs: $ 75

IRA account introduction

If you are most concerned about account opening fees and transaction fees, then FIRSTRADE will be your most ideal Ira account opening channel.FIRSTRADE’s IRA account and common funds have no account fees, and there are no commissions for stock trading, ETF, options and common funds.They all have huge attractiveness.

FIRSTRADE provides investors who seek retirement fund planning to ensure no worry-free retirement plans, and can open an IRA account without annual fees, no application fees, and account management fees.Zero commission.With the help of three trading platforms and mobile applications, whether you want to open an IRA account or retirement investor, FIRSTRADE can provide excellent investment broker services.

advantage

- Stocks, ETFs and option transaction commissions

- Free common fund commission

- No minimum balance requirements and monthly account fees

- Provide a Chinese operation platform

shortcoming

- No 24/7 customer service support

9.Sofi IRA account

Reasons

- The IRA account that is most suitable for beginners

Accounting data

- Minimum deposit: $ 0

- Account opening reward: none

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction without commission per contract

- Full account transfer fee: $ 0

IRA account introduction

SOFI is an emerging online investment agent in the intelligent investment consulting industry, which makes IRA investment very simple.Although it does not provide many trading functions that large securities trading companies have, you can find all the tools required to manage the IRA account, or you can deliver all SOFI to manage all your investment, which seems to initial investors.Particularly important.SOFI attaches great importance to the education field.For initial investors, you can fully enjoy complete educational resources in Sofi applications, including unlimited obtaining certified financial planning teams and free career planners.Good management investment and efficiently complete retirement plan.

No matter what kind of operation, Sofi will not generate IRA account transaction costs in most cases.After activating the IRA account, you can conduct stock and ETF transactions without paying commissions, but the deficiencies are that Sofi does not provide investment options for common funds.SOFI does not charge any management fees, and even when the account is transferred and closed, it is very friendly to investors.

advantage

- Suitable for initial investors and young investors

- Unlimited free acquisition financial planning services

- Free intelligent investment consultant

- No minimum balance or monthly account fee

- Suitable for investors with low savings

shortcoming

- No common fund options

- Investment research tools limited

- Cross-corporate account transfer and collect $ 75 commissions

10.Ally Invest IRA account

Reasons

- IRA account with minimum transaction commission

Accounting data

- Minimum deposit: $ 0

- Accounting reward: up to $ 3,500

- Account annual fee: $ 0

- Transaction costs: No online transaction commission, stock-free, ETF transaction commission, option transaction each contract of $ 0.5 for each contract

- Full account transfer fee: $ 50

IRA account introduction

Ally Invest is an online securities trading company known for providing high-value investment products.It provides a series of investment products with low transaction costs.Ally Invest also has an easy-to-use online trading platform and a series of investment tools.You can use free flow icons, surveillance lists, probability calculators, market data and options tools to help you make the best trading strategy.However, Ally Invest does not teach you to invest, like other agents who provide all-round service, so its IRA account is more suitable for investors with stronger initiative or hoping to save trading costs.

The stock and ETF transactions of the Ally Invest IRA account are completely free.The cost of each bond is only one dollar, and the option transaction is also reasonable.The cost of each contract is only $ 0.5.Except for low commissions, ALLY Invest does not have the minimum deposit amount when opening an account, so you only need a small amount of cash to start investing.When you open a new account, Ally Investt will even give you a prize of $ 3,500, depending on the amount you deposit.

advantage

- Stock-free, ETF transaction commission

- Excellent account opening promotion award

- No minimum account balance requirements

shortcoming

- Unavoidable commission common fund

- Wireless physical service

- Low-priced stocks charge commissions

What is a traditional IRA account?

The traditional IRA account enjoys a discount for slowing personal income tax (TAX Deferred), that is, the funds you deposited in the IRA account each year do not require taxes ( Notice: The amount of tax reduction depends on your/family’s income and whether there are 401K, etc., rely on the employer’s pension plan).

However, after you retire, take out the IRA account Principal and income At the same time, you need to pay the tax on each penny at the tax rate of that year.

You can open an IRA account through banks or securities companies (also known as brokers).

- Since the bank is more providing savings services instead of investment services, the bank is not a preferred way to open an IRA account;

- Compared to banks, the investment broker services and intelligent investment consulting services provided by securities firms will bring you more investment returns;

Because you can pay for capital gains and benefits and the benefits of investment income without paying taxes, you can deposit more principal and obtain more benefits.Regarding the requirements and use rights of the IRA account, the following is a must-have information you need to master:

A.The upper limit of deposits per year

The information below comes from IRS in the United States.View 2020 Deposit amount limit Essence

| age | The amount of amount that can be stored every year |

| Under 50 years old | $ 6000 |

| 50 years old and over | $ 7000 |

Note: There is no restriction on the age of investors who apply for an IRA account. Ira has canceled the previous 70.5 -year-old age restrictions, and investors of any age can be opened now.

Anyone can open a traditional IRA account and there is no restriction on the highest income.This is different from the Roth Ira account we will mention later.

B.Taxation conditions in 2020

You can access IRS and view Full tax reduction conditions Essence

If you nor your spouse have no retirement plan provided by the company, all the principal placed in the traditional IRA can be taxed.

The situation in the table below is applicable to the pension plan provided by the company, such as 401K and so on.

|

Taxation status |

Increase on the tax sheet (AGI) |

Whether IRA can get taxable |

|---|---|---|

| single | Smaller than or equal to $ 65,000 $ 65,000 ~ $ 75,000 Great or equal to 75,000 |

Full taxable Partial tax deduction Can’t deduct taxes |

| Marriage and report tax | Smaller than or equal to $ 104,000 $ 104,000 ~ $ 124,000 Greater than or equal to $ 124,000 |

Full taxable Partial tax deduction Can’t deduct taxes |

| Marriage but reporting taxes separately | Less than $ 10,000 Greater than or equal to $ 10,000 |

Partial tax deduction Can’t deduct taxes |

Related Reading:U.S.Tax DIY >> Use Turbo Tax Online Taxation Detailed Explanation

C.IRA account tax payment method

- Do not pay taxes when depositing: The principal of the traditional IRA account is deposited every year, and there is no need to pay taxes at that time;

- To pay taxes when withdrawing money: After 59.5 years old, when withdrawing the withdrawal, the principal and income need to pay taxes at the tax rate of that year, which is equivalent to slowing taxes, so that more money can be deposited into the IRA account to obtain higher investment income.

Therefore, traditional IRA account Advantage yes:

- Due to the slow tax rate, more money can be deposited into the retirement account and can get higher returns;

- If you think the tax rate after retirement will be lower, then the IRA account delay policy is more worth investing.

But the traditional IRA account also has a disadvantage:

- When withdrawn, not only the principal needs to pay taxes, but also pays taxes at the same time.At this point, Roth Ira has certain advantages.

D.Time to withdraw money

For the funds in the traditional IRA account, the user is 59.5 years old Only then can we withdraw, and the withdrawal of 10%will be charged in advance.But under the following special circumstances, a fine can be avoided:

- Ira holder died and the account that gave it to the beneficiary or heritage

- Complete and permanent disabled account

- Frequently distributed models with equal intervals

- Qualified first-time home buyer

- Elimable educational expenditure

- Do not exceed the premium of medical insurance when unemployed

- Do not exceed 7.5%of the total income after adjustment, unprecedented reimbursement medical expenses

- IRS IRS IRS tax on retirement benefits (IRAS)

- Eligible distribution of reserve members

E.Latest time to get money

In 2019, the latest payment time was delayed from the original 70.5 years to 72 years old, that is, from the age of 72, the IRA account holder must receive the minimum pension based on the scale and expectations of its account funds, otherwise the minimum pension will be charged50%fine.

F.The annual supply time

The deadline for the Ira supply of IRA is the next year’s tax day, that is, April 15.If the amount you did not deposit in the previous year did not reach the upper limit of the deposit, the National Taxation Bureau (IRS) allowed you to pay the contribution and use it for the previous year, provided that you must) Supply.

This policy can maximize the annual deposit limit to avoid reducing the deposit amount of the year due to the reduction of disposable income in a certain year, and the excess funds can be used as a contribution of the previous year with the increase in income in the next year untilThe deposit amount reaches the upper limit.For example, you can deposit up to $ 6,000 in 2019, but only deposit only 4,000 US dollars.At this time, you can continue to pay for 2019 before April 15, 2020, and you can deposit up to $ 2,000.In other words, the payment time of a certain year is from the first day of the year to April 15th, the second year, which allows you to get more enough money for payment.

What is the difference between traditional iRA and Roth Ira?

IRA account is generally divided into: traditional IRA account, Roth IRA account.

Roth IRA is also a personal pension account, which is characterized by the tax exemption of funds in the account.Therefore, you do not need to bear any taxes when withdrawn.However, when the Roth Ira deposits in the principal, it needs to deduct taxes at the tax rate of that year, which is different from the characteristics of the traditional IRA’s slowdown capital benefits.

Same point

- They are all personal pension accounts;

- Neither traditional IRA and Roth Ira have no age restrictions;

- The two have the same amount of contribution amount, that is, the maximum maximum of $ 6,000 under 50, the maximum of 7,000 US dollars in the age of 50;

the difference

|

Traditional IRA |

Roth IRA |

|

|---|---|---|

| income | No income upper limit | There is an income limit, the income is too high, and the Roth IRA account cannot be opened * |

| Whether to pay taxes in the principal | duty free | The principal is paid at the tax rate of the year |

| Whether to pay taxes when withdraw money | (Principal+income) all have to pay taxes | (Principal and income) neither tax |

| Withdrawal time | 59.5 years old can only withdraw money | At the age of 59.5 years old and 5 years after opening an account |

| What are the punishment for advance withdrawal | Try to withdraw money in advance will receive a 10%fine and pay taxes at ordinary income | The principal part: you can take it out at any time, no need to pay taxes, and there is no fine, but you can no longer put it back; Investment part: charge 10%of fines, and pay taxes at the income of income |

| Minimum withdrawal requirements | After 72 years old, there is the minimum withdrawal requirements | no request |

* For the Roth IRA account, if you or the family’s income is too high, it cannot be contributed (single is higher than $ 139,000, the couple’s joint tax will be greater than 206,000 US dollars, and the couple cannot be provided when paying taxes more than 10,000 US dollars).)

common problem

Question 1: What is an IRA account?

IRA account recommendation: IRA account (Individual RETIREMENT Account), that is, a personal pension account, is a pension account based on voluntary investment.IRA accounts are generally opened by individuals, and they can enjoy investment income and may enjoy certain tax-free benefits.

IRA accounts are generally divided into: traditional IRA account and Roth IRA account.

Question 2: What is a traditional IRA account?

The traditional IRA account enjoys a discount for slowing personal income tax (TAX Deferred), that is, the funds you deposited in the IRA account each year do not require taxes ( Notice: The amount of tax reduction depends on your/family’s income and whether there are 401K, etc., rely on the employer’s pension plan).

However, after you retire, take out the IRA account Principal and income At the same time, you need to pay the tax on each penny at the tax rate of that year.

Question 3: What is the difference between traditional iRA and Roth IRA?

Traditional IRA accounts are different from Roth IRA in terms of income restrictions, whether the principal pays taxes, whether to pay taxes, withdrawal time, how to punish in advance, and the minimum withdrawal requirements.

Check the specific comparison

Question 4: What are the recommendations for traditional IRA accounts?

Here are the ten traditional IRA accounts we recommend:

The best overall performance IRA account: TD Ameritrade

IRA account for best customer service: Charles SCHWAB

The best retirement service IRA account: Fidelity

The best intelligent investment adviser IRA account: Betterment

IRA account of the best common funds: Vanguard

Best Investment Ira account: Merrill Edge

The best balanced income IRA account: E*trade

Best IRA account for the best transaction fee: Firstrade

The IRA account that is most suitable for beginners: SOFI

IRA account of minimum transaction commission: Ally Invest