ETF The full name of English is Exchange Traded Fund, Chinese is called “Index Stock Fund”.

ETF is essentially a tracking index (INDEX), an industry (SECTOR), a commodity (Commodity), or other asset securities.It has a related price that can be delivered to a stock exchange like an ordinary stock.

ETF, as an emerging investment method, combines the flexible transactions of the stock and the diversified combination of common funds, has become an increasingly popular investment choice.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How does ETF develop?

- How does ETF operate?

- What are the characteristics of ETF?

- What are the types of ETF?

- The difference between ETF and stock and common funds?

- Common ETF

- common problem

How does ETF develop?

Financial investment has been prevailing for a long time, and there are many categories.The United States, which is mature in the financial sector, has a variety of investment methods and different combinations of various methods.At present, the main popular categories are stock and Mutual Fund EssenceThe stock has a large number of shareholders with its flexibility of its transaction, and the diversity of the common fund has a diversity of investment portfolios, and also has many investors.

The main original intention of ETF is the advantages of the convenience of the stock (STOCK) transactions and the diversified choice of Mutual Funds transactions, bringing better investment options to investors.

The content of ETF can be constructed as any content from tracking a single commodity price to a large number of diversified securities portfolios, or even a specific investment strategy, which involves not only the United States, and can invest globally.

The price of ETF fluctuates throughout the day with ETF’s trading, and can be traded in real time.This is the biggest difference between it and the common fund that can only be traded after the market.

In the United States, most ETFs are established as open funds and received in 1940 “Investment Company Law” Constraint Essence

How does ETF operate?

The basic operation mode of ETF is: ETF founders package target shares, or funds or other financial products, designed a fund in the form of a trust to track its performance and formulate its index.Then divide the fund into ETF share, and then put it into the stock market like a trading stock.

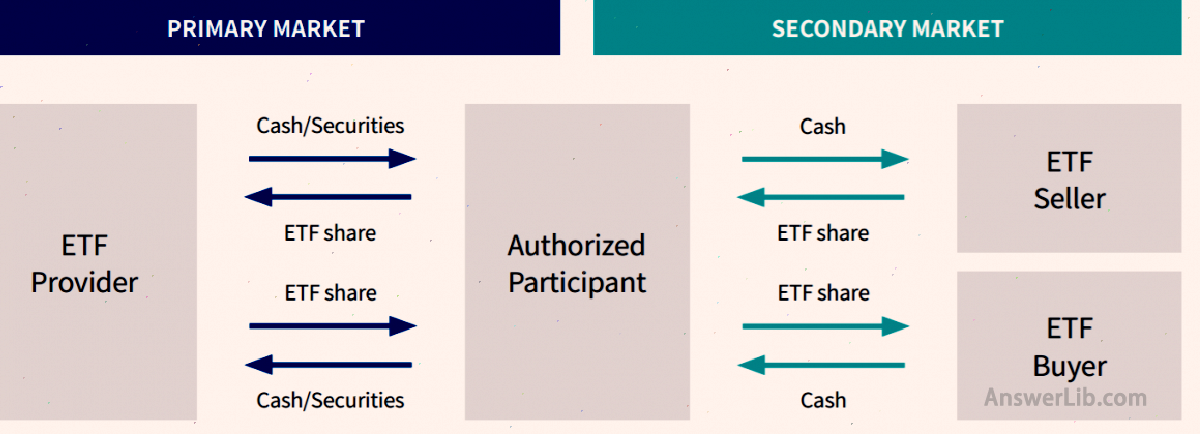

In this process, the supply of ETF stocks is supervised by the “creation” and “redemption” mechanism.This mechanism is usually required and is called a large professional investor of “Authorized Participant” (AP) to operateEssence

During all transactions, fund providers have related assets, and investors have part of ETF shares and do not have the fund’s basic assets.

Investors can use online brokers (for example,, for example, Futu Moomoo,, Penetrate,, Micro-cow As well as tiger As well as First securities As well as Robinhood Or the traditional broker to buy and trade from the business, or you can buy it directly from the EFT issuer.For example, Vanguard directly sells its ETF to the public through its website.

Investors’ income can be re-assigned.If it is used as a income extraction, the relevant taxes and fees need to be paid.If you invest again, you need to pay the transaction fee.

Related Reading:American brokerage ranking and comparison

What are the characteristics of ETF?

ETF has great advantages, such as low cost and diversification; it also has certain disadvantages, such as insufficient liquidity.

A.ETF advantage

low cost

Compared with the common fund, ETF provides a very low annual fee.For example, the annual fee of the S & P 500 Index Fund is only 0.09%, while the VOO ETF is lower, only 0.03%.However, some ETFs are slightly higher, for example, GDX has reached 0.52%.There are many total fees charged by common funds, such as management fees (0.25%~ 1.5%), commissions such as buying and selling funds.

Note that ETF is not a separate management fee, and the cost of ETF has been loaded on the price of ETF.The cost of the common fund is collected separately.

Through ETF, investors only need to execute one purchase transaction and a selling transaction, which saves multiple commissions and transactions for transactions.Some brokers will even provide some low-cost ETF-free transactions.Further reduced the cost of investors.

For example, in Micro-cow As well as Tiger securities As well as First securities The trading ETF is zero commission and does not charge the handling fee.

Diversification

For investment in different fields, you need to pay attention to a lot of information and perform multiple transaction operations.

Through ETFs, not only can you invest in stocks in the same industry or field at one time, but you can even invest cross-industry and multinational investment across the industry.

At the same time, the diversified investment model has also greatly reduced the risks that may bear when investing in a certain field.Of course, based on the personal interests of investors, there are also ETFs focusing on a specific industry (SECTOR).

Transparency

Anyone who can access the Internet can search for specific ETF price activities on the exchange, and the fund holder will also disclose information to the public every day.

Compared with this, the common fund is disclosed once a month or even quarterly.

Low taxation

Different common funds, investors need to pay taxes and fees to their immediately income during the investment process.ETF supports asset reuse, and tax levies only at the last sale.

But just as stocks cannot achieve a diversified combination, the common fund cannot be flexibly traded.Even if the ETF with the advantages of the two has its own shortcomings.

B.Disadvantages

Insufficient liquidity

Like any securities, investors will be affected by the current market price when selling.When the market shakes violently, a large number of single-stock selling may have a greater impact on ETFs for “one basket” packaging and sale.Therefore, investing in some ETFs that are popular in the market are better liquid, so buying and selling are easier.

If the ETF itself was in a period of not frequent transactions, it would be difficult to sell for selling.

ETF turning off risk

The main reason for this is that ETF Fund did not introduce enough assets to pay management costs.

The biggest impact of turning off ETF is that investors must sell earlier than they expect, which means that they may lose money.At the same time, they are facing the trouble of reinvestment of this money and the possibility of accident tax burden.sex.

Investment object selection right

The reason why ETF attracts many investors is its diversity, and this is also its limitations.

Investors usually do not speak to individual stocks in the ETF target index, especially passive management ETFs, which means that for personal wishes, those investors who want to avoid certain companies or industries cannot choose to invest freely freely.Object.

Investors cannot exclude individual stocks in the case of holding the entire ETF stock.

What are the types of ETF?

ETF can be classified according to management methods and types of investment targets.

1.Divide according to management methods

Passive management ETF

Passive management ETF is a more traditional management method of ETF.Generally, it will track a specific benchmark asset.Fund managers will not adjust the various investment ratios of the fund every day.

This type of ETF is similar to the investment trust of the unit.Its investment portfolio will be reset regularly, but they can be traded daily like stocks.

The cost of the transaction required is lower than the active management ETF, and the income obtained is smooth but it is relatively not necessarily able to meet the benefits of positive investors.

Actively manage ETF

Active management of ETF refers to the investment management method of investors’ initiative to manage the stock portfolio, more participating in buying and selling stocks, and changing the holdings in ETF.

It appeared after passive management ETFs, giving investors more stock portfolio selection rights, so that positive investors will be free to choose investment based on their judgment.

Compared with passive management ETFs, active management may obtain higher returns, but at the same time, it will also generate higher transaction fees and management fees due to a high-handed rate.

2.Divide according to the investment target

- Bond ETF: Including US government bonds, local bonds in each state, municipal bonds, and corporate bonds, etc.;

- Commodity ETF: All physical commodity investment targets including crude oil or gold;

- Currency ETF: Including Currency, such as Canadian dollars, euros, yen, etc.;

- Stock ETF: Including stocks, funds, etc.;

- International ETF: Focus on ETFs of all economies outside the United States, including developed markets, emerging markets, etc.;

- Industry ETF: Following specific industries, 11 sections including medical care, finance, industry, information technology, and real estate are separated from the US stock market.Each section consists of companies operating in this sector.The company’s stock portfolio investment, or cross-industry portfolio investment.

There are some novel ETFs, such as network security ETF and ETF focusing on smartphones.

The difference between ETF and stock and common funds?

1.The difference between ETF and stock

The biggest difference between ETF and stock transactions is the form of its “one basket” stock.

Compared with buying different single stocks, ETFs sold in the form of “one basket” can greatly reduce expenditure in terms of transaction fees and agent commissions.

Because there are many assets in ETFs, which are not limited to the same industry or the same country, it can meet the needs of investors to decentralize investment and make more diverse portfolios.

2.The difference between ETF and common fund

The biggest difference between ETF and the common fund is that ETFs can be traded on the stock exchange and have the same flexible transaction processes as stocks.Compared with the stock, it is more cost-effective and liquid.

Management fee is also one of the advantages of ETF.Data in 2019 show that the average annual management fee of the stock-type common fund is 0.52%, while the average rate of ETFs is 0.18%.

In the initial transaction, ETF greatly reduced the minimum investment standard compared to the common fund.

Common ETF

According to the transactions in the first quarter of 2020 or 2021, some ETF performance is worthy of attention.

SPY (SPDR)

- Listing time: January 22, 1993

- annual fee: 0.09%

- Main stock: NYSE and NASDAQ selected 500-502 stocks

- Fund scale:$ 387B (March 2022)

- Daily transaction volume:$ 47B (March 2022)

- MSCI rating: A (March 2022)

- 10 -year return rate:+14.16% (March 2022)

SPY is the first ETF in the world, listing and 1? ️ 22nd, for tracking S & P 500 Index ETF is also one of the largest transactions.The top ten stocks holding the highest proportion of SPY are as follows, and they have a total of 27.88% Share share:

- Apple Inc.(6.97%)

- Microsoft Corporation (5.88%)

- Amazon.com, INC.(3.36%)

- Alphabet inc.class a (2.13%)

- Alphabet inc.Class C (1.98%)

- TESLA Inc (1.84%)

- Berkshire Hathaway Inc.Class B (1.66%)

- Nvidia Corporation (1.50%)

- Unitedhealth group incorporal (1.29%)

- Johnson & Johnson (1.27%)

If you are not familiar with investment but want to make a profit from the stock market, it may be the best choice to buy SPY directly.

Buffett once said at the “Answering Stocking Conference” in 2021:

But for a given indicty, Particularly My Wife, I just Think that having a tiny frame, white is all it takes for her to very well for the rest of her life, I just – I think that the best thing to do is buy 90% in an S & P 500 Index Fund.Now, The Index FIDLE NATURALLLLLLY HAVE Started Over the Time, They Market More -More and more products that go to Other indictathing.

VOO

- Listing time: September 7, 2010

- Publisher: Vanguard

- annual fee: 0.03 %

- Main stock: NYSE and NASDAQ selected 500-508 stocks

- Fund scale:$ 267 B (March 2022)

- Daily transaction volume:$ 3.7 B (March 2022)

- MSCI rating: AA (March 2022)

- 10 -year return rate:+14.19 % (March 2022)

Vanguard S & P 500 ETF tracking the S & P 500 index, providing a basic and widely-wide US listed company’s diversified investment portfolio, which is very similar to SPY, but the 500 stocks contain are less different, but VOO’s management fee is lower (0.03%, vs SPY 0.09%).However, from the perspective of volume and daily transaction volume, SPY is more welcome than VOO.

VOO is initiated by Vanguard, one of the leaders invested by low-cost ETF, and has hundreds of billions of assets.The fund was opened in 2010.It still has a steady growth in the disaster and difficult 2020, which shows its good overall income.

The top ten stocks with the highest proportion of VOO are as follows, and they have a total of 28.86% Share share:

- Apple Inc.(7.10%)

- Microsoft Corporation (6.08%)

- Amazon.com, inc.(3.40%)

- Alphabet inc.class a (2.12%)

- TESLA Inc (1.98%)

- Alphabet inc.Class C (1.98%)

- Meta Platforms Inc.Class A (1.93%)

- Nvidia Corporation (1.59%)

- Berkshire Hathaway Inc.Class B (1.49%)

- Johnson & Johnson (1.18%)

Qqq

- Listing time: March 10, 1999

- Publisher: Invesco

- annual fee: 0.2 %

- Main stock: NASDAQ non-financial sector 100 to 103 stocks, mainly technology stocks

- Fund scale:$ 174 b (March 2022)

- Daily transaction volume:$ 27 B (March 2022)

- MSCI rating: AA (March 2022)

- 10 -year return rate:+18.95 % (March 2022)

INVESCO qqq Trus T only owns Nasdaq’s stock in the field of non-financial sector.The top ten stocks holding the highest proportion are as follows.The proportion is 52.03% The

- Apple (12.63%)

- Microsoft (10.12%)

- Amazon (6.74%)

- TESLA (4.05%)

- Google-C (3.95%)

- Google-A (3.74%)

- Nvidia (3.70%)

- Meta (3.30%)

- Broadcom (1.92%)

- Costco (1.88%)

This makes it an ETF with a high technical content.It is also one of the largest ETFs at present, so its liquidity is very strong.The stable performance in 2020 reflects that technology companies will have a wider market.

GDX

- Listing time: May 16, 2006

- Publisher: Vaneck

- annual fee: 0.52 %

- Main stock: Gold Mining Enterprise Stock

- Fund scale:$ 15.6 b (March 2022)

- Daily transaction volume:$ 770 m (March 2022)

- MSCI rating: AAA (March 2022)

- 1 year return rate:+20.13 % (March 2022)

- 3 -year return rate:+20.59 % (March 2022)

- 10 -year return rate:-2.5 % (March 2022)

VANECK VECTOR GOLD MINERS ETF is one of the largest gold miner ETFs.The average performance of the five-year performance by September 2020 is 21%per year, but the reward rate of ten years is only 2.5%.The price of gold has plummeted.As the price of gold has risen in recent years, GDX’s performance has become better and better.However, you should note that the annual fee of this ETF is very high, reaching 0.52%.

The top ten stocks holding the highest proportion of GDX are as follows, and they have a total of 69.01% Share share:

- Newmont Corporation (17.45%)

- Barrick Gold Corporation (12.43%)

- Franco-Nevada Corporation (8.79%)

- Agnico Eagle Mines Limited (7.43%)

- Wheaton Precious Metals Corp (6.06%)

- Newcrest Mining Limited (4.63%)

- Gold Fields Limited Sponsored ADR (4.00%)

- Anglogold Ashanti Limited Sponsored ADR (3.00%)

- Northern Star Resources LTD (2.63%)

- Zijin mining group Co., LTD.Class H2 (0.58%)

Vixy

- Listing time: January 3, 2011

- Publisher: Proshares

- annual fee: 0.85 %

- Main stock: Tracking futures related to the CBOE fluctuation index

- Fund scale:$ 407 m (March 2022)

- Daily transaction volume:$ 180 m (March 2022)

- 1 month return rate:+44.06 % (March 2022)

- 3 months of return:+21.63 % (March 2022)

- 1 year return rate:-54.36 % (March 2022)

- 10 -year return rate:-49.32 % (March 2022)

Proshares vix Short-Term Futures ETF is one of the relatively special members in the ETF field because it allows investors to profit from market fluctuations, not specific securities.If the volatility is higher, the value of the ETF will increase, usually the opposite of the stock market.However, because it must regularly perform derivative contracts, it will cost its own funds over time, so it is only suitable for short-term investment.Note that if you invest in long-term investment, you may lose heavy losses.

IEO

- Listing time: May 1, 2006

- Publisher: BLACKROCK

- annual fee: 0.42 %

- Main stock: US oil and natural gas companies stocks in 50 DOW JONES

- Fund scale:$ 720 m (March 2022)

- Daily transaction volume:$ 17.5m (March 2022)

- MSCI rating: AA (March 2022)

- 1 year return rate:+69.31 % (March 2022)

- 3 -year return rate:+13.92 % (March 2022)

- 10 -year return rate:+3.49 % (March 2022)

Ishares U.S.Oil & Gas Exploration & Production ETF, after the depression of the nightmare in the 2020 nightmare, IEO’s strong performance in the first quarter represents the recovery of the oil and gas production industry.The top stocks of the ETF include Conjo Petroleum (COP & Nbsp;) and Eog Resources (& nbsp; Eog & Nbsp;), which account for more than 25% of the investment portfolio.Nowadays, oil prices have risen to about $ 60 per barrel.Last year, the current situation of the exploration company that faced the danger of closing in the worst market dynamics was also getting better.

The top ten stocks holding the highest proportion of IEO are as follows, and they have a total of 68.65% Share share:

- Conocophillips (18.76%)

- EOG Resources, Inc.(9.85%)

- Pioneer naturct resources company (7.77%)

- Marathon Petroleum Corporation (6.79%)

- Devon Energy Corporation (4.65%)

- Cheniere Energy, Inc.(4.64%)

- Valero Energy Corporation (4.27%)

- Hess corporation (4.24%)

- Phillips 66 (4.12%)

- Diamondback Energy, INC.(3.56%)

RWJ

- Listing time: February 22, 2008

- Publisher: BLACKROCK

- annual fee: 0.39 %

- Main stock: DOW JONES SMALLCAP 600 Index

- Fund scale:$ 760 m (March 2022)

- Daily transaction volume:$ 7.5 m (March 2022)

- MSCI rating: A (March 2022)

- 10 -year return rate:+14.37 % (March 2022)

Invesco S & P Smallcap 600 Revenue ETF is the seemingly weird “Smart Beta” ETF in the industry.It consists of 600 small-cap stocks Dow Jones SmallCAP 600, and then weighted stocks based on their income, a single singleThe weight of the position is 5%.Diversified small models make the index run well without increasing cost or transaction complexity.

The top ten stocks with the highest proportion of RWJ are as follows, and they have a total of 68.65% Share share:

- PBF Energy, Inc.Class A (3.97%)

- World Fuel Services Corporation (2.93%)

- United Nature Foods, Inc.(2.36%)

- Andersons, Inc.(1.73%)

- Group 1 Automotive, INC.(1.37%)

- SONIC Automotive, Inc.Class A (1.35%)

- Spartannash Company (1.33%)

- BED BATH & Beyond Inc.(1.27%)

- Asbury automotive group, inc.(1.16%)

- Community Health Systems, Inc.(1.16%)

Veu

- Listing time: March 2, 2007

- Publisher: Vanguard

- annual fee: 0.07 %

- Main stock: Big-medium-scale non-US stock (3315 stocks)

- Fund scale:$ 32 b (March 2022)

- Daily transaction volume:$ 375 m (March 2022)

- MSCI rating: AA (March 2022)

- 10 -year return rate:+5.6 % (March 2022)

Vanguard FTSE All-WORLD EX-US ETF is an ETF suitable for global investment, including each geographical area.Top stocks include Asian technology giants Alibaba Group Holdings (& Nbsp; BABA & NBSP;) and Swiss Pharmaceutical Company Nobo (NVS & Nbsp;.But it is “outside the United States”, so it does not include American companies.

Veu ETF also has more than 3,000 stocks, the 80 companies with the highest percentage are listed below, and its proportion:

| VEU mainly holds stocks | Shareholding ratio |

|---|---|

| Tencent Holdings LTD. | 1.35% |

| Nestle S.A. | 1.27% |

| U.S.Dollar | 1.19% |

| TAIWAN SEMICONDUCTOR Manufacturing Co., LTD. | 1.17% |

| Roche Holding LTD | 0.96% |

| ASML HOLDING NV | 0.95% |

| Toyota Motor Corp. | 0.87% |

| Taiwan semiconductor manufacturing Co. | 0.87% |

| Alibaba Group Holding LTD | 0.80% |

| LVMH MOET Hennessy Louis Vuitton Se | 0.73% |

| Shell PLC | 0.71% |

| Astrazneca PLC | 0.64% |

| Novartis AG | 0.64% |

| Royal Bank of Canada | 0.58% |

| Novo Nordisk A/S CLASS B | 0.57% |

| Samsung Electronics Co., LTD. | 0.55% |

| Toronto-dominion bank | 0.52% |

| HSBC HOLDINGS PLC | 0.52% |

| Samsung Electronics Co., LTD.Sponsored GDR | 0.50% |

| SAP SE | 0.50% |

| Sony Group Corporation | 0.50% |

| Totalenergies se | 0.49% |

| AIA Group Limited | 0.45% |

| Siemens Ag | 0.43% |

| Meituan class B | 0.42% |

| Diageo PLC | 0.42% |

| Commonwealth bank of Australia | 0.41% |

| Sanofi | 0.41% |

| Glaxosmithkline PLC | 0.39% |

| Shopify, inc.class a | 0.38% |

| Allianz se | 0.38% |

| Bp p.L.C. | 0.36% |

| British American Tobacco P.L.C. | 0.35% |

| BHP Group LTD | 0.34% |

| Keynce Corporation | 0.33% |

| Schneider Electric SE | 0.32% |

| CSL LIMITED | 0.32% |

| Bank of Nova Scotia | 0.31% |

| ENBRIDGE Inc. | 0.30% |

| BNP Paribas Sa Class a | 0.28% |

| RIO TINTO PLC | 0.27% |

| MITSUBISHI UFJ Financial Group, Inc. | 0.27% |

| Compagnie Financiere Richemont Sa | 0.27% |

| BrookField Asset Management Inc.Class a | 0.26% |

| Prosus n.v.class n | 0.26% |

| Bank of Montreal | 0.26% |

| Hong Kong Exchanges & Clearing LTD. | 0.26% |

| Tokyo Electron LTD. | 0.26% |

| Canadian National Railway Company | 0.26% |

| Airbus se | 0.25% |

| Zurich Insurance Group LTD | 0.25% |

| Basf se | 0.25% |

| China Construction Bank Corporation Class H | 0.25% |

| Unilever PLC | 0.25% |

| GLENCORE PLC | 0.25% |

| Iberdrola Sa | 0.24% |

| Mercedes-Benz Group Ag | 0.24% |

| Shin-etsu chemical co LTD | 0.24% |

| Canadian Pacific Railway Limited | 0.24% |

| Recruit Holdings Co., LTD. | 0.24% |

| BHP Group LTD | 0.23% |

| L’ oreal Sa Temp | 0.23% |

| National Australia Bank Limited | 0.23% |

| Deutsche Telekom Ag | 0.22% |

| Unilever PLC | 0.22% |

| Axa Sa | 0.22% |

| Ubs group ag | 0.22% |

| Banco Santander, S.A. | 0.21% |

| ENEL SPA | 0.21% |

| Bayer ag | 0.21% |

| Reliance Industries Limited | 0.21% |

| Housing Development Finance Corporation Limited | 0.21% |

| SoftBank Group Corp. | 0.21% |

| Canadian Natur flower resources limited | 0.21% |

| Deutsche Post Ag | 0.21% |

| Adyen NV | 0.21% |

| Jd.com, INC.Class a | 0.21% |

| MediaTek Inc | 0.21% |

| Abb LTD. | 0.21% |

| Ing Groep NV | 0.21% |

common problem

Question 1: What does ETF mean?ETF’s full name is Exchange Traded Fund, which is called “Index Stock Fund” in Chinese.The main original intention of its establishment is the advantages of the convenience of the stock trading and the diversified choice of Mutual Funds transactions, bringing better investment options to the majority of investors.

See More

Crude Oil ETF is a commodity ETF, which is based on crude oil futures or oil companies’ stocks as financial products.

See More

Gold ETF is an ETF based on the price of gold.

See More

The Nasda ETF is an ETF that tracks the US Nasdaq 100 index.

See More