Fundamental analysis, English is FundamentalAnalysis It is a way to evaluate the value of the company.Base Analyze to determine the company’s Intrinsic Value(( IntrinsicValue) And compare with the current company’s stock price, so as to provide investors with appropriate investment advice.The basic face analysis is value investment Important foundation.

For example, when the company’s inherent value is higher than the company’s stock price, the stock price is underestimated and can be bought.On the contrary, if the company’s inherent value is lower than the current stock price, the stock price is overestimated and should be sold.

When analyzing the fundamentals of the company, you often need to analyze the company’s financial statements, management discussions and analysis reports, industry research, competitors analysis, market trends, etc.Fundamental analysis is widely used in investment decisions, especially value investment.

Therefore, the company’s fundamental analysis needs to be combined with a variety of data, and after a long study of professionals, professional people can accurately find the required data from the financial statements.From the analysis of the macroeconomic environmentReasonable analysis results.

When conducting the company’s fundamentals, you can use it bottom up or From top to bottom The method, combined with qualitative analysis and quantitative analysis to give a relatively fair analysis result.

Special mention, Tradeup securities(American brand of Tiger Securities) provides detailed financial data from listed companies, as well as news about individual stocks and entire macroeconomics, accurately grasp the fundamentals and help your investment.At present, you can get the opportunity to extract free US stocks in the tradeup account.$ 1570 US stocks.

You can read articles “TRADEUP Certificate Explanation” Learn about the latest account opening reward information.

This article does not constitute any investment suggestions.Remember, the stock market has risks and investment needs to be cautious.

Directory of this article

- What is the company’s fundamental analysis?

- What are the fundamental analysis methods?

- How to use tradeup for fundamental analysis?

- What are the differences between fundamental analysis and technical analysis?

- More investment strategies

- TradeUP certificate account opening

- More investment foundation

What is the company’s fundamental analysis?

The company’s fundamental analysis includes: macroex and micro factors.Considering macroex and micro factors, the company’s inherent value and future development potential can be more comprehensively evaluated.

Macro factors refer to factors that affect the entire economic environment, such as national policies, macroeconomic environment, and market trends.These factors may affect the company’s business environment and future development.Therefore, when conducting fundamental analysis, the impact of macroeconomic factors on the company needs to be considered.

Micro factors refer to factors that affect the company’s internal operations and performance, such as the company’s financial status, business strategy, market share, product competitiveness, etc.These factors can be evaluated through financial analysis, industry analysis, and competitors analysis.

When conducting fundamental analysis, you need to have a sufficient understanding of accounting, finance and economics to accurately evaluate the current overall economic environment and industry development situation, and quickly find from the financial report released by the company when conducting micro analysis.Data required.

Therefore, when the company analyzes the fundamentals, it needs to be performed:

- Economic Analysis

- Industry Analysis (Industry Analysis)

- Company Analysis (Company Analysis)

Economic Analysis

When performing fundamental analysis, economic analysis is a very important part, because the macroeconomic environment has a great impact on the company’s business and profitability.The content of economic analysis includes:

- GDP growth rate: GDP (GDP) is the measurement of the total economic activity of a country, and the GDP growth rate reflects the growth rate of a national economic activity.The company’s industry is usually affected by GDP growth rate.

- Inflation rate:Inflation rate It reflects the speed of price level.When the inflation rate rises, the currency purchasing power decreases, and the company’s cost may increase.

- unemployment rate:unemployment rate It refers to the proportion of unemployed people in the labor market.The level of unemployment rate may affect consumers’ purchasing power and company sales revenue.

- interest rate: Interest rates are the cost of borrowing capital.The company may be affected by changes in interest rates, especially companies that need to borrow money for investment or capital expenditure.

- exchange rate: The exchange rate is the ratio of one currency to another currency.If the company involves international trade, the fluctuation of the exchange rate may affect its profitability.

By analyzing the macroeconomic environment, fundamental analysis can more comprehensively evaluate the company’s inherent value and future development potential.

Industry Analysis (Industry Analysis)

The industry analysis of fundamental analysis refers to analyzing and researching the industry’s industry to understand the current situation, trend and competitive environment of the industry, as well as evaluating the company’s competitiveness and future development potential in the industry.

The content of industry analysis includes:

- Industry market size: The market size of the industry refers to the sales revenue and market share of the entire industry.By understanding the market size of the industry, the competitive environment and market potential of the industry can be determined.

- Industry growth rate: Industry growth rate refers to the industry’s annual sales revenue growth rate.Understanding the growth rate of the industry can predict the future development trend of the industry.

- Industry structure: The industry structure includes the main participants in the industry, the supply chain and value chain of the industry, and the main products and services in the industry.By understanding the industry structure, you can understand the company’s competitors, suppliers and customers.

- Industry Trends: Understanding the future development trend of the industry, such as technology innovation, regulatory changes, and changes in consumer demand, can help evaluate the company’s future development potential in the industry.

- competitor analysis: Understanding the company’s competitors, including the market share of competitors, business strategies and financial conditions, can evaluate the company’s competitiveness in the industry.

Through the analysis of the industry, you can better understand the company’s business environment and competitive environment to evaluate the company’s inherent value and future development potential.

Company Analysis (Company Analysis)

The company’s analysis of fundamental analysis refers to analyzing and researching the company’s own financial conditions, business strategies and future development to evaluate the company’s inherent value and future development potential.

When conducting company analysis, financial data will be used to calculate a variety of financial ratios, such as the following:

Earnings per share Earnings Per Share (EPS): This is one of the most commonly used financial ratios.You can use the company’s net income to be calculated with the number of circulation shares.Through EPS, analysts can learn how many parts of the company’s business profits are allocated into each share.

P / E ratio Price-to-Earnings Ratio (P/E Ratio): It is also one of the most commonly used financial ratios.The actual stock price of the company is obtained from the income per share.Generally speaking, the price-earnings ratio is greater than 1, indicating that the actual stock price is greater than the income per share, and the stock price will be overestimated.On the contrary, the price-earnings ratio is less than 1.The earnings per share are greater than the actual stock price, that is, the stock price is underestimated.

Marketing rate Price-TO-SALES RATIO (P/S Ratio): The marketing ratio is to remove the company’s total market value and sales, and sometimes it is also called the sales multiple.The higher the market sales rate, the higher the current market value of the company is higher than the sales revenue, which means that the stock price is high, which is not a good time for investment.On the contrary, the lower the market sales rate.It is low, and has a good room for rising, which is the time to buy investment.

Net rate Price-TO-BOOK RATIO (P/B): Municipal net ratio is to remove the company’s market value and book value.Among them, the market value is multiplied by the stock price with the amount of circulating stocks, and the book value is to subtract the company’s total assets in the financial statement.The value obtained after preferred shares and interests.The calculation significance of the municipal net ratio is to evaluate the relationship between the company’s current stock price and the company’s book value.The higher the value of the municipal net ratio, the higher the stock price is higher than the book value, the lower the investment value.It shows that the lower the stock price is lower than the book value, the higher the investment value.

Dividend payment rate Dividend Payout Ratio: Also known as the dividend distribution rate, it is a percentage value obtained by comparing the dividend distributed by the company to profit.This value can indicate how many parts of the company’s profit were allocated to shareholders.The lower the value, the less the shareholders’ dividends obtained from the company’s profit.On the contrary, the higher the value, it means that shareholders can get more returns from the company’s profit.

Dividend yield division yield: This ratio is a percentage value that the company’s dividend and stock price are eliminated.The value of the dividend yield indicates the proportion of dividends that the shareholders can get in each unit of investment.The combination of dividend yields and capital gains obtained from the stock price constitutes the entire yield of investors in the investment process.Higher dividend yields indicate that the company’s stock price has grown slowly.Most of the income obtained by shareholders from investment comes from dividends instead of rising stock prices.

Return on equity: This ratio is the percentage value of the company’s net income with the total shareholders’ equity, which represents the company’s ability to make profits by the company’s investment.The higher the return on equity, the higher the ability of the company’s use of profit at all, and it is also what investors are more willing to invest.

Profile growth PROJECTED EARNINGS GROWTH: The expected income growth is that the analyst is calculated through a specific calculation formula and the use of different financial data for calculation.It is expected that the target company’s stock will be in the next time, which is usually a year’s income growth rate.Investors will use this value to estimate this value.You may get investment returns.

When analyzing specific fundamentals, you can follow the top or bottom two research directions.

- The top-down method: This method is to start analyzing from the macroeconomic, such as interest rates, inflation rates, and GDP change rates, etc., and then analyze the development level, prospects and potential development opportunities of the company’s industry.Finally, specific micro-analysis of the company, including the calculation of various financial indicators.Fundamental analysis is performed from macro to micro-sequence.

- Method from the bottom up: The bottom-up analysis method is to start analyzing from the company’s micro-data, first calculate the company’s various financial indicators, and combine the company’s stock price to analyze the company’s operating ability and the current stock price investment significance.Then began to study the company’s positioning and development prospects in the industry, and finally combined with the overall economic environment to analyze the company’s development positioning in the current environment.

The bottom-up research direction focuses on the research and stock selection of individual stocks, and is more suitable for short-term transactions or active investors;

The top-down research direction pays more attention to the research and analysis of macroeconomic and industry trends, which is suitable for long-term investors.

In actual investment, the two research directions can also be used in combination to obtain more comprehensive investment analysis.The difference between the two is as follows:

- The starting point of research is different: The starting point of the bottom-up research direction is to analyze the financial and operating conditions of a single company to find stocks with investment value; the starting point of the top-down research direction isAnalyze with social conditions to predict the economic cycle and market direction.

- Different research points: The focus of the bottom-up research direction is to analyze the company’s own financial and operating conditions to predict its future development potential, and then choose individual stocks with investment value; the focus of top-down research directions isThe research and analysis of the environment to understand the market trend and industry trends, and then choose a good stock.

- Different risk control: The bottom-up research direction usually pays more attention to the risk control of a single company, such as evaluating the company’s financial stability and operating risks; the top-down research direction is more concerned about the macro environment and market risks, such as economic cycle and policy changesThe impact of the factors on the market.

What are the fundamental analysis methods?

When analysts conduct the company’s fundamental analysis, two mainly analyzes:

- Qualitative Analysis

- Quantitative Analysis

Qualitative Analysis

The qualitative analysis of fundamental analysis refers to the evaluation of non-digital analysis of the company and the industry, including the company’s brand, product quality, market status, brand reputation and other factors.These factors are usually difficult to quantify and need to be analyzed by experience, professional knowledge and intuition.

The qualitative analysis is based on the company’s business model, competitive advantage, management status, and corporate governance capabilities.

- Business mode (Business Model): Mainly analyze the company’s operating purpose, whether the overall operating model can obtain sufficient profitability, etc.

- Competition Advantage: Based on the company’s various industries to today, it measures its competitive advantage in the industry, and evaluate whether this competitive advantage can be maintained for a long time.

- Management (management): Analyze the company’s leaders or management to evaluate whether they have the ability to continue leading the company’s healthy development.

- Corporate governance (Corporate Governance): Through the analysis of the internal structure of the company to understand the responsibility relationship and collaboration status of each management level, and find out whether the company can provide a transparent and easy-to -understand governance model to make it easier for investors to understand the company’s operating status.

Quantitative Analysis

Quantitative analysis is usually based on the company’s financial data and statistical data.Calculation and prediction through mathematics and statistical models to evaluate the company’s inherent value and future development potential.

Quantitative analysis can include computing and comparison of various financial indicators, such as yields, price-earnings ratios, market ratios, asset yields, etc., and forecasting through financial models, such as cash flow forecasting, stock evaluation models, etc.

Quantitative analysis uses various financial values to conduct quantitative analysis of the company, and measure the company’s investment value through the calculation of various financial ratios.Here are some common quantitative analysis content:

- financial analysis: Including financial statements such as profit statement, balance sheet and cash flow statement, as well as the calculation and comparison of various financial indicators, such as rate of return As well as P / E ratio As well as Net rate As well as Return on Assets wait.

- Profitability Analysis: Evaluate the company’s profitability, including analysis and comparison of indicators such as gross profit margin, net profit margin, and revenue growth rate.

- Financial stability analysis: Evaluate the company’s financial stability, including liability ratio, Flow ratio As well as Cash ratio Analysis and comparison of indicators.

- Financial leverage analysis: Evaluate the company’s financial leverage, including the analysis and comparison of indicators such as financial leverage ratios and equity returns.

- Industry comparative analysis: Compare the company’s financial indicators with other companies in the same industry to understand the company’s performance and competitiveness in the industry.

- Stock evaluation model: Analyze and predict the company’s financial data and market data through mathematical and statistical models, such as cash flow forecasting and stock evaluation models.

Through quantitative analysis, the company’s inherent value and future development potential can be more objective and accurately evaluated.At the same time, quantitative analysis can also help investors understand the potential risks and uncertainty of the company and the industry to make more accurate investment decisions.

How to use tradeup for fundamental analysis?

You can use the TradeuP Web version or Tradeup APP for fundamental analysis.Taking the TradeUP mobile app as an example, I will introduce it.

Notice: In the explanation, we use Apple stock AAPL as a demonstration.The stock is only used as a demonstration content, not to guide you to buy the stock.Remember: the stock market has a critical danger and investment needs to be cautious.

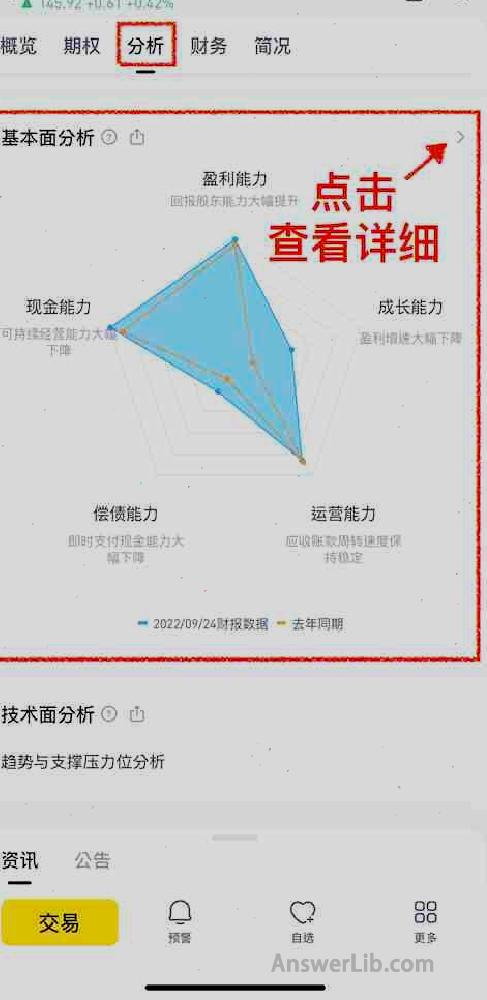

Tradeup provides a specialized 【Fundamental analysis】, By clicking the top 【analyze】 You can find it 【Fundamental analysis】 Essence

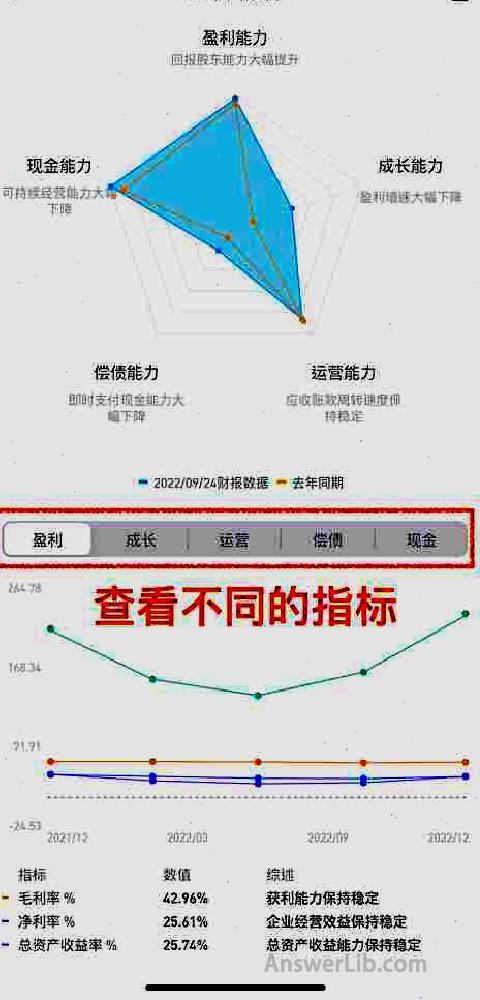

You can understand the strengths of the listed companies through visual graphics, including profitability, cash flow capacity, growth ability, claim ability, and the company’s operating capabilities.

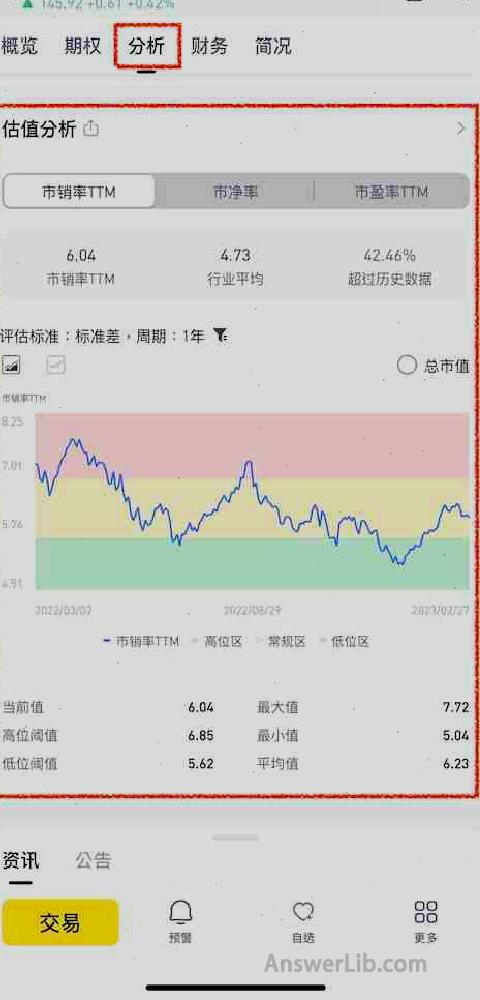

Apart from 【Fundamental analysis】 Some of the company’s fundamentals, you can also pass 【analyze】 Below 【Valuation Analysis】 Come and understand the company intuitively through the image P / E ratio(P/E),, Marketing rate(P/s), and Net rate(P/b).

Through the color curve chart in the figure below, you can intuitively understand the current area of the stock price.The red area represents the overestimation of the company’s stock price, the yellow area shows the reasonable price range, and the green area shows that the area where the stock price is underestimatedEssence

For each listed company, Tradeup also provides detailed financial status information, for example,, for example, Earnings per share(EPS), Return on Assets(Roa), Roe(ROE), Speed ratio(Quick Ratio) important profit-related parameters, as well as information about the asset-liabilities and cash flow sheets.

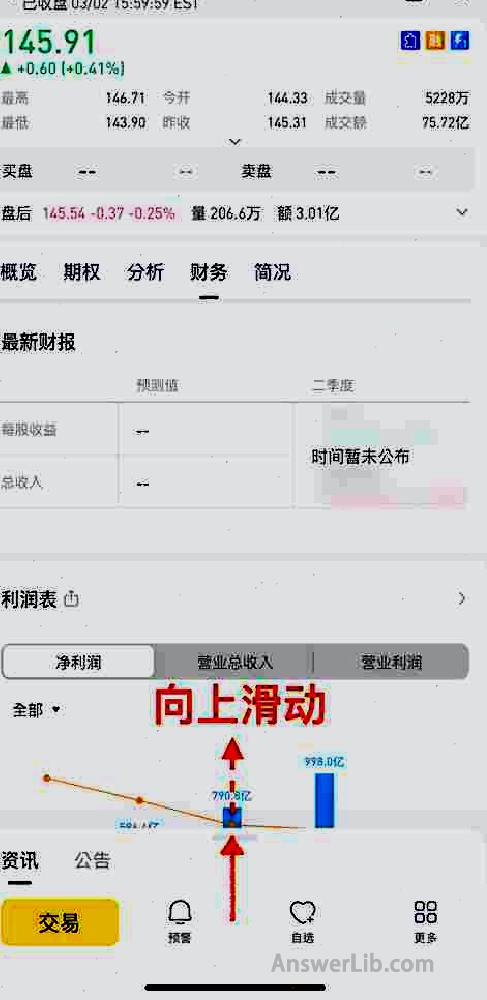

Click the menu option [Finance], you can check it Profits As well as Balance sheet, as well as Cash flow sheet Related financial data, and important property indicators calculated by these financial data.

The following is to obtain important financial data from the profit sheet:

You can also check the profit per share, US stock net assets, flow ratio, speed ratio, net asset yield, asset return rate, gross profit margin, net profit rate value, click the arrow below belowThe data.

Regarding the company’s assets and liabilities, you can find it in the Tradeup App, as shown below:

In addition to the financial information of the profit statement and the balance sheet, you can still view the relevant information of the cash gauge.

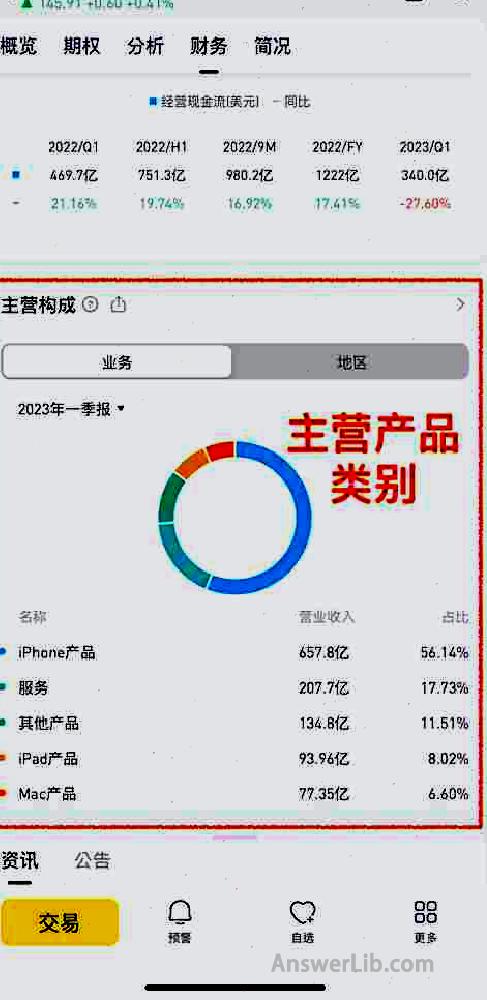

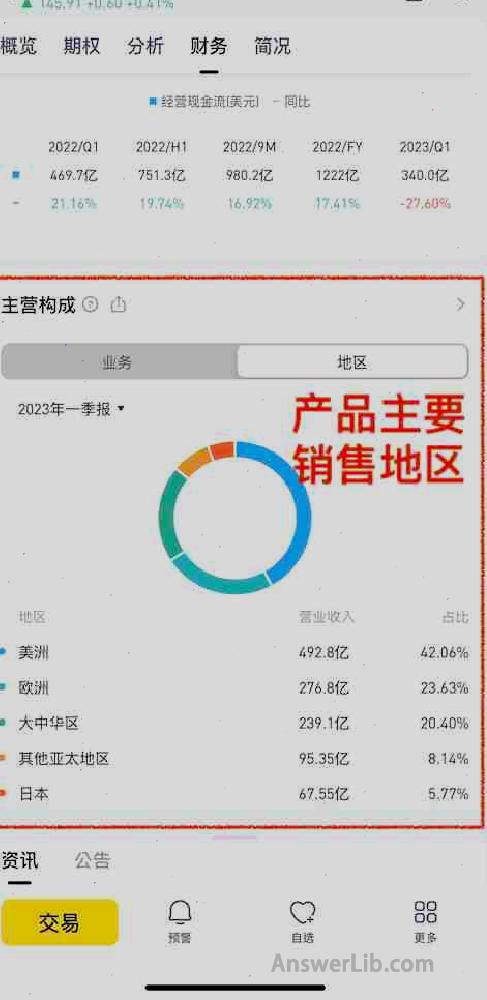

At the same time, under the [Finance] option, you can quickly view the company’s main products and the main sales area of the product.

Finally, you can view related news with listed companies to understand the development trends of the company and the industry.At the same time, you can track the latest moves of other investors.

What are the differences between fundamental analysis and technical analysis?

Fundamental analysis(( FundamentalAnalysis) and technical analysis(( TechnicalAnalysis) It is a method for investment analysis, but their analysis objects and analysis methods are different.The specific differences and connections are as follows:

- Different analysis objects: Fundamental analysis is mainly concerned about the company’s financial and operating conditions, industry and macroeconomic factors, etc., to evaluate the company’s inherent value and investment potential; while technical analysis is mainly concerned about market price and transaction volume, etc.The trend of technical indicators has changed to study market behavior.

- Different analysis methods: Fundamental analysis mainly uses financial statements analysis, macroeconomic analysis, industry analysis and other methods to evaluate the company’s inherent value and future development potential; while technical analysis mainly uses chart analysis of stock prices and transaction volume, thereby looking for searchingPrice trends and predictive price trends.

- Different analysis time: Fundamental analysis is usually a long-term, future-oriented analysis method, focusing on analyzing the company’s financial status and future development potential; and technical analysis is usually a short-term, analytical method for the current market, focusing on the price trend and the market’s price trend and the market trend andtrend.

Fundamental analysis and technical analysis have a complementary relationship in investment analysis.Fundamental analysis can help investors evaluate the inherent value and future development potential of the company, and technical analysis can help investors better grasp the market price trend and the timing of buying and selling.Therefore, in actual investment, investors can formulate more comprehensive investment strategies in combination with fundamental analysis and technical analysis.

| Fundamental analysis Fundamental Analysis | Technical analysis Technical Analysis | |

|---|---|---|

Analysis content | Micro company data to macroeconomic environment | The company’s trend chart in the short term |

purpose of usage | By analyzing various factors that may affect the development of the company to judge the company’s investment value, and help judge the timing of investment | Analyze the trend of stock prices through short-term charts and judge the timing of investment |

Influencing factors of the assessment results | Various objective factors including company operation and national economic environment | Mainly driven by market investment psychology |

Suitable | Long-term investors and short-term investors apply | More suitable for short-term investors. |

More investment strategies

TradeUP certificate account opening

More investment foundation

- What is a necessary return?Required Rate of Return

- What is the American Commodity Futures Trading Commission?CFTC

- What is a credit default? Credit Default Swaps

- What is “oil dollar”?Petrodollar

- What is technical analysis?Technical Analysis

- What is fundamental analysis?Fundamental Analysis

- What is short transaction?Short Selling

- Year-on -year VS?MOM, QOQ, YOOY

- How to query financial institutions to hold positions? FORM 13F

- What is mortgage support bond?Mortgage-back security