Roth IRA is a personal retirement account and a After-Tax account.When you deposit the principal every year, you need to pay the tax rate (after-earning the tax rate).There is no need to pay taxes on gold and income.

How to open the Roth IRA account?

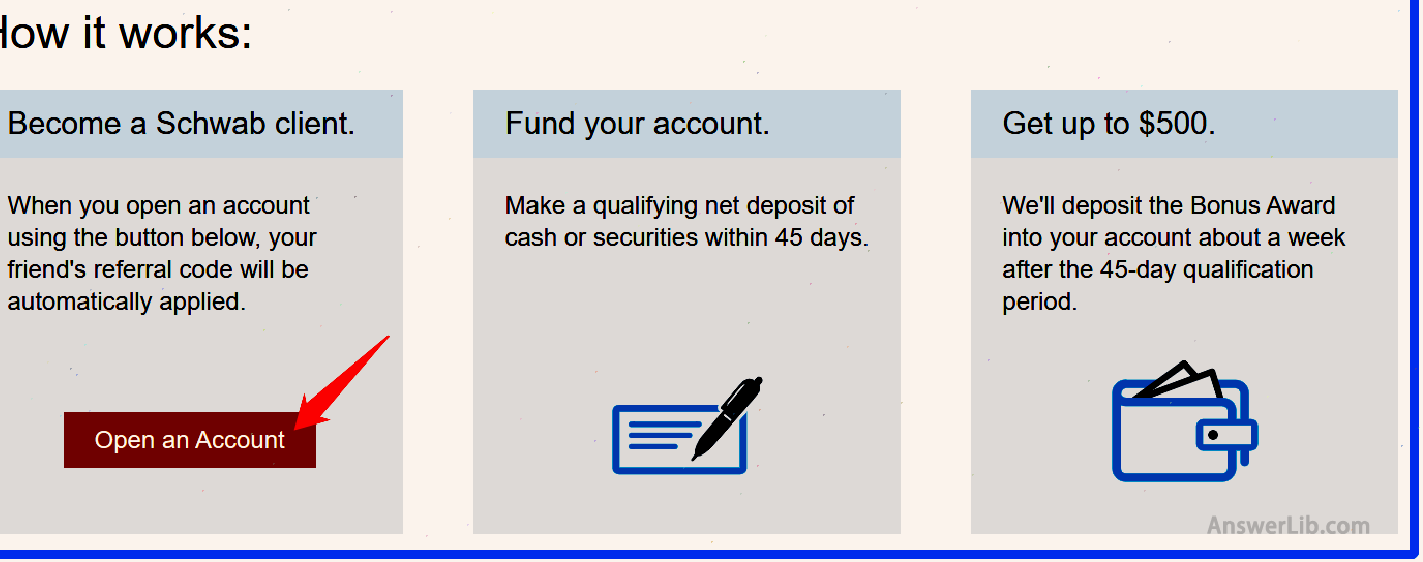

- Click the account opening link to enter the Charles Schwab, and you have the opportunity to get the maximum $ 500 account for opening the account

Open the link: Charles SCHWAB

After opening the account reward is related to your account, the amount deposit is related to the amount.If you deposit 1,000 US dollars, you can get a reward of $ 100;

hint: Use Account opening link While applying for an account opening reward, Charles Schwab will also give us a certain recommendation reward. - Click “Open An Account” to start applying for an account

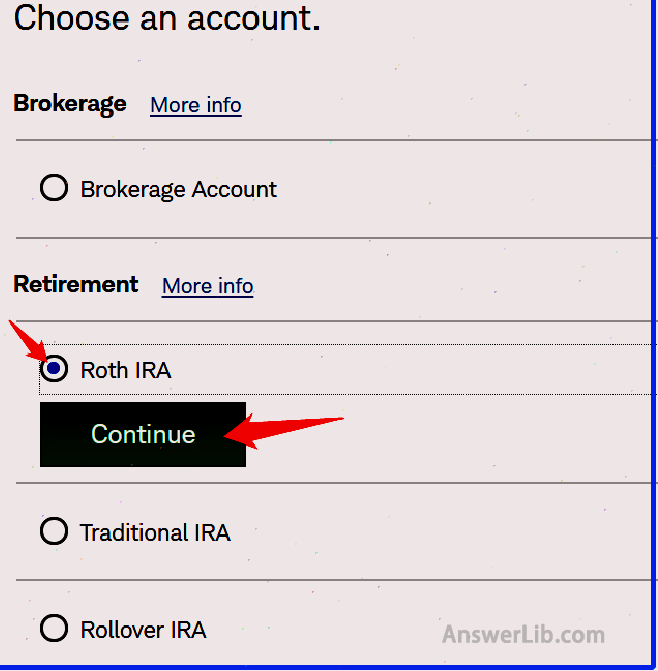

- Select the type of account that needs to be opened.Here

In Charles Schwab, a variety of investment accounts can be opened, such as securities firms, traditional Ira, Roth Ira, Rollover Ira (similar to traditional Ira).Please click “Roth Ira” here, and then click the button “Continue”.

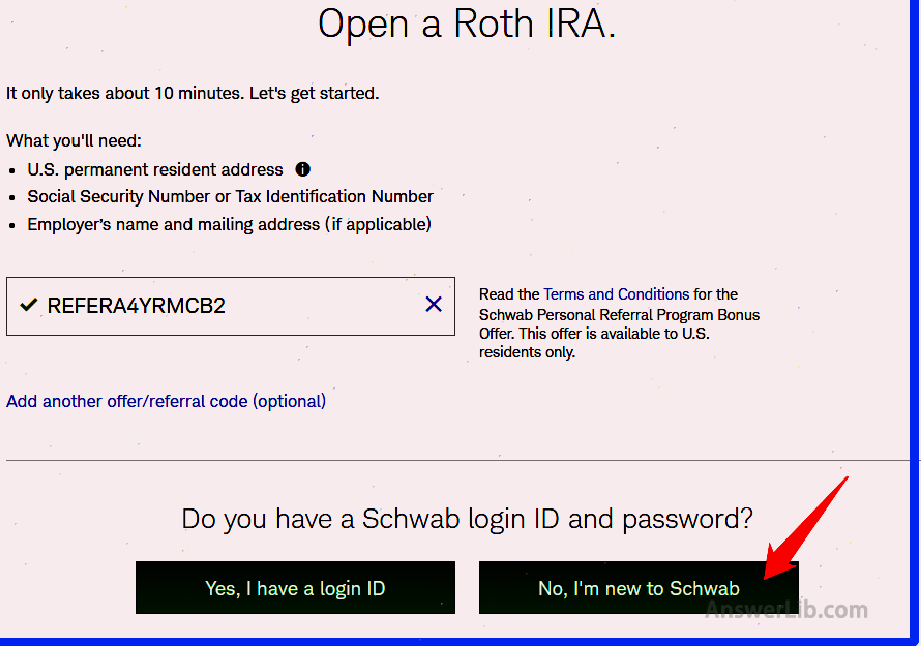

- Check the materials you need to prepare.For new users, click the button “NO, I’ m New To SCHWAB “

To open a Roth IRA account, you need to prepare the following materials:

-Mye-live address;

-S social security number or tax return number;

-E employer name and mailing address (optional);

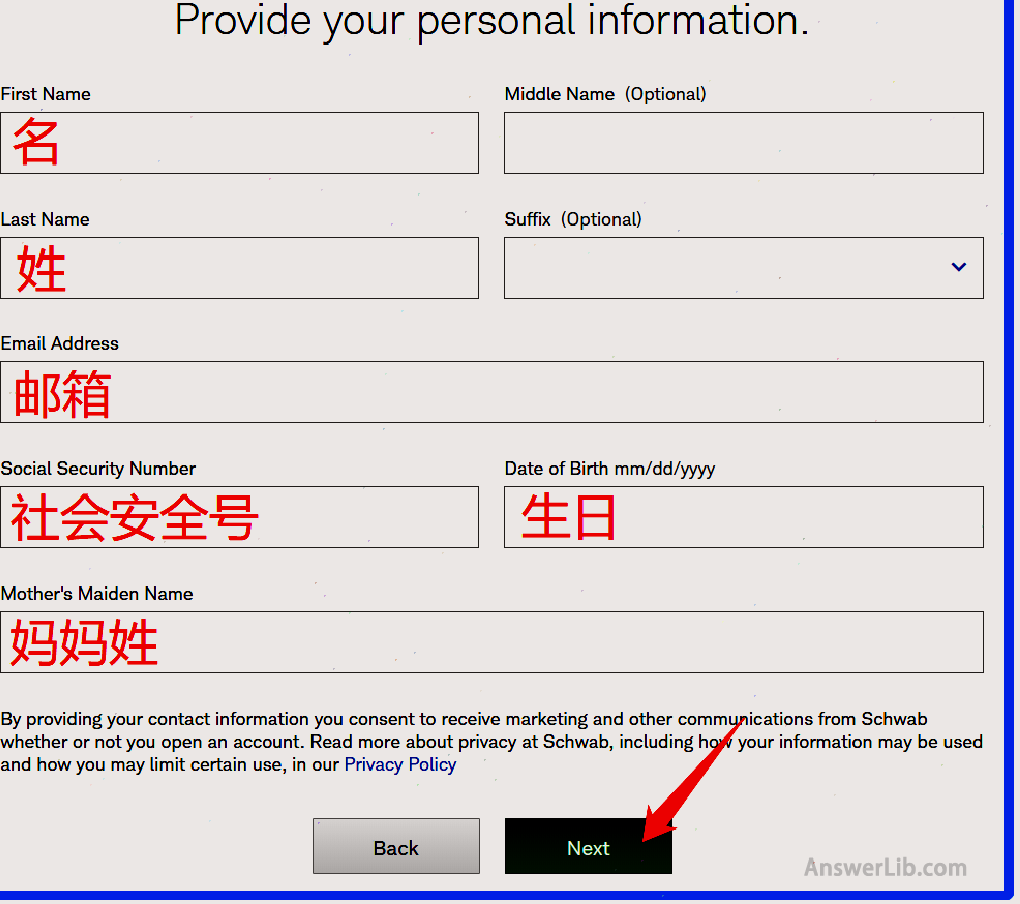

- Fill in personal information and click the button “Next” at the bottom

- Set the login name and login password

After completion, click the bottom button “Next” to enter the next step:

- Fill in the U.S.address

After filling in, click the bottom button “Next”:

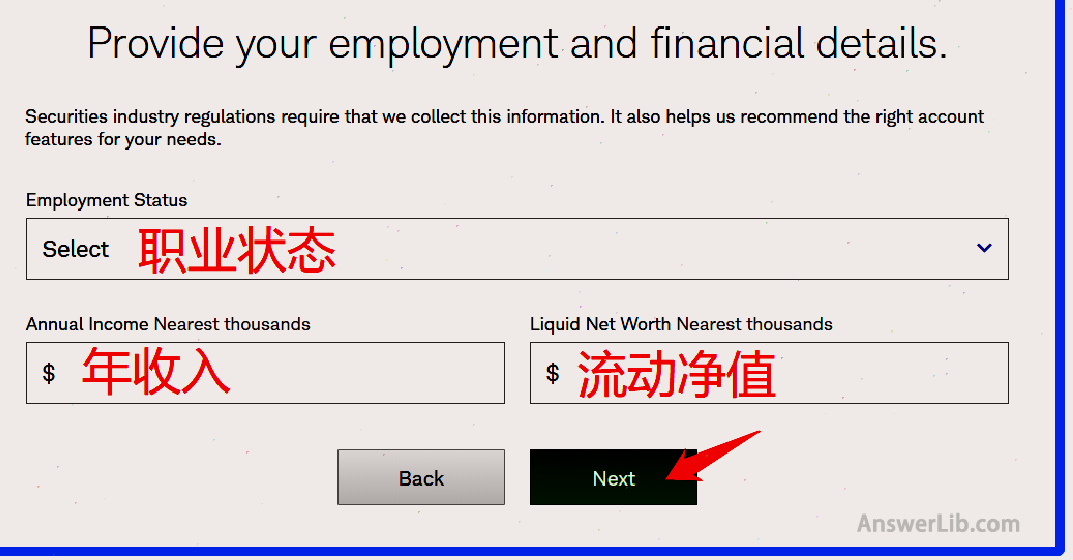

- Fill in employer information

Fill in the working status and annual income.After completing the filling, click the bottom button “Next”:

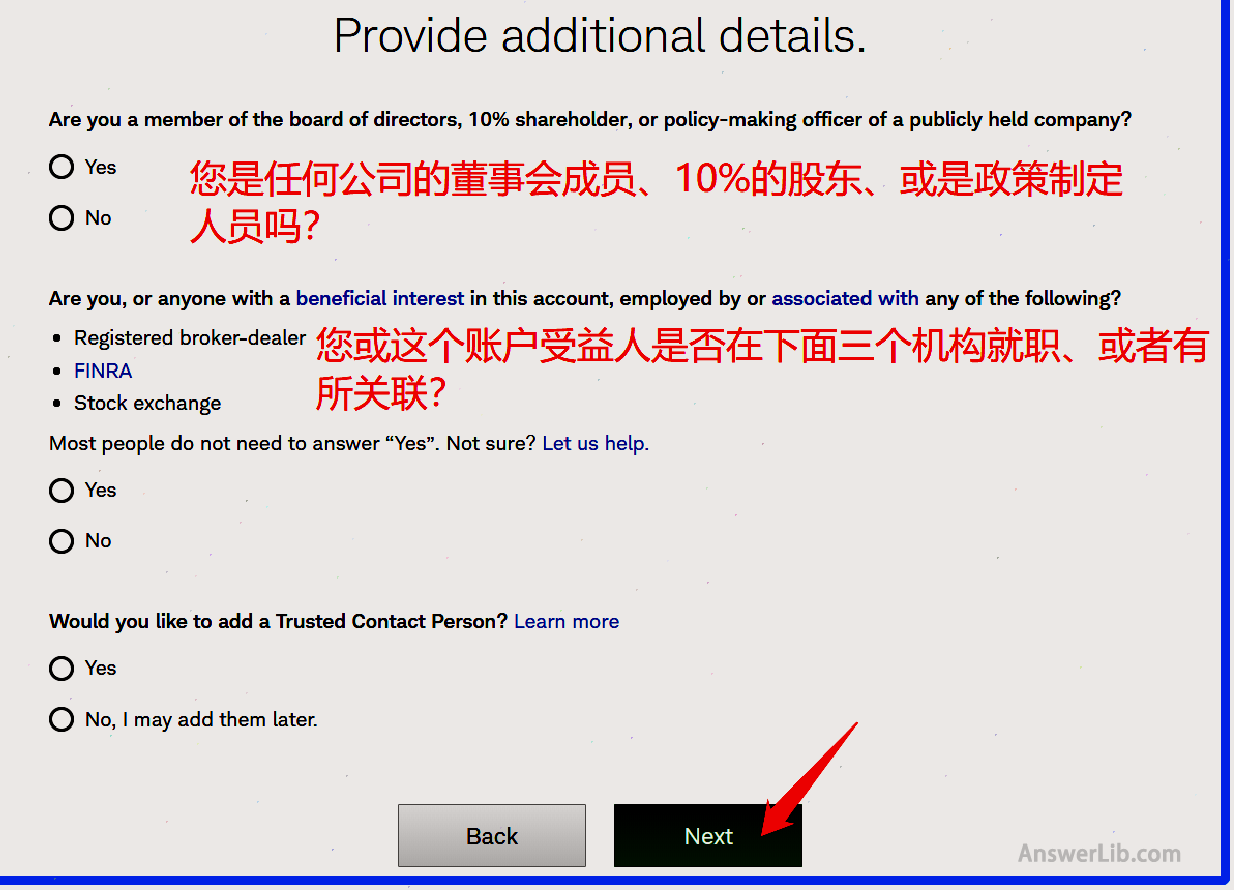

- Need to fill in more information

Fill in according to personal situation.After selecting, click the bottom button “Next”:

- Select some characteristics of the account

“Acount Feature” refers to some of the characteristics of the account, which can be selected for the time being, and selects the four under the “Paperless Features”, so that all transactions, accounts, and tax reporting information can be sent through the network.

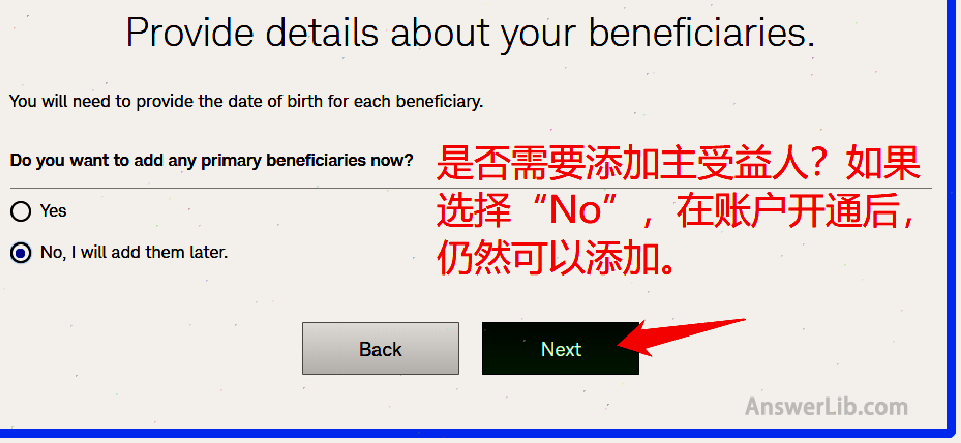

- Provide beneficiary information

Add the information of the first beneficiary, or the second beneficiary, including the date of birth.If you choose “NO”, you can add it after opening an account.In order to be simple here, we choose “No, I will add them later.”

- Ask if you agree with the corresponding terms:

Please read it carefully, each one, and make the corresponding choice:

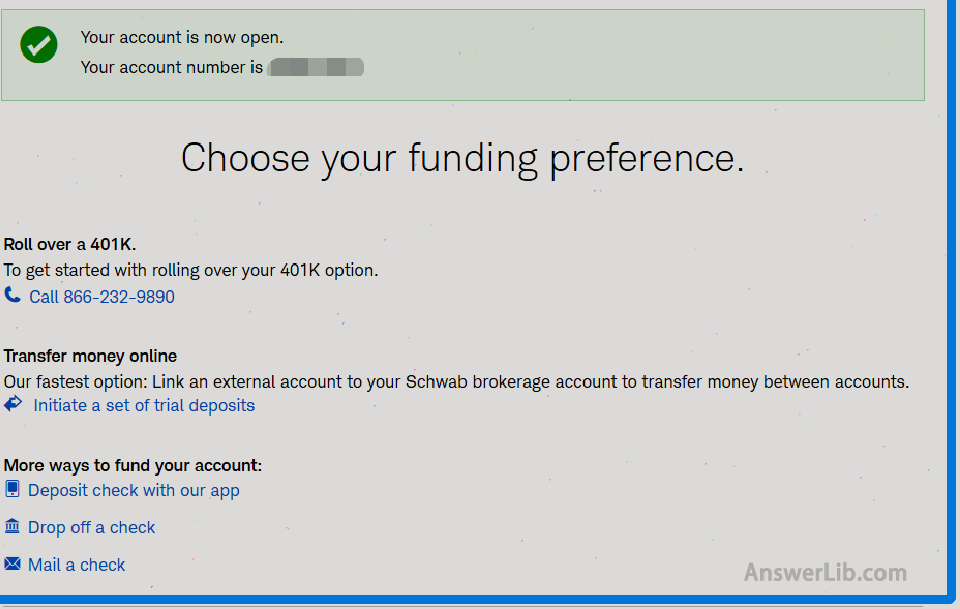

- Congratulations, in less than 10 minutes, the Roth IRA account was created

- What do you do next?

You can deposit funds in the Roth IRA account, mainly in the following methods:

A.You can rolover to this account with the amount of 401K such as the 401K account provided by the employer.Note that because 401K is a Pre-Tax account and Roth Ira is the After-Tax account, while transferring funds, you need to prepare additional fees to pay the income tax for this transfer amount;

B.Connect your bank account and transfer bank funds to the Roth IRA account;

C.Use a check to transfer to funds;

Reader benefits

Subscribe to the American Life Guide and follow the exclusive Raiders article

More about IRA

We have written a detailed Roth IRA account recommendation and comparison.If you want to understand the differences and characteristics of different Roth Ira accounts, you can read the article ” Roth Ira account Recommended: Which Roth Ira is good?”

There is also a personal retirement account similar to Roth Ira, called traditional IRA accounts.This traditional IRA account is a retirement account of After-Tax.In simple terms, it is every year.When you save money, you do n’t need to pay taxes;All need to pay taxes at that time.

If you want to know more about traditional IRA, and the differences and connections between traditional IRA and Roth IRA, please read the article “Traditional Ira account Recommended: Which IRA is better?” Essence

Extended reading

If you want to know some channels and methods investing in the United States, please check the article we write “What is the best investment in the United States: Investment risks and benefits”