Return on Assets, English is Return On ASSETS, referred to as ROA, also known as “asset return”.It is the ratio that the company’s net profit is compared with total assets.Value, often with ROE As well as ROIC Evaluate the combination.In general, the higher the ROA, the stronger the company’s ability to use assets to create profits.

Compared with several other financial data such as ROE and ROIC, asset yields refer to more comprehensive corporate assets, including assets from liabilities.ThereforeThe calculation method is relatively simple.Usually, the company’s net profit and total assets are sufficient.Both data can be obtained directly in the company’s financial statements, or you can directly obtain the data analysis icon of ROA through the financial website.For investors, what are the specific use of ROA?How to use ROA to evaluate the company?What is the difference between ROA and other financial data?

Bleak American broker:Transparent securities| | Futu Securities| | Microex Securities| | Tiger securities| | First securities| | Robinhood in| | American Langshang Daquan

Directory of this article

- How to calculate the asset yield?

- ROA calculation instance “Taking 10-K as an example”

- Another method of calculating RoA

- Buffett’s view of ROA?

- How to evaluate companies with asset yields?

- What kind of asset yield is good?

- How to check the ROA of a listed company?

- ROA in different industries?

- What are the differences and connections between ROA and ROIC?

- What are the differences and connections between ROA and ROE?

- Join investment discussion group

- More investment strategies

How to calculate the asset yield?

ROA is a common financial analysis value.It is mainly used to measure the efficiency of the company’s assets to generate profits, which is the company’s profitability.The company’s internal managers, the company’s external analysts, and investors will evaluate the company’s financial status of the company at a certain time period or time point through the ROA value.

The calculation method of ROA is that the company’s net profit is divided by the percentage value of total assets.The calculation formula is as follows:

ROA = Net Income / Total Assets

Asset yield = net profit / total asset

in:

Net Income is the company’s total income deduction of operating costs and loss fees in a certain period of time, that is, Net Income = (Revenue + GAINS) – (Expenses + Losses) can be in Company profit statement(Income Statement) Find a net profit value.

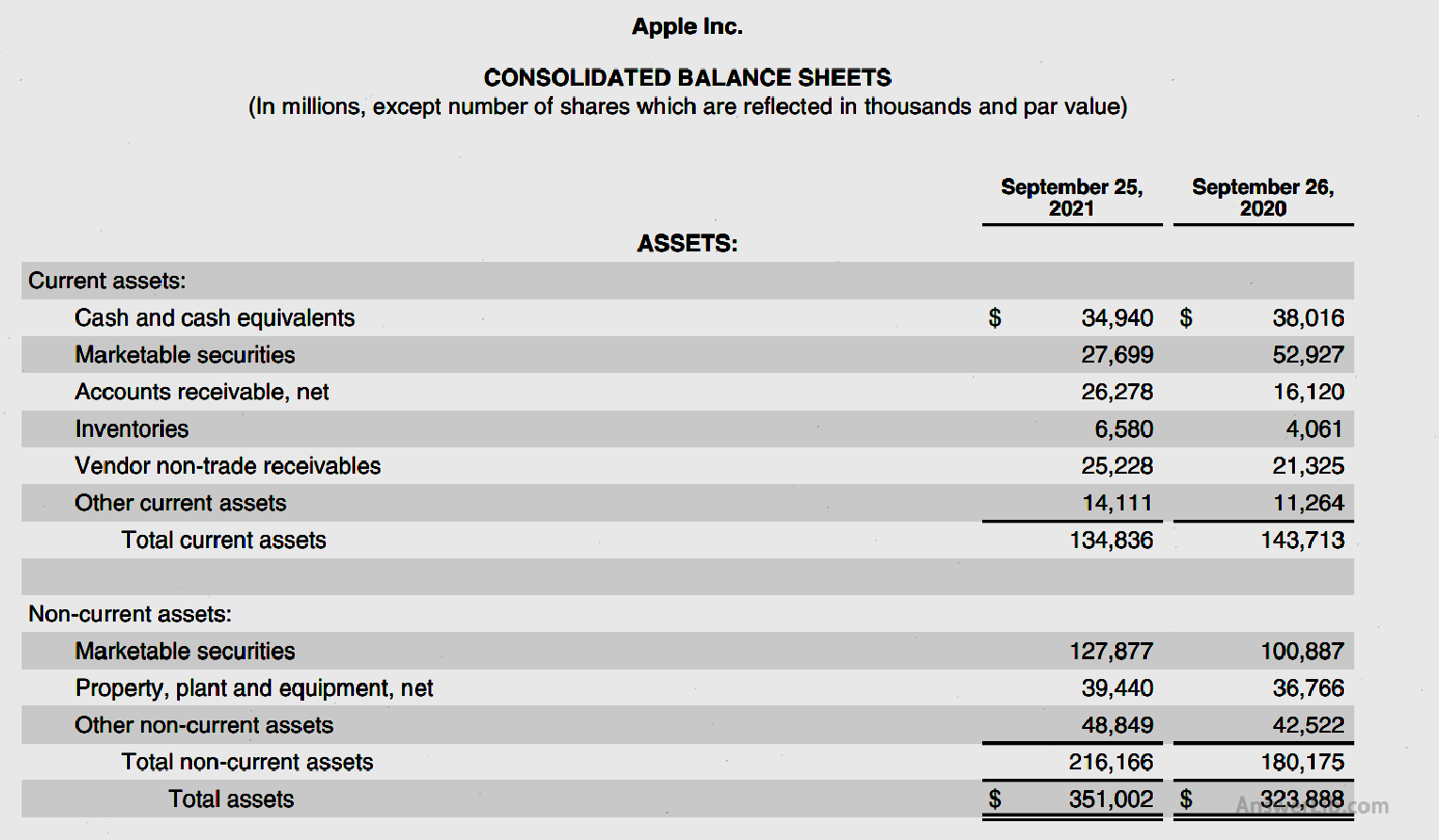

Total Assets is the assets held by the company at the end of the year at the end of the financial year, including the assets of the company at the end of the financial year, including the current assets and the non-current assets, that is, Total Assets= Current Assets + Non-Current Assets, which can be in the company’s Balance sheet Find the total asset value in Balance Sheet.

When calculating ROA, usually use the total asset value in the asset liabilities at the end of the year, but some analysts or investors will use the average total assets to calculate the ROA value.The average value of total assets at the end of the year can consider the company’s assets with changes in time over time.Relatively speaking, the company’s overall performance in that year can be fully and accurately reflect.

Average Assets = (Ending Assets + Beginning Assets) / 2

ROA = Net Income / Average Assets

For example, as follows:

Company A’s total assets at the beginning of 2021 (or at the end of 2020) were $ 30,000,000, and the total assets at the end of 2021 were $ 34,000,000.In 2021, the net profit of Company A was $ 2,500,000.Then the ROA of Company A in 2021 is:

Total assets at the end of the year:

ROA = $ 2,500,000 / $ 34,000,000 x 100% = 7.35%

Use average total assets:

AVERAGE Assets = ($ 34,000,000 + $ 30,000) / 2 = $ 32,000,000

ROA = $ 2,500,000 / $ 32,000,000 x 100% = 7.81%

ROA calculation instance “Taking 10-K as an example”

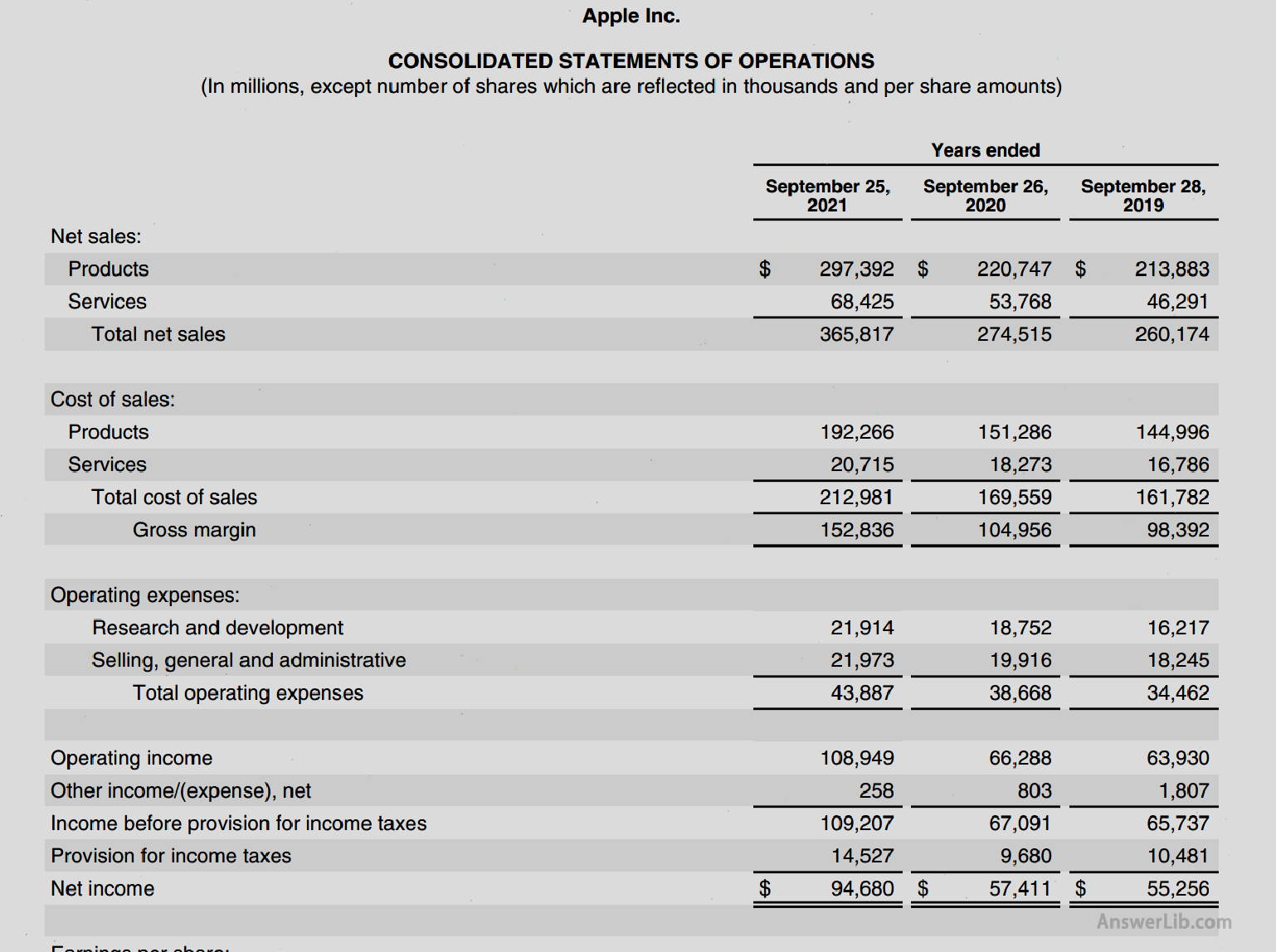

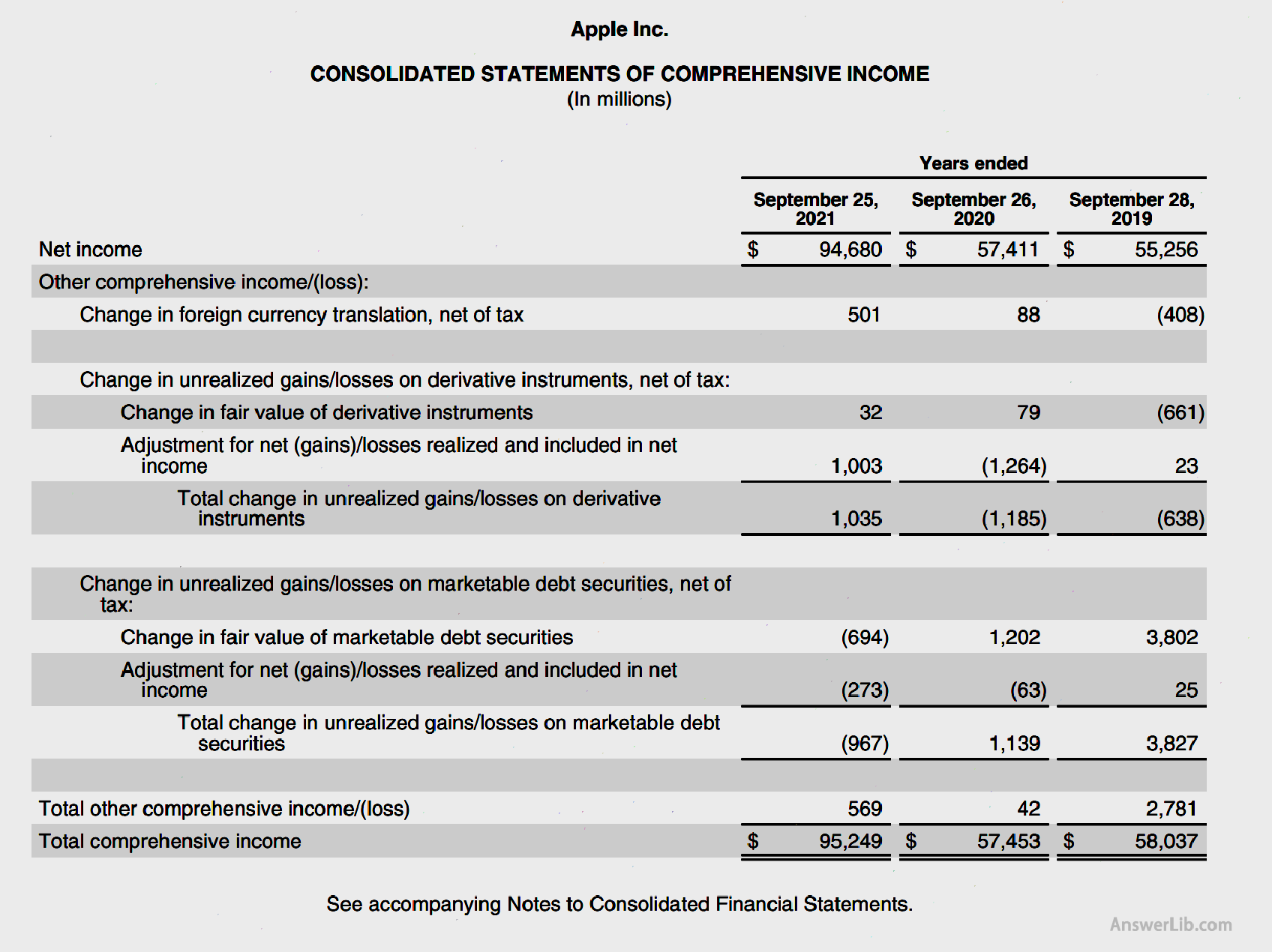

Taking the financial statements released by Apple in September 2021 as an example, two ROA calculations are calculated:

- ROA at the end of 2021

- The average ROA of the whole year of 2021

It can be seen from the data table that Apple’s 2021 financial year-end income net income is $ 94,680 m, the total asset Total Assets at the beginning of the year is $ 323,888 m, and the total asset Total Assets at the end of the year is $ 351,002 m.

ROA at the end of 2021:

ROA = (Net Income / Total Assets) x 100%

= ($ 94,680 m / $ 351.002 m) x 100%

= 26.97%

Average ROA in 2021:

Average Assets = (Ending Assets + Beginning Assets) / 2

= ($ 351002 m + $ 323,888 m) / 2

= $ 337,445 m

ROA = (Net Income / Average Assets) x 100%

= ($ 94,680 m / $ 337,445 m) x 100%

= 28.06%

Another method of calculating RoA

Another ROA calculation method is to calculate ROA using the company’s net profit margin (Net Profit Margin) and Asset Turnover:

Asset return rate | = Net profit margin X asset turnover rate (Asset Turnover) |

Asset return rate | = (Net income/total income) x (total income/average total asset) |

ROA | = (Net Income/Total Revenue) X (Total Revenue/Average Total Assets) |

ROA | = Net Profit Margin x ASSET TURNOVOVER |

Among them, net income and income can be found in the company’s 10-K form, total revenue and average total assets can be found in the company’s asset-liability statement and gains and losses.

In this calculation process, investors can more intuitively judge the company’s development strategy through the proportion of the two multiplications in the calculation process.Is it a low profit and high output type or a high-profit and low output type.If the proportion of profit margins is low, the company is a company with a low profit and high output type, otherwise it is a company with high profit and low-output type.

Also based on the above-mentioned Apple’s financial statements as an example, the Net Income is $ 94,680 m, Total Revenue is $ 95,249 m, and the average total asset Total Assets is $ 351,002 m.

Asset return rate (ROA) | = (Net Income/Total Revenue) X (Total Revenue/Average Total Assets) |

= ($ 94,680 m / $ 95,249 m) x ($ 95,249 m / $ 351,002 m) | |

= 0.9940 x 0.2713 | |

= 0.2697 = 26.97% |

Buffett’s view of ROA?

Buffett said in an interview in the past that an excellent company can get returns from tangible assets, and the return can maintain growth, that is, the company’s ROA value can grow steadily.

For companies that have not increased, small investment can become a good investment, but if there are too many investment, it may turn good investment into bad investment, and appropriate investment can also become a good investment.

However, ROA is not suitable for all industries, such as car dealers, their tangible assets are very small, but the benefits are very high, but the higher ROA value does not indicate that car dealers perform well.

Similarly, the banking industry has similar situations.It is declining, but this does not affect the banking industry to become a good investment object.

How to evaluate companies with asset yields?

When using the ROA value to evaluate a company, the higher the value of the ROA, indicating that the higher the company’s ability to use assets to generate profits, or the company can earn more profits with less assets.

Under normal circumstances, the ROA value of a company increased over time, indicating that the company’s operating mode is correct, in a healthy positive development orbit.Assets, they only earn limited profits, or the company’s operations have made mistakes or troubles.

For more company ROA values, more financial indicators need to be carried out, because different companies in different fields, or in the same field, will have a large ROA valuedifference.

Another use of the ROA value is to judge the asset density of an enterprise:

In conventional development, if the company’s ROA value is low, the higher the asset density of the company, such as airlines.

If the company’s ROA value is high, it means that the company’s asset density is low, such as software companies.

Generally speaking, companies with a conventional ROA of less than 5%are called asset-intensive companies, while companies with conventional ROA higher than 20%are called light asset companies.

What kind of asset yield is good?

Overall, the ROA value is more than 5%, which will be considered a good asset yield, and 20%and above are considered an excellent asset yield.

However, when specific industries are specific, this value will be relatively large.For example, for companies that require a large amount of assets such as manufacturing, 6%of ROA values may be good asset yields, and for the demand for light assets, the demand for light assets may beEnterprises, such as software companies, require up to 15%of the ROA value to be considered a good asset yield.

How to check the ROA of a listed company?

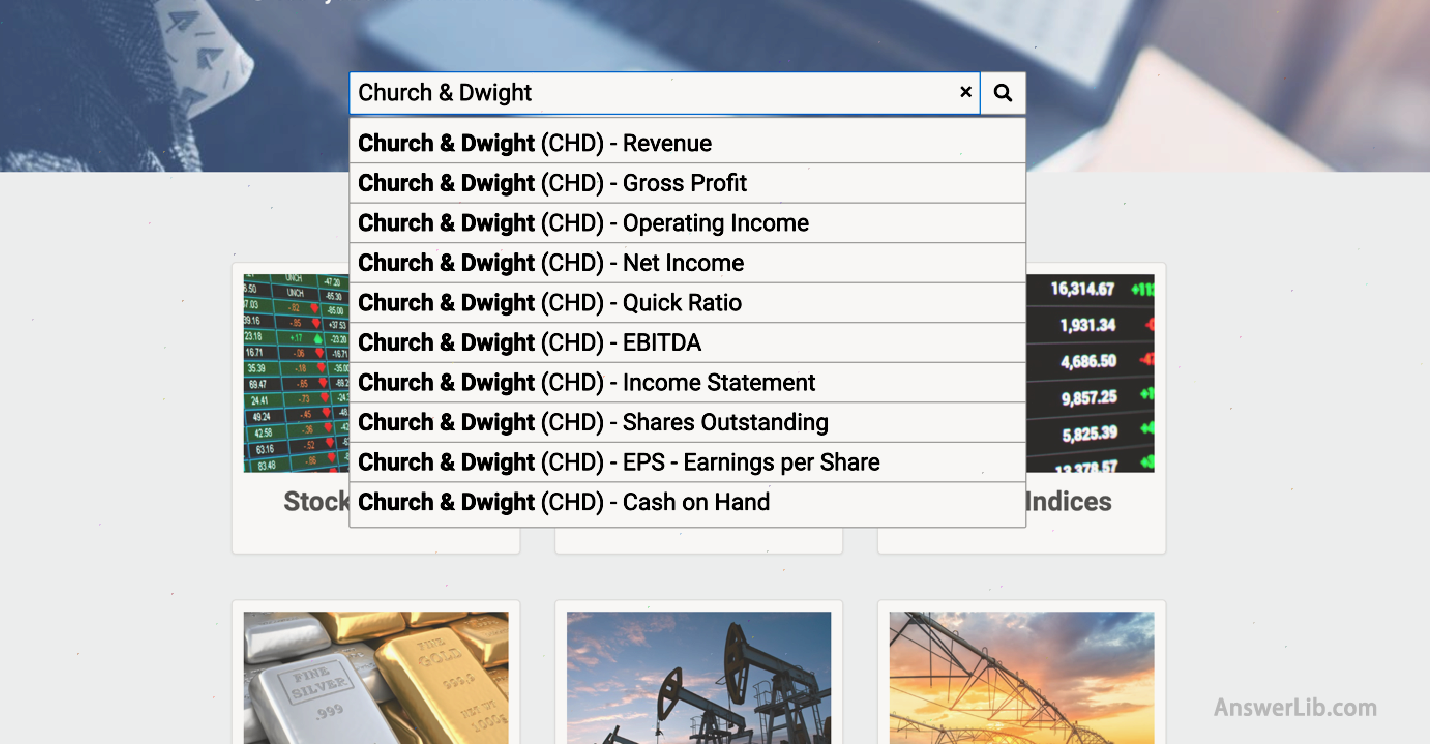

When you need to check the ROA value of a company, you can find it in the financial statement sector on the company’s portal website.You can also search for the ROA value of different companies on some economic analysis websites.For example, this website is used as an example:

step one: login macrotrends.net

Step 2: Enter the target company in the search box on the homepage.

After entering the company name, you will jump out of multiple categories of data options.Select one to enter the company’s financial data general column:

Step 3: Click “Others Ratios” in the menu bar, click “ROA” in the sub-menu bar, and you can view the company’s latest ROA value and historical ROA value icon below the page, which is very simple.

ROA in different industries?

The following is the asset return rate ranking of different industries as of the first quarter of 2022:

| ranking | industry | industry ROA Average |

|---|---|---|

1 | Non-necessary consumer product Consumer Discretionary | 13.24 % |

2 | Capital Goods Capital Goods | 10.86 % |

3 | Technology Technology | 9.21 % |

4 | Non-periodic consumption Consumer Non Cyclider | 8.98 % |

5 | Conglomrates of Enterprise Group | 8.85 % |

6 | Retail Retail | 8.17 % |

7 | Health Health HealthCare | 7.98 % |

8 | Basic Materials | 5.42 % |

9 | Financial Financial | 4.93 % |

10 | Transport Transportation | 4.12 % |

11 | Energy Energy | 3.81 % |

12 | Services | 3.81 % |

13 | Utilities | 1.17 % |

It can be seen from the table:

Non-consumer goods industries, such as McDonald’s, Nike, etc., because of their high profits, the ROA value is higher;

And the retail industry, such as Amazon, Wal -Mart, although there are also high profits, but at the same time require higher capital allocation, so the ROA value is relatively medium;

The transportation industry, energy industry such as Mobil, Chevrolet, etc., as well as the service industry, due to low profits and high capital allocation, the ROA value is generally low.

What are the differences and connections between ROA and ROIC?

| Asset yield ROA | Investment capital return rate root | |

|---|---|---|

Calculation formula | Net income / total assets | After-tax business profit /(total debt + equity + other long-term fund sources) |

| English formula | Net Income / Total Assets x 100% | Net Operation Profit After Taxes / (Total Debt + Equity + Other Long-Term Funding Sources) |

The main purpose | Evaluate the ability of enterprises to make profits by using all their assets | After evaluating the ability of enterprises to use investor funds for operation, the ability to bring income to investors |

Indicator characteristics | It is more evaluated for companies that rely on liability assets to make profits. | Compared to ROA, it is more comprehensive, considering all assets including debt and investment |

Scope of application/limit | It is not suitable for companies that have a large amount of excess cash or assets to be sold, because the calculation results are deviated with the actual company’s profitability. | Companies that can be used to compare different asset structures |

Reading in-depth:What is investment capital return?

What are the differences and connections between ROA and ROE?

ROE, Return on Equity, Burgal return rate, Also known as the “net asset yield”, which is the financial data obtained by the company’s net profit compared with shareholders’ rights and interests in a certain period of time.

ROE and ROA are the same as one of the important company’s financial data.It also reflects the company’s ability to make profits.At the same time, there is the same limitations when using it., And unable to conduct cross-industry comparisons.

In terms of numerical values, because ROE only uses the shareholders investment in the company’s assets, and the same net profit as ROA uses the same net profit, for the same period of the same company, ROE will always be greater than ROA.

The main difference from ROA is that ROE measures the ability of the company to make profit using shareholders’ investment, rather than the ability to earn profits through all assets, including debt, so ROA can consider a company more comprehensively compared with ROEThe relationship between profit and debt can be seen to see the proportion of debt in the company’s assets.If the ROE value is too different from the ROA value, it means that the company’s assets are relatively large.

When evaluating a company, analysts or investors will use ROE to intuitively evaluate the company’s ability to transform shareholders’ investment into profits.At the same time, the ROA value will also be referred to as supplementary references to evaluate the company’s comprehensive profit conversion ability.