Necessary rate, Also known as, Target yield, English is RequiredRateOFReturn, Abbreviation RRR It means that investors expect to get from investment Minimum return rate Essence

Usually percentage Express, It is an important factor in evaluating whether investment is worthy Investors usually compare possible investment with their necessary yields.If the expected return of investment is higher or equal to the necessary return, investment may be a good choice.

For example, if investors believe that the minimum return rate (necessary yield rate) of investment should be 10% Then, this investor will use this 10% to evaluate an investment rate.

If the return rate of an investment is less than 10%, investors will not consider this investment.

The high and low of the necessary rate of return also means the high or low investment risk.The higher the necessary rate of return.Although the return on return is high, the higher the risk it is at the same time.On the contraryEssence

It should be noted that the necessary returns have not considered the impact of investment duration on returns.For example, if the investment cannot be rewarded for many years, the investment risk will increase, but this will not be reflected in the necessary return.Risk is also unable to reflect in the necessary rate of return.

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- How to calculate the necessary return?

- How to calculate Apple’s necessary return?

- What is the significance of investment guidance for the necessary return?

- What are the limitations of the necessary rate of return?

- More investment foundation

How to calculate the necessary return?

Calculate the necessary rate of return, which can usually be used Capital asset pricing model(( Capital Asset Pricing Model, Abbreviation Capm.

For the company, it Weighted average capital cost(( Weight Average Cost of Capital, Abbreviation WACC) To some extent, it can be regarded as a necessary return on the company’s evaluation of any investment.

1.Use capital cost pricing model (CAPM) calculation

The calculation method of CAPM is to add the zero risk income from the investment and the risk premium, which can be expressed as:

Necessary yield = risk-free interest rate + β x (market yield-no risk interest rate)

in:

- RE Besides Necessary rate, Refers to the return of investors’ expectations of stocks;

- RF Besides Risk-free interest rate(( RISK-Free Rate), The risk-free interest rate is usually matched with the national debt rate of the country where the investment is located.The bond term should also correspond to the time limit of the investment, but in the field of investment, it is usually used default Ten-year Treasury Bond interest rate As a zero-risk interest rate, ten years of government bonds are usually the highest quoted and the best liquidity.In the United States, it is also used as a ten-year national bond interest rate to take it as Risk-free interest rate Essence

- β: BETA coefficient is a coefficient that measures the entire market risk, that is, the system risk factor of the stock market relative to the entire stock market.Stocks with β coefficients greater than 1 are more risky than the entire market, while those less than 1 are relatively low.From the β coefficient, it can also be seen that the investor’s expected return on the stock, the higher the β value, indicating that the higher the expected return on the stock.Beta coefficients can be obtained from financial websites such as Baron Weekly, and can also be calculated by returning and analyzing stock income and market income.

- Rm Besides Market expected return rate(( Return of the Market), In the US investment market, the historical average return rate or expected return of Standard Pur 500 is usually used as market expectations.According to the historical return rate of the S & P 500, its average return rate floats up and down 10%, so 10%are usually selected as market expectations.

- Rm– RFCure Besides Risk premium(( MarketRiskPremium), Refers to the additional return of investors in other than risk interest rates, which is an additional return when compensating investors to invest in risk products.The greater the fluctuation of the stock, the higher the investment risk, the higher the return rate of investors, and the higher the risk premium.

2.Use weighted average capital costs (WACC)

Weighted average capital cost (WACC) It is a financial indicator of the company, which reflects the cost of paying the company’s payment (including equity and creditor’s rights).

WACC is a weighted average of the expected return of all sources of capital (including stocks, debt, preferred shares, etc.).

The company’s WACC can be regarded as a necessary return on investors to some extent.

In other words, if the expected return of a company’s investment project is lower than the company’s WACC, this indicates that the project cannot generate enough returns to cover the cost of the company’s capital, which may have a negative impact on the company’s shareholder value.

Therefore, in general, when evaluating investment projects, the company will hope that the expected return on the project is at least higher than WACC.

The company’s weighted average capital cost (WACC) calculation method, please check the article “Calculation Method for the cost of weighted average capital” Essence

how Calculate Apple’s necessary return?

Below, we will use Apple’s relevant data for example calculation.

Use the CAMP model here for calculation.

First of all, we query the yield of US ten-year Treasury bonds 2.8857% (July 2022), so R, R, RF= 2.8857%.

The average return rate of Standard 500 is 10%, so R, Rm=10%

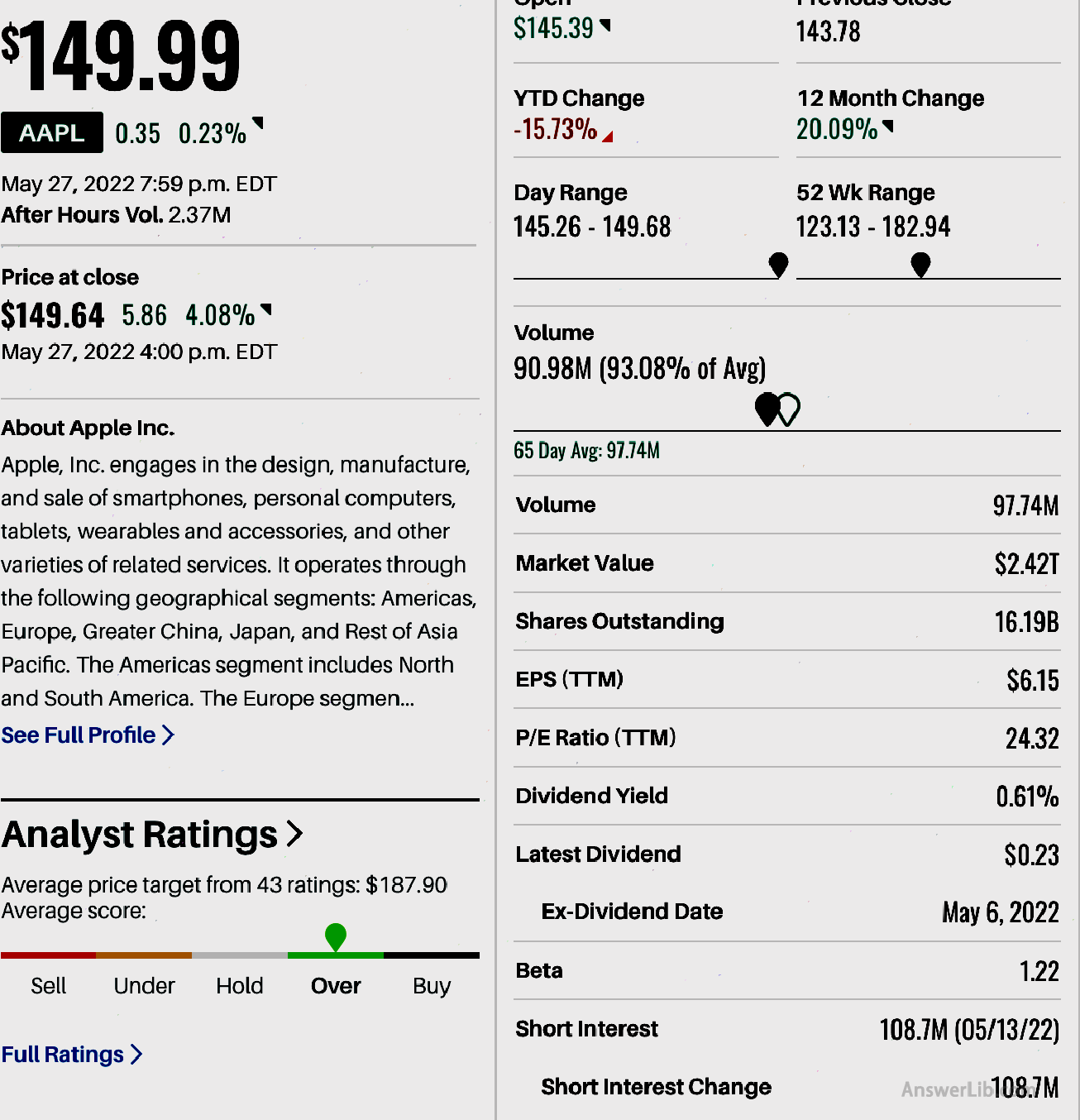

According to the data released by Barrons, as shown in the following, Apple’s current β = 1.22

Therefore, you can calculate the necessary return based on the above parameters:

RE= RF+ β x (Rm– RFCure

= 2.8857% + 1.22 x (10% -2.8857%)

= 11.56%

Therefore, according to capital cost pricing model calculations, Apple’s current CAPM value is 11.56%.

What is the significance of investment guidance for the necessary return?

The necessary rate of return is considered to be the minimum return of investors to invest and acceptable.Investors can compare it with the expected return income of the investment object:

- When the expected return on the investment object is the expected return on return, it shows that the return that the investment can bring does not meet the minimum return value of the investor, and it is likely that it will no longer continue to consider the investment of the object.

- When the necessary yield

Another meaning of the necessary rate of return is to evaluate the degree of risk of investment objects:

- When the necessary income rate is high, it means that the risk of this investment is higher;

- When the necessary income rate is low, the risk of the investment is low.

The necessary yield can also be used for Gordon Growth Model (GGM), also known as the “dividend discount model”.This model considers the inherent value of the stock under the premise that the dividend of the dividend increases at a constant rate is considered.In order to divide the expected annual dividend of dividends per share at the difference between the necessary yield and dividend growth rate, that is,:

Stock value = expected annual dividend per share / (necessary yield-dividend growth rate)

Stock value = anticipated year divisionnds / (RRR -G)

- When the calculation result is higher than the current stock price, it is considered that the current stock price is undervalued, which is suitable for investment;

- When the result is lower than the current stock price, it is considered that the current stock price is overestimated, which is more suitable for watching.

What are the limitations of the necessary rate of return?

The maximum use of the necessary rate of return is limited to the impact of time on value.

If an investment cannot recover the investment cost within many years, the investment risk is essentially increased, but this situation is reflected in the calculation of the necessary yield rate, so investors cannot consider this risk from the calculation.

At the same time, the impact of inflation on assets is not reflected in the calculation of the necessary return.If a high inflation rate occurs during the investment process, it will also directly bring investment risks.

More investment foundation

- What is a necessary return?Required Rate of Return

- What is the American Commodity Futures Trading Commission?CFTC

- What is a credit default? Credit Default Swaps

- What is “oil dollar”?Petrodollar

- What is technical analysis?Technical Analysis

- What is fundamental analysis?Fundamental Analysis

- What is short transaction?Short Selling

- Year-on -year VS?MOM, QOQ, YOOY

- How to query financial institutions to hold positions? FORM 13F

- What is mortgage support bond?Mortgage-back security