US tax reporting: How to use it in detail for you Turbo tax software Fill in the 2022 TAX Year US tax sheet, we have used Turbo Tax to pay taxes for more than 8 years.

The deadline for IRS to process taxes for 2022 is: April 18, 2022 Essence

- This article is not a general introduction to the US tax system

- Instead

- Share some small plug-in to help you predict taxes

⚠️ statement: This article is a summary of the author’s own experience, which may include many understanding of understanding, article do not include If you have any legal effect, if you have any questions, please consult a professional tax personnel or IRS.

Directory of this article

- 2022 U.S.tax reporting several important dates

- What tax do you need to pay?

- Materials required for tax return in the United States

- What are the basic steps of tax returns in the United States?

- What is total income?

- What is adjusted income (AGI)?

- Standard tax reduction or tax reduction one by one?

- How to calculate the tentative tax?

- What are the common tax subsidies?

- Several common tax returns

- Choose tax reporting software

- US tax return steps

- Step 1: Create a Turbo Tax account

- Step 2: Fill in personal and family information

- Step 3: Fill in the federal tax

- Step 4: Fill in the state tax

- Step 5: Review and submit online

- Some thoughts about saving taxes

- references

- common problem

- More American Raiders

2022 U.S.tax reporting several important dates

| Important Date of Taxation in the United States | important content |

|---|---|

| January 14, 2022 | Free tax reporting provided by the State Taxation Bureau |

| January 24, 2022 | IRS taxation starts |

| April 18, 2022 | The Tax Tax Submission Deadline in 2022 |

| October 17, 2022 | The deadline for tax reporting in 2022 |

What tax do you need to pay?

The tax you need to pay include:

- Federal Income Tax (Federal Income Tax): The taxes levied by the US federal government, according to your tax return status and income level, adopt a marginal tax rate system, the higher the income, the higher the tax rate.

- Social Security Tax (Social Security Tax): For the social security system, the tax rate is 12.4%, and the employers and employees pay half, and the self-employed person needs to pay.

- Medical insurance tax (Medicare Tax): For medical insurance projects in the United States, employers and employees pay half, and self-employed people need to pay for full.

- State Income Tax: The taxes levied by the US state, some states, such as Texas, do not levy taxes on income.

Social Security Tax and Medical Insurance Tax (Medical Tax) are two federal taxes for providing funds for Social Security and Medical insurance projects.These two taxes are usually deducted from the salary of employees with Federal Income Tax, called the FICA (Federal Insurance Donation Law) tax.

Federal Income Tax (Federal Income Tax)

Federal income tax, English is FederalINCOMETax It is a tax collection of the US federal government to individual and corporate income, which is used to provide funds for national defense, infrastructure, social welfare projects and other countries.

The United States adopts the marginal tax rate system, and the tax rate is increased step by step with the increase of income.The specific income tax rates and levels of the individual income tax will be different according to the identity of tax returns (such as single, married and common taxation, etc.).

Social Security Tax (Social Security Tax)

Social security tax, English is SocialSecurityTax It is used to provide funds for the American social security system, which provides economic support for retirement, disability and survivors.

For 2022, the tax rate for social security taxes is 12.4% Among them, employees and employers each bear half of each, that is, 6.2% EssenceSocial security tax is only applicable to a certain income limit, and this upper limit will be adjusted according to inflation.In 2022, the upper limit was $ 147,000.

Medical insurance tax (Medicare Tax)

Medical insurance, English is MedicareTax It is used to provide funds for medical insurance projects in the United States.

As of 2022, the tax rate for medical insurance taxes is 2.9% Among them, employees and employers each bear half of each, that is, 1.45% EssenceThere is no income limit for medical insurance taxes, which is suitable for all wages and self-employment income.

Notice: For self-employed people, they need to pay Self-Employment TAX, including all parts of social security tax and medical insurance tax (total 15.3% = 12.4% + 2.9%), because they are both employers and employees and employeesEssenceHowever, self-employed people can deduct half of the self-employment tax when paying taxes to reduce the tax burden.

State Income Tax

State income tax, English is StateINCOMETax It is a tax levied by residents and enterprises in the United States to support the state government’s budget, including infrastructure, education, medical care, transportation and other projects in the state.State income tax is similar to federal income tax, but the tax rate, deduction of projects and credit policy vary from state.It should be noted that not all US states levy state income tax, and some states use other tax methods.

As of 2022, nine states in the United States have not levied state income tax, namely Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyluman, Tennessee and New Hamplon (the latter two only tax on interest and dividend income).These states usually rely on other tax sources, such as sales tax, property tax, etc.to support the state government budget [Source: Source: Turbotax..

Materials required for tax return in the United States

The tax reporting materials you may need:

- W-2: Go to work in the company, or do TA/RA at school, etc.

- 1099-IT table: Interest interest in banks;

- 1099-DIV table: The dividends obtained by buying stocks;

- 1099-B: The profit of selling stocks and securities;

- 1099-MISC table: Rental, self-employed income, etc.;

- 1099-S: S: The income of the sale of the property, etc.;

- 1099-g table: Income from the pension plan;

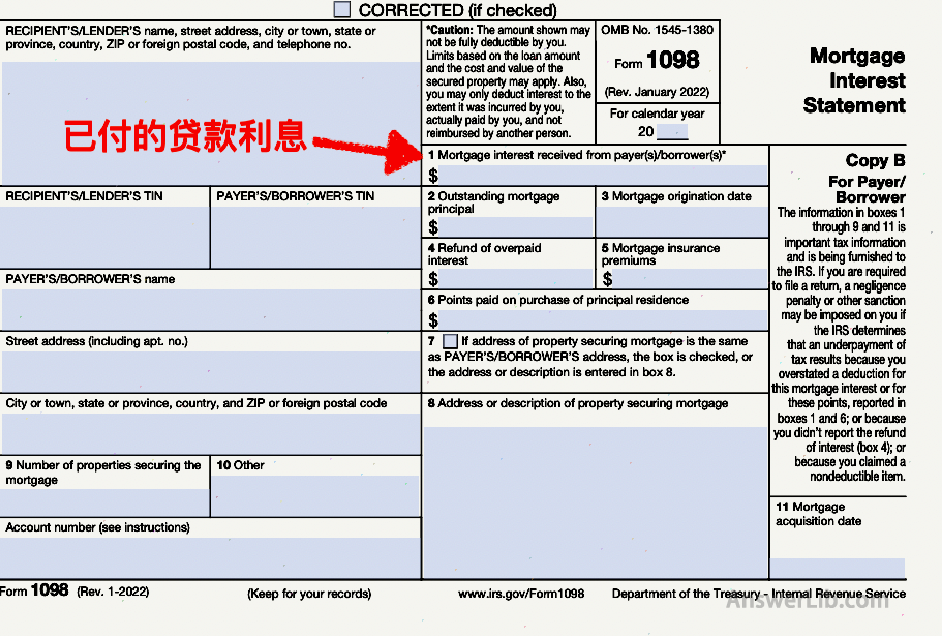

- Top 1098: If you are still paying your house in installments, it shows the loan interest rate and points you paid;

- 1098-E: The child’s loan interest on college;

- 1098-T table: The amount of tuition payment for children to college;

- 1099-R meter: IRA retirement plan and annuity income;

- 1099-SA table: The amount extracted from the health account;

- K-1 table: Partnership business;

- You and your family (including children) Social Security (SSN);

- Children’s payment records of kindergartens and various interest classes (TAX numbers in the interested class) are used for Dependent Care Tax Credit;

- Property Tax (Property Tax) payment credentials 1098 tables for tax reduction;

- Car Registry for car registration is used to reduce taxes one by one;

- The Medical Expense (Medical Expense) at home is used for tax cut one by one;

- If you are Self-Employment, you need all records and records of income and spending;

In addition to the above form, you may also receive other materials related to tax reporting.Please consult the professional tax personnel for details.

What are the basic steps of tax returns in the United States?

- Calculate your or family’s total income (Gross Income) EssenceIf you receive the W2 table, you do not need to calculate the total income alone, but go directly to the next step; if you are self-dployed, then your total income is your net profit (total sales-total sales-total salesexpenditure).All other income of your family, including investment income, and side business income, should be calculated into the total income.

- Calculate the adjustment income (Adjustable Gross Income (AGI) Essence AGI = GROSS Income – Agi Deduction The AGI tax reduction item refers to the part that does not require tax payment in your income.For example, if you deposit part of the income into your retirement account 401k each month, this part of the income is the AGI tax reduction; similar to similar ones;If you open FlexBile Spending Account (FSA), the income that deposited in the FSA account monthly also belongs to the AGI tax reduction.Therefore, except for the AGI tax reduction, the remaining income is called “adjusted income”.If you receive the W2 table, the value of the first item in the W2 table is your post-adjustment income, and you don’t need to calculate separately.If you are a self-dptLoyed, you need to calculate your AGI tax reduction separately, mainly including your Self-Employed 401K deposit amount, and half of the cost of Self-Employment Tax.

- Select Standard Deduction or Itemize Deduction EssenceFor your post-adjustment income, some income does not need to pay taxes, called it called “Tax reduction”(( Deduction.IRS provides two types of tax cuts: Standard Deduction and Itemize Deduction.For most people, choosing Standard Deduction should be the most cost-effective.However, if you spend a lot of expenses in the annual tax reporting year, for example, medical expenses, or buying new cars, or new houses, then you may be more suitableOnly to make a decision.

- Calculate taxable income (Taxable Income) Essence TAXABLE INCOME = AGI – Standard/itemized deduction EssenceThe reduction of tax reduction from the adjustment of income, and the remaining part is taxable income.This part of the income directly determines your tax.

- Calculate your “Tentative Tax” Essence Tenture tax = taxable income (TAX Rates) X tax rate Essence

- Find all tax subsidies that are suitable for you or family (TAX CREDIT) EssenceTax subsidy is the tax that can be directly reduced, which is different from the AGI tax reduction or standard tax reduction amount mentioned earlier.The tax subsidy is the tax that is directly reduced from your tentative tax.Common tax subsidies include: Child Tax Credit.If there are children under 17 years of age in the family, each child can enjoy a tax subsidy of up to $ 2000.

- Calculate your total tax (Total Tax) Essence Total tax = tentative tax-tax subsidy Essence

- Calculate whether you should tax (OWE TAX to IRS) or Refund from IRS EssenceFrom the beginning of each tax year, IRS will lock some taxes from your salary in advance, which is the tax you pay for IRS in advance.If your pre-paid tax is higher than your total taxIf IRS, IRS will return the extra part to you, called “TAX Refund”.If the tax you pay in advance is less than your total tax, then you need to pay taxes.

According to the above introduction, we summarize several important formulas as follows:

Adjustable income (AGI) = total income (GROSS Income) – AGI Deduction

Taxable Income = After-adjusted income (AGI) -Tandard/itemized deduction

TENTATIVE TAX = Taxable Tax X tax rate (TAX Rates)

Total Tax = Tentative Tax -Tax Credit (Tax Credit)

Tax Withheeld (TAX Withheeld) -Total Tax (TAX Withheeld)

If the [tax supplement or refund] is a positive number, then you will get the refund of IRS; if the negative number is calculated, you need to pay the tax.

Note that you’d better ensure that there are enough taxes you pay in advance each year, so that you do not need to pay taxes when returning taxes, so you do not need to pay a fine.

Let’s introduce the important parameters in each formula one by one.

What is total income?

Personal or family Total revenue, English is GrossINCOME It mainly refers to the total income obtained by taxpayers from all sources within a tax year.

Total income includes: salary (W2 table), salary, bonus, commission, commission, tip, interest, dividend, pension, pension, rental income, donation income, etc.

Total income is the starting point of the tax reporting process.It is used to calculate the adjustment of the post-adjustment (Adjustable Gross Income) and the taxable income (Taxiable Income) to determine the tax.

Total income includes the following types of income:

- Employees, salary, salary, bonus, commission, tip and other employees

- Interest income (such as savings accounts, bonds, etc.)

- Dividend income (such as stock dividends)

- Rental income (such as house rental income)

- Business and self-employment income

- Pension and social security benefits

- Absal of maintenance (for some divorce agreement before 2019)

- Unpaid labor, prize and gambling income

- Some government subsidies and benefits

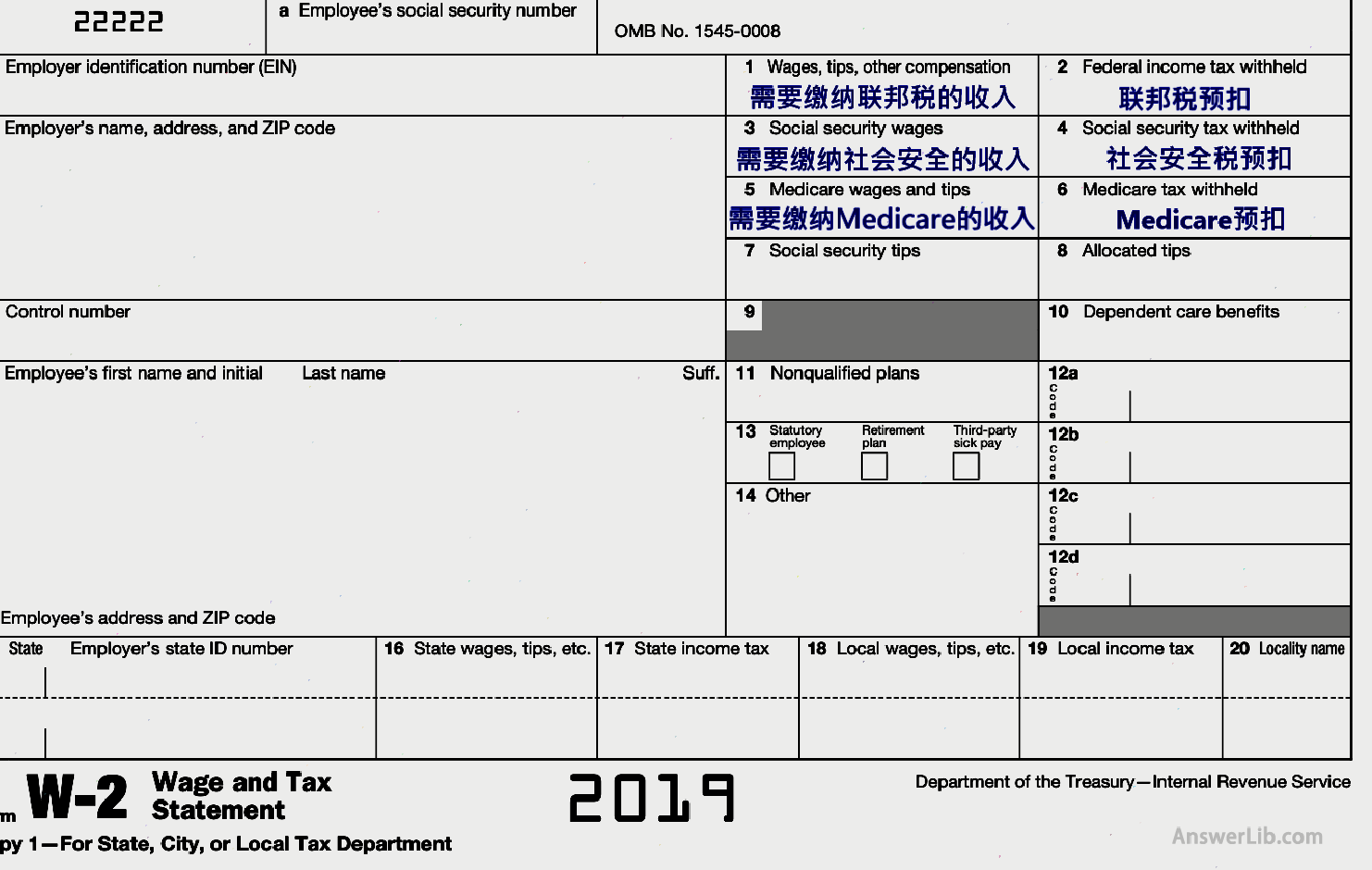

Notice If you receive the W2 table, then the first item of the W2 table no Total income, but the post-adjusted revenue (AGI) introduced later, that is, the revenue deposit in the 401K pension plan, Health Saving Account, Flexible Spending Account.

For example, in the W2 table below, the 48,500 in the first item is not a total income, but the post-adjustment income (AGI).It can be seen from the 12th (12A) in the W2 table that Jane invested $ 1,500 to the 401K retirement account.The medical insurance paid by the 12b (12B) in the W2 table (12B) with the employer.Therefore, Jane’s total income is higher than $ 48,500.

If you are a self-dptLoyed, your net profit (total sales-total expenditure) even your total income.

If you invest in stocks or have any income from the sideline, it is part of the total income.

What is adjusted income (AGI)?

Post-adjustment income, English is AdjustableGrossINCOME, Abbreviation AGI Essence

AGI refers to the total income of taxpayers after subtracting the AGI reduction item (that is, some specific tax exemptions).It is usually the most important data in the tax reporting process, because other tax items, such as deductible costs, tax credits, and deductions are based on this value.The formula for calculating the AGI is as follows:

Adjustable income (AGI) = total income (GROSS Income) – AGI Deduction

AGI reduction items may include:

- If you work in the company, the income you deposited from the 401K retirement account every year

- If you are a self-employer and opened the Self-Employed 401k, the income you deposits in it every year

- Health saving account (HSA), and the deposit amount in FlexBile Spending Account (FSA)

- Education cost (student loan interest, education savings account)

- Half-Employment TAX for self-employment, including 1.45%of Medical Tax, and 6.2%of the Social Security Tax.

- Health insurance costs of self-employment

- Self-employment SEP (Simplified employee pension plan), Simple (simplified incentive matching plan) and qualified pension plan deposit

- The deposit amount of traditional IRA (personal pension account)

- Absal of maintenance (for some divorce agreement before 2019)

- If you are a teacher, you spend on the teaching process

- Some expenses on business or rental income

Notice: If you get the W2 table from your employer, the number in the first item of the W2 table is your post-adjustment income.This number has reduced the deposit of 401K pension and deposits in HSA and FSA.As shown in the figure below, the number 48,500 in the first item is Jane’s post-adjustment income.

Standard tax reduction or tax reduction one by one?

After the income is calculated, you need to calculate “Tax reduction” And decide to use Standard Deductions or Itemize Deductions one by one.

Part of the income after adjustment is no tax, this part is called “Deductions” (deduction) EssenceUse tax reduction to calculate the taxable income.

Taxable Income = After-adjusted income (AGI) -Deductions

There are two types of tax reductions to choose from, but you can only choose one:

- Standard deduction: The tax reduction amount is determined by IRS in advance, and the tax reduction amount of the family is the same.For example, the standard tax reduction for the joint reporting tax on both sides is $ 25,900 (TAX Year in 2022), and this amount increases each year.

- Itemized deductions: Calculate the amount of tax reduction according to different spending projects.For example, housing loan interest, home medical expenses, housing property tax, state income tax, consumption tax, charity donation, etc.can be used for tax reduction.

The comparison of the two is shown in the figure below:

| Standard tax reduction amount Standard Deductions | Tax reduction amount Itemized deductions | |

|---|---|---|

| definition | Disamination of fixed amount | Detailed expenditure reduction and exemption |

| Tax reduction process | Simple, no need to list expenditure | Need to list in detail |

| For people | Most taxpayers | Taxpayers with expenditure exceeding the standard tax reduction amount |

| Deductable project | No need to provide specific items | Mortgage interest, charity donation, medical expenses, etc. |

| Related to tax reporting | Related to tax reporting | It has nothing to do with the identity of tax reporting |

Standard Deductions

Standard tax cuts are a fixed amount of reduction, and taxpayers can directly deduct this amount from their taxable income.The amount of the standard tax reduction depends on the tax return identity of the taxpayer (such as single, married and common tax reporting, etc.).This method of tax cutting is simple and easy to list in detail.

Through the standard tax reduction in the table below, you can quickly calculate your taxable income

Taxable Income = After-adjusted income (AGI) -Standard tax reduction (standard tax reduction)

The following is 2022 Standard tax reduction amount[ IRS]The

Your tax reporting status | age | Tax reduction

|

|---|---|---|

| single | Under 65 years old | $ 12,950 |

| 65 years old and over | $ 14,700 | |

| Husband and wife joint tax | Both are under 65 years old | $ 25,900 |

| Only one person reaches 65 years old | $ 27,300 | |

| Both reached 65 years old | $ 28,700 | |

| Sophomores to report taxes separately | At any age | $ 5 |

| Master | Under 65 years old | $ 19,400 |

| 65 years old and over | $ 21,150 | |

| The death of the husband and wife | Under 65 years old | $ 25,900 |

| 65 years old and over | $ 27,300 |

Notice: If your birthday is January 1, 1958, or after that, then you need to report taxes according to the 65 -year-old category.

For example, if you and your wife/husband have a total annual income of $ 100,000 (GROSS Income), and you are under 65 years of age, and you will use a husband and wife to report taxes.

100,000 (total income) – 25,900 (standard tax reduction amount) = $ 74,100 (income required for tax)

This is the so-called “TAXABLE Income” That is, “income that needs to pay taxes.”

Itemized deductions

The tax reduction amount is different from the standard tax reduction amount.The tax reduction amount is required to list in detail their expenditures within a certain range, such as mortgage loan interest, charity donations, medical expenses, etc.Taxpayers can deduct the expenditures listed by items from taxable income.The tax reduction amount is suitable for taxpayers who can prove that their expenditure exceeds the standard tax reduction amount.

The cost that can be used to calculate the tax reduction amount is as follows:

1.Housing Mortgage Interest

If you buy a house in loans, the interest paid each year can be used as part of the tax reduction.

This includes the mortgage interest of Primary Home and Secondary Home.However, it should be noted that there is a certain restriction on this credit, and the upper limit of the amount of loan that can be used for calculation is $ 1 million(Husband and wife merge taxes).

You can find the 1098 table sent to you by the Loan Bank.The first [Mortgage Interest Received from Payers/Borrowers] in the table lists your interest on the annual tax payment.

source: IRS

2.Property Taxes (Property Taxes)

You can use the real estate tax to calculate the tax reduction amount.Real estate tax is a tax based on real estate value.You usually need to preserve the real estate tax bill and payment certificate.

Notice: The total amount of real estate tax and personal property tax, state and local taxes, and auto registration fees mentioned below cannot exceed the amount of taxation.$ 10,000(2022), the part that exceeds it cannot be used to calculate the tax reduction amount.

3.Personal property tax ( Personal Property Taxes Cure

You can use the personal property tax you paid to calculate the tax reduction amount.The personal property tax is based on the tax collection of personal property (such as cars, ships, RVs, and aircraft).You usually need to preserve the property tax bill and payment certificate.

4.Taxation in car registration fees (Car Regentration Fee)

Note that not all of the car registration fees paid can be calculated with the amount one by one.Only the state tax can be used for calculation.You usually need to save your car registration bill and proof of payment.

It should be noted that not all states will charge the car registration fee.For example, the car registration fee registered in Texas has no state tax in the car registration bill, so it is different for tax reductions one by one.Calculation.

The following states will charge taxes on the registration fee of the car, so you can find the part of the state tax from the car registration fee bill and use it to calculate the tax reduction amount.

- Alabama

- Arizona

- California

- Colorado

- Indiana

- IOWA

- Kentucky

- Louisiana

- Massachusetes

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- North Carolina

- South carolina

- Washington

- Wyoming

5.State and local tax (State and Local Income/Sales Taxes)

You can choose between the state and local income tax (Income Tax) and the sales tax (Sales Tax), and you can only choose one to calculate item by item.

Usually, you will need to choose a better payment.But for some states that have not collected personal income tax, for example, in Texas, you can directly use the sales tax to calculate.

Note that if you buy large pieces in the tax year, such as cars, airplanes, or ships, the sales tax paid when purchasing can be used for calculation.

You usually need to save the bills and small tickets for buying items.

6.Medical Expenses

You can deduct a certain percentage of medical expenses.These costs include the costs of clinics, hospitals, dentists, and medical insurance premiums.have to be aware of is, Only 7.5%of the total revenue (AGI) after the medical expenses exceed the adjustment Essence

For example, your adjustment income is $ 100,000, and the medical expenses you spend are $ 8000, then you can use the calculation process of calculating items one by one as follows:

The part that cannot be used for calculation: $ 100,000 x 7.5% = $ 7500

The part that can be used for calculation: $ 8000 -$ 7500 = $ 500

Therefore, you can use $ 500 to calculate your total tax reduction amount.

7.Charitable Donations

Taxpayers can deduct cash and non-cash donations to qualified charity organizations.Cash donations include donations in the form of checks, credit card payment, and non-cash donations including items and stocks.There is a certain restriction on donation and credit, which is usually related to the adjustment of the post-adjustment of the taxpayer (AGI).You can consider using Isdeductible Online Let’s track and calculate your tax reduction items.

- For a donation of no more than $ 500, you need to donate the receipt issued by the unit to you.

- For donations over $ 500, but less than $ 5000, you need to provide the receipt of the donation unit and the receipt of your original purchase of this item.

- For a donation of more than $ 5000, you need to donate the receipt of the unit, the receipt at the initial purchase, and the shares, except for the appraisal.

- If you donate a car worth more than $ 500, you need to donate the 1098-C table for you to you.

Every year, IRS also has requirements for the upper limit of donations.For 2022, the upper limit of cash donations is 50%of the adjustment of income after adjustment; the upper limit for non-cash donations is 30%of the adjustment of revenue.

8.Investment Interest Expenses

The deduction of investment interest expenditures is a tax reduction and exemption in the United States, and the interest of the loan can be used to calculate the exemption of item by item.This reduction is designed to encourage investment and offset the cost of some borrowing investment.

Interest expenditures may include loan interest for purchasing stocks, bonds, common funds or rental property.However, the deduction amount is limited to net investment income of that year.

To apply for investment interest expenditure deductions, you must list the deduction project on the attached table A of the Personal Income Tax Tax Form 1040.In addition, you need to fill in and add 4952 (investment interest expenditure deduction) to calculate your investment interest expenditure withdrawal amount.

It should be noted that investment interest expenditures do not include loan interest for purchasing duty-free securities (such as municipal bonds), nor include loan interest for personal use (such as credit card debt).In addition, the reduction is not applicable to the loan interest paid by the investment (such as a retirement account or a life insurance) investment (such as a retirement account or a life insurance).

What kind of tax reduction method is used?

You add up all the costs that can be used to reduce taxes one by one.If the value exceeds the standard tax reduction amount, use itemized deductions; otherwise, use Standard Deductions.

In the process of tax reporting, tax reporting software will automatically tell you the most suitable tax reduction method.

You only need to fill in your income to the tax reporting software.

For example, if the family has major purchasing projects, such as buying a car, or a large medical expenses for family members, at the same time, you still have housing loans, etc., then tax cut one by one may be more suitable for you and your family.

For most families, the Standard Deductions may be the best choice, which can save more taxes.At the same time, the tax reporting process is simpler and does not need to provide any receipt or proof.

How to calculate the tentative tax?

After calculating the adjustment of the income, you can calculate the tentative tax at a certain tax rate and calculate the temporary tax.

Tentative Tax = Taxable Income X Tax Rates

You need to be calculated according to the following form, called “TAX Rates”, or “TAX Brackets”【source: IRS As well as Turbotax..

tax rate | single | Husband and wife joint tax | Husband and wife report taxes separately | Master |

|---|---|---|---|---|

| 10% | $ 0 to $ 10,275 | $ 0 to $ 20,550 | $ 0 to $ 10,275 | $ 0 to $ 14,650 |

| 12% | $ 10,276 to $ 41,775 | $ 20,551 to $ 83,550 | $ 10,276 to $ 41,775 | $ 14,651 to $ 55,900 |

| twenty two% | $ 41,776 to $ 89,075 | $ 83,551 to $ 178,150 | $ 41,776 to $ 89,075 | $ 55,901 to $ 89,050 |

| twenty four% | $ 89,076 to $ 170,050 | $ 178,151 to $ 340,100 | $ 89,076 to $ 170,050 | $ 89,051 to $ 170,050 |

| 32% | $ 170,051 to $ 215,950 | $ 340,101 to $ 431,900 | $ 170,051 to $ 215,950 | $ 170,051 to $ 215,950 |

| 35% | $ 215,951 to $ 539,900 | $ 431,901 to $ 647,850 | $ 215,951 to $ 323,925 | $ 215,951 to $ 539,900 |

| 37% | Exceed The part of $ 539,901 | Part of more than $ 647,851 | Part of more than $ 323,926 | Part of more than $ 539,901 |

Notice: For your Taxable Income, not all parts, all of which are paid by a fixed proportion, but according to step-wise Calculate.For income within the 10% tax rate, calculate at 10%, and the excess of the part is calculated at 12%.If there is still a part with more than 12% tax rate, then calculate the next tax rate ratio, and so on.

For example, followed by the above example, the total income of the family is $ 100,000 (GROSS Income), and the reduction of the standard tax reduction is $ 25,900.Then the income that needs to be paid is $ 74,100.Through the above tax rate table (TAX Rates), the federal tax you need to pay can be estimated:

20,550 x 10% + (74,100-20, 550) x 12% = $ 8481

You may find that $ 74,100 is exactly within a 12%tax payment rate range, but it does not mean that all income is paid at 12%.The correct calculation method is that the $ 19,900 of it is paid at 10%at 10%and the excess $ 19,900 will be paid at 12%.Please pay attention.

You can use the estimated tools below, enter the total income of your/home, and the type of tax reporting.

Disclaimer: The estimated results do not consider the specific situation of individuals/families, for example, Tax Credit is not considered.At the same time, it is estimated that only the situation under the age of 65 is considered.Notice: Estimated data is only used for personal reference, and it cannot be used for filling in any tax return form.If you have any tax reporting, please consult Turbo Tax’s tax personnel or CPA.This estimated software is not attached to any tax reporting software or IRS.

Or, you can check IRS1040 Filling Form Guide Page 11 The tax that needs to be paid is $ 8,481 The

Of course, the specific situation is more complicated than this, but the basic reason is:

You need to pay taxes at a certain percentage of taxable income.

In the following chapters, we will introduce how to use it Turbo tax After completing the tax reporting, these tax cuts are gradually set up by the software with your software.

What are the common tax subsidies?

Tax subsidy, English is TaxCredit or Tax breakak It is a part that minus directly from the tentative tax.If you get a tax subsidy of $ 2000, you can pay less than $ 2000.

For example, if you have a dependent, you will enjoy Child Care Credit, which can save a lot of taxes.

Children’s tax subsidy (Child Tax Credit)

If your child, age is in Under 17 years old(As of December 31, 2022), you can enjoy tax subsidies when paying taxes.

For taxes in 2022, every child who meets the conditions of tax reduction can be obtained 2000 dollars Tax subsidy [Source: IRS As well as CFPB..

Check the IRS instructions, you and your children need to meet some conditions before you can enjoy tax subsidies.

Note: If your personal annual income exceeds 200,000 US dollars, or the annual income of the family exceeds 400,000 US dollars, then you cannot enjoy this Tax reduction Essence

Then the above example, before considering the child’s tax subsidy, the federal tax that needs to be paid is $ 8,687 Essence

If you have two children in your family, the federal tax that needs to be paid is calculated according to the following formula:

8,687 (initial tax payment) – 2000 X 2 (tax subsidy of two children) = $ 4,687

Therefore, the amount of Child Tax Credit is minus directly from the “initial tax”.

Parenting cost tax subsidy (Dependent Care Credit)

This tax benefit is aimed at the cost of spending on the child and the interest class of the child.Under 13 years old Essence

Your family needs to meet certain conditions in order to enjoy the Dependent Care Tax Credit.

The specific tax reduction amount is as follows [Source: Turbotax】:::

- for a child Family, the cost of childcare can be calculated at most is 3,000 dollars The proportion of tax reduction is Between 20%and 35% Items

- for Two or more children Family, the cost of childcare can be calculated at most is 6000 dollars The proportion of tax reduction is Between 20%and 35% Items

The specific calculation method is as follows:

| Parenting costs that can be used for calculation | Adjusted income (AGI) | Tax reduction ratio ratio | Maximum tax reduction | |

|---|---|---|---|---|

| 1 child | $ 3000 | Less than $ 15,000 | 35% | $ 1,050 |

| More than $ 43,000 | 20% | $ 600 | ||

| 2 children | $ 6000 | Less than $ 15,000 | 35% | $ 2,100 |

| More than $ 43,000 | 20% | $ 1,200 |

It can be seen from the table above that the ratio of 20%to 35%when calculating depends on your total income:

- If the income is less than $ 1,5000, the ratio is 35%;

- Each income increases by $ 2000, the ratio decreases by 1%;

- When the income exceeds $ 43,000, the calculation ratio drops to 20%of the mouth;

Then the previous example, after considering Child Tax Break, the total tax is $ 4,687.

If you have two children, the cost of spending on parenting is 5,000 knives, then you can get 20%of $ 5,000 as tax subsidies.

In this way, your final tax is calculated according to the following formula:

4,687 (initial tax payment) – 5,000 x 20% (parenting tax subsidy) = $ 3,687

There are many items suitable for Dependent Care Tax Credit, such as::

- Kindergarten, preschool;

- After class;

- Summer camp, but the CAMP of overnight is not counted;

Related Reading: The principal of the traditional IRA account every year does not need to pay taxes (limited conditions) at that time.For specific content, please check “Traditional Ira account Recommended: Which IRA is better?” Essence

Adoption Credit

If you adopt children in the annual tax, or you are adopting children, you may obtain tax reduction and exemption of adoption children, and the maximum reduction amount is $ 14,890, but this tax reduction has certain requirements for family adjustment income.

- If your revenue is higher than $ 263,410 (2022), you will not be able to enjoy this tax reduction.

- If your adjustment income is less than $ 223,410 (2022), you can fully enjoy this tax reduction.

- If your revenue is before the two, you can get some tax reduction and exemption.

Energy-EFFICient Vehicles

Taxpayers who purchase new energy vehicles (such as electric vehicles or plug-in hybrid vehicles) can obtain federal tax reduction and exemption.The amount of credit depends on the type and performance of the vehicle.

To apply for this exemption, please refer to the original purchase record of the purchase of the vehicle.Automotive manufacturers or domestic dealers can tell you the amount of deductions allowed by specific brands, models and years to buy.

Energy-saving vehicles must meet the following conditions:

- Use the vehicle in the current year

- Only the specified models and years can the conditions meet the conditions

- Mainly used vehicles in the United States

- You are the primitive car owner of the vehicle, and the used car does not meet the conditions

If you buy a plug-in electric driver, it is usually called plug-in hybrid electric vehicle (PHEV) or electric vehicle (EV), you may be eligibleDrive Motor Vehicle Credit.

Energy-Efficient Vehicle Charging Station

Taxpayers who install home charging stations for charging electric vehicles can obtain a certain percentage of tax deductions.This debt is designed to encourage the use of green travel and sustainable energy.

The charging station of plug-in electric or hybrid electric vehicles is eligible to get this exemption.To get this exemption, the following conditions must be met:

- You started using the station in 2022

- You are the original car owner of the station

- The station is mainly used in the United States

- The station is installed in your main residence

Home Energy Credit

Taxpayers can obtain tax credits for renewable energy equipment such as solar energy, wind energy or geothermal energy systems.In addition, improvement of family energy efficiency (such as replacing energy-saving windows, insulation materials, etc.) may also be qualified to get offset.

When you install new energy equipment, you need to check the manufacturer’s tax reduction proof (ManuoFacturer ’s Tax Credit Certification Statement to determine whether the new energy equipment you installed is in line with this tax reduction.

This tax reduction and exemption mainly include energy projects including:

- Solar water heating (Solar Water Heating)

- Solar Electricity

- Fuel cell equipment

- Small Wind Energy Property

- Geothermal heat pump equipment(Geothermal Heat Pump Property)

The amount of tax reduction is about 30%of your use of renewable energy costs.When calculating, the cost can include labor costs.

Several common tax returns

- International students: There are scholarships (TA/RA), cars, no houses;

- Double workers in husband and wife: there are rooms, cars, little baby, and deposits;

- The husband and wife go to work, and the other side conspires the occupation (LLC company/do contractor): there are houses, cars, children to college, deposit, stock investment;

1.Abroad student The Scholarship(TA/RA) There are cars, no rooms

| single | Married and baby |

|---|---|

| Single W-2 table Social security number Medical expense(Maybe not) Car registration fee (may not be needed) | Report taxes with Married Filing W-2 table Social security number Payment records of children in kindergarten and various interest classes Medical costs (may not be needed) Car registration fee (may not be needed) |

2.Double workers in husband and wife: there are rooms, cars, baby, and deposits

- Report taxes with Married Filing

- Family member social security number

- W-2 table

- 1099-I

- 1099-DIV table (dividend obtained by buying stocks)

- Table 1099-B (the profit of the sale of stocks and securities)

- Payment records of children in kindergarten and various interest classes

- Form 1098 (House Loan Interest)

- Property Tax (Property Tax) payment credentials

- Car Regentration

- Medical Expense (Medical Expense) at home

3..The husband and wife work, and the other party conspires the occupation (LLC company/do contractor): there are houses, cars, children to college, deposit, stock investment

- Take the joint reporting tax of husband and wife as an example

- Family member social security number

- W-2 (one party to work)

- 1099-int (bank deposit)

- 1099-Misc

- All other income of the professional side (but not written in Table 1099)

- All related costs of self-conspiracy (Expense)

- Form 1098 (Housing Loan Profit)

- Property Tax (Property Tax) payment credentials

- Car Regentration

- Medical Expense (Medical Expense) at home

- 1098-E (the child goes to college loan interest)

- 1098-T (the child’s tuition payment amount to college)

Choose tax reporting software

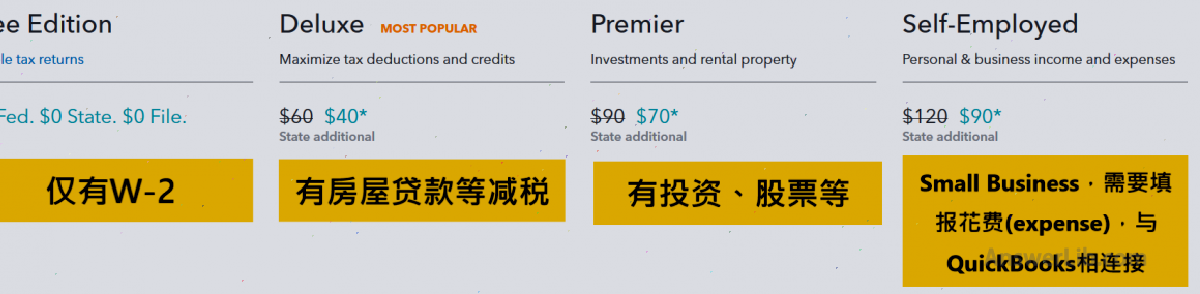

We use Turbo Tax to complete the online tax reporting and submit the tax list online.

You may need different software for your types of income and projects that need to be reported.

- Free version: It is suitable for friends who only need to fill in W-2 tax returns; if you or your family work for the company, there is only W-2 table, then this free version is required.

- Deluxe version: It is suitable for friends who have already bought a house and are still paying in installments.This version can provide you with more tax deductible options, such as house loans and donations;

- Premier version: It is suitable for friends who have stocks, bonds, shares, and other investment, and are also suitable for friends who have housing lease income and buy and sell Bitcoin;

- Self-Employer version: For friends who are suitable for your own company and friends who do Contractor, the company’s operating costs can be deducted.At the same time, seamlessly connect to Quickbooks to make personal operators pay faster taxes.

No matter which version you plan to choose, you can get first Turbo tax homepage, Free registered accounts and start tax filing.

When you need any paid options, the software reminds you which version you should choose.

US tax return steps

- Step 1: Create a Turbo Tax account

- Step 2: Fill in personal and family details

- Step 3: Fill in federal tax (income and cost, tax reduction and tax reduction)

- Step 4: Fill in the state tax

- Step 5: Review and submit tax forms online

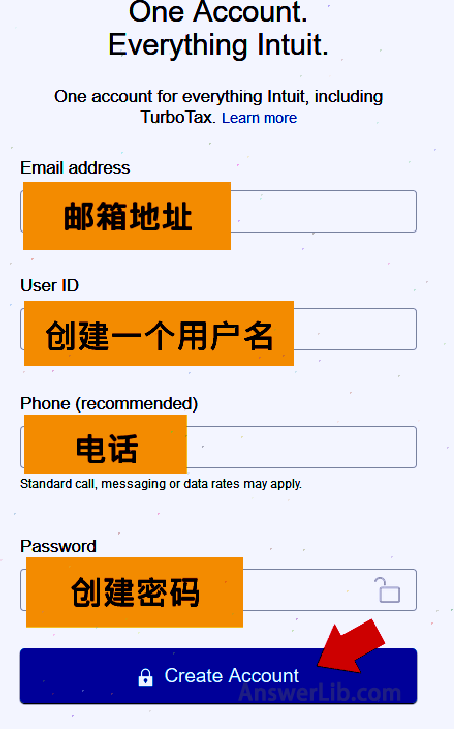

Step 1: Create a Turbo Tax account

- Log in Turbo tax homepage, Click the button in the upper right corner [SIGN UP] Register account

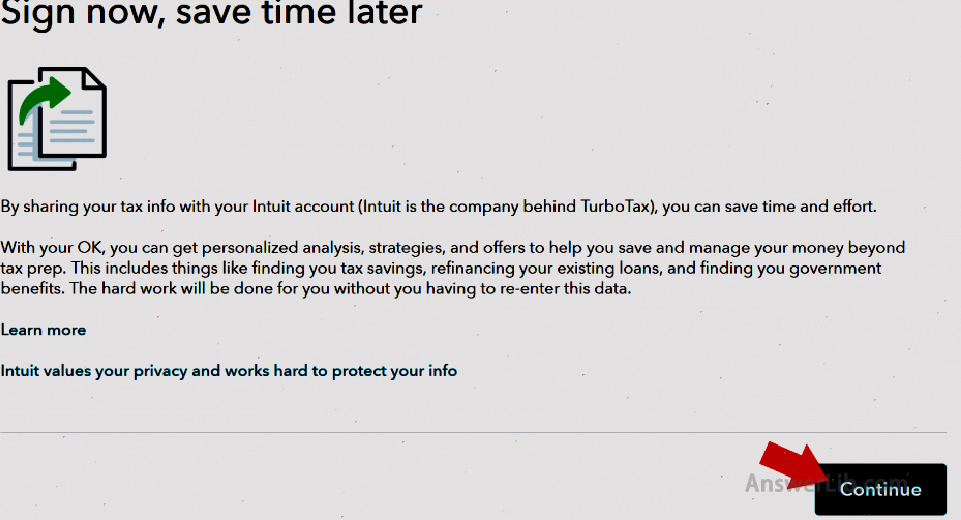

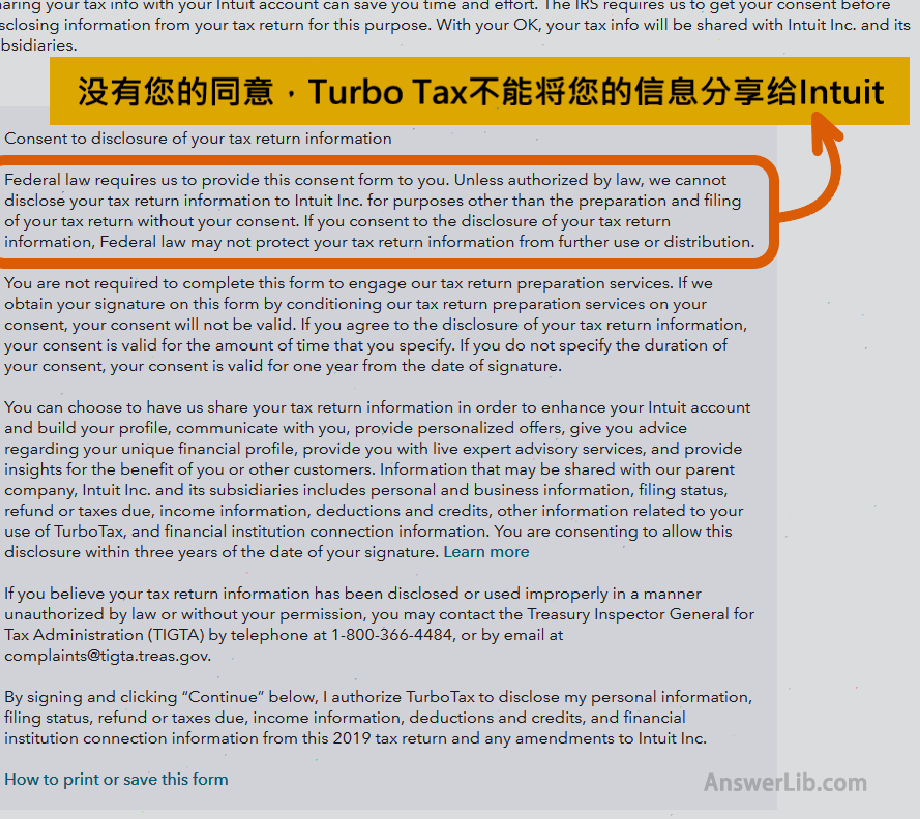

- Select whether to share personal information to INTUIT Inc.

During the tax reporting process, you need to fill in a lot of personal information, such as SSN, W-2, etc.

IRS requirements: Without your consent, Turbo Tax cannot share this information with any organization and individual.

The following page is to ask you: Do you want to share personal information with Turbo Tax’s parent company Intuit Inc.?

You can fill in according to your personal needs, here we choose [No more].

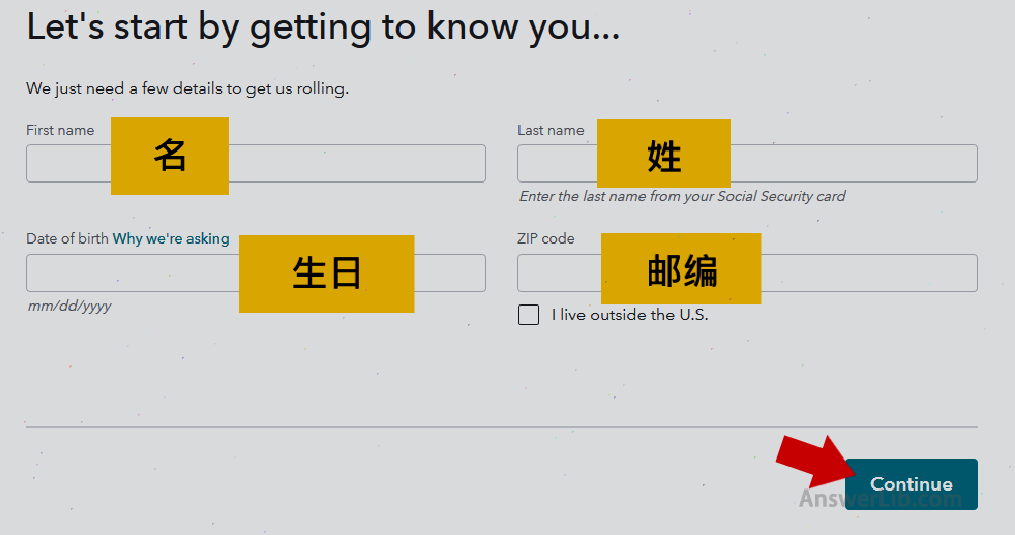

- Enter personal information

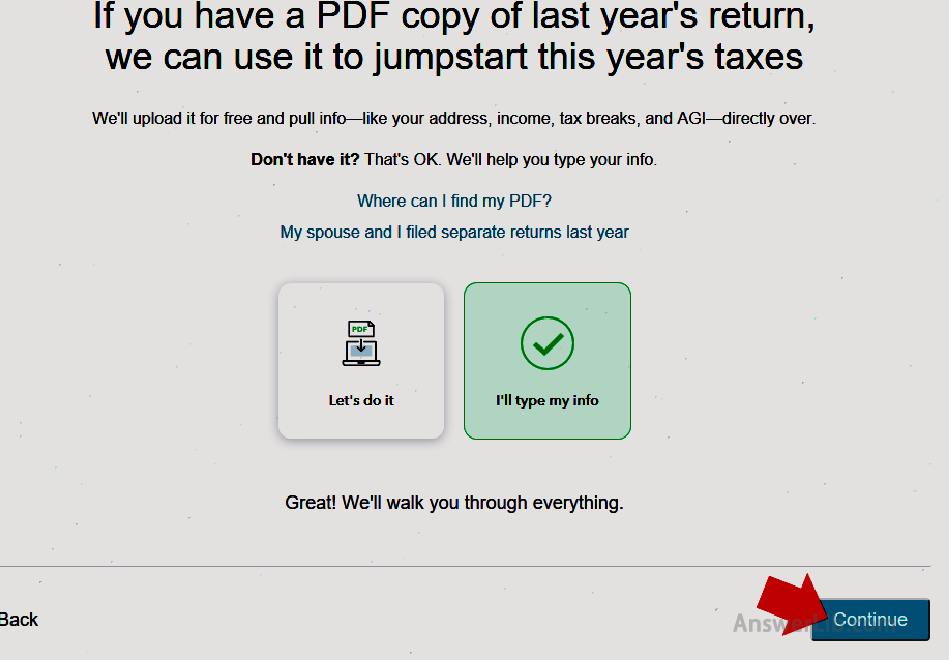

- Choose whether to use the tax table last year

If you have a tax report (PDF) last year, it will save a lot of time input information.Please click [Let ’s do it];

You can also choose to re-enter the information, please click [I ’ll Type My Info].Here we choose this.

- Enter the tax situation of personal or family

Ask you single or get married.Please fill in according to the specific situation:

Please choose the income and spending project of your family according to your family situation:

Here we choose several commonly used items, such as W-2, Childcare Expense, 1099-Int, and so on.Then click OK:

Step 2: Fill in personal and family information

- If it is a husband and wife, it is recommended to use [Filing a Joint Return];

- Fill in your personal information of your wife/husband: including name, birthday, SSN, job position;

- The states where your family lives (to determine which state tax of which state is submitted);

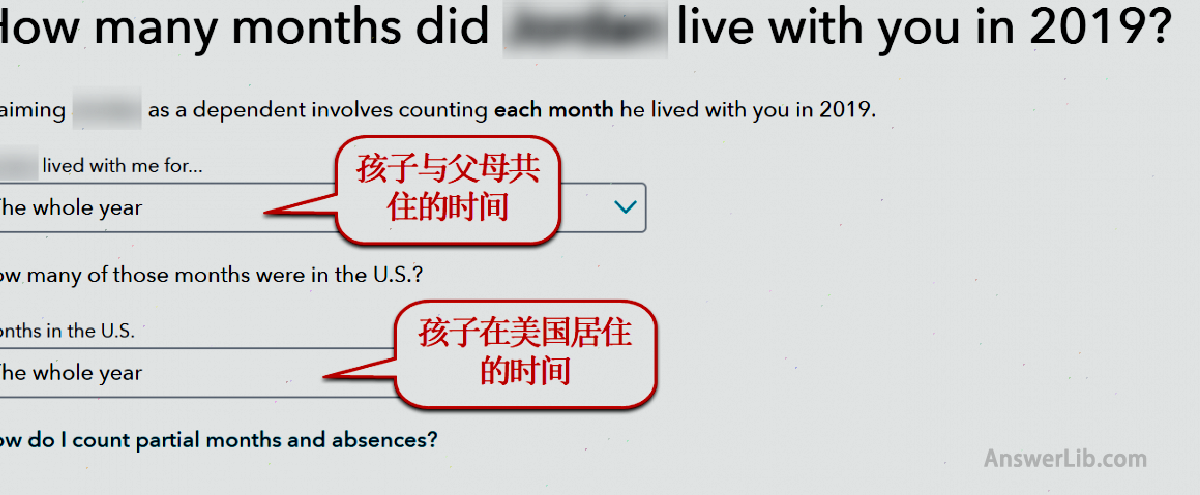

- Finally, you have to fill in your child’s personal information, including name, SSN, whether citizens, and time to live with parents.

You need to fill in the time of living with you and the time in the United States.This time determines whether you can enjoy Child Tax Credit.

Eligible children will bring you tax deduction (Child Tax Credits):

After that, the software system will ask if you get income from other states outside the place of residence.You need to answer:

- Whether there are work income in other states;

- Do you have companies, farms, or renting houses in other states;

- Whether to sell a house in other states

- Do you have gambling income in other states (for example, gambling money to win money in Lasvis)

According to the home condition and revenue source you filled in, the Turbo Tax system will recommend the following Taxation method Give you:

- Single personal taxation (Single)

- Husband and wife joint tax

- Husbands and wives

- The Lord of the Family (Head of HouseHoldCure

- Widow/Windower

Then, according to my family situation, Turbo Tax recommends that I will adopt me Husband and wife joint tax Essence

After filling in all the information of all family members, you can review the content you filled in, please make sure you fill in.

The federal tax began below.

Step 3: Fill in the federal tax

When filling in the federal tax, you need to fill in three major items:

- Income and expenditure (Income & Expenses);

- Deductions & Credits;

- Other tax conditions;

- Federal tax review;

Report tax: income and expenditure (Income & Expenses)

Depending on your income and family income, you may need the following materials to start filling:

- W-2

- 1099-I

- Other Table 1099

- 1099-DIV: Divicnds issued by the company.

- 1099-B: Revenue from buying and selling stocks, trust funds, bonds, real estate, coins, stamps, artworks, etc.

- 1099-R: income from pensions such as Pension Plan, Annuity, or IRA.

- Bank accounts or assets outside the United States.

For example, when filling in W-2 table, there are several important items in the table:

- Project 1: Revenue to pay federal tax;

- Project 2: Federal tax pre-deduction;

- Project 3: Revenue to pay social security;

- Project 4: Social security pre-deduction;

- Project 5: Revenue to pay Medicare;

- Project 6: Medicare pre-deduction;

During the tax return, Turbo Tax will prompt you to fill in the item information in the W-2 table according to the steps.

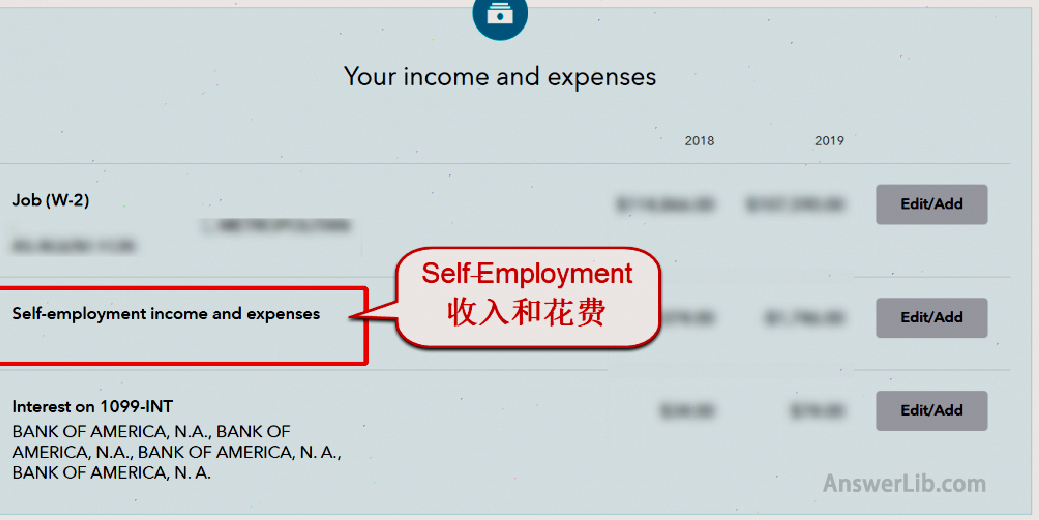

After filling in form W-2, you need to fill in all other income categories in turn, such as

- Your bank deposit is interesting, so you need to fill in the 1099-INT table.

- You have your own LLC company, or if you do contractor, then you can fill in the income and expense, as shown in the figure below:

Net profit = income (Income) -Expense

- In income of more than $ 600, you should receive a 1099 form sent to you by the payer.For all other income with less than 600 US dollars, you need to report them one by one.

- The cost of spending is all the costs you are engaged in these tasks.You need to record in detail the cost of each time, and enter the cost bar for Turbo Tax at the same time.

Business-related costs may include:

- Consumables (SUPPLIES)

- Advertising (Advertising)

- Lawyers’ fees and other hires for professional fees (Legal and Professional Fees)

- Office expenses (Office Expense)

- Commission (Commissions)

- Inventory

- Assets (Assets)

- Business trials (Business Travel)

- Communication costs (Communications)

- Related expenses at home (Home Office)

- Business-related catering costs (Meals)

- Vehicle-related expenses (VEHICLE)

- Other Miscellaneous Expenses

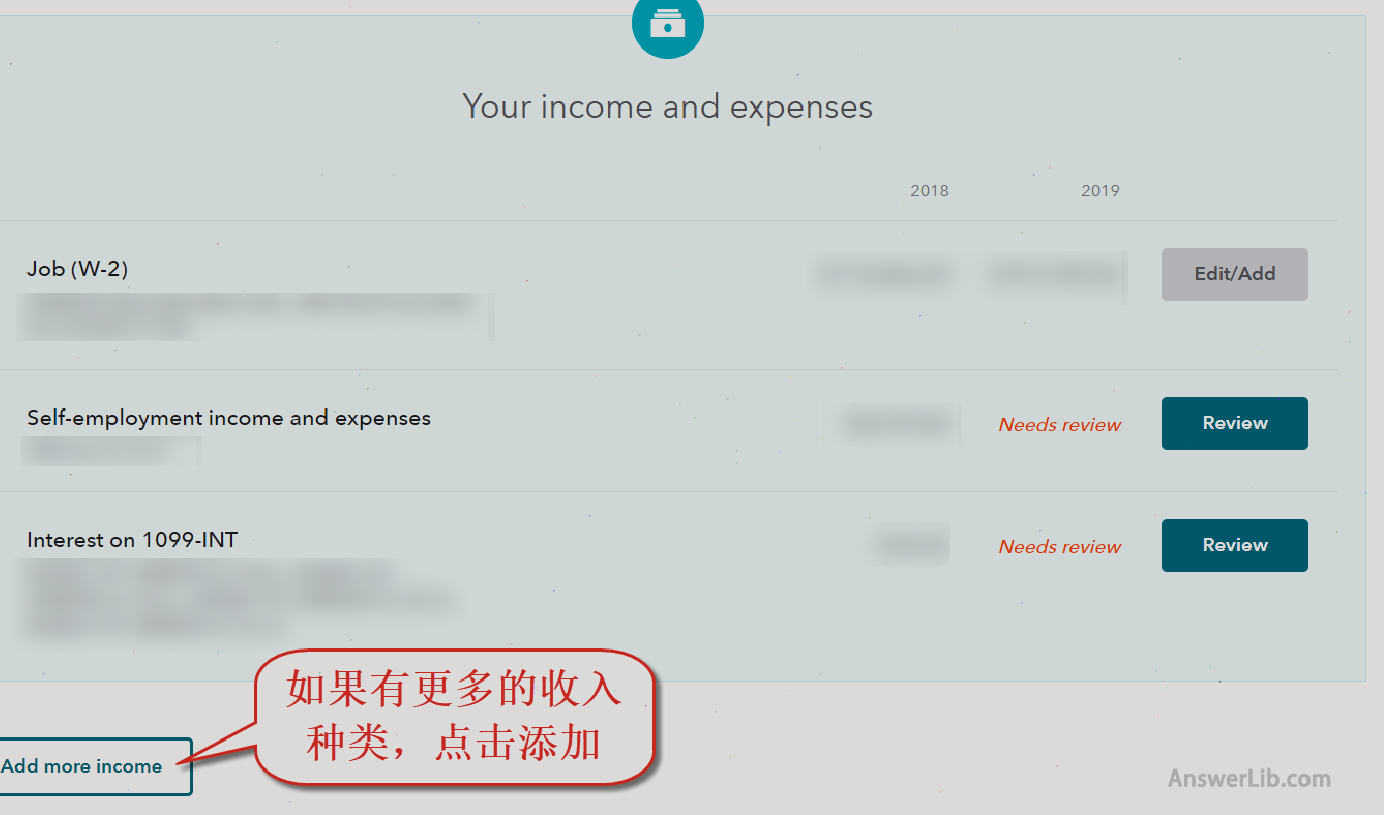

Except for W-2, Self-Employment revenue and cost, 1099-I can, you can click [Add More Incomes] in the figure below to add all the income category.

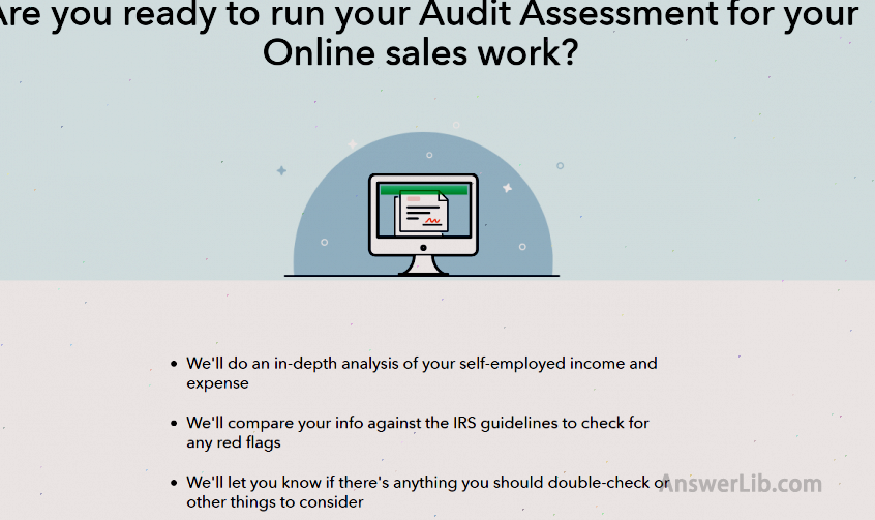

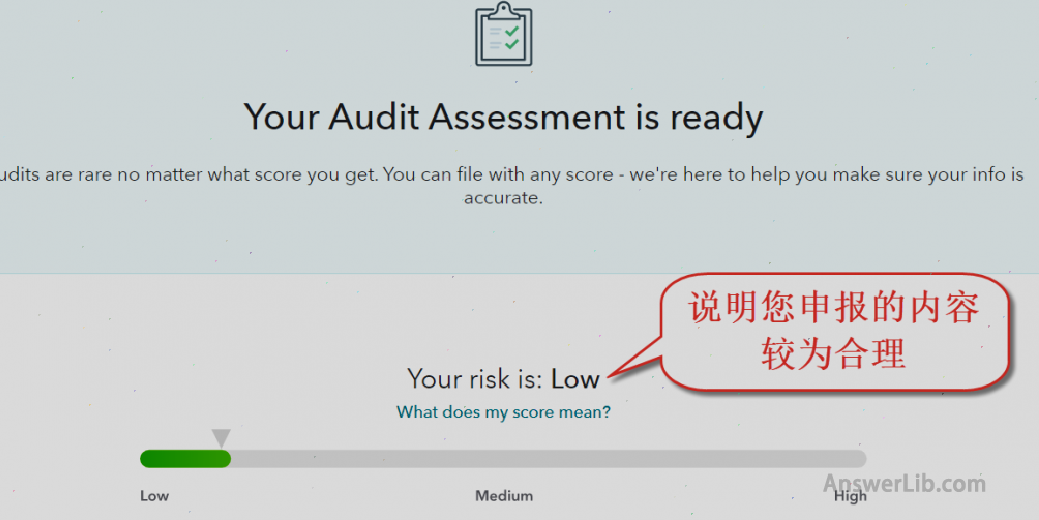

Finally, you have the opportunity to run your audit assessment:

If the content you declare is reasonable, it is not easy to receive the Audit of IRS.

In this way, the revenue and expenses in federal tax are completed.

Let’s check the tax reduction and tax reduction in the federal tax.

Federal Tax: Deductions and Credits (Deductions and Credits)

This step is mainly to view two points:

- Which parts do not need to be paid in the income (take Standard Deduction or Itemized Deduction?);

- What kind of tax reduction and exemption, for example, if you have a child who is 17 years old, you can get children’s tax reduction and exemption, called “Child Tax Credit” Items

Tax reduction method:

We have introduced it in the beginning of the article.There are two tax reductions to choose from:

- Standard dduction

- Itemized deduction

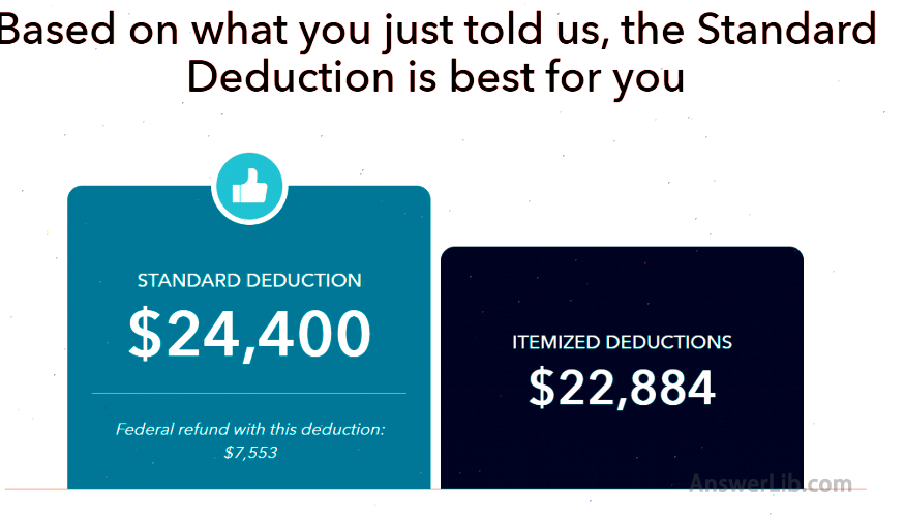

According to the different income of the family, the tax reporting software will recommend the most suitable tax reduction method for you.

You may need the following materials to calculate the amount of ITEMIZED DEDUCTIONS:

- Form 1098: Payment interest for house loans;

- HSA account: health medical account;

- 1098-E: Children’s student loan for college;

- IRA or Roth IRA account: retirement plan account;

- Family member medical expenses;

- Housing property tax payment record;

- Auto registration fee;

- Consumption tax for buying goods;

- Donation records to charity;

Through Turbo Tax, you will get the system recommended by the system.Most people are suitable for standard reduction methods, and they are relatively simple.

Tax reduction

We introduced two types of tax reduction and exemption at the beginning of the article:

- Tax reduction for children (Child Tax Credit);

- Parenting costs can be reduced (Childcare Tax Credit);

Regarding Child Tax Credit, every child who meets conditions can get a tax reduction of $ 2000, that is, minus $ 2000 directly on the amount you should pay.

Regarding Childcare Tax Credit, you can get a tax reduction of 20%to 35%of childcare.For a child, it cannot exceed $ 3,000.For two or more children, the total cost cannot exceed $ 6000.

After you fill in all the tax reductions and tax reductions, Turbo Tax will automatically help you calculate the amount of Itemized Deductions and compare with the amount of the Standard Deductions of the year, and finally decide the tax reduction method you should use.

Turbo Tax’s tax cuts for our family are: Standard Deduction.

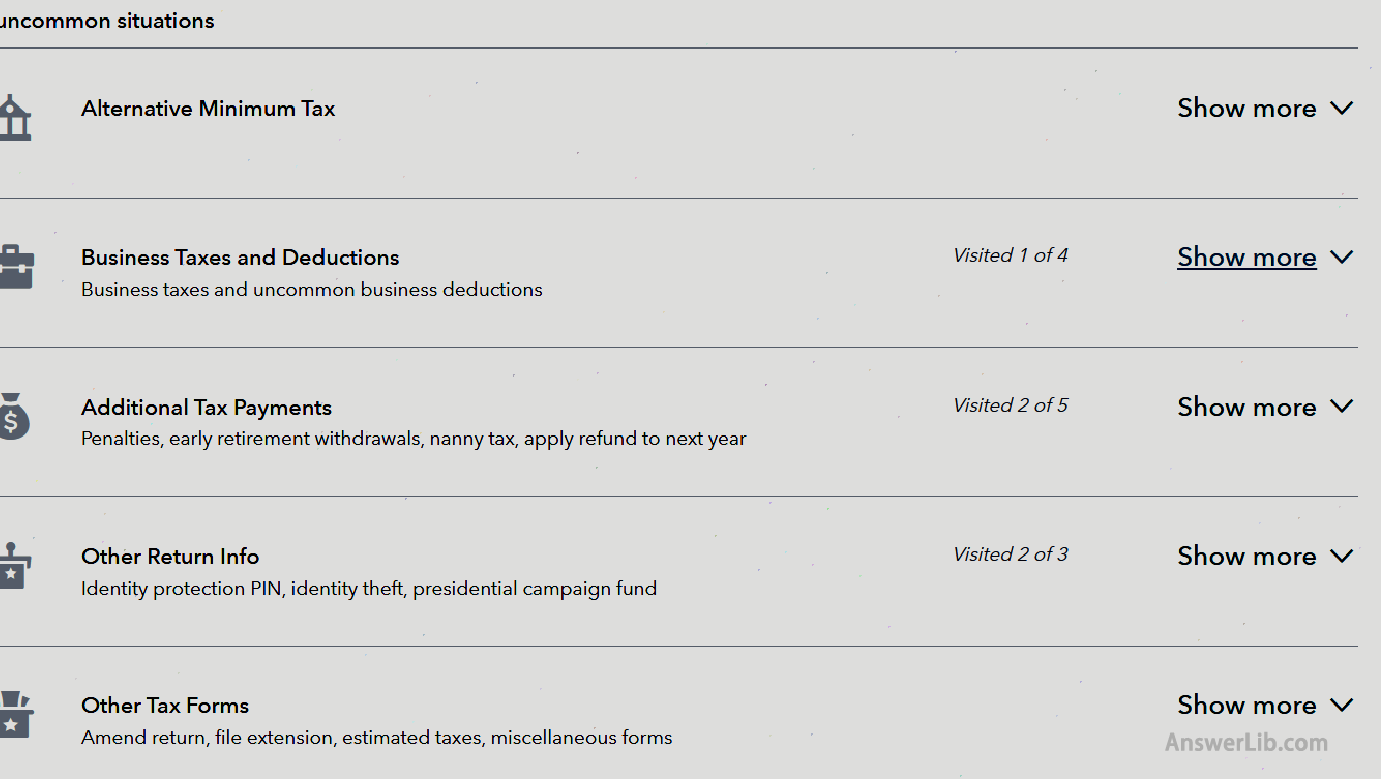

Federal Tax: Other taxes

In this step, Turbo Tax will check for you, whether there are other tax conditions you need to declare, or you have any special declaration requirements.

These are some of the uncommon tax returns.The tax reporting software gives some of the following situations:

If you have some special requirements, for example,

- You want to delay taxes (File An Extension);

- You need to inform IRS that you have just changed the address;

You can declare here.

For most people, this part can be skipped directly and directly enter the Federal Review stage.

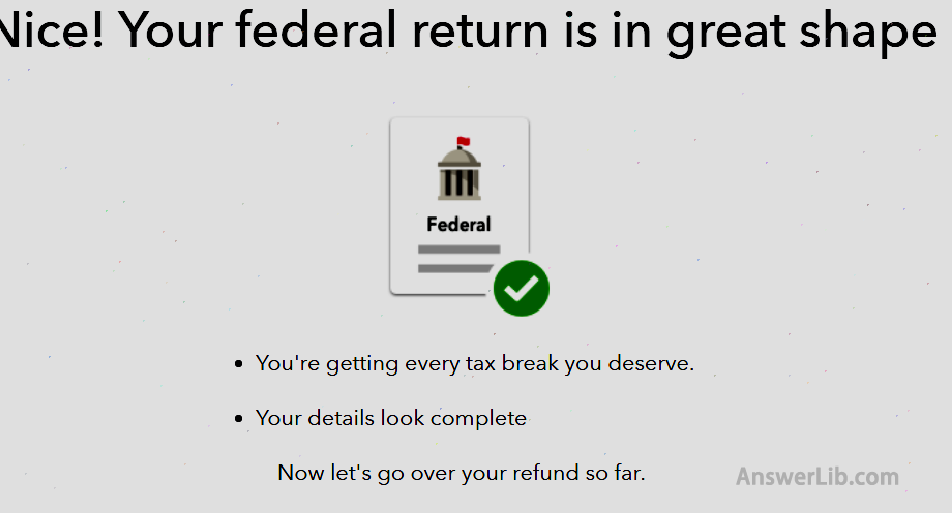

Federal Tax: Review

Turbo Tax will review your federal tax declaration, and the content includes:

- Whether the content of the tax report is correct;

- Whether there is information lack;

- Check the current tax return limit again;

If your tax report is reasonable, then you will get the following confirmation information:

At the same time, you can know the tax return of that year, or how much tax you need to pay:

Step 4: Fill in the state tax

The declaration process of the state tax is similar, but the process is simpler.

There are 7 states in the United States that do not need to fill in state tax (information source: Turbo tax), If you live in these states, then you don’t need to fill in the state tax:

- Texas (Texas)

- Alaska (Alaska)

- Florida (Florida)

- Nevada (Nevada)

- South Dakota

- Washington

- Wyoming

In addition, the two states New Hampshire and Tennessee only tax on interest rate income and dividend income, and do not collect taxes on other income, such as tax collection without paying wages.

If your residential state does not belong to the above 7 states, you need to fill in the state tax.

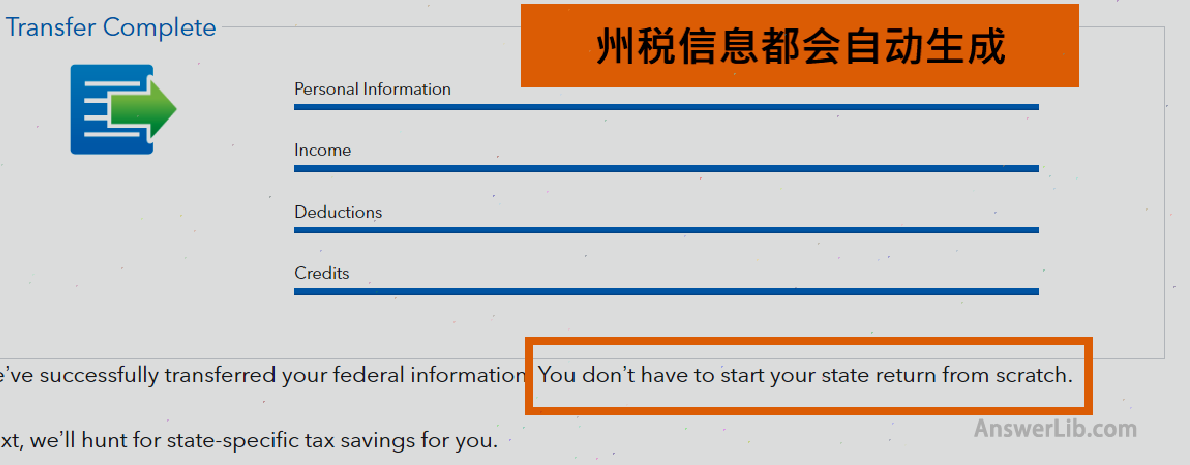

Here California For example, after selecting your state, Turbo Tax will automatically transfer all the information about the federal tax you have filled in before to the report of the state tax:

After that, Turbo Tax will ask you and your family’s residence in the state:

After that, you just follow the prompt information given to you with Turbo Tax and answer all the questions.

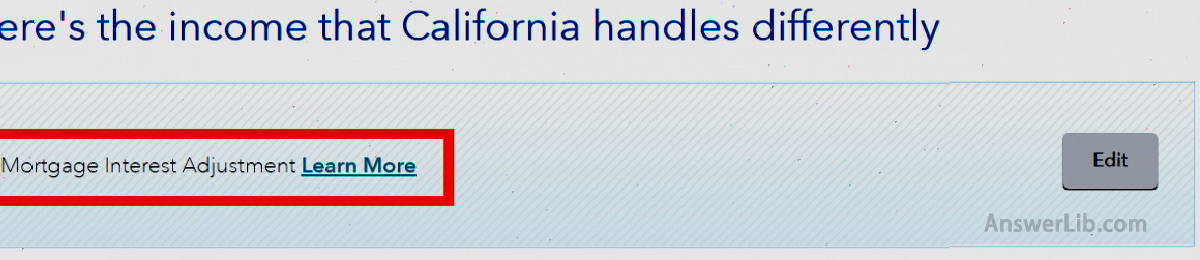

Software will prompt you that you need to update it.For example, California handles the interest rate of housing loan interest rates different:

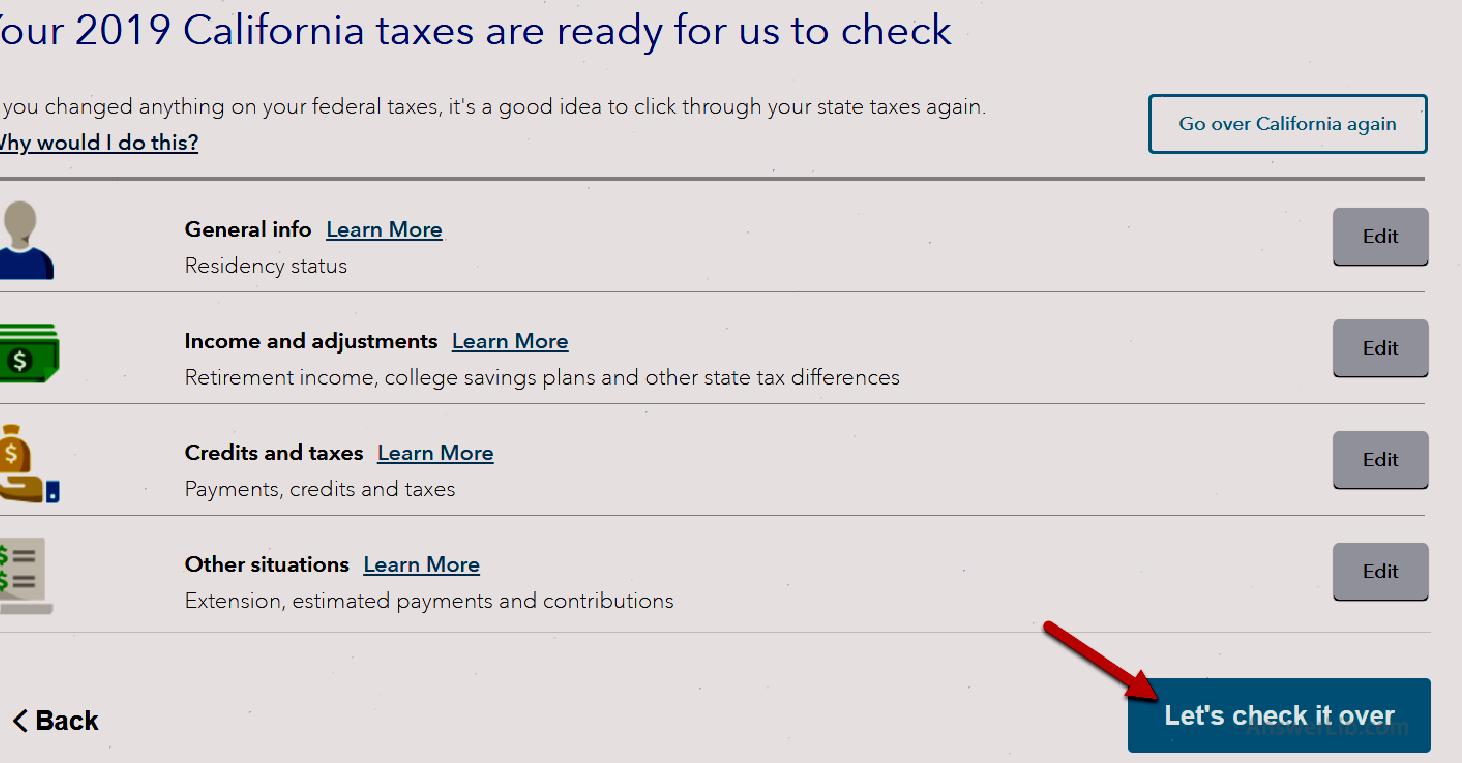

At the same time, you need to view California tax reduction and exemption again:

Finally, tax reporting software will help you check all the tax reporting information filled in:

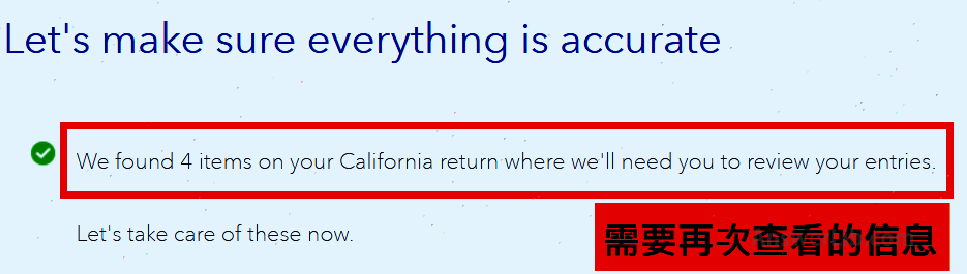

Click [Let ‘S Check It Over] to start review.If you have any errors or information incomplete when filling in, the software will immediately remind you:

Step 5: Review and submit online

After you fill out the federal tax and state tax, the tax reporting software will review whether your tax reporting content is complete and reasonable again.

Click the button [Check My Info] to start reviewing your tax returns.

If there is no problem, you will get the following prompt message: Ready to file

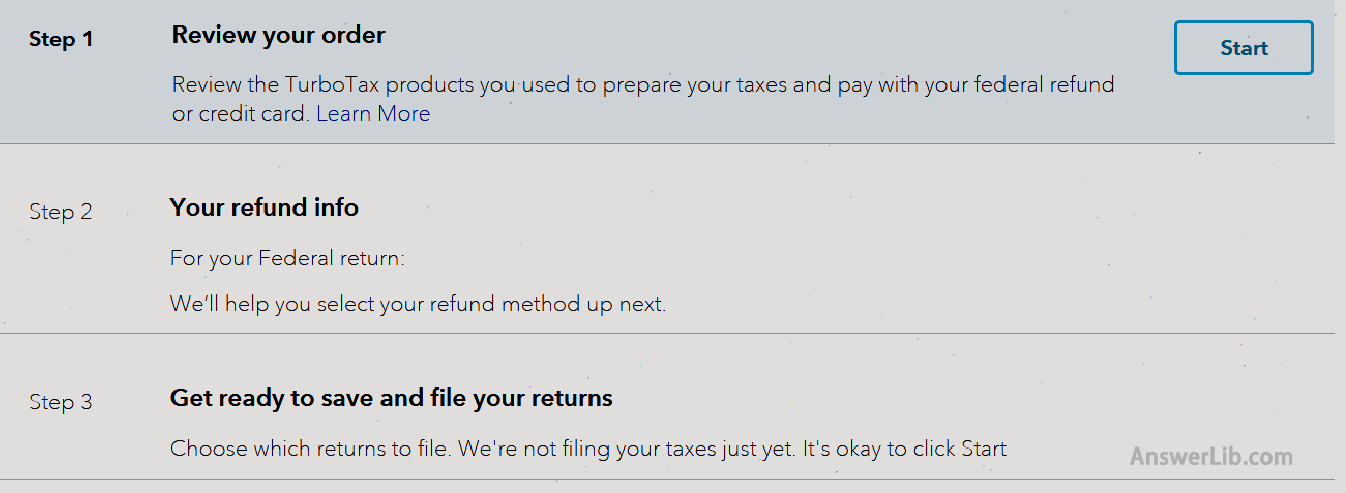

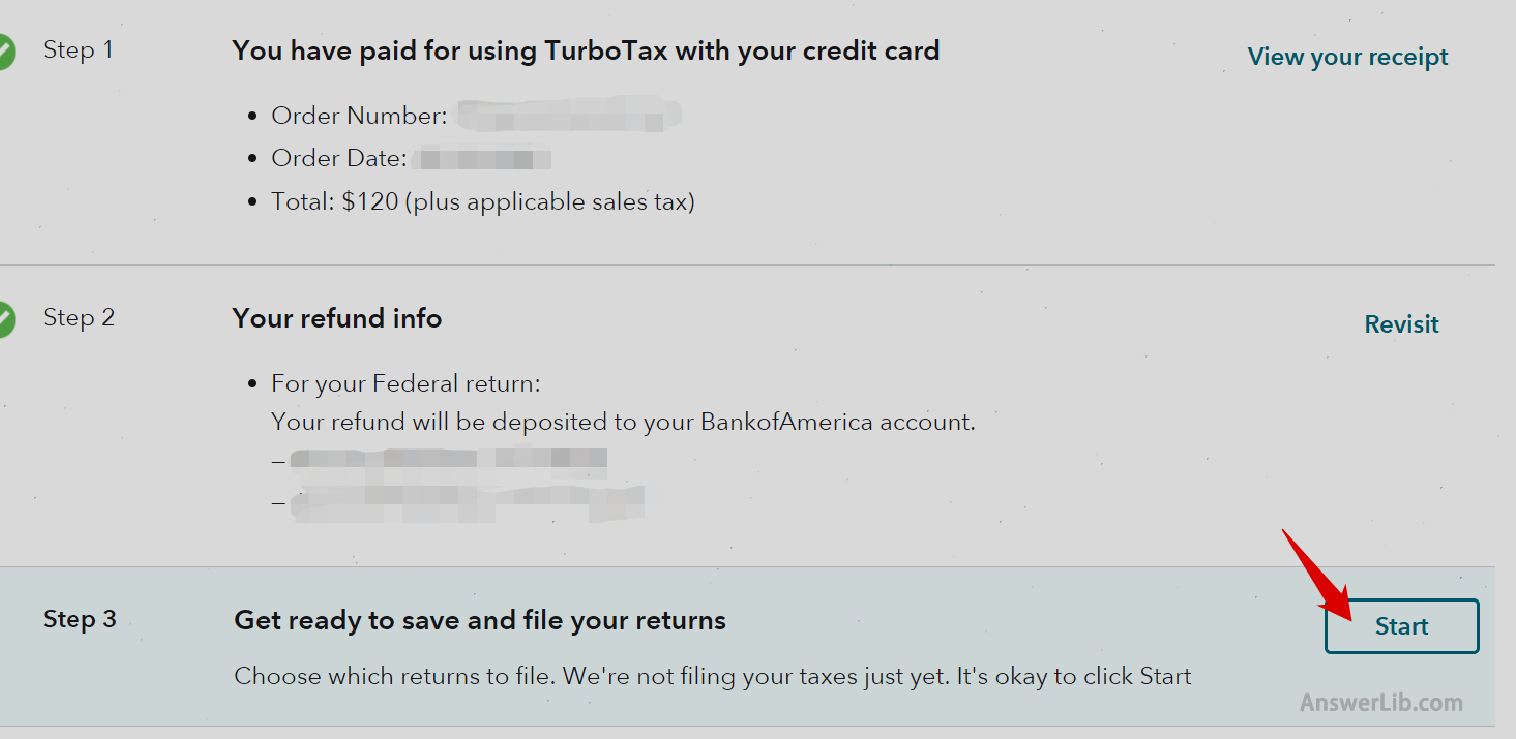

Before the last file, you also need to complete the following three steps:

- Confirm the Turbo Tax software you bought again;

- Choose the method of reporting the tax form to the IRS and the state government;

- Choose a tax table that requires FILE;

After filling in your tax refund information, the third step is left: the tax will be started.You need to fill in your driver’s license or document information, and confirm that the information filled in again is accurate.

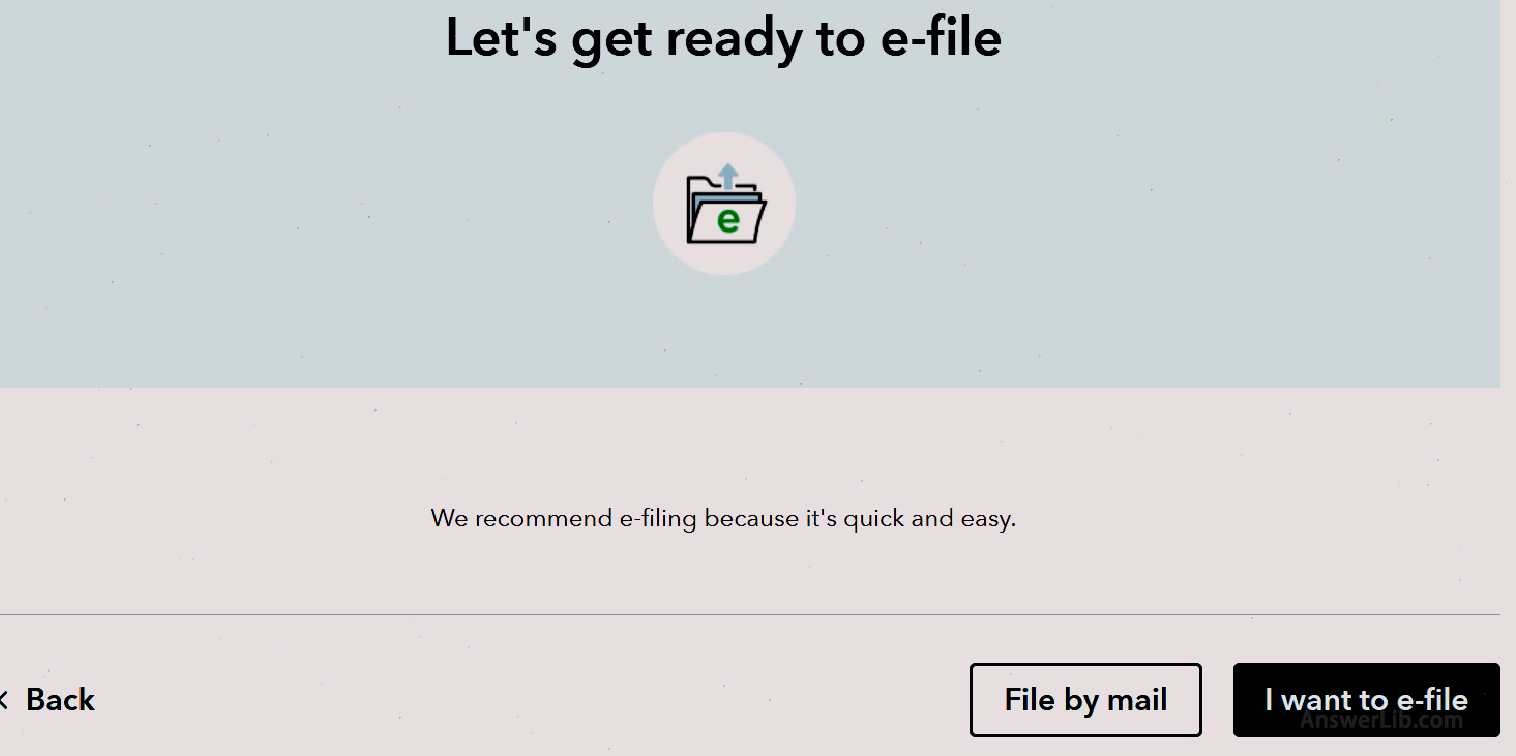

Next, you can choose to mail the tax form, or submit the tax list (E-File) online.We use E-File every year, simple and convenient, and the tax refund is fast.

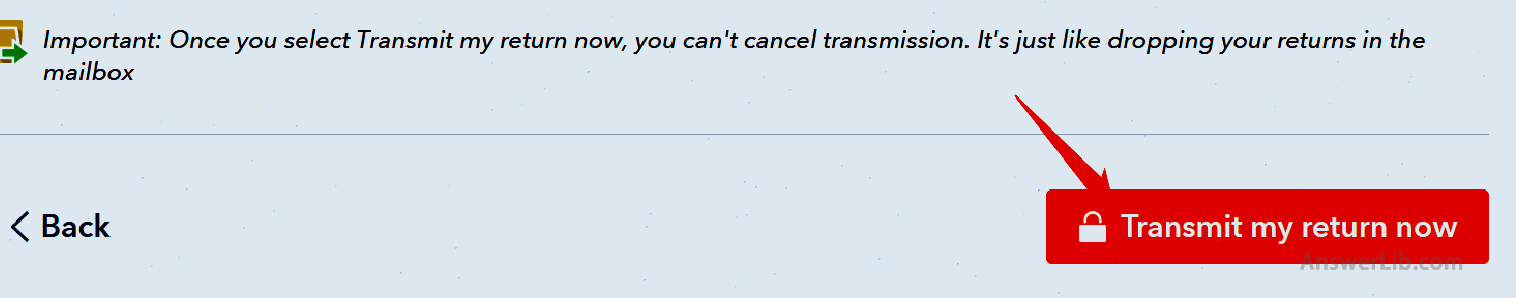

Finally, click the button [Transmit My Return now] to complete the final tax refund process.Please note: When you click the button, the tax reporting process is completed, which is equivalent to sending the tax sheet to the mailbox.There is no way to fill in again.

After completing the above three steps, congratulations, you will complete the 2020 Tax year tax return!

Some thoughts about saving taxes

Calculating formula for taxable taxes:

Total tax = (total income -AGI reduction item-tax reduction) X tax rate-tax subsidy

TOTAL TAX = (Gross Income – Agi Deduction -DEDUCTION) X TAX Rates -TAX CREDIT

For provincial taxes, you can refer to:

- Improve AGI reduction items, for example, using Flexible Spending and Child Spending Acount.If you are a self-employer, you can consider opening a Self-Employed 401k.The income deposited in these accounts belongs to the AGI reduction item.

- Improve DEDUCTION, although most people are suitable for standard tax reduction (Standard Deduction), but if you or your family has a large amount of consumption or a large amount of medical expenses in the tax year, you can consider whether it is more suitable for tax reduction (Itemized deduction).

- Full use of tax subsidies.

references

- Internet revenue service

- 1040 Fill in Guide

- Turbo tax

- US tax reporting software comparison: Turbotax, how to choose taxact?

common problem

Question 1: When will the federal tax declaration of 2022 TAX Year stop?The deadline for submitting the 2022 tax form is: April 1, 2022 8 day Essence

See More

This depends on your income and spending, you may need:

W-2: Go to work in the company, or do TA/RA at school, etc.

1099-IT table: Interest interest in banks;

1099-DIV table: The dividends obtained by buying stocks;

1099-B: The profit of selling stocks and securities;

1099-MISC table: Rental, self-employed income, etc.;

1099-S: S: The income of the sale of the property, etc.;

1099-g table: Income from the pension plan;

Top 1098: If you are still paying your house in installments, it shows the loan interest rate and points you paid;

1098-E: The child’s loan interest on college;

1098-T table: The amount of tuition payment for children to college;

1099-R meter: IRA retirement plan and annuity income;

1099-SA table: The amount extracted from the health account;

K-1 table: Partnership business;

You and your family (including children) Social Security (SSN);

Property tax (Property Tax) payment credentials;

Children’s payment records of kindergartens and various interest classes (the TAX number of interest classes);

Car Registration;

Medical Expense at home;

If you are Self-Employment, you need all records and records of income and spending;

See More

sure.You can easily complete the tax reporting by tax reporting software, such as Turbo Tax.Turbo Tax will take you to complete the filling of all income and expenditure by asking questions.At the same time, calculate the most suitable tax for you.At the same time, these tax reporting software provides the function of real-time connection CPA, which can answer your various tax issues.

See More

The basic principle is: if you add up the total number of projects that can be reduced than Standard Deductions, select itemized depuctions; otherwise, select Standard Deductions.

See More

More American Raiders

- Common Property State in the United States: What are the property systems of American couples?

- What is social security tax and medical insurance tax?Social Security Tax & Medicare Tax

- American driver’s license is directly changed to Chinese driver’s license?Written test, no driving test, just one day

- How about gocashback [2024] An account is $ 8 award

- How to buy cosmetics during pregnancy?What else is worth recommending?

- What is web3 [2024] 11 innovative technologies related to life

- What is i94?How to print I94 form?Entry -Exit Listing Card Analysis

- What is Global Entry Plan [Global Entry] detailed step diagram

- Nursing common sense and common disease response of newborns 0-3 years old

- How to choose the American K-12 school?Public and private • magnetic university? CHARTER?

- Which mathematical thinking class is strong?AirClass vs pea thinking vs spark

- The best online art class [2024] How children learn to draw online

- How about ACG International Art Education [2024] A good assistant for art advancement

- American passport visa-free country [2024] 132 countries fly arbitrarily

- How about pea thinking [Give $ 20] Stimulate interesting mathematical thinking lessons

- Green Card application process [2024] Detailed explanation of American green card category

- American car maintenance guide [2024] Automobile maintenance time arrangement

- Learn Chinese website Daquan [2024] The best online Chinese course

- American plot gift [2024] Learn TA and then send the pair of gifts!

- How to open a shop in Amazon?Amazon e-commerce is red and red