Technical analysis, English is TechnicalAnalysis It is a kind of analysis Transaction data Come on investment analysis, Trend judgment as well as Transaction point recognition Investment analysis method.

Technical analysis and Fundamental analysis(Fundamental Analysis), becoming the two most important financial investment analysis methods.Technical analysis is more concerned about human nature, that is, paying attention to the ideas of other investors, and fundamental analysis pay more attention to the company itself, such as the company’s profitability or cash flow status.You can usually follow the business, such as Tradeup certificate d Finding technical face analysis data and fundamental analysis data provided in the analysis data provided.

- If you pay attention to short-term speculation through technical analysis, then the money you earn is actually the money that other investors pay, which is often said ” Zero-sum game“, English is Zero-Sum Game Essence

- If you invest in growth companies through fundamentals, you may pay more attention to the future growth of the company, then the money you earn mainly comes from Company’s profitability growth Essence

Technical analysis focuses on the price and quantity of transactions.By collecting various data, data statistical analysis is performed, chart production, etc., and the analysis results are displayed in the form of digital statements and intuitive graphics.Analysts or investors obtain the trend of the market from the data table or graphics report, estimate the future trend, and judge the most appropriate investment opportunities.

The technical analysis considerations are investors’ sensitivity to numbers and the ability to use statistics.Unlike fundamental analysis, technology will not pay attention to factors such as the company’s operating model and overall economic environment, and pay more attention to numbers and trends.

pass Tradeup certificate d[[[[[ Open an account], You can analyze the trend and fluctuations of stock prices through a variety of technical indicators and analysis tools provided by it, such as mobile average, relatively weak index (RSI), random indicators, etc.also, Tradeup securities It also provides information such as stock charts and trading volume, which can help you better understand the reasons and trends of changes in stock prices.

exist Tradeup certificate d Opening an account and deposit, you often have the opportunity to draw multiple US stocks and check TradeUP account opening reward and detailed account opening guide Essence

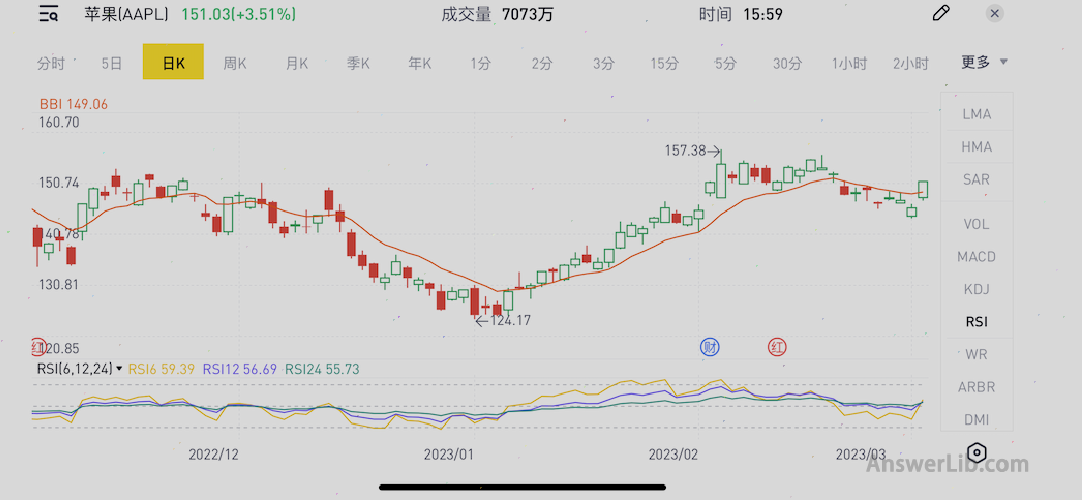

In the explanation, we use Apple stock AAPL as a demonstration.The stock is only used as a demonstration content, not to guide you to buy the stock.Remember: the stock market is risky and investment needs to be cautious.

Directory of this article

- What are the technical analysis?

- What are the main types of technical analysis of the company?

- What are the methods of analyzing the company’s technology?

- How to use Tradeup for technical analysis?

- What are the characteristics of technical analysis?

- TradeUP certificate account opening

- More investment foundation

What are the technical analysis?

The core idea of technical analysis is that the market price reflects all available information that may affect the market.Therefore, technical analysts will pay most of the energy on the stock price trend of listed companies.

Technical analysis usually pays attention to multiple indicators related to stock prices, including::

- Price trend(Trends): The price trend refers to the change direction and trend of the stock price within a certain period of time.Price trends can be divided into upward trends, decline trends, and consolidation trends.Some investors will predict the trend of future stock prices by observing the trend and change of stock prices.

- Transaction volume(Volume): The transaction volume refers to the number of stock transactions in the given time period.It is an important indicator of market participants and one of the most important indicators in technical analysis.

- Quantity indicator(Momentum Indicators): Dynamic indicators are a type of indicators commonly used in technical analysis.They are usually used to measure the speed and amplitude of changes in stock price.The momentum index is usually presented in a straight line under the price chart.Investors can determine the price trend and the kinetic energy of the stock price according to the changes in the momentum index.

- Oscillator indicator(Oscillators): The oscillator indicator refers to the establishment of a high and low zone between the two extreme values of the stock price, and then set the trend indicator when the price enters these areas.Investors can use these toolsEssence

- Moving average(MOVING AVERAGES): The moving average is also one of the most basic attention indicators in technical analysis.It smoothly updates the average price line to smooth the price data in the pavilion.It can be 20 minutes, 10 days or a week, etc.

- Support and resistance level(SUPPORT and Resistance Levels): The support level and resistance level represent the time point of the current stock and demand relationship in the market, which is essential for analysts to analyze stock price analysis.

What are the main types of technical analysis of the company?

There are two main categories of technical analysis: Chart mode and Technical indicator Essence

Chart mode (Chart Patterns)

The chart mode refers to the use of a series of trend lines or trend curves to analyze the price change in the form of graphics.Technical analysts will look for price reversal or continuous signals from the fluctuations in the chart.

The chart mode has certain subjectivity.Technical face analysts judge the information prompts on the chart through various data charts, and then determine a variety of indicators such as supporting areas and resistance areas based on certain subjective psychological factors.

The chart mode of technical analysis usually has the following:

- K-line chart(CandleStick Chart): K-line diagram is one of the most widely used chart modes in technical analysis.It presented the fluctuation of the stock price in an intuitive way, including information such as opening price, closing price, the highest price and minimum price.

- line chart(LINE Chart): The folding diagram mainly reflects the changes in the trend of the stock price, which is presented in the form of lines that connect all price points.

- Pillar(Bar Chart): The column-like diagram is usually used to present the stock transaction volume.The volume of each trading day is represented by vertical strips.

- Bollinger Line(Bollinger Band Chart): The Bollinger line diagram is a chart pattern based on the Bollinger index, which mainly reflects the fluctuations and trends of the stock price, including information such as mid-rail, upper or lower rail.

- MACD diagram(MOVING AVERAGE Convergence DiverGence Chart: MACD diagram is a chart mode based on MACD indicators, which mainly reflects the long-term trend and short-term volatility of the stock price, including DIF, DEA, and MACD.

Technical Indicators

The technical index of technical analysis is a mathematical formula and algorithm used to analyze the price trend of stock prices and market trends.These indicators usually help analysts to better predict the trend and trend of future prices by calculating changes in price and transaction volume.Technical indicators can be divided into different types according to their characteristics, such as dynamic indicators, trend indicators, oscillators, and so on.

Technical indicators in technical analysis usually use computer programs to calculate and present, and investors can use these indicators through stock trading platforms or other analytical tools.Common technical indicators include Moving average(MA), Relatively strong indicators(RSI), Bulin line indicator(Bollinger Bands), average real range indicator (ATR) and so on.

What are the methods of analyzing the company’s technology?

In the specific technical analysis, there are several commonly used methods, including Draw a candlestick picture,, Set the moving average As well as Pivot point and Quantity indicator wait.

Candlesticks (Candlesticks): The candlestick chart is also the “K-line diagram” often referred to as a technical face analysis method based on the icon mode.It is also the most commonly used method for tracking price changes.The candlestick chart is drawn from the price within a single time period in any time.For example, each candlestick on the hour chart indicates the price trend within an hour.Each candlestick on the 4 -hour chart represents the one within 4 hours of 4 hours.Price trend.When drawing a candlestick, its highest point is the highest point of the company’s stock price within the setting period, and the lowest point is the lowest point of the company’s stock price within this time period.Each “candlestick” is drawn in blue or red, indicating that the opening price and closing price within this period of time, the blue “candlestick” indicates that the closing price is higher than the opening price, and the red “candlestick” means that the opening price is higher than the closing price.Some investors also use black and white as the color of the “candlestick”, or other colors.Through the candlestick, technical analysts or investors can intuitively determine that the stock price will be higher or lower at the end of the given time according to the height and color trend of the candlestick to the end of the given time period.

Moving Averages: Moving average is a technical analysis method based on technical indicators.It is the most basic and most widely used method.Technical analysts can set up one or more mobile average to help them quickly judge the trading point, such as setting up “the price is maintained at the 30 -cycle index and the moving average can be bought.In order to simplify the judgment of the investment point to quickly determine the transaction.At the same time, you can also set a more complicated cross-moving average, such as setting up the “10 -cycle moving average of more than 30 cycles of moving average” and so on.

Point point (Pivots): This is also a technical analysis method based on technical indicators.The significance of the pivot point is to indicate important support levels or resistance levels.Analysts or investors will use it to determine the price range of their own or closing positions.Generally, if the pivot point and support or resistance level suddenly rise or fall, investors will think that a “breakthrough” transaction will occur, which means that the market price will rise or fall sharply in the direction of the current range.

Momentum Indicators: This is an analysis method based on technical indicators to measure market volatility.The basic concept of this method is to determine whether the current price trend is normal small fluctuations or an important fluctuation trend by measuring the intensity of price fluctuations.The size of the momentum index can be used as a signal of trend change.For example, after a stock has maintained a strong and continuous upward trend for a period of time, its momentum indicators have begun to weaken steadily, indicating that the rise of this stock has begun to fall.Investors can start considering consideringSell.In addition to the most basic momentum indicators, there are relatively complicated Relatively strong indicators(( Relacted Stringth Index, referred to as RSI), Move the average convergence/divergence indicator(( MOVING AVERAGE Converge-DiverGence, referred to as MACD), Average trend indicator(( Averse Directional Movement Index, referred to as ADX) such as a variety of momentum index analysis methods for more advanced technical analysis.

How to use Tradeup for technical analysis?

Tradeup securities It is an American online broker that provides stock transactions and investment services.In its website and APP, it provides some technical analysis tools and information, such as real-time stock market, stock charts and technical indicators to help investors make technical analysis and investment decisions.

Tradeup provides basic candle maps ( CandleSticks) The table analyzes the price.Chart software includes 22 technical analysis indicators, including common indicators such as MACD, RSI, and Bollinger Bands.

For some indicators, such as BBI, you can stack it on the candlestick map; for other technical indicators, such as MACD, RSI, you can display it below the candlestick at the same time point.

Below, let’s introduce how to find technical indicators in Tradeup:

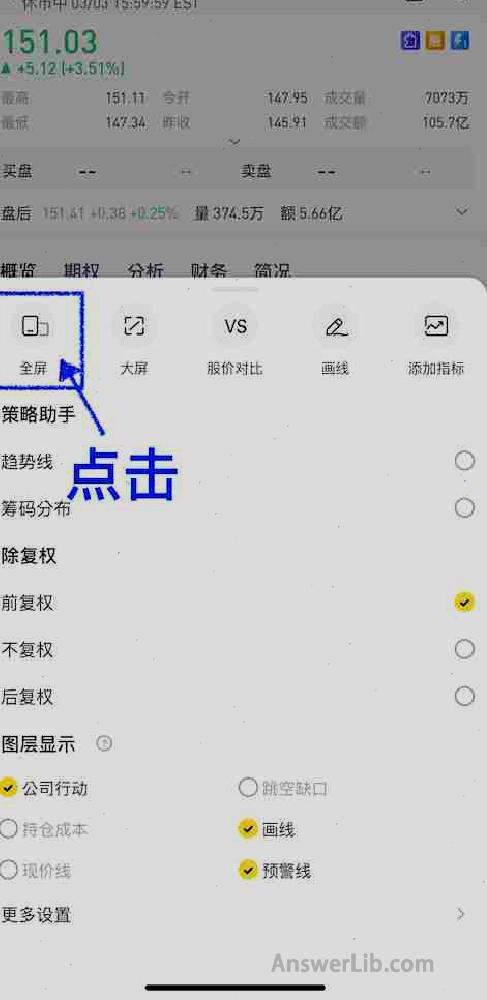

Step 1: Find the button in the left figure below in the Tradeup App, and click [Full screen] in the subsequent page (below).

Step 2: You can see the candlestick map of a specific stock.In the right list, you can choose to display the technical indicators.By drawing down the list, you can find a total of 33 technical indicators, including the BBI indicator that is being displayed.Some indicators are overlapped in the candlestick, and some technical indicators are displayed directly below the candle table.

Step 3: Add technical indicators such as RSI, these indicators are displayed below the candlestick.

Step 4: Select the time period displayed in the technical face indicators, such as the daily K line, the month K line, the year K line or other time periods.

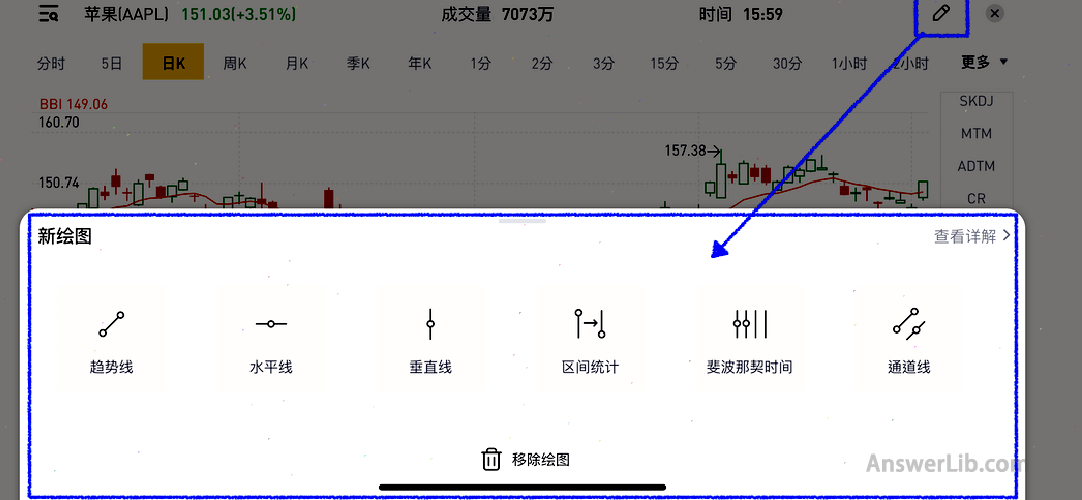

Step 5: In addition, the TRADEUP APP also provides some drawing tools, you can customize the corresponding technical indicators.

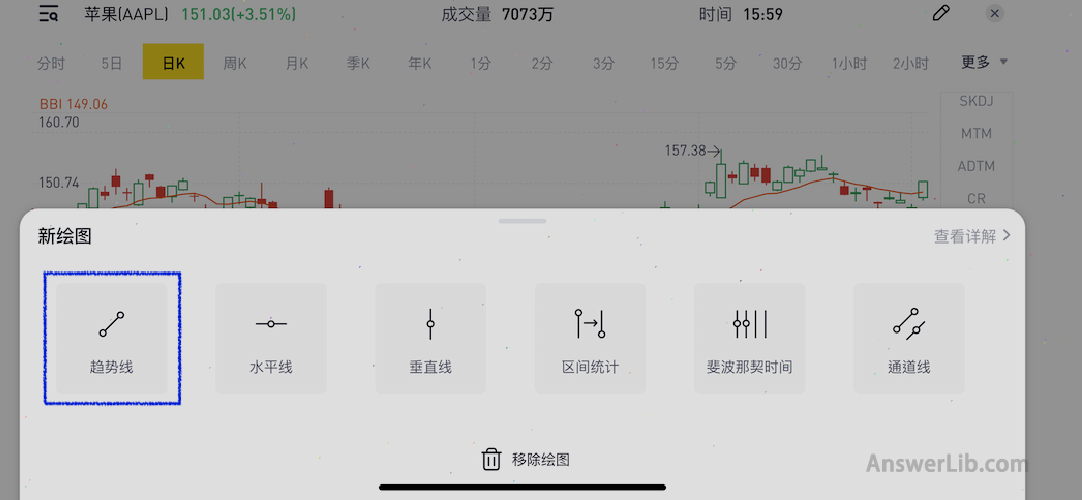

Here you can have six graphic lines to choose from:

- Trend Line: Line tools, as trend lines are the simplest drawing used by technical analysts.It is used to express trends and their acceleration, application fan, analysis of relative steepness and other purposes.

- Horizontal line: Horizontal tools, the price level is a one-vertical time, which acts on the labeling of specific prices, support, and resistance lines.

- Vertical line: vertical line tool, the time horizontal line is a line vertically at a specific time.

- Channel line: Channel Line Gongbei

- Interval statistics

- Channel

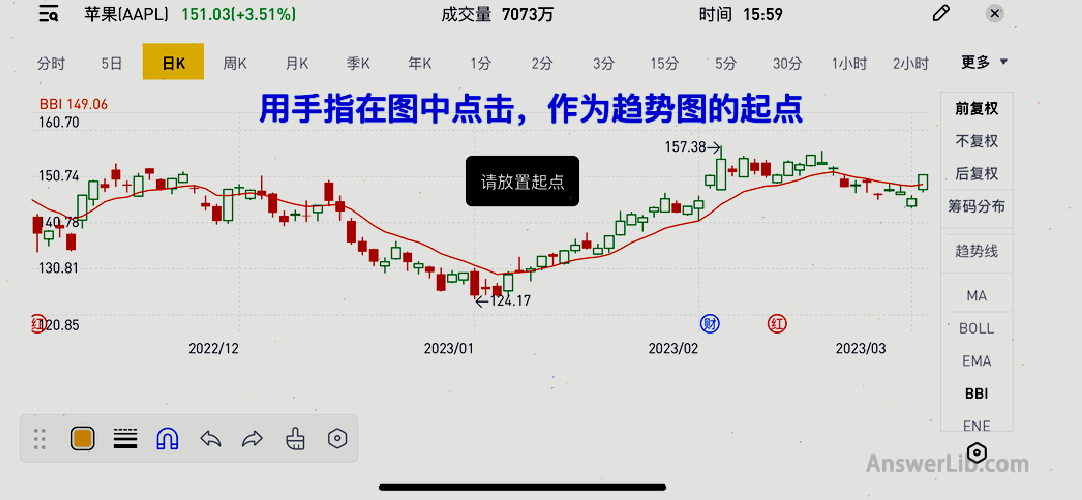

Taking the trend line as an example, click the option [Trend Line].

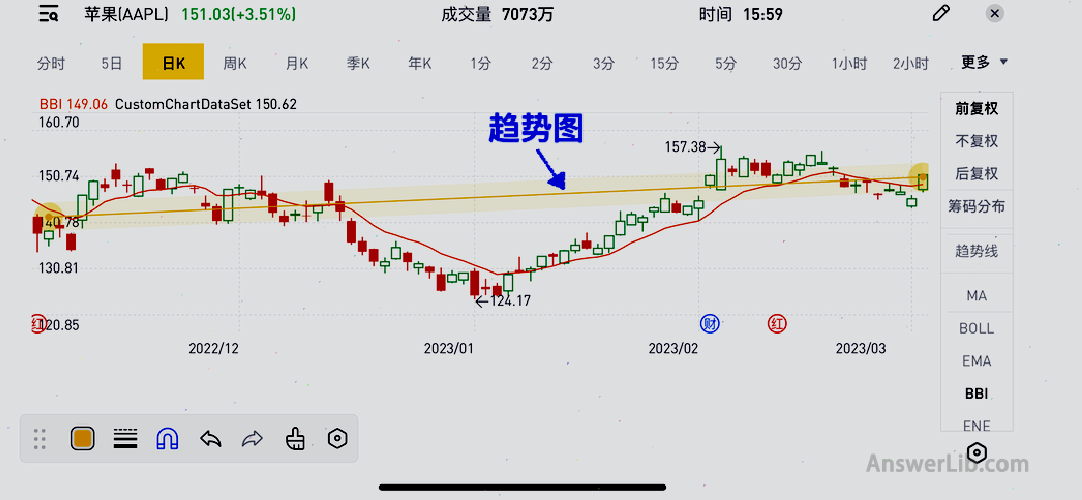

Then, click directly on the candlestick with your fingers to select the starting point and end point of the trend line:

In this way, the trend chart is automatically drawn, and it is very convenient to use.

Below is currently provided by the TradeUP App 34 Indicators of technical face analysis:

- Ma Besides Moving average(MOVING AVERAGE) is a method used to fluctuate the stock price fluctuations, which helps observe the trend and change of stock price, mainly including simple mobile average (SMA) and index moving average (EMA).

- Boll: Bollinger Bands, Bollinger Bands, Bollinger belt consists of three lines.Among them, the intermediate line is a simple moving average of the stock price, and the upper and lower lines are the standards for the standard difference of the stock price.The Blin belt can help analysts determine the volatile range of the stock price and the possible direction of the price change.

- BBI: Bull and Bear Index, it is a comprehensive technical indicator.The calculation method of the BBI is to add the five different cycles of mobile average, respectively, the moving average of the 3rd, 6th, 9th, 12th, and 26th, and then divide it from 5 to get a average value.

- ENE: Elder ’s Force Index is a technical indicator proposed by Alexander Elder, a stock trading expert Alexander Elder.The Elf’s Energy Index can help analysts recognize the trend and change of stock prices and judge the strength and momentum of price changes.

- PBX: Price and Volume Trend Indicator, it is a comprehensive technical indicator.Based on the relationship between the stock price and the volume of the PBX indicator, it can help analysts to determine the strength and direction of the stock price trend.

- Mike: A technical indicator proposed by stock analyst Michael S.Koval.The Mike index can help analysts identify the trend and change of stock prices and provide signals for buying and selling.

- VMA: Volume Moving Average, which is a technical indicator based on transaction volume.VMA can help analysts identify the trend and change of stock prices, and judge the amount and strength of the changes in stock prices.

- LMA: Linear Moving Average, which is a technical indicator based on stock price.LMA can help analysts identify the trend and change of stock prices and provide signals for buying and selling.

- HMA: Swamina’s Hull Moving Average is a technical indicator based on stock price.HMA can help analysts identify the trend and change of stock prices and provide signals for buying and selling.

- Sar: Stop and Reverse Indicator, also known as Parabolic Sar Indicator, can determine the turning point of the stock price trend and provide signals to buy and sell.

- VOL: Volume Indicator, which can identify the amount and intensity of the changes in the stock price, and judge the market pressure and strength of the market.

- MACD Besides Mobile average convergence/divergence indicator(MOVING AVERAGE Convergence DiverGence) can recognize the trend of changes in the stock price and provide signals to buy and sell.

- Kdj: Random indicators (KDJ Stochastic Oscillator), consisting of three curves: K line, D-line and J line.The calculation of the KDJ indicator is based on the highest price, lowest price and closing price price data.K-line represents the speed of stock price changes, line D represents the average value of the K line, and the J line represents the gap between K line and D line.

- RSI Besides Relatively strong indicators(Relative Stringth Index) is a technical indicator for measuring the strength and speed of the stock price.It can be used to determine the sale power of the stock price and provide a signal of buying and selling.

- WR: The full name, also known as the “William Indicator”, was founded by the American trader William Fan En.The WR index is usually used to analyze the trend of short-term market changes.By calculating the ratio between the highest price and the lowest price within a certain period of time, it evaluates the stock price of the stock price.Under normal circumstances, the WR index is calculated by the 14 -day period cycle.

- ARBR: The full name is Asking-Bid Ratio, founded by Chinese analyst Shao Ping.The calculation of the ARBR indicator is based on the sale power in the stock market.The ARBR indicator uses the 5th or 10th time cycle to calculate, including two lines: popularity and will.Among them, the popularity line represents the ratio of buying and selling on the market on the day, and the willingness line represents the change in the market’s transaction volume.

- ADX: A trend indicator, full name Average trend indicator(Directional Movement Index).The ADX indicator judges the rise or decline of the stock price by comparing the price of the stock price the day before and the day, and provides signals for buying and selling.The DMI indicator contains two lines:+di line and-DI cable.+DI line represents the power of the upward trend.The -Di line represents the power of the decline.

- ATR: The full name is the Average True Range, which is used to measure the amplitude and degree of change of stock price fluctuations.The calculation of the ATR indicator is based on the fluctuation of the stock price, and the difference between the closing price of the previous day and the highest price and the lowest price on the day.The ATR indicator usually uses a 14 -day time cycle to calculate.

- DMA: Difference of Moving Average, which is a trend indicator to measure the direction and strength of the trend of stock prices.The DMA index is evaluated to evaluate the trend direction and strength of the stock price by calculating the short-term movement average of the stock price and the long-term mobile average.DMA indicators usually use the 10 -day mobile average and 50 -day mobile average to calculate.

- CCI Besides Commodity channel index(Commodity Channel Index) is an indicator for measuring the trend and intensity of stock price fluctuations.The CCI indicator is to determine the trend and intensity of price fluctuations by calculating the difference between the stock price and the average price.The CCI indicator usually uses the 20 -day time cycle to calculate.

- MFI Besides Capital flow index(Money Flow Index) is an indicator for measuring the fluctuation of stock price fluctuations.The MFI indicator is to determine the trend and strength of price fluctuations by calculating the relationship between the volume and the stock price.The MFI indicator usually uses a 14 -day time cycle to calculate.

- EMV: Ease of Movement Value, which is an indicator for measuring the trend and intensity of stock price fluctuations.The EMV indicator is to determine the trend and strength of price fluctuations by calculating the relationship between the volume and the stock price.The EMV indicator can help analysts determine whether price fluctuations are caused by changes in the volume or the change of the price itself.

- ROC: The change rate indicator, also known as the change rate indicator, is used to measure the rate and degree of changes in the stock price.The ROC indicator is to determine the rate and degree of price change by calculating the percentage of stock price changes.The ROC indicator usually uses a 12 -day time cycle to calculate.

- SKDJ: The variant of the KDJ indicator is used to measure the trend and strength of the stock price.The SKDJ index is to determine the price trend and strength by calculating the relationship between the closing price and the highest price and the lowest price.The SKDJ indicator usually uses a 9 -day time cycle to calculate.

- MTM: Momentum, which is used to measure the rate and degree of changes in stock price.The MTM indicator is to determine the rate and degree of price change by calculating the absolute value of the stock price change.The MTM indicator usually uses a 12 -day time cycle to calculate.

- Adtm: Dynamic buying and selling gas indicators (ACCUMULATION DISTRIBUTION TRENDLINE MULTI TIMEFREFRAME), used to measure the sale of stock prices.The ADTM indicator is to determine the price of price trading by calculating the relationship between the trading volume and price change within multiple time cycles.The ADTM index is calculated using multiple time cycles.The commonly used time cycle is 5 days, 10 days, 20 days, 30 days, 60 days, etc.

- Cr: Cumulative Return, which is used to measure the stock price of stock prices.The CR indicator is to determine the price of the price by calculating the relationship between the stock price and the volume.The CR indicator usually uses a 26 -day time cycle to calculate.

- Trix: Trirate Index Smooth Moving Average, which is used to measure the rate and trend of changes in stock price.The TRIX indicator is to determine the rate and trend of price changes by calculating the three-heavy index of the stock price to smooth the average.The TRIX indicator usually uses a 12 -day time cycle to calculate.

- Bias: (:: (BIAS), which is used to measure the degree of deviation and trend of the stock price, indicating that the extent and trend of the stock price for the moving average.When the value of the BIAS indicator is negative, it means that the stock price is in a downward trend.

- PCNT: Percentage Change (Percentage Change), which is used to measure the change and trend of the stock price.The value of the PCNT indicator indicates the percentage of the stock price change.When the value is negative, it means that the stock price is in a downward trend.

- DKX: DiaoKongxi, which is used to measure the long-short forces and trends of stock prices.The value of the DKX indicator indicates the long and short force and trend of the stock price.When the value of the DKX indicator is positive, it means that the bulls are strong and the stock price is on the rise; when the value of the DKX indicator is negative, it means that the short power is strong.Stock prices are in a downward trend.

- UDL: UP and DOWN LINE, which is used to measure the power and trend of rising stock prices and declines.The UDL indicator is to determine the rise and fall of the price by calculating the rise and fall of stock prices in multiple time cycles to determine the power and trend of prices and declines.The UDL indicator usually uses a 10 -day time cycle to calculate.When the value of the UDL indicator is high, it means that the stock price rises is strong; when the value of the UDL index is low, it means that the stock price fell strong.

- VRSI: Volume Relative Stringth Index, which is used to measure the strength and trend of stock prices.The VRSI indicator is to determine the strength and trend of the price by calculating the ratio of the stock price in multiple time cycles to the average transaction volume.The VRSI indicator usually uses a 10 -day time cycle to calculate.When the value of the VRSI indicator is high, it means that the stock price is relatively strong; when the value of the VRSI indicator is low, it means that the stock price is relatively weak.

- XS: EXCESSIVE Stream, which is used to measure the strength and trend of stock prices.The XS indicator is to determine the strength and trend of the price by calculating the closing price of the stock price in multiple time cycles relative to the degree of deviation of the moving average.The XS indicator usually uses a 10 -day time cycle to calculate.When the value of the XS indicator is high, it means that the stock price is relatively strong; when the value of the XS indicator is low, it means that the stock price is relatively weak.

- Bibiboll: Pen’s Pen’s Pen Line Index, which is further developed on the basis of the Bollinger indicator.The Bibiboll index adopts the concept of pens, and determines the market’s sale and entry and exit signal through the pen formed by identifying the medium and long-term trend of the market.Its calculation method is to translate the mid-rail of the Bollinger index upward to a certain proportion of standard deviations, form a new upper orbit, and then translate the mid-rail downward to the same proportion standard difference to form a new downrom.When the price breaks through the lower track, there will be oversold signals in the market, and you can consider buying.When the price breaks through the upper orbit, the market has a super-buy signal and can consider selling.

What are the characteristics of technical analysis?

The biggest advantage of technical analysis is that the energy is concentrated in the stock price and the volume of trading, combined with a variety of data models and chart production to analyze, which greatly simplifies the process of trend judgment and helps to accelerate the development of investment decisions.

Several characteristics of technical analysis are as follows:

- Historical data: Technical analysis is mainly through analysis of historical prices, trading volume, etc.to predict the future trend of stock prices.Therefore, technical analysis pays more attention to the historical market and price trend of the market.

- Presented in graphics: Technical analysis usually uses charts and graphics to present data such as price and transaction volume to help analysts observe the trend and price changes in the market more intuitively.

- Relatively short-term: Technical analysis pays more attention to short-term price changes and trends, and the indicators and tools that are usually used also pay more attention to short-term price fluctuations.

- Main attention to price changes: Technical analysis mainly focuses on price changes, often ignoring the company’s fundamental factors, such as performance, financial status, management and other factors on the stock price.

- Can be combined with other analysis methods: Although technical analysis is an independent analysis method, it can also be combined with other analysis methods, such as fundamental analysis, event drive analysis, etc.to obtain more comprehensive investment decisions.

However, there are some disadvantages of technical analysis.Because the data used during analysis are historical data, some analysts or investors believe that history will not repeat it repeatedly.It is their biggest questioning point for technical analysis.

Another point is the followality of investors.When technical analysts or investors judge that the price enters a certain range, it is suitable for selling, so when the stock price enters that area, it will start selling.In the market, other investors in the market will follow the selling of the stock price, which further leads to a decline in the stock price.From the data point of view, the stock price does began to fall as the technical analyst estimated, but this has nothing to do with the company’s own operating ability.It is more caused by market emotions.

TradeUP certificate account opening

More investment foundation

- What is a necessary return?Required Rate of Return

- What is the American Commodity Futures Trading Commission?CFTC

- What is a credit default? Credit Default Swaps

- What is “oil dollar”?Petrodollar

- What is technical analysis?Technical Analysis

- What is fundamental analysis?Fundamental Analysis

- What is short transaction?Short Selling

- Year-on -year VS?MOM, QOQ, YOOY

- How to query financial institutions to hold positions? FORM 13F

- What is mortgage support bond?Mortgage-back security