Common Fund, English is Mutual Funds, a financial product in financial investment wealth management products, second only to stock (Stock) financial products.The common fund is different from ETF The common fund is generally managed by the fund manager.You generally need to buy at the Investment Company, and ETF is a fund that can be traded by stocks.You can use any of your own use Quotient Trading.

The fund that the common fund raised because of the trust of investment institutions is often under strong supervision.Generally, the risk is relatively small.It is favored by most stable investors.It is also a reasonable choice for investment entryrs as trying.What do you need to know about common funds?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is a common fund?

- What are the categories of common funds?

- What are the characteristics of common funds?

- What are the fees for the common fund?

- How does the common fund operate?

- How risks are the risks of common funds?

- How to deal with common funds?

- How to profit through the common fund?

- Introduction to several American common funds

- The difference between the common fund and hedge fund

- common problem

What is a common fund?

The common fund is based on the professional knowledge of the fund manager and its credible professional team.It is issued by the fund company to collect funds from social investors.Derivatives and other investment products to obtain interest, dividends and capital benefits.

The common fund is managed by a professional financial practitioner, that is, the fund manager.Because the common fund is the public’s investment in financial institutions, and the possibility of deliberate fraud, the governments of various countries have strictly managed the common foundation.

The United States is the strictest country.The establishment of common funds, information disclosure, transactions, changes in capital structure, and dissolution have received strict legal control.

Related Reading:Ranking and comparison of the 12th National Congress of the United States

What are the categories of common funds?

According to the types of securities invested in the portfolio, the common funds are: stock funds, bond funds, currency market funds, balance funds, index funds, and other types of funds.

1.Equity Fit

The stock fund invests in a series of listed companies stocks.At present, most of the common funds in the market are stock funds in various industries or cross-industry.Stock funds often fluctuate with the stock market, and of course have greater growth potential.

Depending on the type of stock type, stock funds can be divided into different categories.

According to the company scale

- Hirosarius: the market value of listed companies exceeds 10 billion US dollars;

- Mid-market Fund: The market value of listed companies is between US $ 2 billion and $ 10 billion;

- Small Pan Fund: The market value of listed companies is between US $ 300 million and $ 2 billion;

According to the industry or department

Some investors tend to invest in company stocks in a specific field for their own situation, such as oil and gas energy, medical care, and technology.

Growth type and value type

- When choosing an investment in stocks that will be high than the average level of stocks, these funds are called growth funds.

- When choosing a company stock that is considered by the market to be underestimated, this kind of fund is called a value-based fund.

Different regions of investment

When investing in companies outside the United States, it is called international funds; when investing in companies in many countries including the United States, it is called a global fund; when the investment market is small but grows a good growth trend, it is called emerging market funds.

2.Bond Funds (Bond Funds)

Bonds have the characteristics of fixed income, so bond funds are also fixed income-type common funds.It is a common fund second only to stock funds on the market, and is the favorite fund type of conservative investors.

Such funds are invested in government and corporate debt, and the income is stable but the growth potential is not as big as stock funds.

3.Money Market Funds

The investment targets of this type of fund include short-term debts such as US Treasury Bonds and commercial bills.They are low-risk funds like bond funds, and currently account for about 15%of the fund market.Such funds do not increase very high returns, but usually higher than bank deposit interest.

4.Balanced Funds

Balanced Fund has also become an asset allocation fund, which is invested in hybrid assets, including stocks, bonds, currency markets or other investment objects.The main purpose is to diversify the risk through exaggerated investment.It can be divided into dynamic proportions and fixed proportion according to the fixing of the proportion of investment objects.

- Dynamic ratio: Refers to investors to reserve a certain proportion of floating space for various investment objects, and then adjust the proportion at any time according to the market conditions to obtain higher returns.Of course, risks will change accordingly.

- Fixed proportion: That is, the proportion of various categories in the investment objects is always fixed, such as investing at 60%of the stock and 40%of the bond ratio.The target date fund that retirees in this type of fund are the most familiar with the target date.This type of foundation automatically distributes the investment ratio when it is close to investors to increase the proportion of bonds to increase the security of pensions.

5.Index FUNDS

Fund managers of this type of fund will purchase stocks corresponding to major market indexes such as the Standard Pur 500 Index or the Dow Jones Industrial Average Index.Rate is often better than active investment strategy funds.It is similar to stock funds, and it will also be different due to the size and industry of the investment target.

6.Other funds

In addition to these popular funds, there are currently social responsibility funds-Socially Responsible Funds (only invested in companies that meet certain standards or beliefs), special funds-Specialty Funds (including real estate investment trusts, etc.) and even funds-Funds ofFunds (investing in other common funds of other common funds).

What are the characteristics of common funds?

1.Diverse investment objects

The common fund has no specific investment target, and the fund manager allows the fund manager to mix in the investment portfolio to increase the return of investment portfolios and reduce risks.

The diversification of the common fund is reflected in the investment portfolio can have hundreds of different stock securities in different fields and industries, as well as bonds of different periods and issuers.

Compared with purchasing personal securities, buying a common fund can achieve diversified investment cheaper and faster.

2.Easy to enter investment

Common funds can be relatively easy to trade on the major securities exchanges, making them a financial investment project with high liquidity.Common brokers include Charles Schwab, E-Trade Financial, TD American, etc.

In addition, for some special types of assets, such as foreign stocks or unpopular derivatives, common funds are usually the most feasible way for individual investors to participate in investment, sometimes even the only way.

3.Low-cost scale investment

When investors buy multiple securities separately, a large amount of transaction fees will be incurred.If they create a diversified investment portfolio by themselves, a large amount of commission is required, so that a large part of the initial investment is lost.

And if investors are only 100 or 200 US dollars, they are usually not enough to buy a lot of stocks.Then, the common fund allows investors to use smaller amounts to buy diverse investment products.

This is due to the one-time buying and selling a large amount of securities at a time, which makes the transaction cost lower than the fee paid by individuals during securities transactions.

4.Professional management of assets

A main advantage of the common fund is that investors do not have to choose the subject matter and management investment, but to deal with all transactions by a very professional investment manager by carefully studying and skilled transactions.

For small investors, they usually have no time or professional knowledge to manage their own investment portfolios, or they cannot obtain similar information that professional funds can get.

As a result, the common fund has become a low-cost but very professional investment management assistance.

5.High-strength supervision of transactions

The common fund is based on investors’ recognition of institutional credibility.As a result, the fund has received the strictest supervision and constraints of the financial industry to ensure the fairness and guarantee of investors.

6.Diversity of costs during the transaction process

The entry costs of common funds are not high, but multiple types of expenses will be involved during the transaction, and these costs are also a measure of measurement when investors choose the fund company.

What are the fees for the common fund?

The expenses of various non-investment funds in the investment process are investment costs.In the investment of common funds, two types of expenses are mainly required:

- Annual fund operation fee

- Shareholder fee

These two expenses do not have industry standards, and different funds will have different proportion, and the difference in expense structure will directly affect the final investment return.

A.Annual fund operation fee

Annual fund operation fee English is Annual Fund Operating Expenses.

This part of the cost continues to exist with the development of investment, and it is also essential.It mainly includes management fees, 12B-1 costs and other expenses.

The cost of this year accounts for about 0.25%to 1.5%of the total fund investment.The fees of ETFs similar to common funds are much lower in this area, usually floating up and down at 0.25%.

Management fees

Pay to fund managers and investment consultants to manage and run their own investment accounts.

12B-1 fee

It is the annual marketing and distribution operating costs of the common fund, accounting for 1%.

other fee

Including the deposit fee, legal costs, accounting costs, transfer agency expenses, and other administrative expenses during the investment process.

B.Shareholder Fees

It mainly includes sales fees, redemption fees, exchange fees, account fees and purchase fees.It is a one-time fee paid during the purchase or sale of fund share.

Sales loads

The commission paid to the agent when buying or selling fund shares also becomes a load.According to the payment time, it can be divided into “front-end load” and “back-end load”.

The front-end load is paid when buying stocks.This fee will occupy investors’ investment funds.For example, investors want to invest $ 1,000 for stock purchases.The front-end load is $ 10.Then the investor actually only bought a stock of $ 990.

The back-end load is paid for the stock when selling stocks.

Some foundations and agent agreements do not charge investors for sales load fees.Such funds are called “load-free funds”.

Redemption fees

Investors sell stocks in a short time after purchasing stocks, fund companies may charge redemption fees.According to the instructions of the Financial Industry Regulatory Bureau, this time may include “any time from a few days to a year”, depending on the contractual details of the fund company.

Exchange fees (Exchange Fee)

When investors exchange or transfer shares to another fund sold by the same investment company, the fund company will collect the fee from investors.

Account Fee (account fees)

If the fund company sets up the minimum amount of investors’ accounts, when the balance of investors is lower than this specified value, the account fee is required.

Purchase fees (Purchase Fee)

The fee paid to the fund company when purchasing a fund shares is different from the sales load fee paid to the agent.

How does the common fund operate?

When investors want to invest, but do not know the investment method, do not understand the tricks, and do not have enough funds to try in multiple fields, they will focus on the trustworthy company called a common fund, and get the company’sRapid.

Then the fund company invested in various fields.According to the size of the funding volume, it can be invested in a variety of combinations such as long-term, short-term, and unilateral industries.Sell the share in your hand to the company when you stop the transaction and redeem your investment.

In this process, investors have exempted professional and tedious operations such as various data analysis and value comparison of self-investment, and also exempt some of the risks and transaction expenses of independent investment.

The fund company is a actual company.Unlike other industry companies, the operating business of such companies is financial investment.

After investor injection and purchase, some ownership of the company and its assets became shareholders.The shareholders selected CEOs, which is the fund manager, and the fund manager has the obligation to work for the maximum interests of all shareholders.

Most common foundations belong to a larger investment company, such as the famous Fidelity Investment-Fidelity Investments, Pioneer Group-The Vanguard Group, etc.They are in charge of dozens or even hundreds of independent common funds.

How risks are the risks of common funds?

There is the most stringent regulatory efforts, which is not equal to 100 % benefits.There are also many risks during the fund transaction.

Uncertain return

Each investment is risky, and the value of the common fund is also likely to depreciate.Fund shares will also be affected by market fluctuations.In addition, it should be noted that monetary funds are different from banking funds, and these funds will not be subject to the joint fund stock insurance of the FDIC-Federal deposit insurance company.

Cash delay

This is mainly reflected in open funds.Every day, people are investing funds from the fund and withdrawn from funds.Therefore, most of the investment portfolios must retain a certain amount of cash to meet the daily stock redemption.This situation is called “cash drag”.

High cost

The common fund provides investors with extremely professional management, but this requires payment.It is like the cost of diversity during the transaction process mentioned earlier.These costs directly reduce the actual investment amount, and some of them reduce investment returns.No matter which one, they are the cost of investment in common funds and borne by investors.

When the benefits of the common fund are not ideal, this cost may make the seemingly profitable investment in essence.

Lack of liquidity

The common fund allows investors to convert their stocks into cash at any time.However, unlike stocks traded throughout the day, many common funds redeemed at the end of each trading day, which caused the liquidity of funds to be suffered.There are certain restrictions.

Evaluate data

For the common fund, accurate research and comparison of investment income will have some difficulties.

The net asset value of the common fund can provide some relatively basic data analysis, but given the diversity of investment portfolios, even if it is a fund with similar names or a established target, it is difficult to make accurate comparisons.

Only index funds that continue to track the same market have true comparability.

How to deal with common funds?

In the past, the common fund can only be traded through financial professionals.With the development of online trading platforms, investors have now allowed investors to trade online common funds.

When decided to start investing in the common fund, investors can choose to buy directly on the fund company website or buy on a third-party trading platform.

fund company

This is the most direct and relatively cost-effective way of transaction, but it may be limited by the number of fund investment objects.

Investors have entered the fund company trading website, opened personal accounts, transferred to funds, and purchased target funds based on the analysis of various funds given by the fund company to obtain the company’s equity.

Most fund companies, such as American Century As well as DODGE & CoX Wait, only allow investors to buy fund products of their own company, but currently there are some companies, such as Vanguard group and Fidelity Investments Support investors after paying some fees through their purchase of fund products or ETF products of other companies.

Third-party trading platform

This is a more common investment method with traditional investment.Trading on a third-party trading platform can not only allow investors to invest in a variety of financial investment products other than the common fund, but also obtain more investment data analysis to keep up with the market dynamics and conduct the market dynamics.Reasonable asset allocation.However, such operations will generate high costs, including transaction fees and commissions.

Investors open online accounts on third-party trading platforms, transfer to funds, and then buy products provided by the platform.

The current mainstream third-party trading platforms are: Interactive Broker As well as TD Ameritrade As well as Charles SCHWAB, as well as E*trade wait.

Introduction to more securities firms The American brokerage ranking and comparison

How to profit through the common fund?

Investors, also the shareholders of the fund company, can get a return from three aspects after the capital company is invested and purchased:

Dividend payment (dividend)

Investors can get from fund stocks Dividend The interest of the bonds held in the fund investment portfolio.The fund pays almost all the income received in the year in the form of allocation to investors.Foundation provides investors’ income checks or allows investors to re-invest in income to obtain more stocks.

Capital Gain

If the fund sells securities with prices, capital returns will be obtained.Fund companies will pay these income to investors by distribution.

NetASET VALUE

If the price of securities invested by the fund is rising but the fund manager is not sold, the price of the corresponding fund shares, also known as the net asset value of the asset value, will rise.Investors can then sell the share of the common fund in their hands.

Introduction to several American common funds

Federated Hermes Corp Bond Strategy Port (FCSPX)

The common fund is a fixed-income securities portfolio mainly invested in the diversified large-scale enterprises.

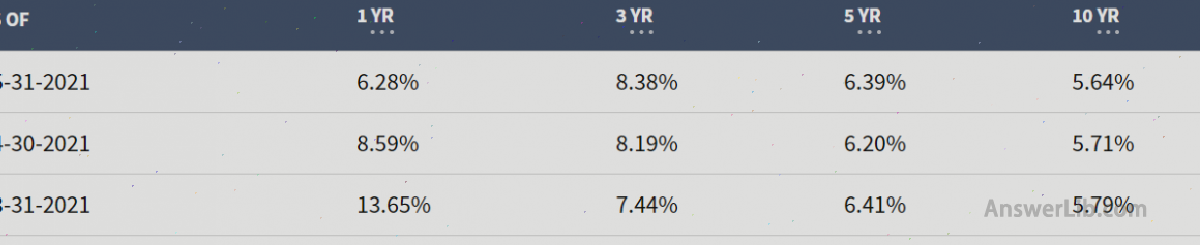

As of May 31, 2021, the yield of one year was 6.28%, the three-year yield was 8.38%, the five-year yield was 6.39%, and the 10 -year yield was 5.64%.

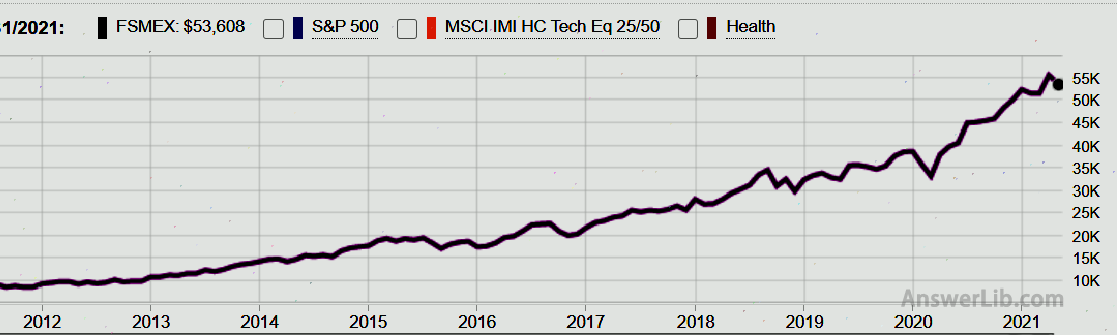

Fidelity Select Medical Technology & Devices Portfolio (FSMEX)

The fund tracks MSCI Mingsheng Company American IMI healthcare equipment and supplies 25/50 index, which is modified to reflect the performance of the industry.The fund is for investors seeking risk exposure to specific industries.It requires an initial investment of $ 2,500

In the past year, the return rate was 35.35%, the return rate in the past three years was 22.41%, the return rate in the past five years was 22.16%, and the return rate in the past ten years was 18.28%.

Putnam Global Technology Fund (PGTAX)

The fund is mainly invested in ordinary shares of global large and medium-sized companies that believe that the fund manager believes that it has good investment potential.Under normal circumstances, at least 80%of the net assets of funds invest in the securities of technology industry companies.The fund is non-diversified.

The fund’s return in the past year was 90.21%, 31.39%in the past three years, 32.12%in the past five years, and 20.45%in the past ten years.

Bridge Builder Large Cap Value Fund (BBVLX)

The investment aims to provide capital appreciation.Under normal market conditions, the fund invests at least 80% of net assets in the securities and other tools of large capital companies.It may also invest in the US deposit certificate (ADR) or global deposit certificate (GDR)

The fund’s return in the past year is 65.43%, 14.00%in the past three years, and 13.70%in the past five years

PIMCO Long-Term Credit Bond Fund (PTCIX)

The investment seeks the total return that exceeds its benchmark, which is in line with capital preservation and prudent investment management.The fund usually invests in at least 80% of the assets in different periods of fixed income tools.These investment portfolios may be represented by long-term or derivatives, such as options and futures contracts.

The fund’s return rate in the past year was 9.84%, the return rate in the past three years was 7.86%, the return rate in the past five years was 7.63%, and the return rate in the past ten years was 8.44%.

Holbrook Income Fund

This is a short-term fund.

The fund aims to provide an immediate income, and the secondary goal is to protect the book in an environment where interest rates rise.The fund usually invests at least 80% of net assets in a diversified fixed income tool combination.

It distributes up to 100% of its investment portfolio to fixed income securities by direct investment or purchase of closed-type common funds and ETFs that mainly invest in income stocks.Managers can also distribute up to 50% of fund assets into ordinary shares and preferred shares of basic funds.

The fund’s return in the past year was 32.41%, and the return rate in the past three years was 6.46%.

The difference between the common fund and hedge fund

Common fund and Hedge Fund It is often confused by people, and there are obvious differences between them:

1.Different investor qualification requirements

Mutual Fund

Common funds generally do not have clear investor funds, and only a few funds may have a certain minimum funding requirement.

Hedge Fund

Investors in hedge funds have strict qualifications.The US Securities Law stipulates that participating in the name of personal names.In the past two years, personal annual income is at least $ 200,000 or more; participating in the name of the family, the income of the couple in the past two years is at least 300,000U.S.dollars or above; participating in the name of institutions, net assets are at least $ 1 million.

2.Different investment operations

Mutual Fund

The actual investment operation process of the common fund has been subject to many restrictions and supervision, which makes it more than some investment products and is more suitable for junior investors.

Hedge Fund

The operation of hedge funds is not restricted, and the investment portfolio and transactions are rarely limited.The main partners and managers can use various investment technologies freely, including short and derivatives transactions and leverage, which makes it lose its original originalThe hedging effect has great risk.

3.Different supervision strength

Mutual Fund

Due to stricter supervision, because most investors are ordinary people, many people lack the necessary understanding of the market.They are strictly supervised because of the consideration of avoiding popular risks, protecting the weak, and ensuring social security.

Hedge Fund

Hedge funds are currently not subject to supervision.The US Securities Law in 1933, the 1934 Securities Trading Law, and the 1940 Investment Corporation Law stipulated that less than 100 investors did not need to register with the US Securities Management Commission and other financial authorities when they were established, and they could be exempted from control.Because investors are mainly a few very sophisticated and rich individuals, they have strong self-protection ability.

4.Different funding methods

Mutual Fund

The common fund needs to raise funds through public recruitment.Fund companies will advertise to the public, and promote their credibility to raise funds.

Hedge Fund

Generally, it is initiated by private equity, and the securities law stipulates that it shall not use any media to advertise when attracting customers.Investors mainly participate in four ways: obtaining the so-called “investment reliability” in the upper society, the manager who directly understands a hedge fund, transferred through other funds, and the investment bank.

E.Can it be different from offshore?

Mutual Fund

Can’t set up offshore.

Hedge Fund

A offshore fund can be set up, which can avoid the number of investors in US law and the limit of taxation requirements.

Usually set up taxes, such as Virgin Island, Bahamas, Bermuda, Cayman Island, Dublin, and Luxembourg.

common problem

Question 1: How to say in English in common funds?

Common Fund English is Mutual FUNDS.It is based on the professional knowledge of the fund manager and its credible professional team.Investment in commercial bills or financial derivatives to obtain a financial investment product that obtains interest, dividends and capital gains.

See More

Question 2: What are the categories of common funds?

According to the types of securities invested in the portfolio, the common funds are: stock funds, bond funds, currency market funds, balance funds, index funds, and other types of funds.

See More

Question 3: What are the fees for the common fund?

The expenses of the various non-investment funds in the investment process of the common fund are investments.In the investment of common funds, the two types of expenses are mainly required: annual fund operation fees and shareholders’ expenses.

See More

Question 4: How to trade the common fund?

Investors can choose to buy directly on the fund company website, or buy on a third-party trading platform.At present, the mainstream third-party trading platforms are: Interactive Broker, TD Ameritrade, Charles Schwab, and E*Trade.

See More