Apr, English is A nnual P Ericentage R ATE refers to the loan’s annual interest rate, that is, you are using credit card shopping, loans to buy a house, or a loan to buy a car to buy a car each year.In general, the higher the APR, the more expensive borrowing money, and the higher the interest you need to change.

Open credit card At this time, you will definitely receive a Credit Card Agreement sent by a credit card company.In this protocol, a variety of APR values will be marked, such as Purchase APR, Cash Advance APR, and so on.So, what exactly do these different APRs mean?If you do not pay off the arrears one month, how to use APR to calculate the interest you need to afford?In this article, you will understand in detail:

Directory of this article

- What are the types of credit cards?

- How to use APR to calculate interest on interest?

- Credit card recommendation

- More investment strategies

Recommended credit card:Chase credit card| AMEX credit card| Discover credit card| Non-annual credit card| No SSN credit card| Aviation Credit Card| Hotel credit card

What are the types of credit cards?

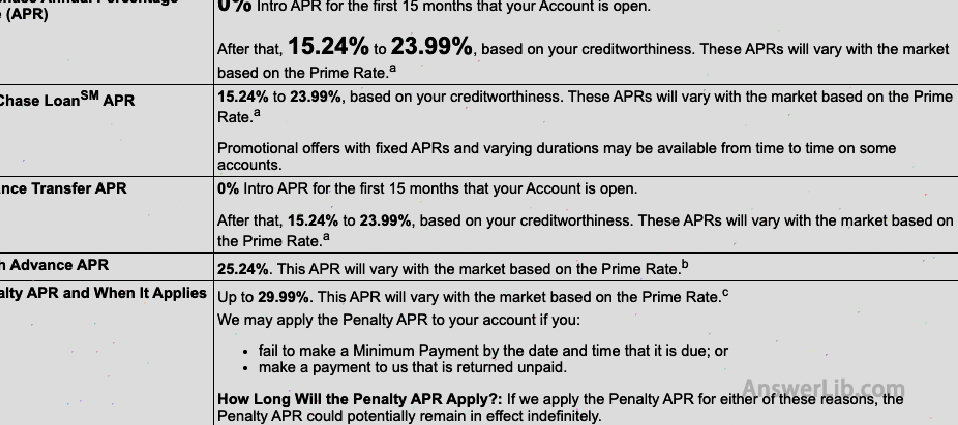

When opening a card, the card opening bank will generally list the costs of various APRs.For example, for Chase FreeDom University, the credit card APR listed is as follows:

1.Purchase APR (consumer APR)

This is the most common credit card APR, that is, if you use credit cards to borrow money to shop, do not repay on the repayment date, for the annual interest rate that does not afford the bond.

For example, you spend $ 1000 with a credit card and purchased a color TV.When the repayment date, if you pay back the $ 1000, then you don’t need to afford any additional interest.However, if you only change $ 600, then you need to pay interest for unppaned $ 400, and the proportion is calculated according to the Purchase APR.Remember, the compound interest adopted by the credit card, which is profit, will be loaded on your previous interest, which will make you overwhelmed.Therefore, do not owe the money of the credit card company.

2.BALANCE Transfer APR (debt transfer APR)

Balance Transfer APR is not common.This APR occurs.When you transfer the debt of other credit cards to this credit card, you need to afford interest APR.If a credit card Balance APR is far lower than the Purchase APR of other credit cards, and you have no way to repay on time, you can consider the credit card of high APR arrears to low Balance Transfer APR.

For example, some credit cards that have just been opened will provide a certain time 0 Transfer APR.For example, Chase Freedom Unlimited Credit Card provides zero Balance Transfer opening rewards within 15 months after opening the card.

Note that when you transfer the arrears between different credit cards, you often need to pay a part of the handling fee, which is generally 3%to 5%of the transfer amount.

3.Cash Advance APR

When you use a credit card from the bank’s ATM, the credit card company will follow the Cash Advance APR procedures.Note that the interest will start from the day of withdrawal.This is different from the Purchase APR.The Purchase APR will have a certain repayment period.At the repayment period, no interest is calculated.

For example, you use Chase Freedom Unlimited credit card to get $ 1000 from Chase ATM.Then, on the day of cash, you need to pay interest according to the Chase Advance APR.At present, the cash with CHASE FREEDOM Unlimited Credit Card is 25.24%.At the same time, this value will be based onThe market situation changes.

4.Penalty APR (delay paid APR)

When using a credit card, the monthly bill will display a minimum payment amount.If you cannot pay the minimum payment amount on time, you need to afford the Penalty APR for account arrears.This APR is often higher than the Purchase APRmany.For Chase Freedom Unlimited credit card, its Penalty APR is as high as 29.99%.

5.My CHASE LOAN APR (Chase loan APR)

This Chase Loan APR is a loan APR exclusively provided by Chase.You can apply for a certain amount of loan through your Chase credit card.The annual interest rate for the loan is calculated according to My Chase Loan APR.This is equivalent to borrowing money from Chase Bank directly, calculating the monthly repayment amount according to My Chase Loan APR, and then repaying in a credit card account monthly.

How to use APR to calculate interest on interest?

The formula for calculating interest with APR is as follows:

Interest = initial arrears X (1+ interest rate)duration– Initial arrears

Among them, the interest rate is calculated by APR, and APR is an annual interest rate, that is, the annualized interest rate.HoweverThe

Daily interest rate = APR / 365

Monthly interest rate = APR / 12

At the same time, the duration in the formula refers to the time of arrears.For the daily interest rate, the length of time is the number of days of arrears; for the monthly interest rate, the length is the restriction of the arrears.

Here we use Purchase APR to calculate the interest you need to cost the amount.When calculating, we use the daily interest rate to perform, because in actual life, the credit card formula is calculated based on the daily interest rate.

Assuming, you use this Chase Freedom Unlimited credit card to consume.A total of 1000 has not been paid off.According to the current credit card’s Purchase APR 20%, let’s calculate the interest you need to afford one month.

Step 1: Calculate daily interest

Because APR is an annualized interest rate, when the credit card company calculates interest, it is often calculated according to the daily calculation.Therefore, first of all, we convert the APR to the daily interest rate:

Daily interest rate = APR/365

= 20% / 365 = 0.055%

Step 2: Calculate 30 days of interest

30 -day interest = arrears X (1 + daily interest rate)30– arrears

= 1000 x (1 + 0.055%)30– 10000

= $ 16.5696

If you want to check for 30 days, daily interest, please check the following form:

Number of days | Arrears ($) | Daily interest ($) |

|---|---|---|

| 1 | 1000.0 | 0.5479 |

| 2 | 1000.5479 | 0.5482 |

| 3 | 1001.0962 | 0.5485 |

| 4 | 1001.6447 | 0.5488 |

| 5 | 1002.1936 | 0.5491 |

| 6 | 1002.7427 | 0.5494 |

| 7 | 1003.2922 | 0.5497 |

| 8 | 1003.8419 | 0.5501 |

| 9 | 1004.392 | 0.5504 |

| 10 | 1004.9423 | 0.5507 |

| 11 | 1005.493 | 0.551 |

| 12 | 1006.0439 | 0.5513 |

| 13 | 1006.5952 | 0.5516 |

| 14 | 1007.1468 | 0.5519 |

| 15 | 1007.6986 | 0.5522 |

| 16 | 1008.2508 | 0.5525 |

| 17 | 1008.8032 | 0.5528 |

| 18 | 1009.356 | 0.5531 |

| 19 | 1009.9091 | 0.5534 |

| 20 | 1010.4625 | 0.5537 |

| twenty one | 1011.0161 | 0.554 |

| twenty two | 1011.5701 | 0.5543 |

| twenty three | 1012.1244 | 0.5546 |

| twenty four | 1012.679 | 0.5549 |

| 25 | 1013.2339 | 0.5552 |

| 26 | 1013.7891 | 0.5555 |

| 27 | 1014.3446 | 0.5558 |

| 28 | 1014.9004 | 0.5561 |

| 29 | 1015.4565 | 0.5564 |

| 30 | 1016.0129 | 0.5567 |

| Total arrears | 1016.5696 | |

| Total interest | 16.5696 |

Credit card recommendation

30+ US Credit Card Recommended+ Comparison [2023] 1,000 account opening rewards

More investment strategies

- 2024 Comprehensive index of stock markets in various countries in the world

- Australian MOOMOO Account Opening Reward: Leading Tencent Stock! November 30th

- How about Futu Niu Niu?What is the difference between Futu Niu Niu and Futu Moomoo

- What is compound interest [Compound Interest] The 72 rule of getting rich

- American Education Fund [2024] COVERDELL ESA, 529 Plan Detailed Explanation

- What is investment returns [ROI] different from the annual investment return rate

- US stock index [2024] S & P 500, Nasdaq detailed explanation

- How to invest in Hong Kong stocks in the United States?Buy Tencent’s little tricks in the United States!

- What is US Treasury Bond?How to buy U.S.Treasury bonds?What is the yield?

- US Gold Coin Investment [2024] What gold coins do you buy?Where can I buy it safely?