inflation, Referred to as ” Inflation“, English is Inflation The overall price of refers to rising prices, the decline in the purchasing power of the currency held by people, that is, the economic phenomenon that the items or services that the currency of the same unit can buy becomes less.

Inflation rate, English is Inflation rate It is used to measure the speed of inflation changes, or the decrease of currency purchase capacity.Through the inflation rate, it can intuitively judge the degree of inflation.

通货膨胀是在衡量一个国家的经济发展状况时经常使用的指标,一个健康的通货膨胀可以表示这个国家的经济状况处于稳定的上升阶段,而过高的通货膨胀会降低人们的消费能力,进而影响To a series of economic situations such as productivity.

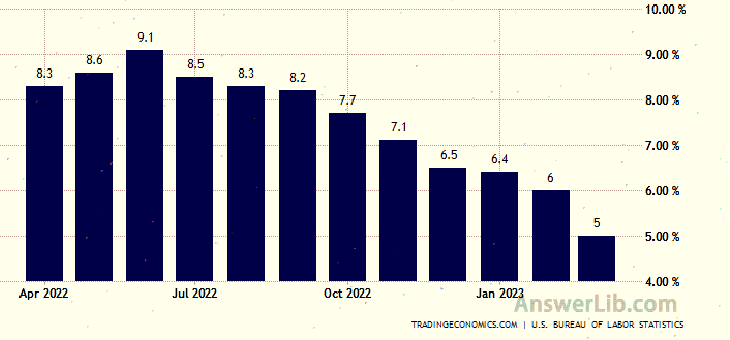

The inflation rate of the United States in March 2023 Year-on -year Increase 5% Although 9.1%of June 2022 decreased, it was still at a high level.The inflation rate of 9.1% in June 2022 was the highest value since 1981.

So, 9.1%of the inflation rate means what is the ordinary working class and how is the inflation rate calculated?People often discuss CPI What is it?

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is inflation?

- What is CPI?How to calculate CPI?

- What is the inflation rate?

- What does 8.5%mean?

- How is the American CPI calculated?

- How is China’s CPI calculated?What categories?

- What impact does inflation have on economic life?

- What is stagflation?What are the differences and connections with inflation?

What is inflation?

The literal meaning of inflation means “increased the number of currency circulation”, which refers to the rise in overall prices in social life, including the increase in the average price level of goods and services, and the purchasing power of the currency held by people, that is, the currency office of the same unit of the same unit, that is, the currency office of the same unit of the same unitThe economic phenomenon that can be purchased less or services.

If the central bank (the United States Federal Reserve or the People’s Bank of China of China) increases the circulation currency, the amount of currency flow on the market increases, and when the number of goods on the market does not increase simultaneously, there will be insufficient supply of supply.The situation, which causes prices to rise, and the purchase capacity of equivalent currency declined.When this situation continues, it is called inflation.

Ray Dalio, the founder of Bridge Water Fund, proposed the formula for the price:

Commodity price = currency circulation volume/amount of goods

Therefore, once the central bank’s currency circulation increases significantly, inflation will be caused, which will cause currency depreciation.Starting from Grimpan, the United States has adopted the so-called quantitive easing policy (QE) policy.In order to stimulate the economy, a large number of currencies have been injected into the market in a short time.As of April 2022, the central bank’s central bank’s asset liabilitiesIt is close to $ 9 trillion.

The intuitive feelings in actual life can take coffee as an example.For example, twenty years ago, a cup of coffee only cost $ 0.80, ten years ago, a cup of coffee required $ 1.25, and now a cup of coffee is $ 1.95.The same cup of coffee has increased from $ 0.80 to $ 1.95 in 20 years.

Three cases that cause inflation

The fundamental cause of inflation is that the currency is issued, and there may be three cases, which will eventually lead to rising prices:

- Demand stretch (Demand-Pull)

After the increase in currency, the overall demand for the market’s overall demand for goods or services increases.When this increase is greater than the increase in production capacity, it will lead to the imbalance of supply and demand relationship, because the demand is increased to drive the price level.

- Cost-Push

When currency issuance causes the cost of commodity or services to increase, the price of the entire supply chain of goods or services will increase.For example, after the currency is increasingThe production costs of raw materials will rise, which will eventually lead to rising prices at the consumer side.

- Built-in inflation

Internal inflation is usually related to the occurrence of inflation, people are related to adaptive expectations, that is, people expect that current inflation will continue in the future, so people ask for continuous increase of wages to copeIt will further cause the rise in prices and form a cycle impact within a certain period of time.

How to evaluate inflation?

When judging and calculating inflation, the most commonly used consumer price index, the CPI, also referred to as CPI, and also uses a wholesale price index.WHOLESALE Price Index, referred toReferred to as PPI.

- Consumer Price Index (CPI)

This is one of the most commonly used indicators.It judges and measures the price level and inflation level in the current economic environment by directly comparing the prices of consumers during shopping.

- Wholesaler Price Index (WPI)

The degree of inflation is measured by measuring changes in commodity prices before sales.According to the economic policies of different countries, it mainly includes producers and wholesalers, such as cotton, including cotton, cotton raw materials, cotton yarn, cotton, and cotton clothing in cotton, cotton, cotton and cotton clothing in cotton, cotton, cotton clothing in cotton clothing onInner price.

- Producer price index (PPI)

It is the price index used in some countries, including the United States, and the price index of the amount of currency obtained by the seller, and analyzes the degree of inflation from the cost end.

What is CPI?How to calculate CPI?

CPI The full name Consumer Price Index, that is, the consumer price index, is an index that reflects the price changes related to people’s lives and services, analyzes it in a percentage form.The main role of CPI is to evaluate inflation amplitude.

CPI is the main indicator of inflation.By comparing the calculated CPI values with the benchmark value, the inflation rate of this period can be calculated.Stability requires timely adjustment of monetary and fiscal policies to stabilize socio-economic situations.

The prices calculated in CPI usually include a variety of people’s livelihood fields such as food, transportation, housing and clothing.CPI’s calculation formula is

CPI = The cost of the item or service of the specified year / the service cost of the year of the year

= Cost of Market Basket in Given Year / Cost of Market Basket in Base Year × 100%

The conventional CPI calculation process is:

- Collect the price of the corresponding product or service collection of the designated year;

- Collect the price of the corresponding product or service collection of the benchmark years;

- The sum of the price of the product or service collection of two time points is added, respectively;

- The total price of the specified year is divided by the total price of the benchmark;

- Multiplying the calculated results at 100%;

The following changes in the CPI changes from the calculation of the Inteoscopic products sold in the United States from 2020 to 2022 as an example:

The price of pasta and pasta in the benchmark year and the price of 2022 are:

| years | Pasta price | Price of pasta sauce |

|---|---|---|

Benchmark year | $ 0.8 | $ 1 |

2020 | $ 3 | $ 4 |

According to the above calculation steps:

- The sales unit price of the two products in the benchmark year is $ 0.8 and $ 1, so the total price of the two products is $ 0.8 + $ 1 = $ 1.8

- The unit price of the two products in 2020 is $ 3 and $ 4, so the total price of the two products is $ 3 + $ 4 = $ 7;

- The cost of items or service cost / service cost of the year 2020 at the designated year = $ 7 / $ 1.8 = 3.9

- So, 2020 CPI = 3.9 x 100% = 390%

During the calculation process:

- Depending on the selected date, monthly CPI analysis, CPI analysis per quarter, annual CPI analysis, etc.;

What is the inflation rate?

Inflation rate, English is the Inflation Rate.It refers to the increase in prices or the decrease of the currency purchase capacity when inflation is inflated.The value of inflation can intuitively judge the degree of inflation.

The higher the inflation rate, the higher the price of prices is too fast, the faster the currency purchase capacity decreases, and people’s spending power will be greatly affected, which may lead to stagnation or even backwardness of economic growth.ThereforeThe inflation rate is controlled within a smaller value range to stabilize the country’s economic development process.

When calculating the inflation rate, it can be used for a period of time, and the price of the initial period (Starting Cost) and the Ending Cost during the final period:

Inflation rate = (Ending Cost – Starting Cost) / Starting Cost × 100%

When using CPI to calculate the inflation rate, you need to determine the starting CPI (Starting CPI) and the final value CPI (Ending CPI) for a period of time, and then calculate based on the following formula:

INFLATION RATE = (Ending CPI – Starting CPI) / Starting CPI × 100%

The following takes the same pair of sneakers in different years as an example, and the inflation rate is calculated through CPI:

| years | Pasta price | Price of pasta sauce |

|---|---|---|

Benchmark year | $ 0.8 | $ 1 |

2020 | $ 3 | $ 4 |

2021 | $ 3.5 | $ 4.2 |

2022 | $ 4 | $ 5 |

use CPI calculate 2020 Year -2021 Year, 2021-2022 Inflation rate of the year:

- CPI = (3+4) – (0.8+1)/(0.8+1) = 288.9% in 2020

- CPI = (3.5+4.2) – (0.8+1)/(0.8+1) = 327.8% in 2021

- CPI = (4+5)-(0.8+1)/(0.8+1) = 400% in 2022

use CPI Calculate the inflation rate:

Inflation rate = (Previous Year CPI – Current Year CPI) / Starting CPI × 100%

- Inflation rate from 2020-2021: (327.8%-288.9%)/288.9% = 13.5%

- Inflation rate from 2020-2021: (400%-327.8%)/327.8% = 22%

The following is the 20 -year CPI changes in the United States (12 months of changes).CPI report It shows that the overall CPI in the United States increased by 8.5%year-on -year, the month that has risen the highest increase since December 1981.

The main reason for this situation is the Fed’s large number of US Treasury bonds and MBS (Mortgage-Backed Securities).Of course, other reasons include the Russian and Ukraine War.The price of oil caused by the Russian and Ukraine War rose and the rise in grain prices directly led to the rise in the CPI.

What does 8.5%mean?

Ordinary people’s most intuitive feelings about inflation rates are much more expensive, but if you use investment views to explain 8.5%of the inflation rate, you will be frightened in a while.

Take $ 100,000 as an example, if 8.5%of the inflation continues 5 In the year, the purchasing power of $ 100,000 was worth only $ 66,000, and the depreciation was reached 34% Essence

If 8.5%of inflation continues 8 In the year, the purchasing power of $ 100,000 was worth only 51,000 yuan, and the depreciation was reached 49% Essence

If 8.5%of inflation continues 10 In the year, the purchasing power of $ 100,000 was worth only 43,000 yuan, and the depreciation was reached 57% Essence

The following table shows the annual currency depreciation ratio.

| years | Amount | Depreciation |

|---|---|---|

principal | $ 100000 | & nbsp; |

First year | $ 92479 | 8% |

Second year | $ 84917 | 16% |

Third year | $ 77974 | twenty three% |

Fourth year | $ 71598 | 29% |

5th year | $ 65744 | 35% |

6th year | $ 60368 | 40% |

7th year | $ 55432 | 45% |

8th year | $ 50900 | 49% |

9th year | $ 46738 | 54% |

10th year | $ 42916 | 57% |

How is the American CPI calculated?

American CPI is by the US Labor Statistics Bureau Bureau of Labor Statistics(BLS) Published once a month, the earliest CPI values were calculated in 1913.In subsequent development, the average CPI value from 1982 to 1984 was 100%as evaluation standards for subsequent CPI values, such as the CPI value was the value of the CPI value as the value of the CPI value.At 100%, it means that the average price increase of specific commodities and services this year remained the same level as in 1984.If the CPI value is 125%, it means that the level of inflation has increased by 25%.

1.CPI includes commodity categories

The goods covered by the American CPI mainly include food, beverage, energy, house expenditure, clothing, transportation, transportation, medical care, entertainment, education and other/services.During different periods, the types of types may be adjusted:

| Commodity category | Main products |

|---|---|

food and drink | Breakfast oatmeal, milk, coffee, chicken, wine, snacks, etc. |

energy | Petroleum, gasoline, natural gas, etc. |

Housing expenditure | House rent, property fee, fuel, bedroom furniture, etc. |

clothing | Men’s shirts and sweaters, women’s dresses, jewelry, etc. |

Transportation | New car, air tickets, gasoline, motor vehicle insurance, etc. |

medical insurance | Prescription medicine and medical supplies, doctor services, glasses and eye health, hospital services, etc. |

entertainment | TV, toys, pets and pet supplies, sports equipment, performance tickets, etc. |

educate | College tuition, postage, telephone service, computer software and accessories, etc. |

Other/service services | Tobacco and smoking products, haircuts and other personal services, funeral costs, etc. |

At the same time, the data collection of CPI also includes government expenses including sales tax, consumption tax, and including water and sewage treatment fees, car registration fees and vehicle fees, etc., but does not include income tax and investment expenses, such as stocks, such as stocks, stocks, such as stocks, stocks, such as stocks, stocks, such as stocks.Bonds, etc.

2.What types of American CPI?

CPI-W and CPI-U

In the past, CPI data collection in the United States was divided into consumer price index (CPI-W) data acquisition and consumer prices of consumer price index (CPI-W) data collection and consumer prices of all city consumers (All Urbanrs) of all cities.Index (CPI-U) data collection.

CPI-W mainly includes consumer units composed of cultural staff, sales staff, craftsman, operator, service personnel or workers.These personnel represent at least 28%of the population in the country.Received the “Cost of Living Adjustment (COLA)” based on CPI-W to ensure that the social security and replenishment benefits they have obtained are sufficient to cope with inflation.

CPI-U is a CPI that includes all city consumers, including professionals, individual operators, people who live below the poverty line, unemployed, retirees, urban working class and cultural staff.It accounts for 88 of the American population at that time%, Can represent the general public than CPI-W.

With the development of society, BLS reforms the calculation of CPI, and will merge the data collection process of CPI-W and CPI-U.CPI-W will use data information from CPI-U.

Core CPI

Core CPI also becomes a core CPI.It is a CPI computing value that eliminates food and energy products, because the two are constantly trading in the market.The fluctuations are relatively severe and non-systematic fluctuations, so it is impossible to accurately reflect the overall price change of the market.After excluding these two types of commodities, you can get a relatively stable and reference value CPI value.

CPI-E

The full name of CPI-E is CPI for the Elderly, that is, the elderly CPI, and the consumption data collection and analysis of the elderly over 62 years of age, about 24%of the people in the United States meet the conditions.Among the consumption distribution of this type of group, The proportion of consumption in healthcare categories is twice as many consumers in CPI-U or employee categories in CPI-W, so it is a more targeted CPI data category.

3.The calculation process of the American CPI

Step 1: Data collection

Each time the CPI is calculated, the US Labor Statistics Administration will check the self-report expenditure data of family and individual consumers within two years, but there will be a certain gap in time.For example, to calculate the CPI data in 2021, you will view 2018 and 2019.The collected data is used to determine the category of goods that need to be collected.

It will then collect commodity prices in different cities through different ways, such as sampling and on-site inquiries.

Step 2: Calculate the CPI value of different categories

The price of the corresponding products collected in the eight categories is calculated according to the calculation formula of the CPI, and the CPI values of different categories are calculated according to the calculation formula of the CPI.

Step 3: The total CPI value of the weighted calculation

In different periods, the proportion of different consumer goods or services in total consumption will be different.According to the proportion data formulated in the year, the calculated CPI values calculated were used to obtain a total CPI value after weighted calculations.

The following is the weight table of the February CPI issued by the U.S.Labor Statistics:

| Commodity category | Weights |

|---|---|

food and drink | 13.4% |

Energy (including gasoline) | 7.5% |

Commodity (including drugs and cars) | 21.8% |

Housing expenditure | 32.7% |

medical insurance | 6.9% |

Transportation | 5.6% |

other fee | 12.1% |

All-round | 100% |

In the calculation, different starting numbers will be adopted according to the analysis cycle.The monthly CPI will be calculated using the value of the month and the value at the end of last month.The CPI of the year will be calculated with the value of the year and the value last year.For example, the latest data report released by the US Labor Statistics shows that the CPI in March increased by 8.5%year-on -year, that is, for monthly CPI computing, the core CPI rose 6.5%on the basis of 12 months, that is, the annual CPI calculation.

4.The release frequency of different cities

Because various autonomous prefectures in the United States have high autonomy, in addition to the national CPI data report once a month on the website of the US Labor Statistics’ website, different cities and regions will release CPI data for the location.

The following urban areas once a month

- Chicago-Gary-Kenosha

- California-Los Angeles-Riverside-Olanzhi County

- New York-Northern New Jersey-Long Island

The following urban areas are released in each occasion for several months

- Atlanta

- Michigan-Detroit-Annabour-Flint

- Texas-Houston-Galvesston-Brazoria

- Florida-Miami-Fort Lauderdale

- Philadelphia-Wilmington-Atlantic City

- California-San Francisco-Auckland-San Jose

- Washington-Seattle-Tacoma-Brerolon

The following urban areas are released in each strange months

- Boston-Brockton-nashua

- Ohio-Cleveland-Aklen

- Texas-Dallas-FORT WORTH

- Washington-Balt Momo

How is China’s CPI calculated?What categories?

CPIs in mainland China cover the main contents of food, tobacco, alcohol and supplies, clothing, family equipment, medical care, transportation and communication, entertainment education culture, residence, and other eight major products.At least 6,000 products are classified in 262 sub-categories, covering urban and rural residents, covering urban and rural residentsAll consumption content will adjust the number of samples according to the scale differences in different cities.For example, first-tier cities will investigate more types of goods than second-tier cities.

During the data collection, according to the corporate list obtained by the past economic census and the administrative records of the relevant departments, the retail sales or operating scale will be randomly selected from high to low.In order to take into account the principles of various scale, carry out reasonable regional distribution, and require data collection personnel to collect the most authentic and comparable data information under the principle of “fixed, fixed-point, timing”.

After the data collection is completed, the CPI value is calculated according to different categories, and the total value is calculated according to the proportion of different categories of weights.The detailed proportion of expenditure is determined, and the value can China National Bureau of Statistics The relevant years of the publishing and publishing were found.The current system stipulates that the weight ratio in the CPI is adjusted every five years.

The National Bureau of Statistics of China releases CPI.The monthly period is generally around 13th, and the quarterly and annual anniversary will be postponed to around the 20th.The content published is mainly:

- CPIs of the country and provinces (autonomous regions, cities);

- 36 large and medium cities CPI;

- Monthly publishing data contains the total index, the large category index, and some medium-class indexes, such as food prices, oil prices, meat and poultry and product prices, fresh egg prices, aquatic products, fresh vegetable prices, fresh fruit prices, seasoning, seasoningData analysis of product price and other data.

What impact does inflation have on economic life?

The impact of inflation on economic life will have different performances on different people:

1.Reverse influence

For ordinary consumers, inflation means the increase in living costs, so most ordinary consumers do not support inflation.

Institutes or enterprises with assets that are denominated by currency, such as cash, savings accounts, bonds, etc., will depreciate their assets due to inflation.

For importers, inflation may lead to more payment than the original amount when paying the payment of imported goods.

For the government, excessive inflation means that the economic environment has occurred seriously.It is necessary to intervene as soon as possible to avoid bad impacts such as stagnation or even backward.

2.Positive influence

For individuals or enterprises with tangible assets, such as real estate and inventory goods, inflation will increase the price of their own assets.Therefore, inflation is good for them.

For exporters, when inflation causes currency depreciation and exporters can use foreign currency to trade, they can get more benefits.

For borrowers, the reduction of currency value caused by inflation will be reflected in the decline in borrowing value that needs to be repaid.

For the government, stable and small inflation is beneficial.It can encourage consumers to buy more goods, promote the development of enterprises, increase employment opportunities, increase the productivity of workers, and drive the overall economic rise.

What is stagflation?What are the differences and connections with inflation?

Stagflation, the full name is “stagnant inflation”, English is stagflation, which is composed of stagnation and inflation.In economics, especially macroeconomics, stagnation refers to the abnormal economic phenomenon that coexist at the same time of economic stagnation, inflation and high unemployment rates.

Economists generally believe that the two root causes of stagflation are the financial/monetary policy of supply impact and wrong.

Among them, the supply shock means that in some special circumstances, emergencies have caused changes in productivity and costs.For exampleThe shortage of raw materials leads to rising costs, which causes prices to rise, which causes economic stagnation.

In the 1970s, the United States experienced a severe stagflation period.

After the end of World War II, the United States entered a period of economic prosperity, but when it entered the late 1960s, this prosperity began to subscribe.In the face of fierce international competition, invested a lot of funds to Vietnam, etc.The position of positions began to decrease, and the economic environment began to rise in unemployment rates and increase inflation rates.

In 1970, Nixon, then US President, promulgated some measures, such as salary and price frozen for 90 days, increased import tariffs by 10%, removed the United States from the golden nickname, etc.It is to stimulate the economy, increase employment opportunities, and alleviate inflation, but the result has accelerated the speed of the United States entering the stagflation stage.The Fed hopes to use monetary policy to fight stagflation.As a result, the stagflation is further intensified.I feel uneasy, irrational shopping increases the degree of inflation.

Outside, OPEC, an international oil output organization, announced that it has implemented oil embargo on the United States since 1973, which directly led to surge in cost, price and unemployment rate.

Faced with the internal and external pinch, the United States entered a period of stagnation, and from 1981 to 1982, it experienced the worst period of economic recession in history.

Simplicity between stagnation and inflation

The same point of stagnation and inflation is that both prices have risen, and if timely intervention is not intervened when inflation is severe, economic development will stagnate.

The most obvious difference between stagnation and inflation is that in inflation, although prices rose, people’s wages and income will also increase accordingly.The average income of people shows a downward trend.

Another difference is that if it is small inflation, it is beneficial for economic development, which will stimulate consumption, increase employment rates, increase labor, etc., but regardless of the size, stagflation brings negative, negative negative, negative, negative, negativeImpact.