In the United States, expenditures in education are an important part of the family economic plan.It will start preparing for children’s educational costs early.In the future, children can have more education choice rights.

In order to help more families better plan education funds, the IRS and Federal State provide different educational savings accounts or prepaid tuition fees.What are the differences between different accounts or plans?How should parents or students use these educational savings accounts effectively?

Directory of this article

- What are the categories of education savings accounts?

- The difference and connection between CoverDell ESA and 529 plan

- The difference and connection between CoverDell ESA and Roth IRA

- Where to open the 529 account?

- Where can I open the COVERDELL ESA account?

- Subscribe to American Life Guide

- More investment strategies

What are the categories of education savings accounts?

Currently in the United States, there are three main educational savings accounts:

- CoverDell Education Saving Account

- 529 PLAN

- Custodial Accounts

Among them, the CoverDell Education Saving Account is provided by the IRS.The 529 Education Savings Plan is proposed by each federal state.Custodial Accounts is similar to conventional savings accounts.

1. CoverDell Education Saving Account

COVERDELL Education Savings Account, referred to as CoverDell ESA, is an educational savings account provided by the U.S.Taxation Agency (IRS)., ETF and other financial products, the growth and principal of investment do not collect taxes when they are taken out, similar to the pension account Roth Ira.

Conditioners:

Adjustment (Modifed Adjusted GROSS Income (AGI) individuals with a total of $ 110,000, or a married couple with a total annual income of less than $ 220,000 after adjustment.

Account beneficiary:

Children under 18.

Deposit requirements:

- Cash deposits, no minimum amount requirements;

- For the ESA account of each beneficiary, the highest amount of deposits each year is $ 2,000.For example, if the beneficiaries of the beneficiaries, the deposit of $ 1,000 in the ESA account of the beneficiary of the beneficiary then, the grandmother of the beneficiary also opened the ESA account for them.The maximum amount can only be $ 1,000.If the deposit of the year exceeded $ 2,000 and did not take out the part before May 31 the next year, it would face a 6%fine.On the contraryWill face a fine;

- The deposit can only be stored in the age of 18 years old, and then cannot continue to continue the deposit from the account;

- All the contributions of the contributor are not available for tax deduction.

How to use:

- The beneficiary can extract the balance in the ESA account to pay the Education-related expenses of the K-12 stage, middle school, and higher education stage, including but not limited to: tuition, purchase of books, stationery, appliances, tutor fees, special demand services (special demand services (Limited to those with special demand), dormitory costs at the education stage, school uniform costs, commuting costs at school, auxiliary items and services during the education stage, such as post-class costs.But it cannot be used to pay apprenticeship plans and student loans.If the balance in the ESA account is paid, you do not need to pay taxes for withdrawal for withdrawal;

- If the purpose of the use of funds does not meet the above-mentioned education-related requirements, it must be paid for some taxes earned by investing in the account and a fine of 10%;

- The deposits in the ESA account can be used for investment in wealth management products such as stocks, bonds, and common funds.When the investment growth part is removed for educational expenditure, there is no need to collect taxes;

- When the beneficiary is 30 years old and the ESA account still has a balance, the balance will be automatically allocated to the conventional savings account of the beneficiary, and the balance part must be paid as a gift tax as a gift amount.

Method of benefit:

Before the beneficiary of the ESA account, the tax exemption increased before the beneficiary, that is, the beneficiary does not need to pay federal taxes for the amount earned by this fund.It can be said that this is the biggest advantage of the ESA account, which is with the retirement account Roth IRA Are the same.

Suitable object:

- Personal adjustment of individuals with an annual income of less than $ 110,000, or a married couple with annual income of less than $ 220,000 after the adjustment of the family;

- Satisfy income qualifications, but cannot meet the qualifications of the 529 education savings plan where the state is located;

- It is hoped that the deposit in the ESA account will be managed by the child after the age of 30.

COVERDLL ESA advantage:

- When used for investment, all contributions can increase tax exemption;

- The account owner can manage the account by themselves and decide the investment project by themselves;

- The beneficiary of the account can be changed;

- Everyone who meets the income conditions can provide money for children.

COVERDLL ESA shortcoming:

- Former-funded persons need to meet the annual income after personal adjustment of less than $ 110,000, and the income of couples after the bonded adjustment is less than $ 220,000;

- Conflicia cannot be used for tax deduction of that year;

- After the beneficiary is 18 years old, the account cannot continue to be confeired;

- The balance in the account can only enjoy tax discounts only before the beneficiary is 30 years old;

- CoverDell, as a beneficiary (child) asset, may affect its application for student funding.

2. 529 Education Savings Plan (529 Plan)

The 529 Education Savings Plan is to allow students to obtain a tax-delay investment account for the purpose of paying college tuition, that is, when the beneficiary or manager extract funds in the account with a compliance education purpose, the income of account investment can enjoy a certain amount of revenue.Tax discounts may be reduced, and each federal state has its own tax discounts or reduction regulations.The funds in the 529 Education Plan are mainly used to pay for children’s expenses for college.

529 Education savings plan mainly provides two categories:

- University savings plan (College Savings Plan): Funding is usually invested in the common fund portfolio.As the fund trend obtains income, or faces losses.The account balance is used to pay tuition fees for private or public universities where the state is located.

- Prepaid tuition plan (Prepaid Tuition Plan): For those who have purchased credits or “tuition certificates” at the current price, the tuition fees may increase when students enter the same credits or tuition fees when they enter the students.But not all colleges accept the plan and must confirm with the school before participating.

Conditioners:

- The beneficiary relatives and everyone, including friends.

Account beneficiary:

- Students who are about to go to school can sometimes be the parents of students.

Deposit requirements:

- Must use cash supply;

- It can only be stored in the cost of education determined by the local state.

How to use:

- Students can withdraw money from the 529 account at any time for compliance education-related fees, including tax-free withdrawal, including miscellaneous fees, book supplies, accommodation fees, hardware equipment fees, apprenticeships, student loans, etc.However, personal insurance premiums, medical expenses and transportation expenses are not applicable to the scope of tax exemption;

- The 529 account is mainly used for education costs after high school.When used in the education stage of elementary and middle schools, there will be more use restrictions.

Suitable object:

- Suitable for anyone who wants to store education for children;

- Adults with income exceeded COVERDELL ESA;

- The people who store education funds for students are later;

- Parents who are always in charge of account funds will always be in charge of account funds.

Advantages of Plan 529:

- In addition to the discounts of federal tax, you can also enjoy the tax discounts of your state, and the specific tax discounts you can enjoy should be determined by the corresponding documents of different states.

- Anyone can provide money without income restrictions;

- All contributions can be superimposed;

- Compliant education includes apprenticeship plans and student loans;

- Students can withdraw money at any age and use funds in the 529 account;

- If the account name is a student’s parents, parents can always manage funds.

Disadvantages of Plan 529:

- Compliance education fees do not include transportation fees, etc.;

- For the prepaid plan, not all states are applicable.

Here are the 529 university savings plans of states in the United States:

| state | 529 University Savings Plan | Whether the contributor of the state enjoys tax discounts | Minimum supply amount |

|---|---|---|---|

Collegecounts | yes | $ 0 | |

Alaska 529 | no | $ 25 | |

AZ529 | yes | $ 25 or less | |

Arkansas 529 Gift Plan | yes | $ 25 | |

Scholarshare 529 | no | $ 0 | |

CollegeInvestst | yes | $ 25 | |

Connecticut Higher Education Trust (CheT) | yes | $ 0 | |

DE529 | no | $ 0 | |

DC College Savings Plan | yes | $ 25 | |

FLORIDA 529 SAVINGS PLAN | no | $ 0 | |

Path2college 529 Plan | yes | $ 25 | |

Hi529 | yes | $ 15 | |

Ideal – Idaho College Savings Program | yes | $ 25 | |

Bright Start 529 Plan | yes | $ 0 | |

CollegeChoice 529 | yes | $ 10 | |

College Savings Iowa 529 | yes | $ 25 | |

Learning Quest 529 Education Saves Plan | yes | $ 0 | |

Ky saves 529 | no | $ 25 | |

Louisiana ’s Student Tuition Assistance & Revenue Trust | yes | $ 10 | |

Nextgen 529 | no | $ 25 | |

Maryland 529 | yes | $ 25 | |

Massachusetts 529 College Savings Plan | yes | $ 0 | |

Michigan Education Saves Program | yes | $ 25 | |

Mn saves | yes | $ 25 | |

College Savings Mississippi | yes | $ 25 | |

Mobile – Missouri ’s 529 Education Plan | yes | $ 1 | |

Achieve Montana | yes | $ 25 | |

Nest 529 Advisor Plan | yes | $ 0 | |

Nevada College Saves Plans Program | no | $ 15 | |

Unique College Investing Plan | no | $ 0 | |

Njbest | no | $ 25 | |

The Education Plan | yes | $ 1 | |

New York ’s 529 College Savings Program | yes | $ 0 | |

College Foundation of North Carolina | no | $ 25 | |

Collegesave | yes | $ 25 | |

Ohio ’s 529 College Advantage | yes | $ 25 | |

Oklahoma 529 College Savings Plan | yes | $ 100 | |

Oregon College Savings Plan | yes | $ 25 | |

PA529 | yes | $ 10 | |

Collegebound saver | yes | $ 0 | |

FUTURESCHOLAR | yes | $ 0 | |

CollegeAccess529 | no | $ 250 | |

Tnstars | no | $ 25 | |

Texas College Savings Plan | no | $ 25 | |

My529 | yes | $ 0 | |

VT529 | yes | $ 25 | |

Virginia529 | yes | $ 10 | |

Dreamahead College Investment Plan | no | $ 25 | |

Smart529 | yes | $ 1 | |

Edvvest | yes | $ 25 |

The following are the states and their plans that provide 529 prepaid tuition plan:

| state | 529 prepaid tuition plan | Whether the contributor of the state enjoys tax discounts |

|---|---|---|

FLORIDA Prepaid Plans | no | |

Maryland Prepaid College Trust | yes | |

U.Plan Prepaid Tuition Program | yes | |

Michigan Education Trust (MET) | yes | |

MissIssippi Prepaid Affordable College Tuition Plan (MPACT) | yes | |

Nevada Prepaid Tuition Program | no | |

Texas Tuition Promise Fund | no | |

Guaranteed Education Tuition | no |

3.Custodial Accounts

The custody account for education is generally:

- Provide a gift bill to minors (UGMA) account

- UNIFORM Transfers to Minors Act, referred to as UTMA) account

Account holder:

- The parents, grandparents or other adults of minors, as the opening and custody as the account;

Account beneficiary:

- Children after adulthood

Deposit requirements:

- UGMA account is limited to cash and securities, and UTMA accounts can hold other types of property;

- The unlimited limit of deposits is usually controlled at $ 16,000 in personal annual limit, and the annual limit of couples is within $ 32,000, so as not to trigger the gift tax.

How to use:

- Before the child’s adult, the account custodian is managed and used.After the child is adult, the child decides the method and purpose of the use.

advantage:

- The funds in the account can be used freely without being punished.

shortcoming:

- The custody account is regarded as the child’s asset, so if there is a large amount of balance in the account, it may affect the child’s qualification to apply for economic funding;

- When the child is adult, the funds in the account will be managed by the child, and the parents will lose their ability to supervise funds;

- The host account cannot be replaced by the beneficiary;

- Non-labor income of more than $ 2,100 will be taxed at the tax rate suitable for trust and inheritance.

The difference and connection between CoverDell ESA and 529 plan

As the main type of education savings account, students can hold the CoverDell ESA account and 529 planned account at the same time.They can all provide a certain degree of tax incentive for students’ educational funds savings and use.At the same time, roughly similar restrictions have been made for the scope of use.

However, because the two have different restrictions when applying, not everyone can hold the CoverDell ESA account.On the other hand, according to the different tax preferential tax policies of the 529 plan accounts, it will also affect some parents to decide whether to open whether to open it.Standing the account.

| CoverDell ESA | Plan 529 | |

|---|---|---|

Account household | Parents, or grandparents, or other guardians There are strict income restrictions on individual or family income | No restriction |

Account manager (Trust/Custodian) | Account accountant (for example, parents, grandparents, or other guardians) | Account households, or children themselves |

Deposit restriction | The upper limit of the annual beneficiary account is $ 2,000 | Due to the state, but the upper limit is usually higher, and sometimes the upper limit will be higher than the education cost |

Deposit time | Students must not continue to contribute to the money after the age of 18 | No age restriction |

Tax discount period | Student 30 years old | Unlimited |

Whether to support prepaid tuition fees | not support | Support in some states |

Whether to support the payment apprentice plan and loan plan | not support | support |

Can you change the beneficiary | The account owner can change the beneficiary under the condition of a certain restriction | The account owner can change the beneficiary twice a year |

Whether the contribution can be taxed | Can’t | Can’t |

When the balance is used for unqualified expenditure | Federation of federal tax and 10% fine | Federation of federal tax and 10% fine |

Whether to support the cost of education in the K-12 stage | Support, limiting the same as the university stage | There will be different restrictions |

Do you support the two? | support | support |

Whether the account balance will affect students’ application for financial assistance | If the account owner is a parent, it will have a certain impact on Financial AID; if the account owner is the grandparents, it will basically have no effect. | Not affect |

The difference and connection between CoverDell ESA and Roth IRA

COVERDLL ESA is an educational account for children, and Roth Ira is a retirement account prepared for themselves.The biggest point of the two is that the funds deposited in the account are the funds of After-TAX.They cannot be used as a tax delegation for that year.When the principal and investment growth obtained by reasonable, no taxes are required.

Below is the difference and connection between COVERDLL ESA and Roth IRA:

| CoverDell ESA | Roth IRA | |

|---|---|---|

Open-person | Adults (for example, children parents) | Adult |

Beneficiary | minor | Usually the opening person himself |

Supply type | Can only be cash | Assets such as cash, stocks, bonds and common funds |

Can you change the beneficiary | Under certain conditions, you can change the beneficiary | Can change the beneficiary |

Whether the funds in the account can be used for investment | Can | Can |

Whether funds can be tax-free withdrawal | Used in the field of compliance education can be exempt from withdrawal and withdrawal | After 59 years old, you can |

Is there an annual supply limit | have | have |

Is there any income restriction when opening an account | have | have |

Whether to accept third-party contributions | Can | Can’t |

Where to open the 529 account?

Because the specific account opening policy, requirements and tax discounts of the 529 account are determined by states by themselves, different federal states will choose different financial institutions to provide 529 account opening and maintenance work.

Please check the 529 plan websites listed above to understand the detailed application methods.

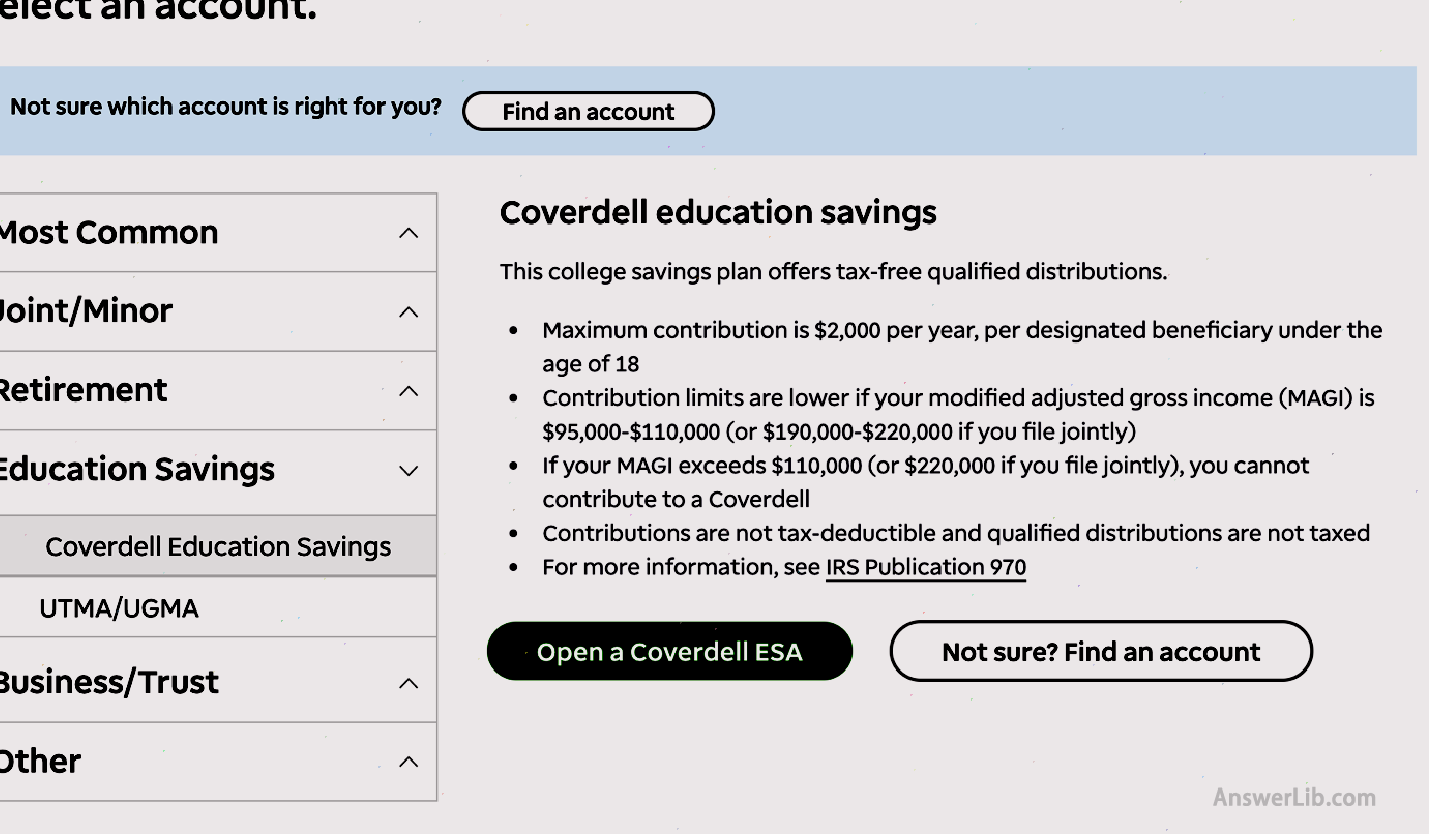

Where can I open the COVERDELL ESA account?

It is relatively easy to open the ESA account.Any financial institutions that can open and manage the IRA account can help open ESA accounts and conduct subsequent management and investment guidance.

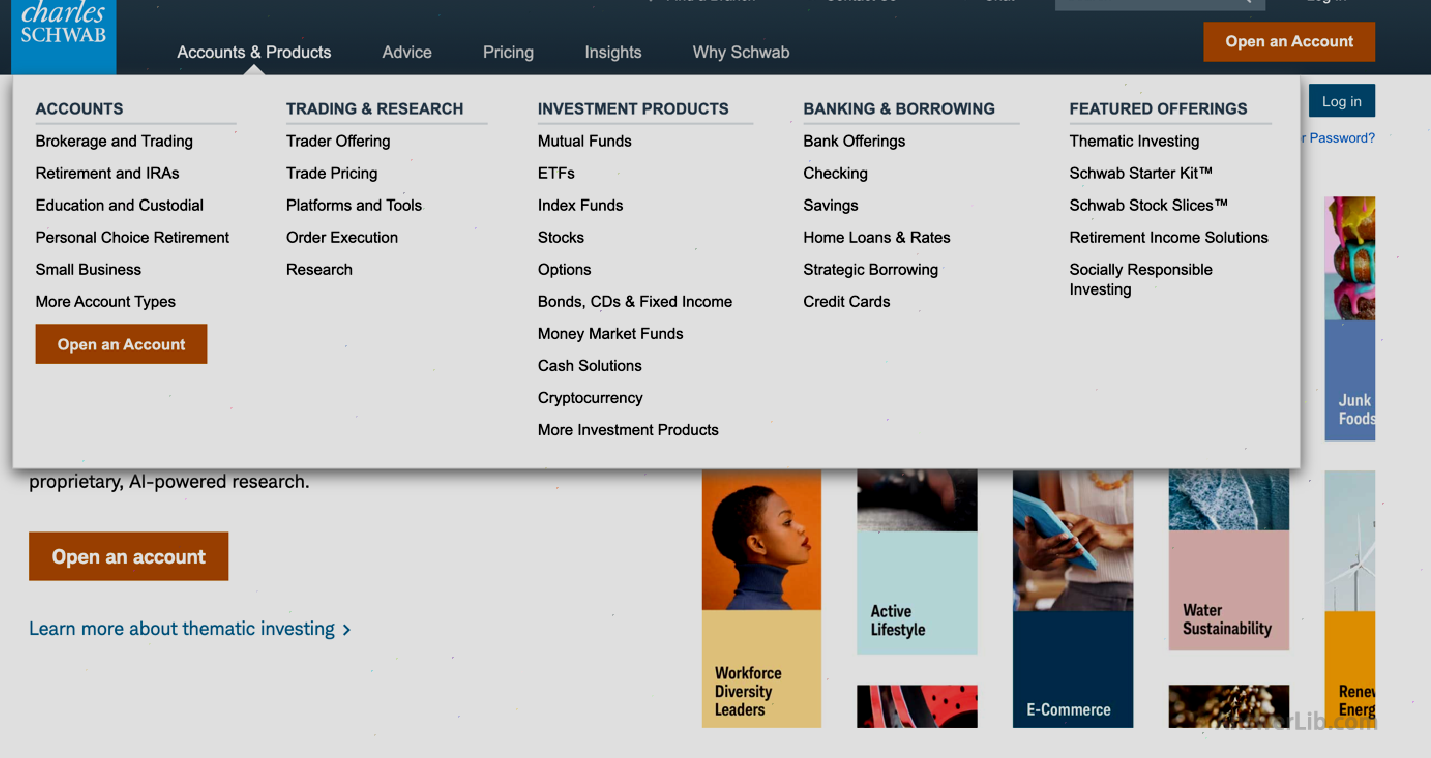

Charles SCHWAB

Apply to open an ESA account through Charles Schwab, you can log in Charles Schwab homepage Find the Education and Custodial in the account on the Internet on the homepage.

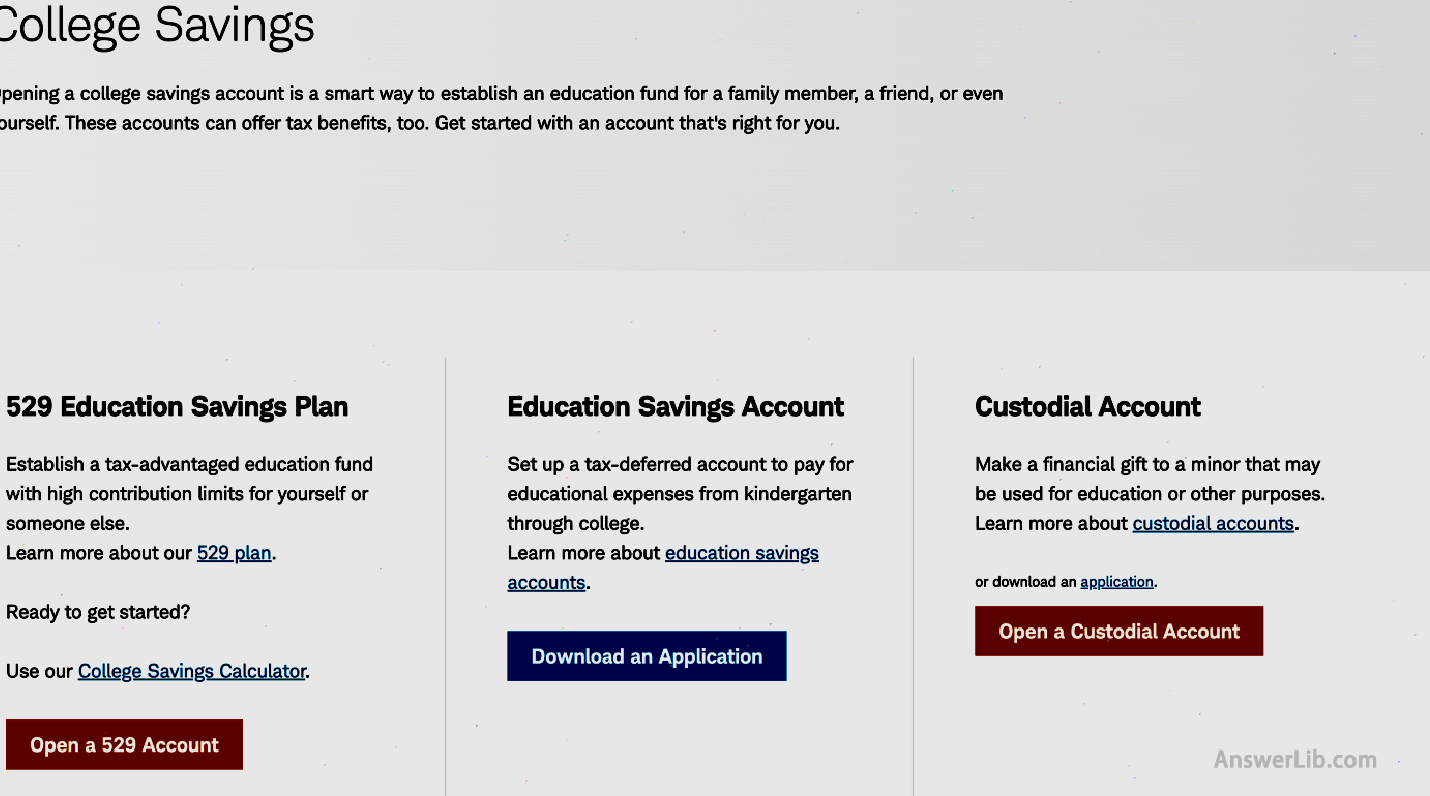

After clicking, you can enter the application or query page of multiple educational savings accounts provided by Charles Schwab.

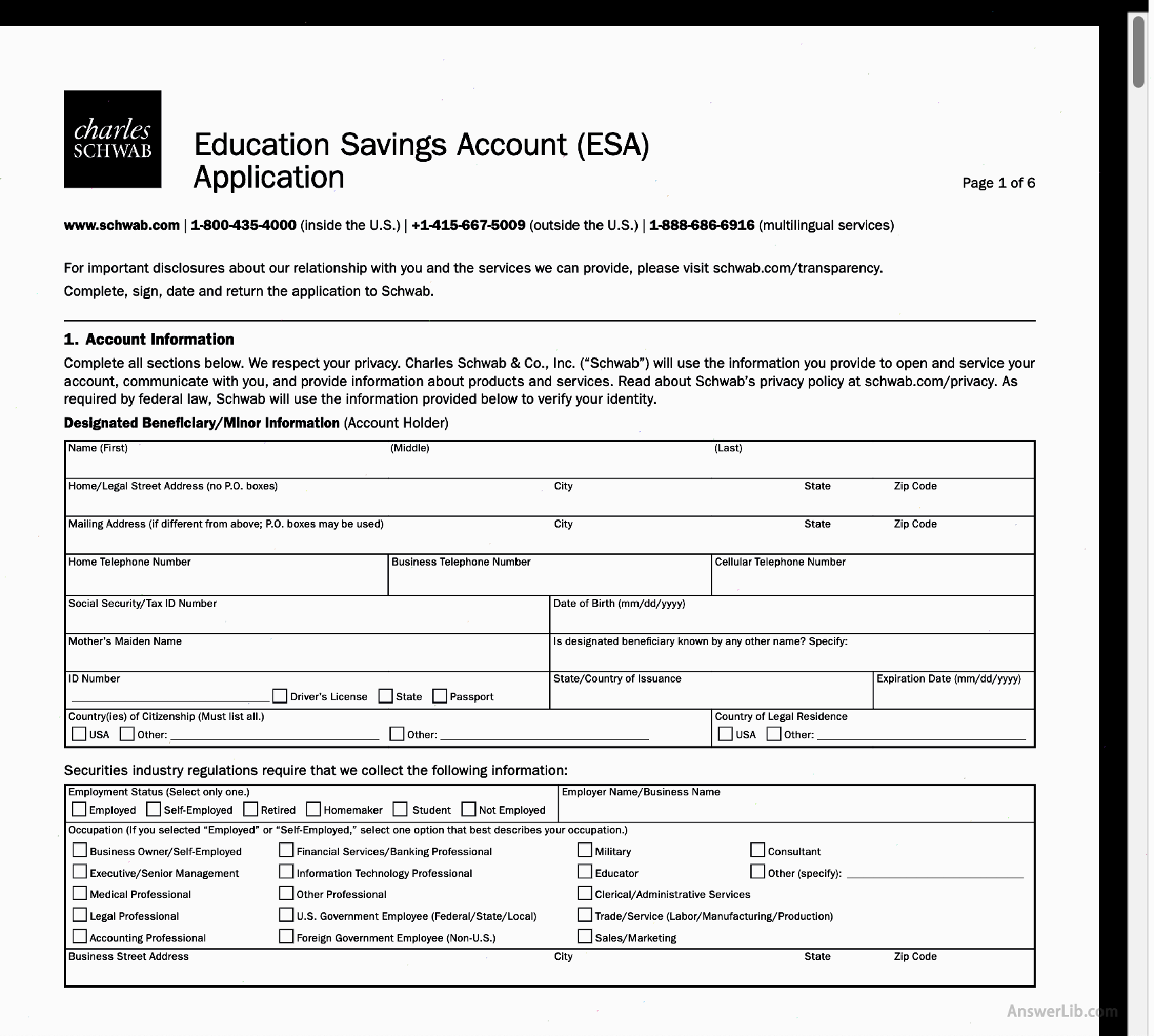

In the middle, you can find the opening information of the ESA account.Click the blue button below to see the preview of the account opening contract.

Through the contract preview, you can know that you need to provide information and information.If you have any questions about the content, you can contact the customer service staff of Charles Schwab.They will contact you at the fastest speed and provide effective assistance.

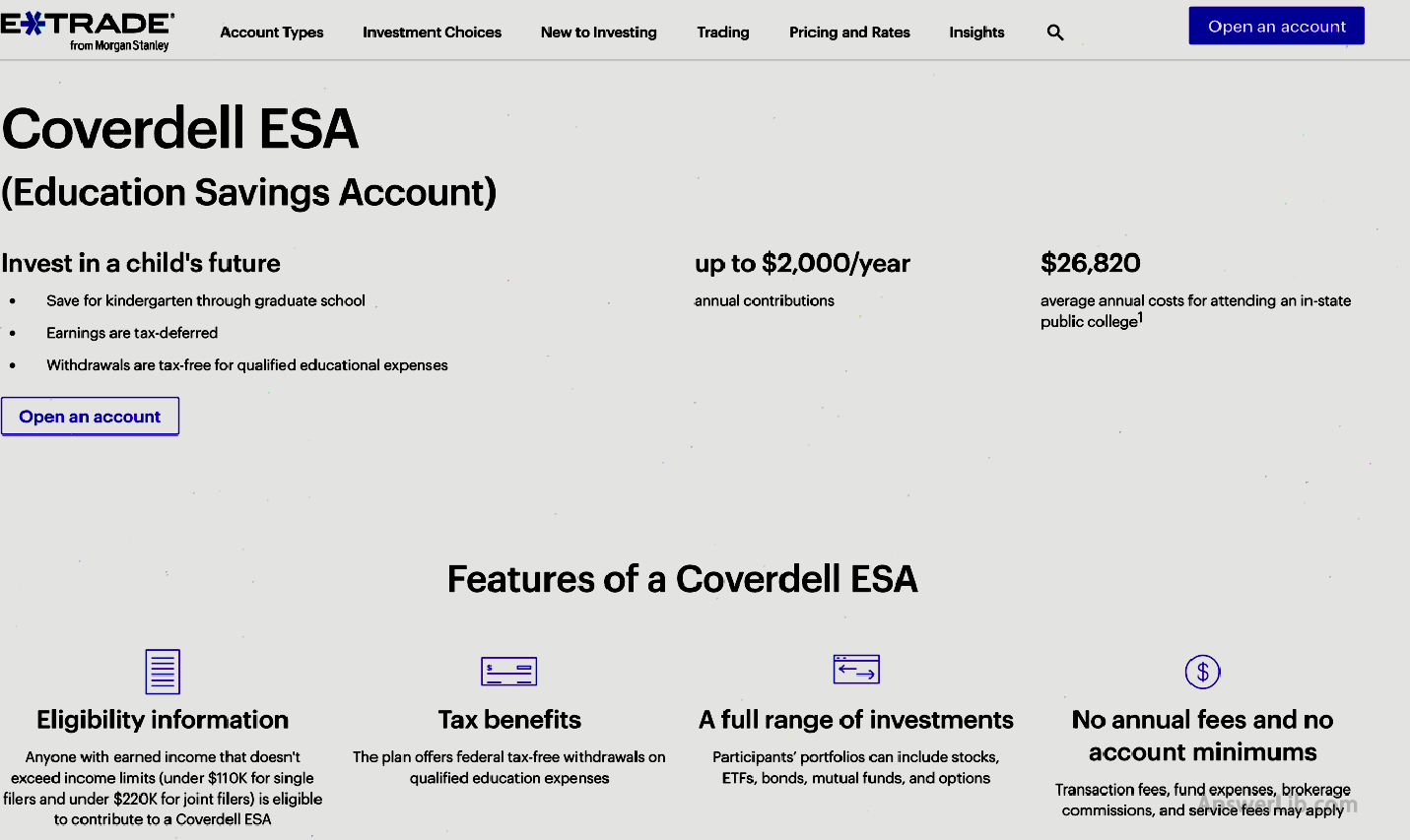

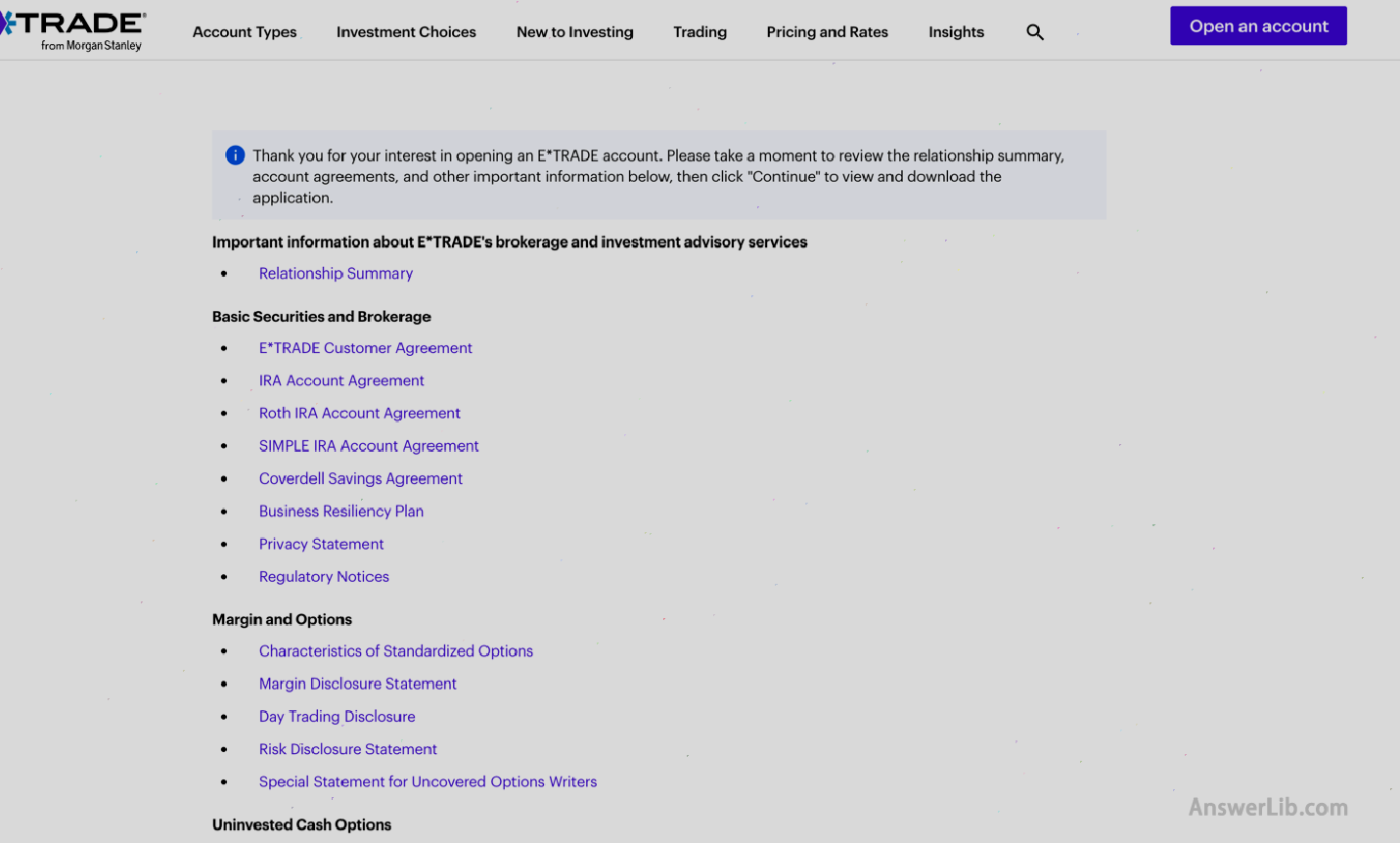

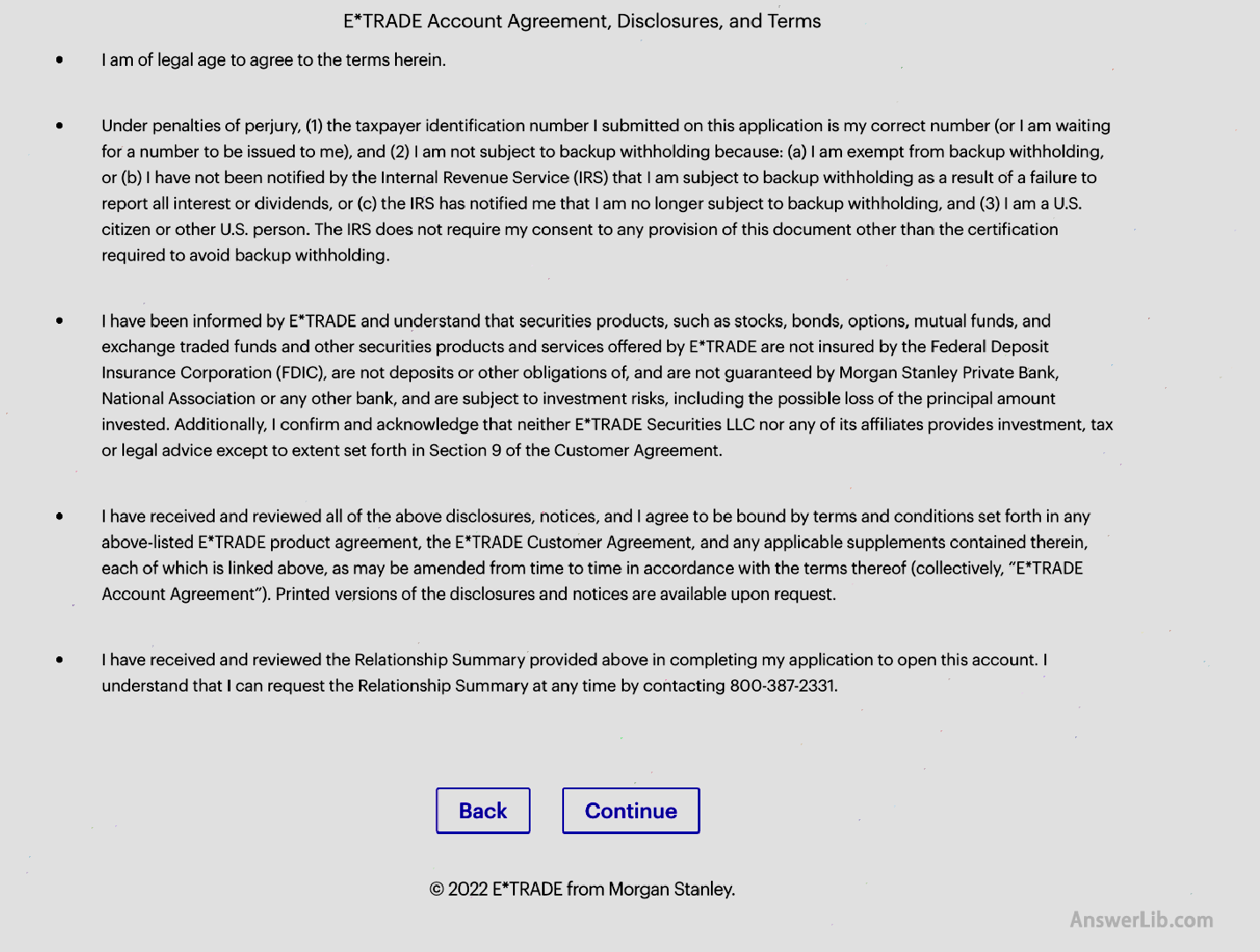

E*trade

Open the ESA account at E*Trade, you can enter the E*Trade’s Official link The

After clicking on the Open An Account button on the page, you can enter the information prompt page.

In this page, E*Trade provides a detailed introduction to the ESA account and the precautions when opening the ESA account.After selecting the content reading confirmation you need to understand, you can click the Continue button to enter the electronic contract at the bottom of the page to enter the electronic contract.Browse and sign page.

TD Ameritrade

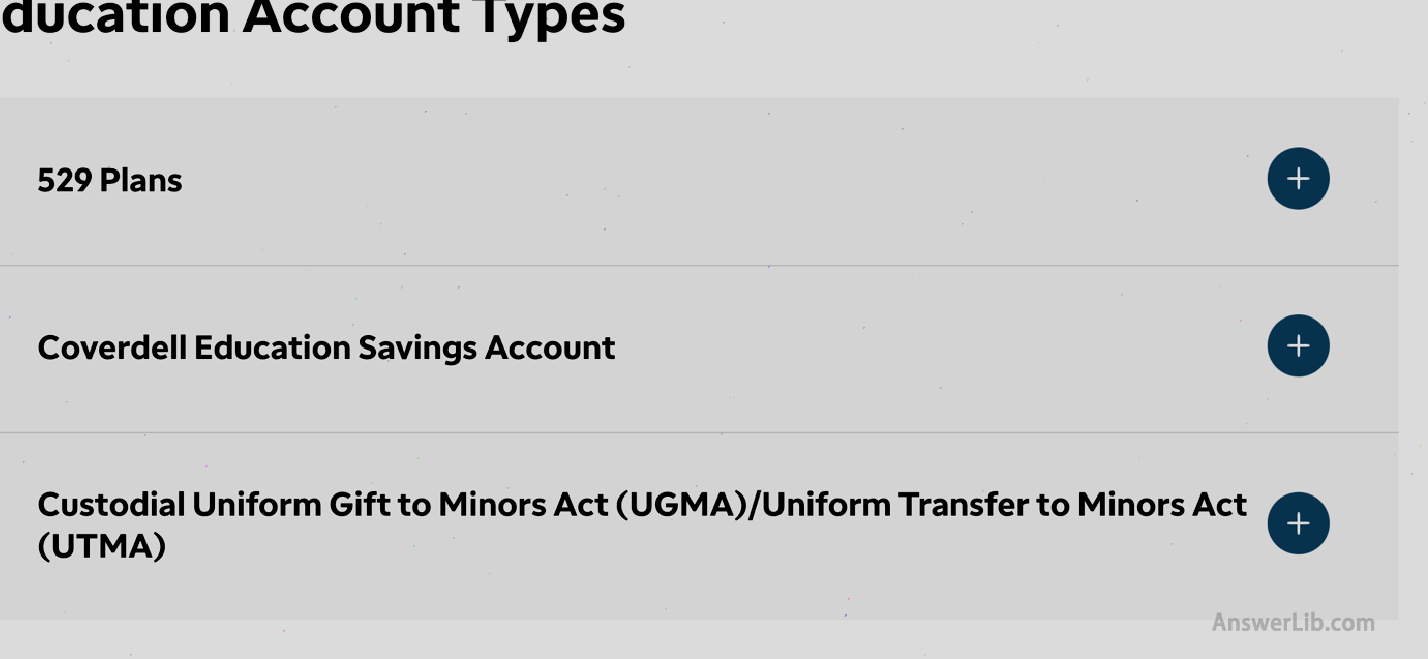

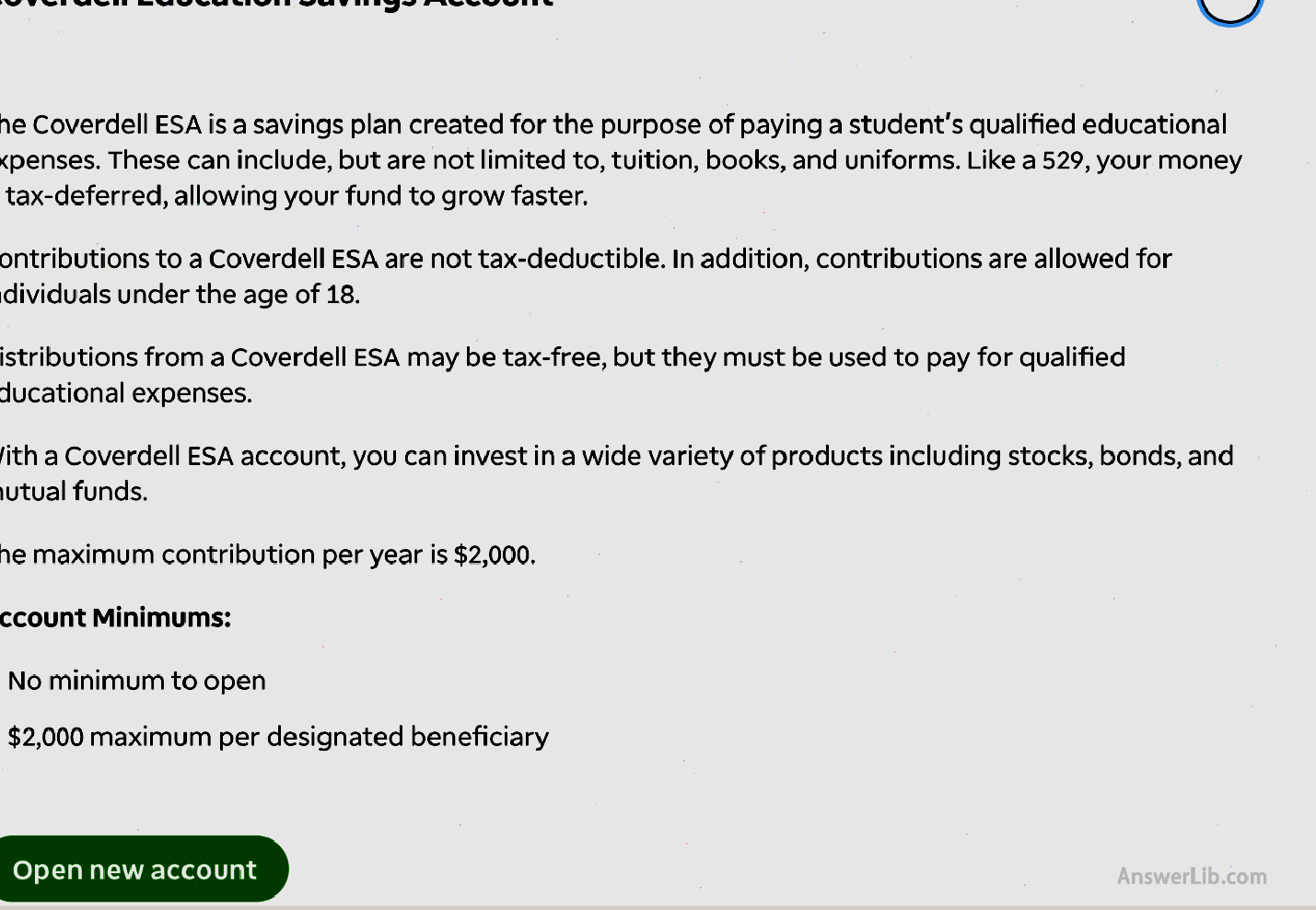

When you want to open the ESA account at TD Ameritrade, you can enter Official link The

For the drop-down page, you can see different educational savings accounts provided by TD American:

Click the “+” button on the right side of the ESA account

Then you can see the general introduction of the ESA account provided by TD Ameritrade.You can click the Open New Account button to continue after confirmation.

After entering the account to select the page, click the Education Savings column in the menu bar on the left, select the ESA account to enter the account opening application page, and follow the button to guide the account opening process.

Subscribe to American Life Guide

We have been committed to writing the most real, practical and detailed US Raiders.

The detours and losses we have walked will really share with you, so that you will take less detours.

If you like our article, you can consider joining the American Life Guide Twitter community And share this article with your friends.

At the same time, you can use mail Subscribe to our channel Some strategies, we only share with our subscribers!

More investment strategies

- 2024 Comprehensive index of stock markets in various countries in the world

- Australian MOOMOO Account Opening Reward: Leading Tencent Stock! November 30th

- How about Futu Niu Niu?What is the difference between Futu Niu Niu and Futu Moomoo

- What is compound interest [Compound Interest] The 72 rule of getting rich

- American Education Fund [2024] COVERDELL ESA, 529 Plan Detailed Explanation

- What is investment returns [ROI] different from the annual investment return rate

- US stock index [2024] S & P 500, Nasdaq detailed explanation

- How to invest in Hong Kong stocks in the United States?Buy Tencent’s little tricks in the United States!

- What is US Treasury Bond?How to buy U.S.Treasury bonds?What is the yield?

- US Gold Coin Investment [2024] What gold coins do you buy?Where can I buy it safely?

- How about Robinhood [2024] Brokers with obvious advantages and disadvantages

- How about Futu Moomoo [2024] Give 16 US stocks+5.1%APY

- How about Yingyou Securities [2024 latest] Detailed explanation of account opening and deposit!

- How to invest in gold [2024] Golden-based VS Fiat System

- What is Bitcoin?How to invest in Bitcoin?

- How about the first securities [2024] Detailed explanation of the first securities account opening and deposit

- How about tradeup securities [2024] Exchange accounts for $ 1570

- How about Wei Niu [2024] Weimiu Securities Account Opening Reward and Step

- US savings account recommendation [2024] Which bank is better to open an account in the United States?

- How to open Roth IRA account [2024 latest]