US Treasury, English is U.S.Treasury Securities, Also known as “” National debt“It is a debt relationship with investors based on its own credit as the guarantee and raised funds from investors.

The form of the transaction is: issued by the state, issuing a commitment to investors to pay interest during a certain period of time, and the bond debt vouchers that pay back to the principal due to maturity, and investors will get interest and principal after purchasing.

Treasury investment is one of the lowest risks of all financial investment products.And US bonds are national bonds issued by the United States, and their security has attracted investors from all over the world.What information do we need to know about US Treasury bonds?

Directory of this article

- What is US Treasury Bond?

- How does U.S.Treasury bonds operate?

- What is the US Treasury yield?

- What is the total amount of US Treasury bonds?

- How to buy U.S.Treasury bonds?

- What are the countries holding US Treasury bonds?How much US Treasury bonds hold in China?

- Why should China buy U.S.Treasury bonds?

- Join investment discussion group

- More investment strategies

What is US Treasury Bond?

US Treasury bonds are issued by the US federal government, and all US Treasury bonds have been supported by the US government’s “fully trust and credit”.

This means that under the circumstances of economic recession, inflation or war, the U.S.government will take care of their Treasury bond holders.

The US Treasury bonds require more than 20 first-level traders to purchase a large number of U.S.Treasury bonds, and they are always ready to trade in the secondary market.At the same time, it also attracts retail investors to buy.Retail investors can be purchased at a minimum of $ 100.Convenient trading.

Therefore, regardless of domestic and foreign, U.S.Treasury bonds are the best targets for stable investors.

There are many types of US Treasury bonds, and there are three main forms: of which:

- Treasury Bills: Short-term Treasury Voucher

- Treasury Notes: mid-term bill

- Treasury Bonds: Long-term Treasury Bonds

1.Treasury Bills: Short-term Treasury Coupon

Treasury Bills, referred to as T-Bills, is a short-term securities that does not count, that is, zero interest rates.The general time is 4 weeks, 8 weeks, 13 weeks, 26 weeks, or 52 weeks.

Therefore, T-Bills has no ticket interest [Coupon], and you will not get ticket interest on a regular basis.This is different from the Treasury Notes and Treasury Bonds that will be introduced later.

When buying, investors buy them with a certain discount price of the national treasury coupon value [DISCOUNT RATES], and then redeem the face value at the face value at the expiration to earn the difference in the entire process.Therefore, T-Bills can only be issued at a discount.

After the T-Bills expires, the US government will be recovered at the face value, so that the difference you obtain is the time investment income.This income is still regarded as “interest” and requires federal income tax, but it is exempt from state and local income tax.

2.Treasury Notes: mid-term bills

Treasury Notes, referred to as T-Notes, is a fixed principal securities with a term, 3 years, 5 years, 7 years, or 10 years.

T-NOTES has a ticket interest.Pay interest every six months [Coupon Payment].When the Treasury bills expire, the government will pay the principal.Interest income obtained by investors must pay federal income tax, but it is exempted from state and local income tax.

3.Treasury Bonds: Long-term Treasury Bonds

Treasury Bonds, referred to as T-Bonds, is a long-term fixed principal securities with a period of 10, 20, and 30 years.

T-Bonds also has ticket interest.Interests are paid every six months, and investors obtain the principal when the bond expires.During the period, all interest income must be paid by federal income tax, but levy state income tax is exempted from state and local income tax.

How does U.S.Treasury bonds operate?

U.S.Treasury bonds are an electronic bond.All transactions are online transactions.They can be purchased through online brokers trading platforms, or they can be purchased directly on the official website of the US Treasury bonds.

A.The offering of U.S.Treasury bonds

According to the types of bonds of three different periods, the issuance of US Treasury bonds is also different.

- For T-BILLS, the 52nd period of the state treasury coupon is released once a month, and the remaining periods will be released once a week;

- For T-Notes, the two, 3 years, 5 years, and 7-year periods of the bills are available per month, and the 10-year period is available for sale in each quarter;

- For T-Bonds, bonds are released in February, May, August, and November of each each;

B.Buy US Treasury Bond

Treasury bonds can be alone US Treasury Official Website Buy directly, this is an electronic market and online account system.Investors can hold qualified bookkeeping U.S.Treasury bonds and trade.

The fiscal system is managed by the Public Debt Bureau of the Ministry of Finance and belongs to a branch of the federal government.Investors must have an effective SSN when registering, as well as the US address.During the transaction, a email address is required, a network browser that supports 128 -bit encryption, and a check or savings account.

At the same time, Treasury bonds can also be purchased at an online trading broker, or purchased through other investment tools including a basket of bonds, such as common funds and ETFs.

C.Ranning expiration

Investors can hold national bonds until the expiration date, and pay interest regularly during the period.Ranning is proposed at the expiration date.The US government will repay the amount of all initial investment.

For short-term Treasury coupons, the difference is obtained by buying and redemption.

If investors want to redeem bonds electronic, click the “Redemption” button near the bottom of the “Current Hold” page on the personal account page, and need to specify whether it is some redemption or all redemption, and then provide hope to deposit in and store inRetroting income receipt account.

D.Sale transfer

For specific reasons, investors can redeem them and sell them before the national debt expires or expires.They can let them operate on their behalf through banks and agents.

When selling and transferring, you must fill in the transfer application form online or in the form of paper, and then transfer the national debt out of your account.The form should indicate the correct CUSIP number*, bank name, and reason to explain the reason to transfer government bonds.Finally, submit the form to TreasuryDirect to wait for the application result.

*CUSIP number, also known as the unified securities identification procedure committee number, is the only 9 -character identification number assigned to all US stocks and registered bonds.

The transferred bonds in the secondary market, also known as the bond market as the target, investors conduct financial management transactions.At this time, bonds are usually merged into specific ETFs or common funds for transactions.In this case, investors should pay attention that if the bonds are sold through the bond market in advance, they cannot guarantee their initial investment.

In the secondary market, investment liquidity is strong, which makes the national debt prices fluctuate in the trading market.The sales price and yield of government bonds determine their level of pricing in the secondary market.When the rate of national bond yields increases, the bond prices in the secondary market will fall, because more people are willing to obtain the income of bonds, but they are unwilling to be unwilling to get bonds, but they are unwilling to be unwilling.It is put into a more risky secondary market.On the contrary, the price of bonds in the secondary market will rise when the yield declines.

What is the US Treasury yield?

The yield of US Treasury bonds usually exceeds Inflation rate Or at the rate of rising prices, the inflation rate is usually hovering at about 2%, but in 2022, the inflation rate in the United States continued to rise, reaching 8.4%, which was a new high after 1980.

For the interest rate of new government bonds, that is, the US Tresury Yield Rates, often fluctuates with market interest rates and overall economic conditions.US Treasury yields mainly include: January Treasury Treasury [1 MO], February Treasury Treasury [2 MO], March Treasury Bond [3 MO], June Treasury Bond [6 MO], 1 -year Treasury Bond [1 YR], 2 -year national debt [2 YR], 3 -year national debt [3 YR., 5 -year Treasury Bond [5 YR], 7 -year Treasury Bond [7 YR], 10 -year Treasury [10 YR], 20 yearsPeriod Treasury [20 YR], 30 -year Treasury Bond [30 YR].

Among all national debt yields, the 10 -year-old Treasury yield rate of US ten-year Treasury bonds can be said to be an important economic indicator of the world economy.When the 10 -year Treasury bond yield rises, it often means that many investors are purchasing U.S.Treasury bonds to further explain that a large amount of funds are poured into government bonds, and the stock market may have the risk of decline.

During the period of economic recession or negative economic growth, the Federal Reserve System Management Committee, also known as the Federal Reserve, usually reduces interest rates to stimulate loan growth and expenditure.rate of return.

On the contrary, when economic growth or economic growth is growing, interest rates often increase with the increase in credit product demand, which will lead to higher returns to newly issued government bond bonds.

As of early June 2022, the US Treasury bond yield is about 2.94%, as shown below【source】The

| Day | 1 MO | 2 MO | 3 MO | 6 mo | 1 YR | 2 YR | 3 YR | 5 YR | 7 YR | 10 YR | 20 YR | 30 YR |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 06/01/2022 | 0.77 | 0.90 | 1.15 | 1.63 | 2.16 | 2.66 | 2.84 | 2.94 | 2.98 | 2.94 | 3.31 | 3.09 |

| 06/02/2022 | 0.85 | 1.05 | 1.17 | 1.64 | 2.15 | 2.65 | 2.83 | 2.92 | 2.95 | 2.92 | 3.30 | 3.09 |

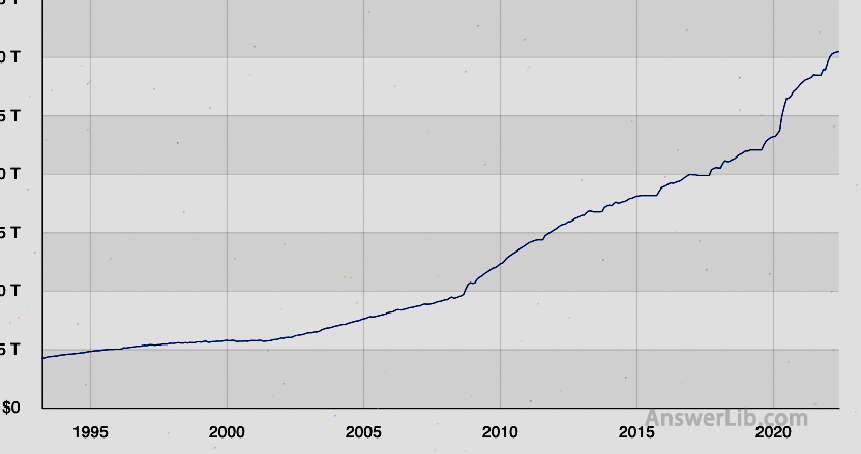

USA Ten-year national debt yield rate Historical data as follows:

What is the total amount of US Treasury bonds?

Facing the catastrophic blows brought about by the new crown epidemic, in order to alleviate the economic recession, since March last year, the US government has launched the most economic stimulus measures in history, including interest rate cuts, unlimited and loose measures, and sending money to enterprises and residents.Essence

This has caused the US government to spend up to $ 4 trillion, so that the fiscal deficit has soared rapidly, and issuance of government bonds has become the most effective way to raise funds under the epidemic.In the full year of 2020, the total US Treasury bonds increased by 4.55 trillion, about three times the 2019.

According to data released by the US Ministry of Finance, as of June 1, 2022, the total amount of US federal government bonds has exceeded $ 33 trillion Among them, about the part of the public $ 23 trillion Essence

How to buy U.S.Treasury bonds?

A.Buy directly

You can buy U.S.Treasury bonds from Treasurydirect Buy directly.You can only buy at non-competitive prices [Non-Comptitive Bidding].

In addition to Treasury Direct, you can also buy it through banks, agents or many online securities firms, such as: Fidelity, Charles Schwab, TD American, and Etrade.

To purchase government bonds through banks or online securities firms, you can use non-competitive bidding [Non-Competitive Bidding], or you can use competitive bidding [Competitive Bidding].

Fidelity

Fidelity provides an analysis picture.The X-axis is due, and the Y axis is a bond.Then you can further screen it.For example, by clicking “U.S.Treasury Zeros” and “3YR”, a page containing 4 results will be generated.Their due interest rates are slightly different, and the yields may be as many as 11 points.Bonds have a separate depth characteristic description.

Fidelity also shows the worst yield and due yield ranking.There is a direct purchase of links on the right side of the screen for investors to operate.

In addition to charts, Fidge also has a complex bond screenter.You can select “fixed income, bonds and CDs” through the “News and Research” tab, and then click the “Personal Bond” tab to generate a screener.At the same time, there is a drop-down menu for bond types, which are Treasury bonds, bills and bonds.

There are currently 4,559 US Treasury bonds on sale, 569 in the secondary market, and the remaining bonds are in the first-level market.

The national debt-free commission on the Fidelity website, but if the transaction is traded with the assistance of the agent, it will charge $ 19.95.Investors need to maintain an account balance of $ 2,500 to trade any types of US Treasury bonds.

Charles SCHWAB

Charles Schwab provides first-level market bonds for Treasury bonds, that is, direct-off bonds for the state, and also provides bond investment in the secondary market to make bonds to buy, transfer, and circulate.

The expiration date of the primary market ranges from 1 month to 30 years, and the bonds in the secondary market range from 9 days to 3 years.

In addition to national bonds, there are zero-interest national bonds and other government-related bonds, including institutional bonds.

The secondary market provides more than 20,000 national debt investment portfolios.They can be sorted according to the face interest rate, due yield, the worst yield, and the expiration date.It also shows several other screening standards, such as the estimation of the price, the total amount of the order, and the CUSIP number.There is a convenient purchase link on the left side of the page.

The minimum subscription volume provided by CHARLES SCHWAB is $ 1,000, and they will not charge any commissions and trading fees for national debt, bills and national treasury coupons on the second or first-level markets.

TD Ameritrade

TD Ameritrade provides charts containing government bond information.The X-axis is realized in expiration.The highest display is 20+ years, and the Y-axis is the name of the government.233 bonds are provided.As a result, CUSIP can be displayed according to the price, yield, the worst yield and quantity of the widest return.

When buying, the website will guide customers to make a series of choices and settings, including the choice of national bond term, the filling of the personal tax identity, personal rating, and purchase rate.

The TD American bond transaction charges $ 25 for national bond transactions, and the minimum limit for all bond transactions is $ 5,000.

E*trade

E*Trade will provide a very practical fixed-income product search engine.The “bond” section will be sorted in fixed income, and the objects include Treasury bonds, bills and bonds.

The displayed search results are presented in the form of charts.The Y axis is distinguished in different bonds, including US Treasury bonds, companies and institutional bonds.X-axis data includes the number of bonds, the lowest interest rate, type, expiration date, depth analysis link, and the right to buy on the right sideThe options greatly optimize the user’s purchase process.

E*Trade does not charge any commissions on the second or first-level government bond transactions on the line, but charges a transaction fee of $ 20.

B.Buy a combination

Treasury bonds can also be purchased through other investment tools including one basket of bonds, such as common funds and ETFs.

It can be seen from the above recommendations that most online securities firms provide first-level market bonds for sale.At the same time, they also conduct transactions for various types of bond portfolio products in the secondary market.

The combination is ETF

Most brokers can use U.S.Treasury bonds as ETFs.There are many government bond ETFs to choose from, including short-term government bond ETFs, long-term national debt ETFs, etc.The national bond ETF can be stored in many tax-free accounts as pension investment.

Combination is a common fund

Bond funds are common funds invested in bonds issued by the US government and their institutions.

These funds are invested in debt instruments, such as Treasury coupons, bills, national debt, and bonds issued by enterprises funded by the government.

These government bonds common funds are very suitable for low-risk investors, and they are also a good choice for novice investors and investors seeking cash flow.

What are the countries with US Treasury bonds?How much US Treasury bonds hold in China?

In international trade, countries or regions outside the United States will adopt the method of purchasing U.S.Treasury bonds as foreign exchange reserves to conduct asset-preserving investment.

At present, the biggest holders of US Treasury bonds are Japan As of March 2022, Japan held US $ 123.24 billion U.S.Treasury bonds, close to 18%of US foreign bonds.

China It ranks second, as of March 2022, holding 103.96 billion US dollars, accounting for 15.5%of US foreign debt.

The US Treasury bonds held by these two countries account for more than one-third of the overseas market.

The fifteen countries with the largest number of US Treasury bonds are as follows (as of March 2022) 【source】 The

- Japan: 12324 billion billion

- China: 103.966 billion billion

- British: 634.9 billion billion

- Irish: 3159 billion billion

- Luxembourg: 30 billion billion

- Cayman Islands: 29.29 billion

- Switzerland: 2741 billion billion

- Belgium: 2646 billion trillion

- France: 2470 billion billion billion

- Taiwan, China: 2384 billion billion

- Brazil: 2372 billion billion

- Canada: 2218 billion billion

- Hong Kong, China: 208.2 million billion

- India: 1998 billion

- Singapore: 1918 trillion

Why should China buy U.S.Treasury bonds?

It can be seen from the above data that China holds a large number of US Treasury bonds.As of April 2020, it holds 1.07 trillion US dollars of government bonds, accounting for 15.5%of the total foreign bonds of US Treasury bonds.

Why does China hold such a large number of US Treasuries?

1.Reduce export price

China is a large manufacturing country and a large export industry.This has brought a lot of employment to China.The US dollar is the most common currency unit in the world.In order to maintain export volume and export profits, China needsIn foreign currencies (such as US dollars), in a lower position to obtain trade difference profits.

The effective way to control the appreciation of the RMB is to buy a large number of US Treasury bonds, because the purchase of US Treasury bonds requires US dollars.A large number of U.S.Treasury bonds means that a large number of US dollars have redeemed the US dollar, and the reduction of the US dollar will increase it.Correspondingly, the renminbi will depreciate, which can maintain China’s low exit price and high export profits.

2.Stable asset safety

As a national investment, compared with national debt in real estate, stocks, or other countries, purchasing U.S.Treasury bonds is currently the most secure and stable national asset investment method.

3.Extended foreign trade

The US dollar has a high globally, especially in the Middle East neighboring China, which means that holding the US dollar can effectively expand the scope of foreign trade.And holding U.S.Treasury bonds can improve China’s US dollar foreign exchange reserves, and then quickly expand the expansion of foreign trade.

Join investment discussion group

Publish the latest market information on a regular basis and share your investment experience:

More investment strategies

- 2024 Comprehensive index of stock markets in various countries in the world

- Australian MOOMOO Account Opening Reward: Leading Tencent Stock! November 30th

- How about Futu Niu Niu?What is the difference between Futu Niu Niu and Futu Moomoo

- What is compound interest [Compound Interest] The 72 rule of getting rich

- American Education Fund [2024] COVERDELL ESA, 529 Plan Detailed Explanation

- What is investment returns [ROI] different from the annual investment return rate

- US stock index [2024] S & P 500, Nasdaq detailed explanation

- How to invest in Hong Kong stocks in the United States?Buy Tencent’s little tricks in the United States!

- What is US Treasury Bond?How to buy U.S.Treasury bonds?What is the yield?

- US Gold Coin Investment [2024] What gold coins do you buy?Where can I buy it safely?

- How about Robinhood [2024] Brokers with obvious advantages and disadvantages

- How about Futu Moomoo [2024] Give 16 US stocks+5.1%APY

- How about Yingyou Securities [2024 latest] Detailed explanation of account opening and deposit!

- How to invest in gold [2024] Golden-based VS Fiat System

- What is Bitcoin?How to invest in Bitcoin?

- How about the first securities [2024] Detailed explanation of the first securities account opening and deposit

- How about tradeup securities [2024] Exchange accounts for $ 1570

- How about Wei Niu [2024] Weimiu Securities Account Opening Reward and Step

- US savings account recommendation [2024] Which bank is better to open an account in the United States?

- How to open Roth IRA account [2024 latest]