Dividend, English is Dividend It is an asset return method unique to stocks or stock-related financial investment products.

When listed companies provide stable and persistent dividends, shareholders will receive considerable return on investment, and may even exceed the capital income of the stock itself.Some listed companies will provide dividend stocks to benefit shareholders and get more investment funds.

Composed of stocks with dividends Mutual Fund(Mutual Fund), or ETF It has also become the first choice for many investors in stable returns.But it also has its own risk, such as the instability of dividends.For dividends and dividend stocks, we can better optimize our financial investment portfolio after understanding.

If you use it Futu Moomoo You can easily find the dividend information of each stock in the online trading software or APP.If you open a stock account and contribute to the Futu Moomoo, you can get a number of free US stocks.For specific account opening benefits, please check Futu Moomoo Welfare EssenceBelow is the dividend distribution information obtained from Futu Moomoo:

Bleak American broker:Ying Diandai 劵| | Futu Moomoo| | Microex Securities| | Tiger securities| | First securities| | Robinhood in

Directory of this article

- What is dividend?

- What if Futu Moomoo finds the dividend rate of stocks?How to view your dividend issuance?

- What are the types of dividends?

- What is a dividend rate?

- Do I need to pay taxes?

- What investment products can get dividends?

- What DivIDEND Stock?

- What are the good DIVIDEND ETFs?

- What is DIVIDEND Aristocrats?

- What are the members of the DIVIDEND Aristocrats?

- What is DIVIDEND KINGS?

- What are the members of DIVIDEND KINGS?

- common problem

- More company value analysis

What is dividend?

A dividend is a listed company.After earning profits, part of the profit to shareholders and investors will be paid to shareholders and investors.

Unlike the capital income obtained by investors after the stock price rises, the dividend is that after the company earns profits, it is paid to the shareholders of the shareholders according to the quarterly or half-year or annual interval between each quarterly or every year.

For example, when Company A announced that when the dividend of $ 0.3 per share will be issued to the holder, if the investor holds 100 shares of the company’s shares, the subscription of the company announced by the company can get $ 0.3 x 100 = at $ 0.3 x 100 =$ 30 Dividends, this is a fixed income that does not change with the fluctuation of the stock price.

Dividends can become an excellent way to attract investors.When the company releases the season or the dividend of the year, regardless of how the stock price changes, shareholders can get conventional income from the stock.

Especially when the stock price has stagnated or fell, dividends have become the main way for shareholders to benefit in adversity.At the same time, another favorable situation will occur, that is, when the stock fell, the rate of return on dividends will rise, so that after attracting more investors, the stock price will increase.

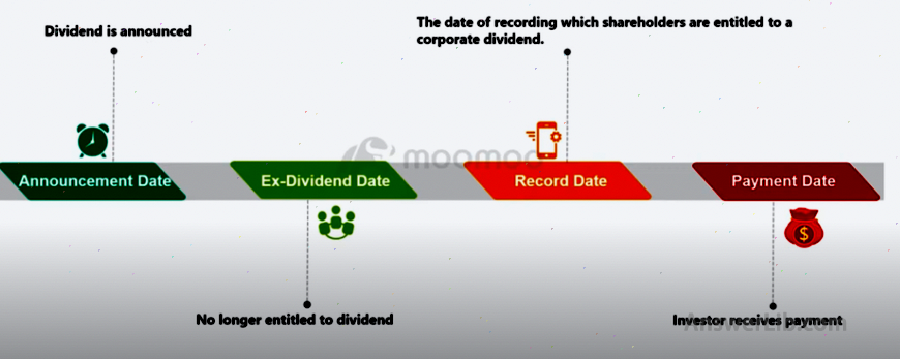

Regarding dividend investment, investors need to understand four critical dates: A dividend announced day As well as Eliminate As well as Equity registration day, and Dividend payment day The

1.Declaration date

A dividend announced day, English is DeclarationData or AnnoundcementData It is the date of the board of directors of listed companies announced its plan to pay dividends and related information.

2.EX-DIVIDEND DATE

The division of the date is to determine whether investors are qualified to obtain current stock dividends.Divideating means that after investors buy stocks, they cannot get the current dividend of the stock.

Shareholders who purchase the company’s shares before the Sabbath can get the dividend of declared Paid.

Shareholders who purchase the company’s stock on the Sobs Day will not receive the dividend of the Paids, but they can get dividends from the next round.

Generally, the removal date of the stock is the first few working days of the record date.

3.Record date

As of the date of equity registration, shareholders need to record the equity information they hold on the company’s shareholders’ roster, and they are eligible to get the dividend of the company’s preach during this period.In other words, only when the shareholders of the company’s shareholders have recorded on the list of shareholders of the company, they can get dividends during this period.

4.Payment date

This is the date of the company’s actual dividend to shareholders.Most companies send dividends every quarter according to the quarter, and some companies will choose to send dividends once a year.

What if Futu Moomoo finds the dividend rate of stocks?How to view your dividend issuance?

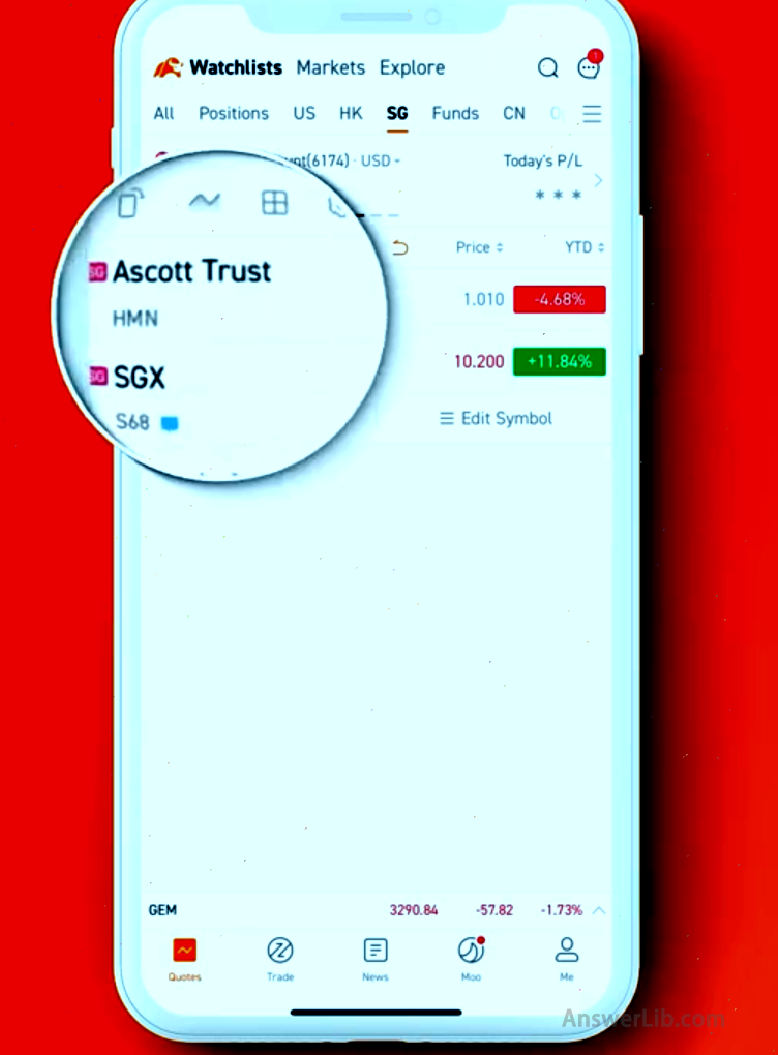

- Open the Futu Moomoo APP and find the stock that needs to be viewed from WatchList

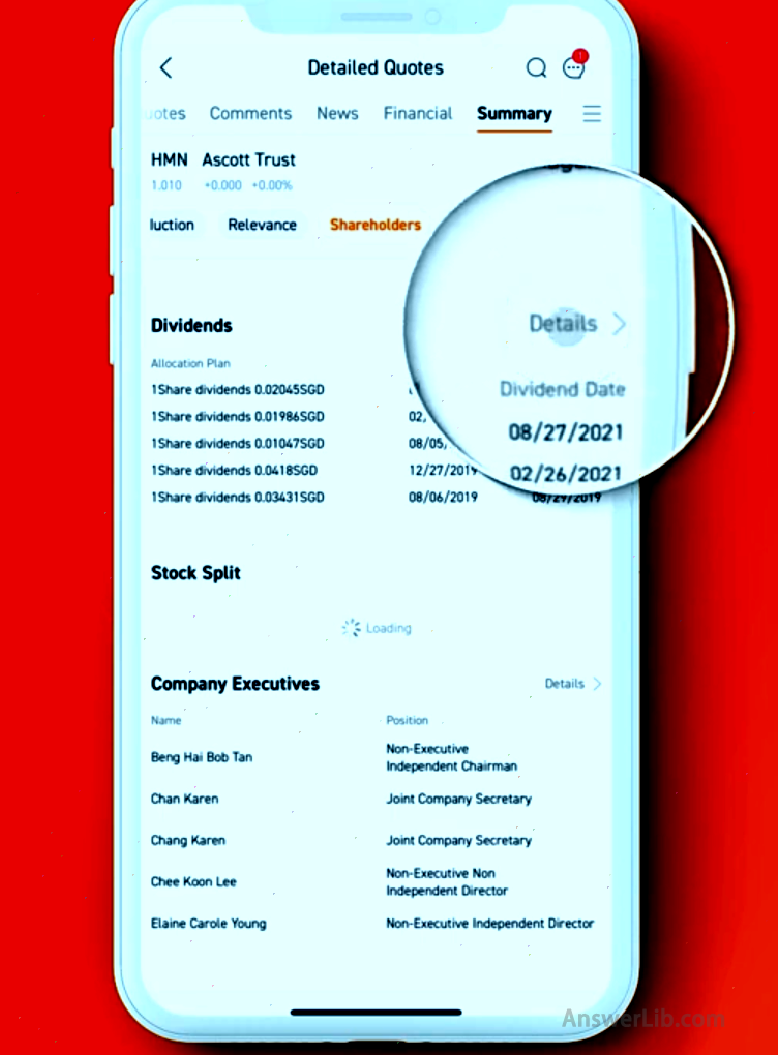

- In the individual stock information page, find the [Summary] option

- In the Summary page of individual stocks, find the [Shareholders] option

In Shareholders, you will see the brief information of this stock dividend.

- Click [Details] on the right to view the details of the dividend

- Check the details of dividend issuance, including information such as removal date, registration date, and issuance date

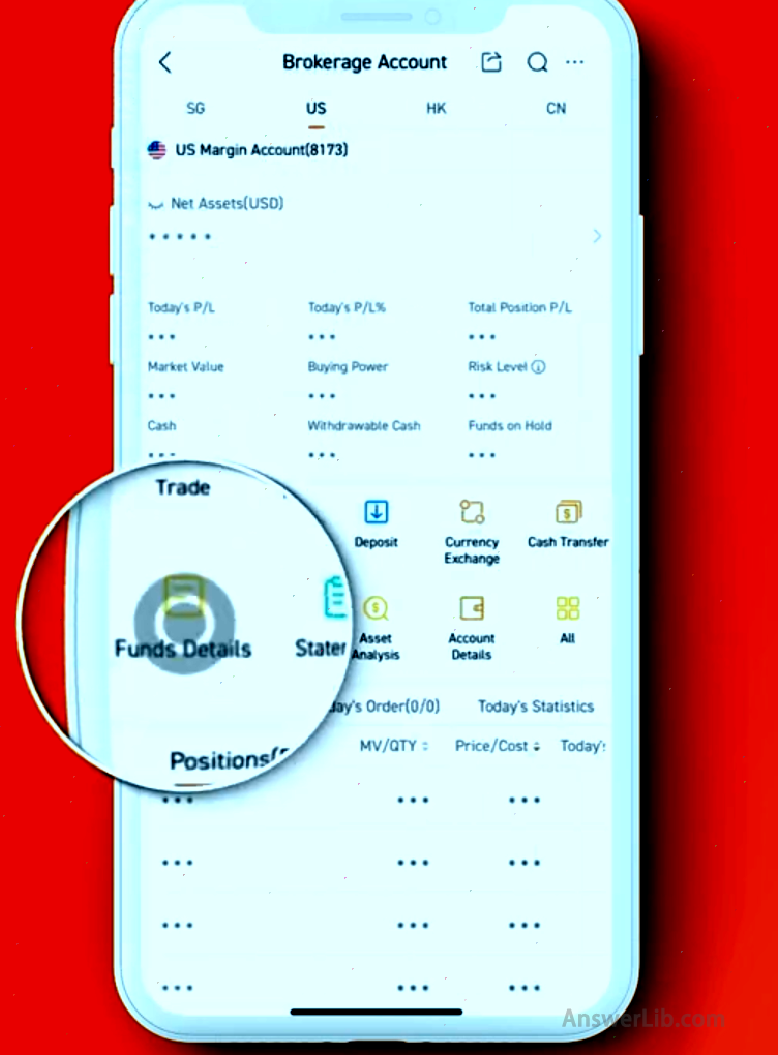

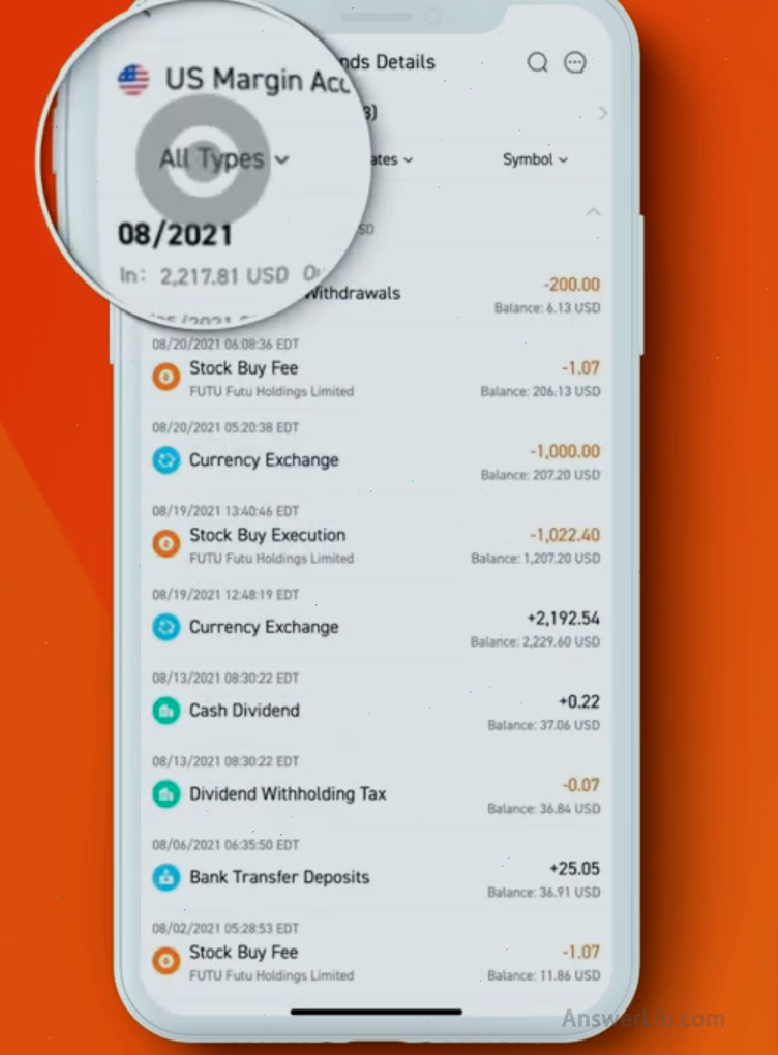

- Click the [Trade] option at the bottom end of the Futu Moomoo App

- Click your [Brokerage] account

- Click [Funds Details] to view account information

- Click [All Types]

- Select [Coporate ActionS] in the drop-down menu of [All Types]

- Check the dividend issuance record of your stock

What are the types of dividends?

1.Cash dividend

Regular cash dividends are dividends paid to shareholders from the company’s profit.Issuing preferred shares*The company must first distribute the profit to the shareholders of the preferred shares, and then issue it to ordinary shares.**Holding shareholders.

*Preferred shares: Refers to general shares in terms of corporate profitability and the distribution of remaining property.The dividend rate of preferred shares is fixed.When the issuance of priority issuance is issued, a fixed dividend rate is agreed.No matter how the company’s profitability changes, the dividend rate remains unchanged.But the shareholders of the priority shareholders have no voting right and cannot be refunded.

** Ordinary shares: It is the company’s commonly issued stocks that have no special rights, and are the most important equity securities.Ordinary shareholders have the basic rights of shareholders, that is, the right of income and voting.

2.physical dividend

When paying for the paid day, the dividend amount is included in the company’s accounts, and then issued by various physical objects such as dividends, such as gold, silver and other tangible values to shareholders, not cash or stocks.

3.Special one-time dividend

In addition to regular dividends, the company may sometimes pay a one-time special dividend.This situation is rare, and it may occur for various reasons, such as major litigation victory, sales of enterprises, or investing in liquidation.It can be cash, stocks or physical assets.& nbsp;

4.Stocks

Dividends distributed in the form of shares holding companies rather than cash.

Usually, the additional shares of the company’s shares are allocated to shareholders by comparison.The company’s dividend dividends may be due to the lack of cash in the company, or to reduce the overall stock price by reducing the unit price per share to promote more transactions and increase liquidity.

Dividend RE-Investment Plan (abbreviated as DRIP) plan is to distribute dividends to shareholders in the form of stocks for the company, thereby implementing dividend reinvestment plans.

Purchase of stock share shares through dividend reinvestment plans usually pay very little or no commission, and supports the purchase of fragmented shares.Companies with good dividend distribution records hold shares.After accumulation of time, it will often make investors’ income rolling snowballsGrow up like.

What is a dividend rate?

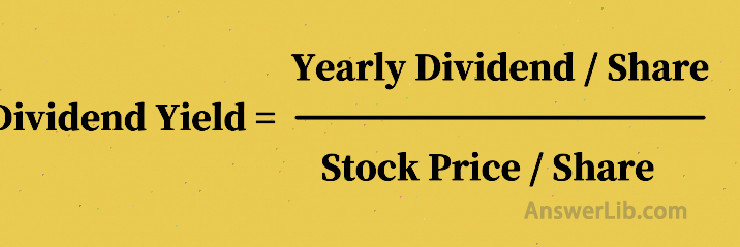

The dividend rate is sometimes called “dividend yield”.English is DividEnd Yield, which refers to the ratio of dividends (one year) by shareholders to buy stocks when buying stocks.Calculated as follows:

Usually the value of the year-on-year dividend yield is usually calculated.Because dividend payment is usually four times a year, this means that when a company proposes to get a dividend of $ 0.22 per share per share, then the shareholders actually get 0.88 per share each year 0.88 each yearUS dollar dividend.

Of course, some companies will pay dividends once a year.At this time, the dividend yield is the rate of return when shareholders receive dividends.

For example: you use $ 10/share The price was purchased.The company pays a dividend of $ 0.1/share per quarter, and it is obtained in one year $ 0.4/share Dividends.

Then the dividend yield is $ 0.4/$ 10 = 4%, that is, the company’s dividend yield (DIVIDEND YIELD) was 4% Essence

Personal dividend yields will be confirmed when purchasing stocks.However, the company’s announced dividend yield will change according to the floating of the company’s stock price.For example, when the dividend is determined, when the company’s stock price falls, the dividend yield will rise; on the contrary, when the stock price rises, the yield will fall.

Due to changes in dividend yields relative to stock prices, the dividend yields usually look extremely high for stocks with value falling rapidly.

For the company, this will play a role in attracting investors to a certain extent, but as an investor, the return on yield within a longer period of time to determine whether the high yield is worth investing.

Do I need to pay taxes?

As a personal income, dividends also have tax requirements, but the tax will be different for different types of dividends.Generally, there are two types of dividends: compliance dividends and non-compliance dividends.

1.For compliance dividends

The English dividend English is Qualified Dividend.Need to meet the following requirements:

- The company with dividends is a US company, or foreign companies (such as Inditex) registered in countries/regions that can enjoy tax benefits in accordance with the US tax agreement, or foreign companies that trades in major US stock markets in the United States;

- Before the end of the way, investors have held the stock for more than 60 days;

The dividend income that meets these conditions shall be levied at a lower long-term capital profit tax rate:

- For individuals with an annual income of less than $ 39,375, qualified dividends are tax-free;

- For individuals with annual income from $ 39,375 ~ $ 434,500, the dividend tax rate is 15%;

- For individuals with an annual income of more than $ 434,500, the dividend tax rate is 20%;

2.For non-compliant dividends

The English of unqualified dividends is Unqualify Dividend

The dividends that do not meet the conditions of compliance dividends are called non-compliant dividends, and the income pays taxes at the tax rate of normal personal income tax.

What investment products can get dividends?

1.Dividend Stock (DividEnd Stock)

Dividends are issued to investors by listed companies.Generally speaking, blue chip stocks*and companies with stable profit growth are more likely to issue a long-term and stable yield dividend.

*Blue chip stocks: Refers to the important dominance status in the industry, with excellent performance, active daily transaction, high company awareness, large stock market value, company operators with high public credibility, stable company revenue profit, fixed dividends all year round, excellent dividend dividends, excellent dividends, Stocks of large companies with high market recognition.

It is unlikely that rapid expansion of growth companies, because they need all the funds they have obtained to help them grow.Start-ups are also unbelievable, because they may not have achieved profit.

For the dividend of a single company, there are two states of stocks: Cum-DivIDEND and Ex-DIVIDEND.

- CUM DIVIDEND (and dividend stocks): English abbreviation is CD.The state of this type of stock is that the company announced that the dividend will be paid in the future, but the specific amount and time have not yet been determined.At this time, if investors buy CD stocks, they will get the right to get future dividends.If CD stocks are sold, they will lose their lossThe right to get dividends in the future.

- Ex-DIVIDEND: English abbreviation is ED.The state of this type of stock is that the company has clearly proposed that a certain percentage of dividends will be issued in a specific date in the future.When this date is determined and announced, the shareholders who have registered the information can still get dividends even when the shares in their hands are issued, but shareholders who purchase stocks after the dividend of the stocks cannot get this time.If you still hold it, you can get the next dividend distribution.

2.ETF (DIVIDEND ETF) of dividend dividends

This is one of the ways to invest a basket of listed companies that pay dividends.It can be traded like stocks.The price often changes throughout the transaction.

Professional managers study the market and invest in reasonable shares to invest in.They are usually more willing to invest in the stocks of old companies with a long history of dividend payment.This is more conducive to investors decentralized investment risks.

The establishment of a dividend ETF is to obtain high returns when investing in company stocks or real estate investment trusts (REIT).The dividend ETF may only include US companies stocks or international global dividend ETFs.

Like the dividend of the stock, the dividend ETF issued dividends will also be carried out at the set timetable.The frequency of dividends can be monthly, every quarter, half a year, or even every year.

The dividend is first paid by the company to the fund, and then issued to investors.Of course, investors need to pay additional fees for managers.Like the cost of ordinary ETFs, the additional costs here are pointing to the cost of paying for investors to buy dividend stocks directly.Buying ETFs will generate costs with fund managers, which is also one of the transaction costs.

Investors should carefully study the terms and conditions of specific dividend ETFs that are considering, and ensure that the frequency of payment and the frequency of paying dividends before actual purchase are suitable for their own investment strategies.

What DivIDEND Stock?

Here are a few good stocks that provide dividends:

Annaly Capital MANAGEMENT Inc.(Nly)

Dividends yield: 9.69%

Market value: $ 12.9 billion

Annaly Capital MANAGEMENT is a diversified capital management company, which is mainly invested in personal residential and commercial assets.Its investment strategy includes institutional mortgage loans to support securities, residential and commercial real estate, and intermediate market loans.The company’s total assets are about $ 100 billion.

Home DEPOT (HD)

Dividend yield: & nbsp; 2.1%

Market value: & nbsp; $ 345 billion

Home DEPOT is the leading retailer in the United States, with nearly 2,300 physical stores.The annual sales are $ 140 billion.

Since 2011, HD stocks have skyrocketed by 760%, while the Standard 500 Index has risen by about 200%in the same period.At the same time, dividends have risen from 25 cents per quarter to $ 1.65 per quarter.

EQUITRANS MIDSTREM CORP.(ETRN)

Dividend yield: 7.35%

Market value: $ 3.6 billion

EQUITRANS MIDSTREAM is a midstream energy service company.Its business is mainly to support natural gas development and transmission and storage systems, collection systems and water supply services.Its main assets are located throughout the Abbarachia Basin.

Agnc Investment (AGNC)

Dividends yield: 8.03%

Market value: $ 9.7 billion

AGNC Investment is an internal real estate investment trust that mainly invested in institutional residential mortgage loans to support securities.It is a mortgage borrowing as an asset financing by the mortgage borrowing of the agreed agreement.

New residential investment company (NRZ)

Dividends yield: 7.46%

Market value: $ 4.8 billion

New residential investment is a mortgage real estate investment trust.It provides funds and services for mortgage and financial services industries.The company invests in assets with stable and long-term cash flow.

OneMain Holdings (OMF)

Dividend yield: 13.06%

Market value: $ 7.4 billion

OneMain Holdings is a financial service holding company focusing on consumer finance.OneMain provided a series of credit insurance products through its subsidiaries and provided a guarantee and unpaid personal loan.The company operates a network consisting of 1,500 branches in the United States and provides a digital platform for customers to apply for products online.

Greif (GEF)

Dividend yield: 2.7%

Market value: $ 3 billion

Industrial packaging and container company GREIF can participate in the dividend investment portfolio as a medium-sized stock.This is a gentle growth company with a dividend yield of 2.7%.Analysts expect the income per share in the next five years to increase by 10%per year.GEF provides a good combination of income and stable growth.With the global economic recovery, this steel and plastic barrel, corrugated board, container lining and other behind-the-scenes packaging products have benefited from demand improvement.Greif’s products are used by all walks of life, and customers include pharmaceuticals, petroleum, food and beverages, and chemical industries.

Coca-cola Co.(ko)

Dividend yield: & nbsp; 3.2%

Market value: & nbsp; $ 230 billion

Coca-Cola has been in the 59th consecutive time in February this year to implement annual dividend growth.At present, the dividend of 41 cents per quarter is higher than the 17 cents in early 2007 before the financial crisis broke out.Essence

Intel Corp.(intc)

Dividend yield: & nbsp; 2.2%

Market value: & nbsp; 263 billion US dollars

Intelby, which has strong intellectual property rights, is more valuable to produce small foundries designed by others.Its dividends have soared from 18 cents in 2011 to nearly 35 cents, because the current semiconductor patent demand is strong, and the demand for these products in the digital age is increasing.Intel will be a “buy and hold” forever.stock.

Jpmorgan chase & Co.(JPM)

Dividend yield: & nbsp; 2.4%

Market value: & nbsp; $ 453 billion

During the financial crisis in 2008, Citi Bank and Bank of America were hit hard, and JPMorgan Chase became the most tough financial stock in Wall Street.Although it has reduced dividends during the most chaotic period, by 2013, it has returned to the level of 38 cents before the crisis, and now it has reached 90 cents per share.

What are the good DIVIDEND ETFs?

Here are a few good ETFs that provide dividends:

Invesco KBW High DiVIDEND YIELD Financial Portfolio (KBWD)

KBWD realizes its high returns by focusing on the investment portfolio of the financial sector company.It tracks the dividend yield index of KBW Nasdaq, which consists of about 40 shares.These are mainly small-cap stocks in the financial field.

The 30 -day dividend yield was 12.93%, and the cost rate was 1.58%.

Vanguard High Dividend Yield (VYM)

Vym tracks FTSE high dividend yield index.The fund represents nearly 400 stocks that generate high dividends.

Its yield is 3.77%, and the minimum cost is 0.06% or $ 6.

Ishares Core High Dividend (HDV)

HDV offers about 75 investment portfolios of US dividend stocks.According to the parent company Berlaide, all investment targets have “had a financial health screening.”

Its dividend yield is 4.67%; the cost is the lowest at 0.08%.

Alerian MLP ETF (AMLP)

AMLP is one of the largest funds of energy storage operators, related pipeline companies and other industries that support exploration business companies.It has nearly $ 6 billion in assets.

Its dividend yield is & nbsp; 8.84%, and the cost rate is 0.9%.

Ishares Select Dividend Index (DVY)

DVY from Bellaide tracks about 90 stock indexes.These stocks have all recorded dividends in the past five years.

Its dividend yield is 4.61%, and the cost rate is 0.39%.

Invesco Zacks Multi-Asset Income (CVY)

If investors do not mind paying higher fees to obtain higher returns, CVY is a good choice, and the fund tracks a multi-asset index composed of 149 stocks.

Its dividend yield is 6.43%, and the cost rate is 0.97%.

Vanguard Dividend Appreciation (VIG)

VIG tracks Nasdaq’s US dividend successor selection index, which covers about 182 dividend stocks.

Its dividend yield is 1.98%, and the cost rate is 0.06%.

Cambria Shareholder Yield ETF (SYLD)

Syld is an active management ETF that uses a quantitative method to select US stocks with high cash distribution characteristics.It screens US stocks with a market value of more than 200 million US dollars.The fund consists of 101 top companies based on dividend payment and net stock repurchase.It also screens value and quality factors, such as low financial leverage.At present, assets are managed about $ 318 million.

Its dividend yield is 1.24%, and the cost rate is 0.59%.

SPDR S & P DIVIDEND (SDY)

SDY is one of the most reasonable funds.It tracks Standard Purgan’s Bonus Noble Noble Index, which consists of more than 100 dividend stocks.

Its dividend yield is 3.44%, and the cost rate is 0.35%.

Schwab u.S.Equity Dividend (SCHD)

Schd is a favorable choice for investing in US high dividend stocks at a low cost.The fund tracks the Dow Jones US dividend 100 index, including some of the most dividend stocks in the United States.

Its dividend yield is 3.80%.The cost rate is 0.06%.

What is DIVIDEND Aristocrats?

DIVIDEND Aristocrats can be translated as “dividend nobles” or bonus nobles, which means like nobles in dividends.The dividend payment has a long history and credit, good records, and “noble descent”.

Similarly, it can also be called the “elite club”.The members of the club are good dividend credit companies, and they are more popular with investors.

To become a “club” member, the company must be satisfied:

- At least 25 years continuous Increase dividend Items

- The company issued by the company must be a member of the S & P 500 Index (S & P 500);

- After paying dividends every quarter, the company’s value is at least $ 3 billion;

- During any consecutive three months, the average daily transaction volume is at least 5 million US dollars;

What are the members of the DIVIDEND Aristocrats?

As of January 2021, there are 65 members of Dividend Aristocrats, as shown below:

|

Listed company (Ticker) |

The year of continuous increase of dividends |

Dividend yield |

|---|---|---|

| 3m (mmm) | 63 | 2.92% |

| AO Smith (AOS) | 28 | 1.46% |

| Abbott Lab (ABT) | 49 | 1.52% |

| ABBV (ABBV) | 49 | 4.48% |

| Aflak (AFL) | 38 | 2.35% |

| Air products and chemicals (APD) | 39 | 2.04% |

| Yabao (alb) | 27 | 1.02% |

| Anumko PLC (AMCR) | 38 | 3.76% |

| Acet Daniels-Midland (ADM) | 47 | 2.22% |

| American Telegraph Company (T) | 36 | 6.49% |

| ATMOS Energy Company (ATO) | 34 | 2.44% |

| Automatic data processing (ADP) | 46 | 1.9% |

| Becton, Dickinson & Co.(BDX) | 49 | 1.38% |

| Brownfolman Company (BF-B) | 37 | 0.93% |

| Kantle (CAH) | 34 | 3.47% |

| Caterpillar (CAT) | 27 | 1.74% |

| Chevron (CVX) (CVX) | 34 | 4.92% |

| Chu Bo (CB) | 28 | 1.87% |

| Cinf Finance (CINF) | 61 | 2.1% |

| Cintas Company (CTAS) | 37 | 0.86% |

| Gao Le’s Company (CLX) | 45 | 2.41% |

| Coca-Cola Company (KO) | 59 | 3.11% |

| Gao Loujie Brown (CL) | 59 | 2.19% |

| Union Edison (ED) | 47 | 3.98% |

| Dov (Dov) | 65 | 1.3% |

| Yikang (ECL) | 29 | 0.84% |

| Emerson Electric (EMR) | 59 | 2.16% |

| Essex Property Trust (ESS) | 27 | 2.93% |

| International Expeditionary Force (EXPD) | 27 | 1% |

| ExxonMobil (xom) | 37 | 5.71% |

| Federal Real Estate Investment Trust Fund (FRT) | 49 | 3.72% |

| Franklin Resources (Ben) | 40 | 3.3% |

| Universal Power (GD) | 30 | 2.45% |

| Original parts (GPC) | 65 | 2.46% |

| Holl Food (HRL) | 55 | 2.06% |

| Illinois Tool Factory (ITW) | 50 | 1.92% |

| International Business Machinery Company (IBM) | 25 | 4.52% |

| Johnson & Johnson (JNJ) | 59 | 2.54% |

| Kim Baili (KMB) | 48 | 3.35% |

| Lien School (Leg) | 50 | 2.95% |

| Linde (Lin) | 28 | 1.43% |

| Laos (Low) | 47 | 1.17% |

| McCike Corporation (MKC) | 35 | 1.51% |

| McDonald’s (MCD) | 44 | 2.2% |

| Midunli (MDT) | 43 | 1.82% |

| Nextera Energy Corporation (NEE) | 25 | 2.08% |

| Nue (Nue) | 48 | 1.69% |

| PNR (PNR) | 44 | 1.19% |

| People’s United Finance (PBCT) | 28 | 3.88% |

| Pepsi (PEP) | 48 | 2.95% |

| PPG Industry (PPG) | 49 | 1.2% |

| Procter & Gamble (PG) | 65 | 2.57% |

| Real estate income company (o) | 26 | 4.17% |

| ROP Technology (Rop) | 28 | 0.5% |

| S & P Global (SPGI) | 48 | 0.79% |

| Xuanwei-Williams (SHW) | 42 | 0.77% |

| Stanley Bacid (SWK) | 53 | 1.29% |

| Siyo (SYY) | 41 | 2.17% |

| T.Rowe Price Group (Trow) | 35 | 2.29% |

| Target (TGT) | 49 | 1.28% |

| VF Company (VFC) | 49 | 2.21% |

| Ww Granger (GWW) | 50 | 1.41% |

| Walgreen Boot League (WBA) | 45 | 3.43% |

| Wal-Mart (WMT) | 48 | 1.56% |

| West Pharmaceutical Services Inc.(WST) | 28 | 0.21% |

What is DIVIDEND KINGS?

DIVIDEND KINGS can be translated into “the king of dividends”, and it can also be called the “Super Elite Club” that pays dividends.Member company has at least 50 years continuous Increase dividend This is very difficult, especially after several after-the-me-out crisis.

The king of dividends is a merging company, which has a high market value, but it is not necessarily very vibrant.The reason why it becomes the king of dividends is because it shows its continuous benign growth over time.

All members in the club prove that their long-lasting operations, good cash flow, stable capital returns, and long-term stable dividends, and according to their historical data, to some extent, the company’s stock price trend can predict that it can be predictedof.

What are the members of DIVIDEND KINGS?

2021 The latest Dividend King Kings members are as follows:

|

Company Name |

Continue to increase the number of dividends |

|---|---|

| Amer.States Water (AWR) | 66 |

| Dover (dov) | 65 |

| Genuine Parts (GPC) | 65 |

| Northwest nat.(NWN) | 65 |

| ProCTER & Gamble (PG) | 65 |

| Parker Hannifin (pH) | 65 |

| Emerson Electric (EMR) | 64 |

| 3m (mmm) | 63 |

| Cincinnati Fin.(CINF) | 61 |

| Johnson & Johnson (JNJ) | 59 |

| Coca-cola (KO) | 59 |

| Colgate-Palmolive (CL) | 57 |

| F & M Bank (FMCB) | 58 |

| LANCaster Colony (Lanc) | 58 |

| Lowe ’s (low) | 58 |

| Nordson (NDSN) | 57 |

| ABM Industries (ABM) | 54 |

| California Water Services (CWT) | 54 |

| Hormel Foods (HRL) | 54 |

| Sjw group (sjw) | 54 |

| Commerce Bancshares (CBSH) | 53 |

| Federal Realty Investment Trust (FRT) | 53 |

| Stepan Co.(SCL) | 53 |

| Stanley Black & Decker (SWK) | 53 |

| Target (tgt) | 53 |

| H.B.Fuller Co.(ful) | 52 |

| TootSie Roll Industries (TR) | 52 |

| Altria Group (MO) | 51 |

| Black Hills Corporation (BKH) | 50 |

| W.W.Grainger (GWW) | 50 |

| National Fuel Gas (NFG) | 50 |

| Sysco Corp (syy) | 50 |

| Universal Corporation (UVV) | 50 |

common problem

Question 1: What is the English dividend?

A dividend English is DIVIDEND, and it is an asset return method unique to stocks or stock-related financial investment products.After the company earns profits, it is paid to the shareholders of the shareholders according to the quarterly interval between the quarters or half a year or each year.

See More

Question 2: How to calculate the dividend rate?

The dividend ratio, also known as dividend yield, English is DivIDEND YIELD, which refers to the ratio of dividends (one year) obtained by shareholders (one year) compared to the stock price per share price when buying stocks.

See More

Question 3: What is “dividend noble”?

DIVIDEND Aristocrats can be translated as “dividend nobles” or bonus nobles, which means like nobles in dividends.The dividend payment has a long history, credit and record well, and has “noble descent”.Become a “club” member, the company must be satisfied: having at least continuous 25 years Payment dividend records;

The company’s stock must be a member of the S & P 500 Index (S & P 500).

See More

Question 4: What is the “king of dividends”?

DIVIDEND KINGS can be translated into “the king of dividends” and can also be called the “Super Elite Club” that pays dividends.Member company has at least 50 years The history of good dividend payment is very difficult, especially after several crisis of integration.

See More

More company value analysis

- Julian Roberts – Julian Robertson: Father of Tiger Baby

- Explore the 24 first-level dealers of the Federal Reserve

- Important Finance and Investment News

- What is a corporate value multiple?Enterprise Multiple

- What is preferred stock?Preferred stock

- What is the operating leverage coefficient?Degree of Operating Leverage

- What is debt repayment payment rate?DEBT Service Coverage Ratio

- What is capital expenditure?Capital Expendital

- What is the capital asset pricing model?Capital Asset Pricing Model

- What is financial leverage coefficient? Degree of Financial Leverage